Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Federal Open Market Committee voted to keep US interest rates steady at their last meeting, citing concern for the economy in spite of persistently rising prices. Had the European Central Bank not elected to keep interest rates steady too, I suspect the dollar would have been lower against the euro Friday.

The dollar has held steady against the euro and the pound since mid-May, fell modestly against the Chinese renminbi and strengthened against the yen and the Swiss franc - pretty much a mixed bag. During this time the gold price in US dollars fell by $90 an ounce, or 12%.

This decline in the gold price during a relatively stable period for the US dollar confirms my belief that metals prices ran too high, too fast, and are merely correcting for past exuberant behavior. I am therefore still raising cash by selling high-flying stocks and waiting for the market to settle down.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold is much more attractive in the low $600 an ounce range than it was three months ago, but I remain concerned that the weakening US economy is going to lead to reduced demand for base metals, which in turn could lead to lower base metals prices and possibly drag the gold price lower as well. Every time I say this I get a flurry of emails pointing out that the economic boom in China and India will drive demand for raw materials for decades to come. I don't buy that.

Economic growth in both China and India is closely tied to US consumption. India's service sector provides outsourcing solutions predominantly for US companies servicing US consumers. Similarly, Chinese manufacturers rely on US consumption for much of their output. At current exchange rates the United States accounts for almost one third of global economic activity, and over 70% of the US's GDP is consumer spending. In other words, US consumers account for almost one quarter of all economic activity worldwide. If US consumption slows down, every large, integrated economy will suffer the consequences; and that includes India and China.

All the economic woes I have been warning about are at hand: housing sales are plummeting, inventories are rising, car sales are falling, companies are downsizing and consumer spending is not quite as giddy as it used to be. This is serious stuff. It all stems from aberrant capital flows that began more than 20 years ago and have not yet been corrected: the US dollar is still about 35% to 50% overvalued. When the dollar finally corrects, the US dollar gold price will double from here. That is why I am not concerned about the current decline in the gold price - the lower it goes, the more money we can make when the dollar finally cracks.

I always feel much better when I know that my opinion is not in the mainstream; without differing opinions there could be no market. We all need other people with different, or opposing, opinions to buy from and sell to. I get nervous when too many people agree with me.

First published on Kitco.com (www.kitco.com)

By Paul van Eeden. Paul van Eeden works primarily to find investments for his own portfolio and shares his investment ideas with subscribers to his weekly investment publication. For more information please visit his website (www.paulvaneeden.com). If you would like to read more from Paul, you can sign up to get his weekly commentary at https://www.paulvaneeden.com/commentary.php.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

France’s government collapses – could it trigger the next euro crisis?

France’s government collapses – could it trigger the next euro crisis?Briefings France’s government has toppled after losing a vote of no-confidence, plunging the euro zone’s second-largest economy into turmoil. Is this 2012 all over again and should Europe be worried?

-

The junk-bond bubble bursts

The junk-bond bubble burstsNews Yields in the US high-yield bond market (AKA junk bonds) have soared to more than 8% since the start of the year as prices collapse.

-

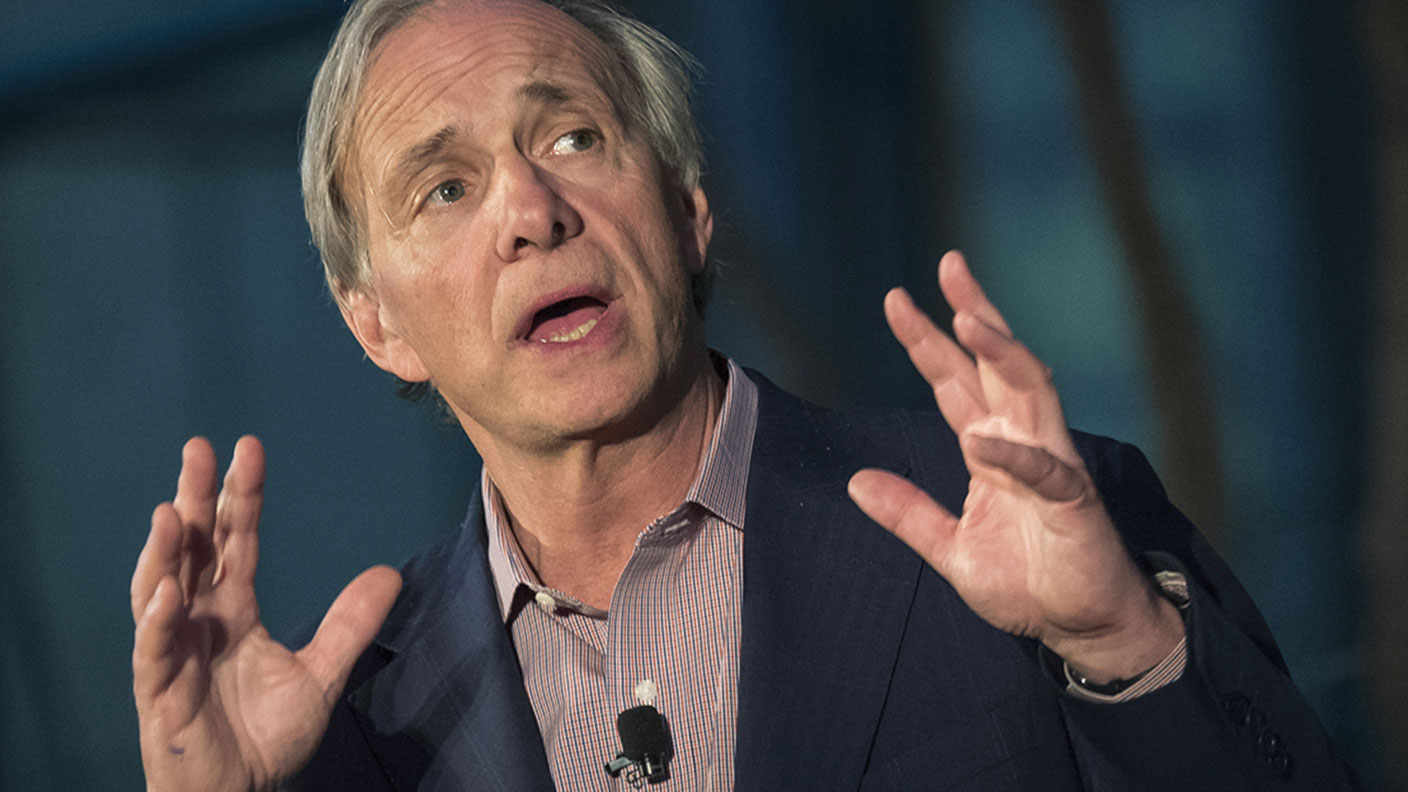

Ray Dalio’s shrewd $10bn bet on the collapse of European stocks

Ray Dalio’s shrewd $10bn bet on the collapse of European stocksOpinion Ray Dalio’s Bridgewater hedge fund is putting its money on a collapse in European stocks. It’s likely to pay off, says Matthew Lynn.

-

French stocks are back in fashion

French stocks are back in fashionNews France’s CAC 40 stockmarket index gained 29% in 2021, making it the world’s best performing major market.

-

Has Italy’s economy turned the corner?

Has Italy’s economy turned the corner?News Italy’s FTSE MIB stockmarket index has returned 23% so far this year, more than double the FTSE 100’s performance over the same period.

-

Overlooked European stocks are a solid bargain

Overlooked European stocks are a solid bargainNews The lack of speculative exuberance in European stocks compared to US markets bodes well for investors seeking less tech-heavy drama and more deep value.

-

Too embarrassed to ask: what are negative interest rates?

Too embarrassed to ask: what are negative interest rates?Videos There’s been a lot of talk from the Bank of England recently about introducing “negative interest rates”. So what on earth are they, and what would they mean for your money?