Bitcoin is in a bear market. So what should hodlers do now?

Having fallen 10% overnight and 40% from its highs, bitcoin is now firmly in bear market territory. Dominic Frisby looks at where it might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bitcoin is in a bear market. Let’s not beat about the bush, or try to spin it. The price is falling – it fell 10% just while I was asleep last night and it’s already almost 40% off its highs.

If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck. It’s a bear market.

So what happens next? How long does it go on for? Where does it fall to? And, most importantly, what do we do?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bitcoin is on the slide. But what do you do about it?

Bitcoin, as we know, is a highly speculative asset. It is not only a new technology, but a new technology that is money. A more “bubbly” asset has never been designed.

It thus evokes all the emotions that come with a speculative mania. In fact, it heightens them to the “nth” degree. Massive FOMO (fear of missing out) on the way up, as well as elation, exhilaration and delusion.

When it goes into a bear market, the opposite happens, with equal emotional intensity. I don’t know what the opposite to FOMO is – GMOOTT, maybe (get me out of this thing). There will be denial (hence all the arguing, especially with Elon Musk), fear, capitulation and despair.

Just as many lose perspective on the way up – “it’s going to a million dollars!” – so will many lose perspective on the way down – “it’s finished, bitcoin is over!”

Lots of bad decisions are going to get made. In fact, many bad decisions have already been made – buying near the top. Now it’s about damage limitation; do you sell now, take a loss and buy back lower? Easy to say, hard to do.

The particularly hard thing to do is the buying back lower bit. Bitcoin goes to $30,000. Do you buy now? “No, I think it’s going to $20,000”. It goes to $20,000. At this point pessimism is so pronounced that it is very, very difficult to persuade yourself to buy. So you don’t. Then bitcoin reverses and before you know it, it’s back above $40,000, and you’ve lost your position.

So do you “hodl”? This is the tried and tested practice of holding no matter what. It’s been the most effective bitcoin trading strategy since its inception 12 years ago; perhaps it will be again. Who knows? But hodling is very hard too. It takes extraordinary will power to hold through two years of bear market.

How much further could bitcoin fall? Here are the key technical levels

Just before I went to bed last night bitcoin was sitting around $43,500. It fell $5,000 in the time I was asleep – that’s over 10%.

Shortly before shuteye, I was posting on Twitter that if $42,000 doesn’t hold, then $30,000 comes into play. Technical analysis 101 says that’s the next line of support.

After $30,000, then $20,000 comes into play. $20,000 is the old high from 2017 – a monumental price point. It would be very typical of bitcoin to come back to that level, touch it and then resume normal business – to kiss $20,000 goodbye.

I’m not saying that will happen, because I don’t know. I’m just speculating (and with words, not money). Heck, I wouldn’t rule out going all the way back to $12,000. But bitcoin could just as easily turn up and rally from here. You know what it’s like.

The bull market was tired. Bear markets in bitcoin are normal. They are as vicious as the bull markets are epic, they are part of the territory and that is where we are now.

The Financial Times will be all over it, so will the BBC and The Economist. There’ll be stories about lost fortunes. Many of the scams will be exposed. There will be calls for greater government intervention and regulation. But all the while the tech will evolve and improve.

I would say we have moved on from the “denial” phase and are now in the “fear” stage. We still have “capitulation” and “despair” to go. That is also when we reach peak gloating from “nocoiners”.

This bull market hasn’t been quite as epic as previous bitcoin bull markets, so the corresponding bear market probably won’t see the usual 85%-90% correction (I think there have been five of these so far). But a bear market is still a bear market.

Bitcoin isn’t over. It will come back. But when it starts feeling like it’s over, that’s the time to be buying. Ultimately, if you are selling your bitcoin for fiat currency, you are exchanging a superior asset for an inferior one. It’s usually better to hold quality assets, even in bear markets.

This isn’t about Elon Musk – this is about the return of real assets

By the way, despite the fact that many will blame Elon Musk’s recent tweets for these falls in price, there is a bigger force at play here. Bitcoin is a new technology. It has been behaving like a tech stock. Bitcoin and the Nasdaq have been tracking each other for some time.

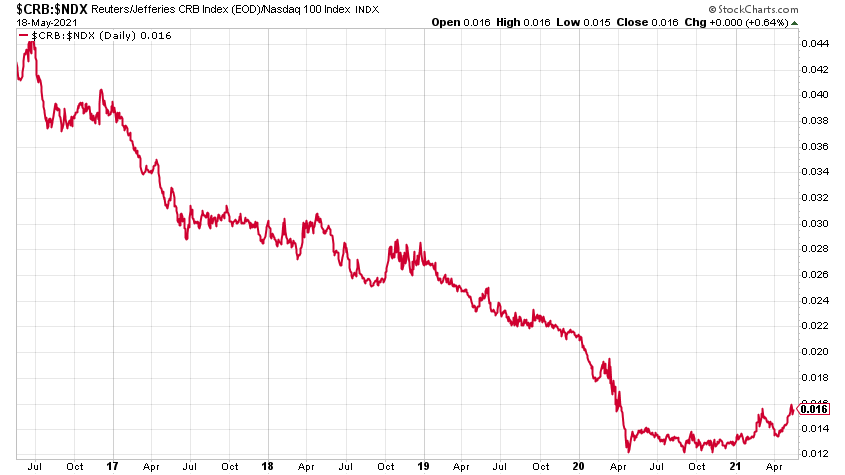

For some 13 years – since 2008 – tech stocks, digital assets in other words, have been dramatically outperforming commodities (real stuff). That is another bull market that is over. It has reversed. Real stuff is outperforming again, and I rather suspect it is going to do so for a good few years yet.

My goodness me, this is a reversal that is overdue. Tech trashed commodities from the late 1980s to 2000; between 2000 and 2002 commodities had their day; from 2002 to 2008 the two range-traded. Tech has led since 2008 and it will lead again. The scalability of digital is phenomenal.

But for now, real stuff is retracing some of the huge ground that has been lost. That should continue for a few years yet is my view. Here’s the ratio of the Nasdaq versus the CRB commodities index over the last five years. It has clearly turned up; Covid marked the bottom.

Bitcoin’s slide is part of that rotation from digital into real stuff.

For now the negative narratives are taking over. If the price continues to fall, they will get even more pronounced. A little bit of upward price action, however, and the overwhelming bullish bitcoin story will take over once again.

I’m hodling bitcoin. But I’m hodling lots of real stuff too.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.