Whisk yourself away to better times with transport memorabilia

Nostalgia is driving a boom in transport memorabilia, including tube train luggage racks and illuminated garage signs. Chris Carter reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For those of us fortunate enough to be able to work from home, successive weeks of lockdown almost makes one nostalgic for the daily commute to the office. Almost. But it does also offer up at least one explanation for the growing popularity of transport memorabilia. “Collectors have gone wild for parts salvaged from decommissioned Tube trains, with goods ranging from seat fabric, station tiles and phone handsets,” says Rory Tingle for MailOnline. Sales of Metropolitan Line luggage racks from the Sixties, for example, have generated hundreds of thousands of pounds for the London Transport Museum. Lift buttons, bizarrely, are apparently especially popular.

Since the museum comes under Transport for London’s direction, it is free to keep or sell any old items that come into its hands – a lucrative revenue source, as it turns out. According to MailOnline, the museum has, over the years, sold 1,053 Jubilee Line lift buttons for a total of £26,325, eight Overground train drivers’ seats at £375 a pop and 3,554 Metropolitan Line luggage racks for £355,500.

Driving the market

It’s not just trains. “The market [in automobilia] is showing no signs of slowing, and items which might have been £50 or so a couple of years ago are now making around £250,” says collector Stewart Imber, who runs a business, Themed Garages, dressing sets for motoring events, such as the Goodwood Revival. In October he sold part of his collection through Cambridge-based auction house Cheffins. “Illuminated signs are now really coming into their own as part of the vintage sale,” says Cheffins’s director, Jeremy Curzon. And yet, “despite their meteoric rise in popularity, illuminated signs can still be picked up at a good price at auction and we see many buyers coming to the sales looking to pick up a bargain”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“Upcycling” memorabilia

British Airways indulged plane enthusiasts in November with a sale of its surplus stock. William Edwards plates were on sale for £25, bread baskets for £42 and hot towels for £12 each. In fact, such was demand that some customers complained of delivery delays. Sensing a trick, the airline has even launched a range of 150 limited edition BOAC Speedbird suitcases this month, each made with bits of an old Boeing 747 and costing £1,935 apiece.

But it’s best to wait for transport items to be decommissioned first. Earlier in January, one fashion student ran into trouble with clothes sales platform Depop after refashioning and selling a Chiltern Railways seat cover cum bandeau top. She sold it for £15 before refunding the money and delisting the item. Chiltern Railways was not amused. “Whilst we appreciate this new take on railway memorabilia,” a spokesperson said, “…we would respectfully ask that they are left in place.”

Auctions

Going…

Film posters, memorabilia and toys are going under the hammer at Van Eaton Galleries, in California, as part of its A Celebration of Popular Culture sale on 30 and 31 January. A poster from the 1954 classic Creature from the Black Lagoon is expected to sell for up to $30,000 and an “exceptionally rare” life-size replica of Rocket Racoon from Marvel’s Guardians of the Galaxy has been given an upper estimate of $50,000. Among the toys for sale is a Batman Utility Belt from 1966 that is valued at up to $10,000.

Gone…

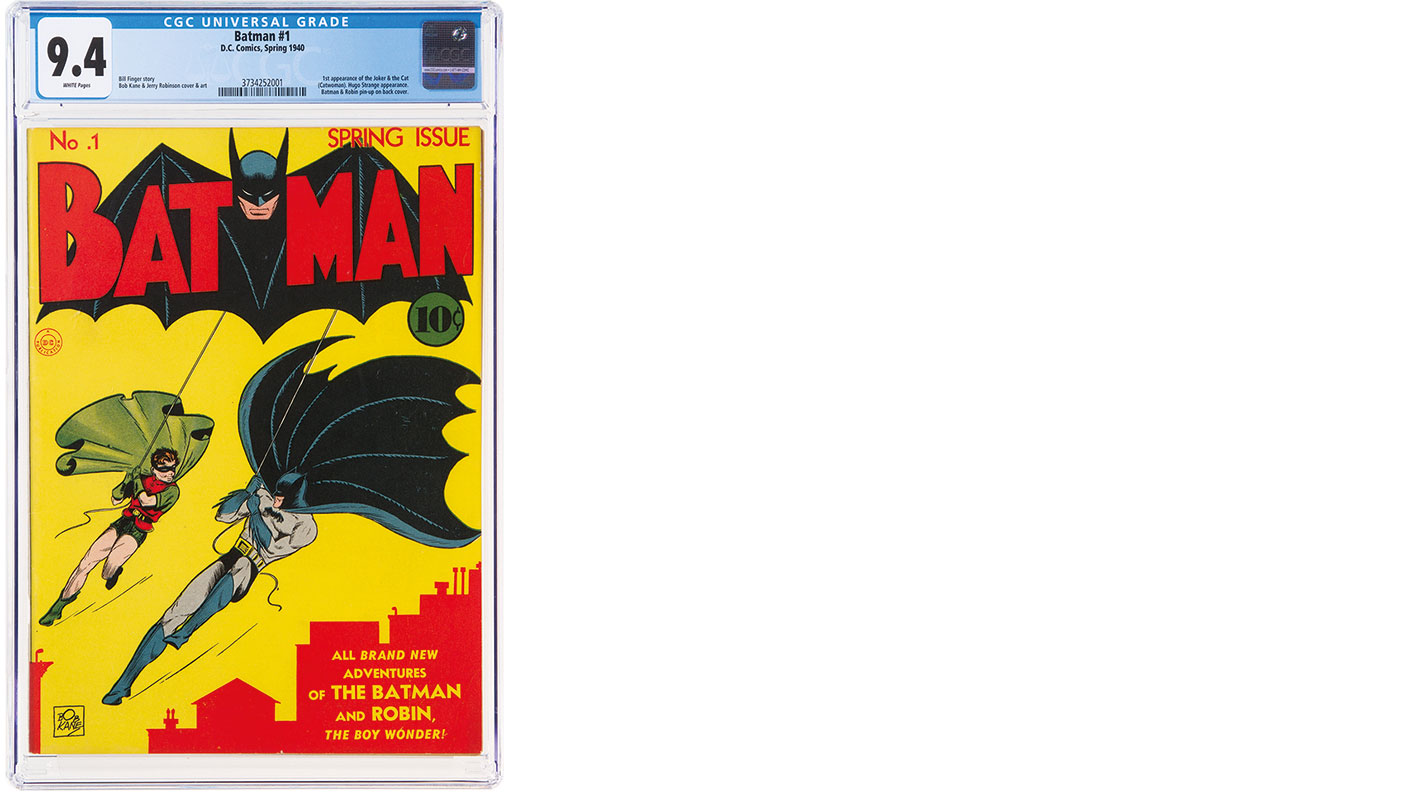

The first comic to feature Batman in its title has fetched a record $2.22m, “far and away the highest price ever realised for a comic book starring Bruce Wayne and his caped-and-cowled alter ego”, says Texas-based Heritage Auctions. The No.1 issue is the sole copy to receive a 9.4 grade (out of ten) for its condition. The record was reached after online bidding surpassed $1.53m with a week still to go. The 1940 issue of Batman also features the debuts of villains the Joker and Catwoman.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward