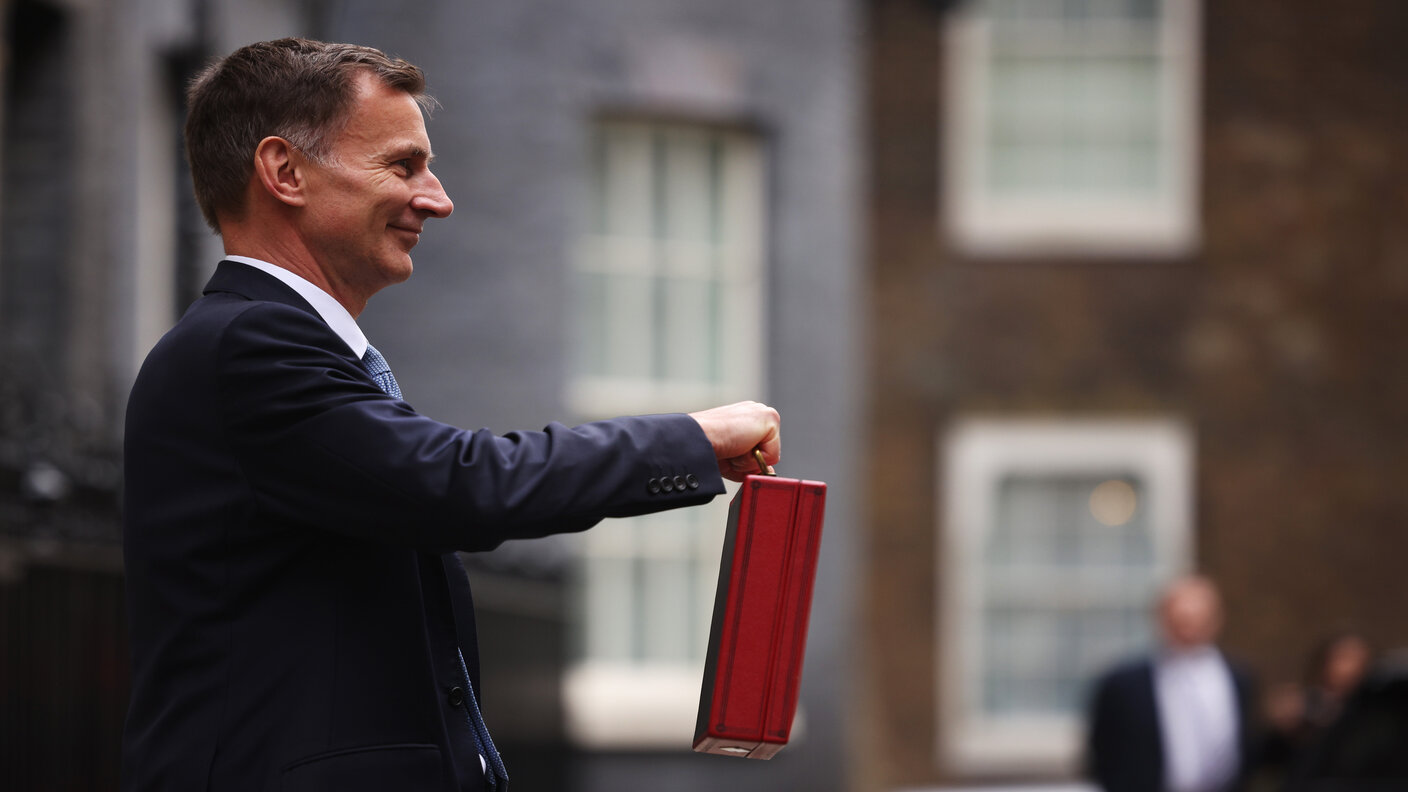

The Budget brought a short-term reprieve for investors

The Budget spared investors for now – so make sure you use up all your your allowances.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For all the fanfare about cheaper draught beer and sparkling wine, few will be raising a toast to last week’s Budget. Tax rises and personal-allowance freezes will leave the average household £3,000 a year worse off next year than they were at the time of the last general election, according to calculations by Hargreaves Lansdown. The already-announced health and social care levy, a 1.25% rise in national insurance that takes effect next April, plus an associated dividend-tax rise, will net the Treasury £13bn a year.

More insidious are frozen personal allowances. In April, the chancellor froze the basic-rate tax band at £12,570 and the higher-rate band at £50,270 until 2026. At a time of high inflation and strong wage growth, many earners will be sucked into higher bands over the coming years: the Office for Budget Responsibility (OBR) estimates that an extra one million taxpayers could be paying the higher rate by 2026. Several other thresholds – including the capital-gains tax (CGT) allowance, pension contributions and inheritance tax – have also been frozen. The “stealth tax raid” looks set to raise £47bn over the next five years, says Laith Khalaf of AJ Bell. Taxpayers always face “fiscal drag” – the practice of the Treasury holding tax threshold increases below the rate of wage increases. Yet these frozen thresholds amount to “fiscal drag on steroids”. The freeze means a taxpayer earning £80,000 could pay an additional £5,505 in tax over the next five years, assuming current OBR forecasts for wage growth and inflation.

There are some winners at the lower end of the income spectrum: households on universal credit will enjoy a slightly lower “taper rate” of tax on extra income, while the national living wage has been raised. A planned fuel-duty rise has been scrapped, although soaring oil prices mean motorists are unlikely to notice. Overall, the OBR says that Britain is heading for levels of taxation not seen since the 1950s.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The dogs that didn’t bark

For investors, most important were the dogs that didn’t bark. A widely discussed rise in CGT didn’t materialise, while higher-rate tax relief on pension contributions once again escaped the chopping block. The pensions lifetime allowance remains frozen at £1.073m, with the annual allowance likewise stuck at £40,000. Yet this only amounts to a reprieve, as Michael Martin of Seven Investment Management tells the Financial Times. It is difficult to “make large tax changes in the middle of a tax year”, but changes to the CGT regime “must be in the pipeline… be prepared for an announcement in March 2022, with potentially a year’s window to crystallise gains… before the higher tax rate comes in”.

With taxes only heading upwards it is crucial to use up tax-free allowances. Make the most of tax relief on pension contributions (especially for higher-rate taxpayers) and the £20,000 annual individual savings account (Isa) allowance. For assets outside of a pension or Isa wrapper, make the most of the £12,300 per person CGT allowance while it lasts, says Angela Lloyd-Read for This is Money. “Transferring assets to a spouse or civil partner, free of CGT, allows them to use their allowance too, effectively doubling the household CGT allowance for the year.”

There is one silver lining to the tax grab: improved economic forecasts from the OBR mean that the chancellor could have £25bn of spare fiscal room to play with by the end of this parliament. That war chest could eventually turn into pre-election giveaways.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

Is Britain heading for a big debt crisis?

Is Britain heading for a big debt crisis?Opinion Things are not yet as bad as some reports have claimed. But they sure aren’t rosy either, says Julian Jessop

-

When is the Autumn Budget and what should you expect?

When is the Autumn Budget and what should you expect?Chancellor Rachel Reeves is set to deliver her second Autumn Budget next week – but what exactly does the fiscal event involve?

-

Conservatives pledge to cut National Insurance again – how much could you save?

Conservatives pledge to cut National Insurance again – how much could you save?News A 2p reduction in National Insurance is a key feature of the Tory’s general election manifesto.

-

Bank of England hikes key interest rate to 4.25%

Bank of England hikes key interest rate to 4.25%News The Bank of England raised rates by 0.25% following a surprise jump in inflation.

-

Spring Budget: what does it mean for your finances?

Spring Budget: what does it mean for your finances?News From energy and childcare help to pension changes and frozen tax bands – what does the Spring Budget mean for you?

-

What is a recession? UK impact explained

What is a recession? UK impact explainedAnalysis Office for National Statistics (ONS) figures show UK GDP growth has gone into reverse. But what does a recession mean?

-

What could be in the Autumn Statement?

What could be in the Autumn Statement?News Jeremy Hunt will reveal his first Autumn Statement as chancellor on Thursday, 17 November. From pensions and inheritance tax to income tax and capital gains tax, we look at what could be announced, and the potential impact on your finances.

-

What could be in the chancellor’s statement on 31 October?

What could be in the chancellor’s statement on 31 October?Analysis After dismantling most of the mini-Budget in a series of U-turns, Jeremy Hunt will reveal the rest of his “medium-term fiscal plan” on Halloween. We look at what changes could be announced, and the potential impact on your personal finances