Get in on the new craze for digital art

Auction houses are hoping to lure the Reddit mob with digital art. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

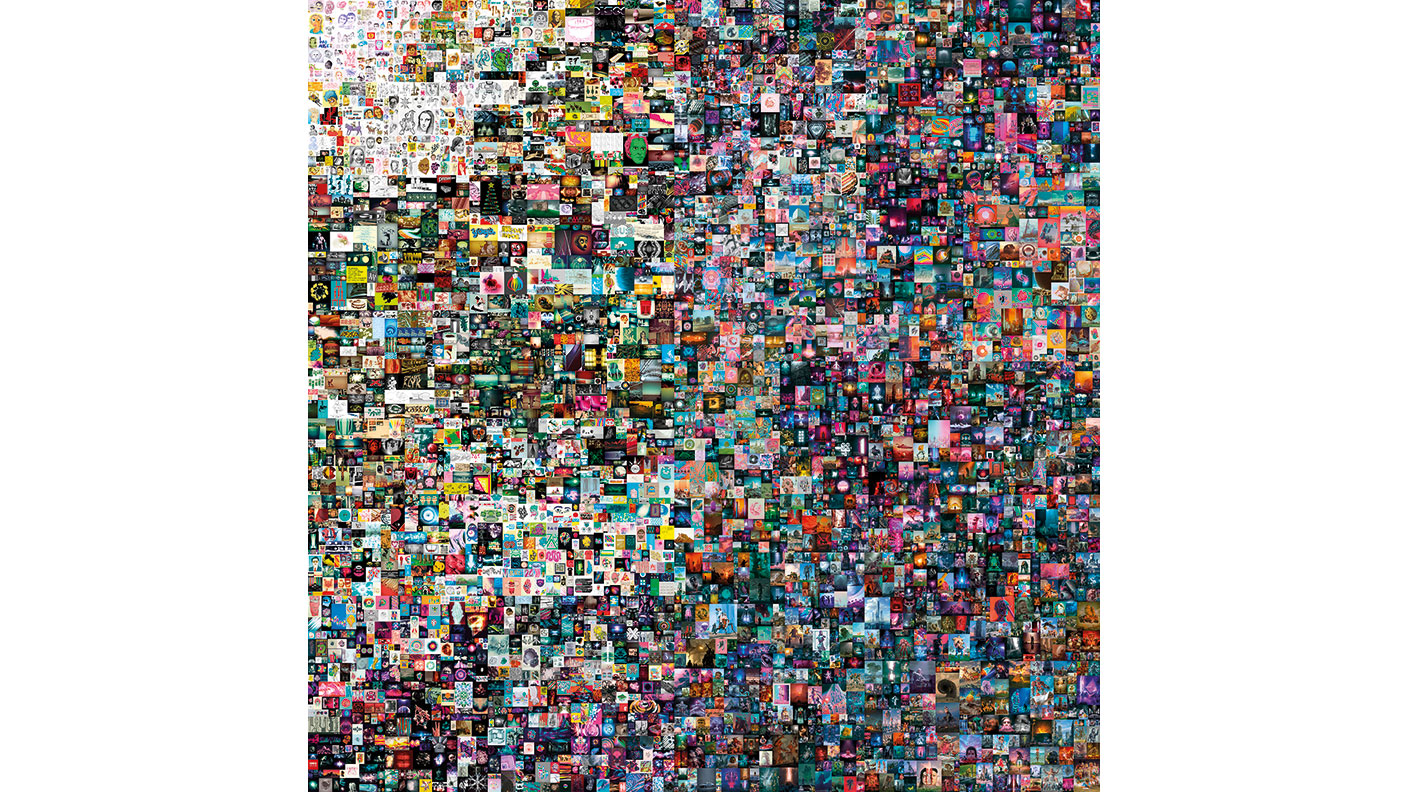

Last month, younger adults with time and money on their hands rocked the investing world when they descended en masse on GameStop and AMC Entertainment, taking on the hedge funds and investment banks. Christie’s is hoping to lure this rabble into shaking up the traditionally staid world of art auctions. It is offering Everydays – The First 5000 Days (2021), an artwork by Mike Winkelmann, known as Beeple to his 1.8 million Instagram followers. In 2007, Winkelmann began creating an image a day, which he has collected together into this one piece (pictured right). It was 13 years in the making and was “minted” on 16 February. Everydays is a “non-fungible token” (NFT) and this is the first time a major auction house has offered a solely digital NFT, with online bidding due to run until 11 March. But what on earth is an NFT?

Place your bids in ether

It’s the art equivalent of a bitcoin. The winning bidder in the auction will receive an encrypted file, bearing the artist’s digital signature and information such as time of creation. The transaction will then be registered on the blockchain, a public digital ledger that cannot be tampered with. It is a technology more often associated with cryptocurrencies, such as bitcoin and ether (ethereum). This latter “crypto” has become the means of exchange most closely associated with the fledgling NFT market. One anonymous bidder on 14 February, as Anny Shaw points out in The Art Newspaper, paid 10.8 WETH (a form of ether), equivalent to $18,600, for “a glitchy rendering of a flower”. Recognising the popularity of ether among NFT collectors, Christie’s has even said it will accept ether in payment for the principle of Everydays, with the fees to be paid in dollars.

The auction house is keeping the opening bid for Everydays low at $100 and, as “this is a new medium”, Christie’s has listed its estimate for the artwork as “unknown”. It is keen to find out what will be raised. Beeple, it says, is “one of the most sought-after digital artists within this market, having sold a collection of 20 works at auction for $3.5m on another blockchain-based platform”. He has worked with brands, including Apple and SpaceX, as well as music artists, such as Ariana Grande and Childish Gambino. It is the younger generation associated with these brands that the auction house is out to attract. “I think we are going to see an explosion of not only new [NFT] artwork,” says Winkelmann, “but also new collectors and I am very honoured to be a part of this movement.”

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The retro appeal of old computers

It’s not just new technology that is getting collectors excited. Old “retro” computers are too. “‘Retrocomputing’, [as] the hobby is called, is hardly just a way to pass the time,” says Kim Key in The New York Times. “Instead, as enthusiasts see it, it’s a means of communing with the past.” Demand for cumbersome, old vintage kit is rising, with collectors flocking to online message boards to trade spare parts. “You get into this mind-set of what it must’ve been like to be somebody in the late 1970s, having spent thousands of dollars on this thing that barely does anything more than a calculator,” Clint Basinger, who runs YouTube channel Lazy Game Reviews, tells the paper. “It’s like a time machine to me.” Before the pandemic struck, vintage computing conventions were springing up across the US. But its not just an American phenomenon.

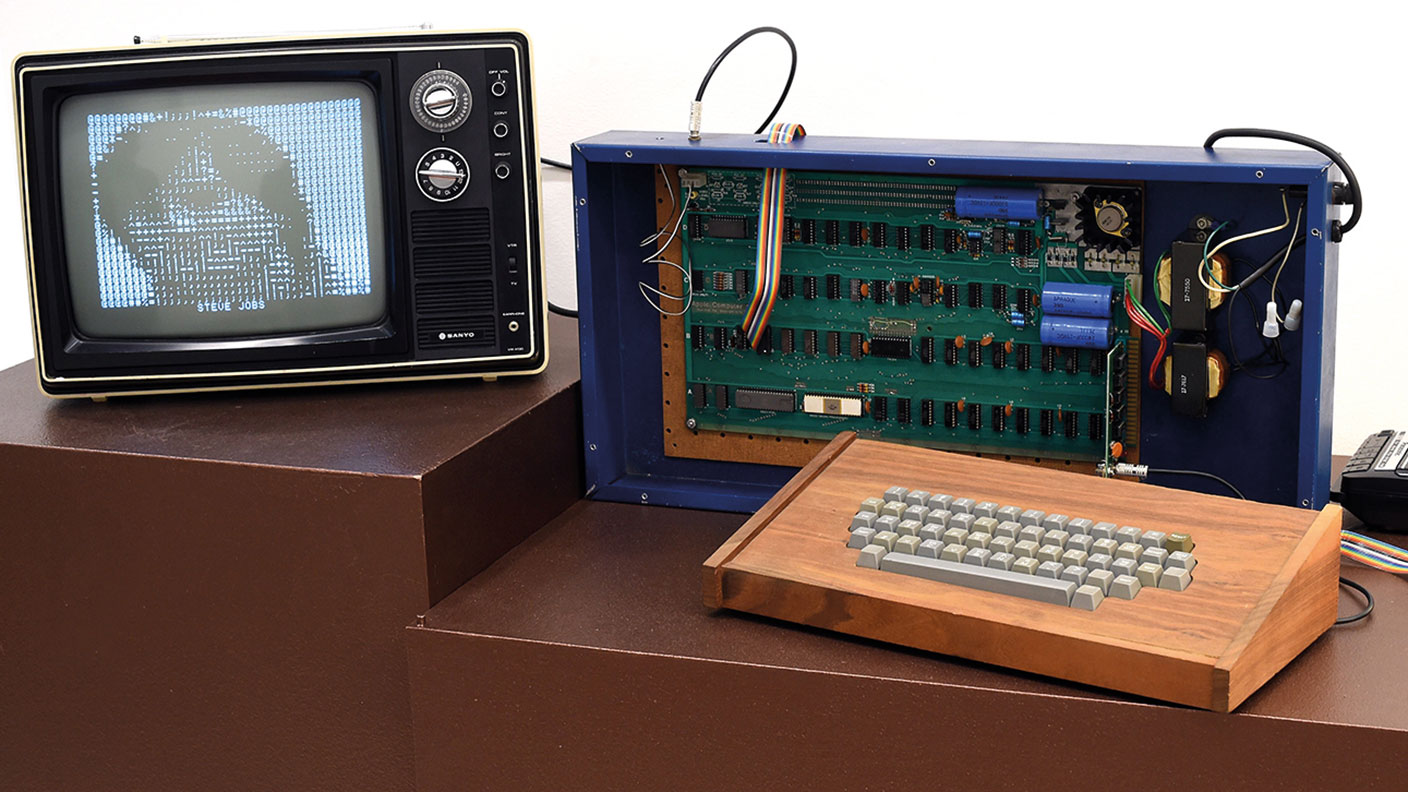

“The retro-computing scene is huge and growing in the UK,” Martin Cooper, of the British Computer Society, tells Elisabeth Perlman in The Times. “Look no further than eBay. There you’ll see machines including Amigas, Spectrums, and Acorn BBC Micros all eagerly changing hands for hundreds of pounds.” Nostalgia is driving demand. The Acorn BBC Micros, for example, were widely used in schools and they have become favourites among collectors, says Katrina Bowen, design officer at the Centre for Computing History in Cambridge. And because these computers used fairly standard components, “many enjoy the challenge of learning basic electronics and repairing non-working machines”, she says. But it is the Apple-1, created in 1976 by Steve Wozniak, Steve Jobs and Ron Wayne, that occupies the high end of the market. In March last year, a rare, fully functional one sold for $458,711.

Auctions

Going…

Jean-Michel Basquiat’s 1982 painting Warrior (above) will become the most valuable Western artwork ever offered in Asia, when it goes up for auction with Christie’s on 23 March in Hong Kong. The painting carries a HK$240m (£22m) upper estimate. It was, says the auction house, painted at the height of Basquiat’s “artistic power”, while the artist was still in his early 20s, marking him out as one of the most important painters of the last half century. The “Christ-like, gladiatorial figure” was “extensively explored by the artist in numerous sketches prior to this work”. In 2017, Christie’s in New York sold a similar painting, La Hara (1981), for $35m, including fees.

Gone…

Sandro Botticelli’s masterpiece Young Man Holding a Roundel (late 15th-century) sold for $92m, with fees, late last month with Sotheby’s in New York, setting a new auction record for the Italian Renaissance artist. There were doubts about whether art collectors would still be prepared to pay such sums, says BBC News. The successful sale could help boost prices for other such Old Masters paintings “at a time when many art collectors are chasing newer works from post-war and contemporary artists”. The previous record for a Botticelli was set in 2013, when Madonna and Child with Young Saint John the Baptist, sold with Christie’s in New York for $10.4m.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward