The battle of the bond markets and public finances

An obsessive focus on short-term fiscal prudence is likely to create even greater risks in a few years, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bond and equity investors are fundamentally in opposition. A bondholder cares only about receiving their interest and capital; anything that puts that in danger is bad. The ideal borrower might be one that takes your cash, parks it in ultra-safe assets to protect the principal and makes paying the coupons the only priority for its cash flow. There is no upside if the borrower takes risks. In fact, there is not even much value in long-term survival: the borrower can fail due to a lack of investment and the bondholder is still happy if they have been repaid in full.

On the other hand, equity – “the fine sliver of hope between assets and liabilities”, as Russell Napier calls it – hopes to profit from growth in earnings or assets. Shareholders want the company to take some kind of risk because they benefit if that risk pays off. If that might increase the chance that loans aren’t repaid, so be it.

This is well understood by markets. Nobody expects bondholders and shareholders to speak in each others’ interests. Yet when it comes to the public finances, that gets completely lost.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

All about the bonds

Today, we hear endless talk about why the chancellor needs to cut spending, raise taxes or both. Look at this through the bond-equity framework, and we can see that this is framed in bondholders’ terms: it’s all about making them feel more secure. The discussion rarely touches on whether borrowing is rising because of current expenditure or long-term investment.

Bond investors could make a very valuable intervention by signalling that borrowing to invest in the infrastructure that Britain needs (with a well-costed plan) would be seen very differently from borrowing to fund profligate current expenditure. Yet most talking points simply boil down to “large deficit = bad”.

This reasoning gets stretched into some bizarre pretzel logic. Raising taxes will slow growth since disposable income will be reduced, we are told approvingly. That may curb inflation and allow interest rates to be lowered, which is good for bonds. Yet the idea that anybody else would want weaker growth in an economy that is clearly not overheating is frankly unhinged.

Equity holders in this scenario are everybody who benefits from a stronger economy and more investment. And this is where long-term consequences of the current mindset look so worrying. Consider the visible deterioration in physical and social infrastructure in Britain. Failure to fix this because the government is cowed by the self-important bond vigilantes will open the door further to populist parties.

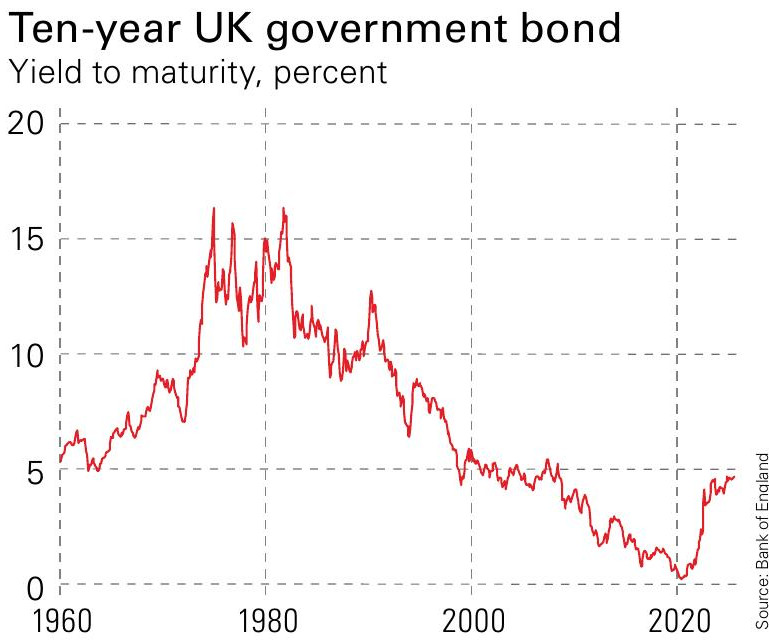

At present, UK 10-year gilts yield 4.4%. This is not high by past standards: it only feels high because of 15 years of ultra-low rate policy. True, it is high enough that rising interest costs puts even more strain on public finances, which makes the challenge even greater. But what compensation does it offer for, say, the inflationary risk of a future government in five years’ time with a populist mandate to spend and willingness to be radical? Very little.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Should you sell your Affirm stock?

Should you sell your Affirm stock?Affirm, a buy-now-pay-later lender, is vulnerable to a downturn. Investors are losing their enthusiasm, says Matthew Partridge

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Beeks – building the infrastructure behind global markets

Beeks – building the infrastructure behind global marketsBeeks Financial Cloud has carved out a lucrative global niche in financial plumbing with smart strategies, says Jamie Ward

-

Saba Capital: the hedge fund doing wonders for shareholder democracy

Saba Capital: the hedge fund doing wonders for shareholder democracyActivist hedge fund Saba Capital isn’t popular, but it has ignited a new age of shareholder engagement, says Rupert Hargreaves

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

Investing in space – finding profits at the final frontier

Investing in space – finding profits at the final frontierGetting into space has never been cheaper thanks to private firms and reusable technology. That has sparked something of a gold rush in related industries, says Matthew Partridge

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn