Why we need to chop off the “dead hand” of the Treasury

HM Treasury, the department in charge of long-term growth, fiscal policy, and departmental budgets, is a single bloated behemoth. It would be better to split the roles.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Recent weeks have seen yet another supposedly ambitious announcement from the government – in this case on the UK’s future energy security – first delayed and then radically scaled back in the face of objections from the Treasury.

Boris Johnson came to power promising to solve the social care crisis, make the UK a “science superpower”, “level up” the country and speed up progress to net zero carbon. All are noble ambitions, but all require massive long-term investment of a kind the Treasury appears determined to avoid, just as it pulled the plug on delivering the whole of HS2.

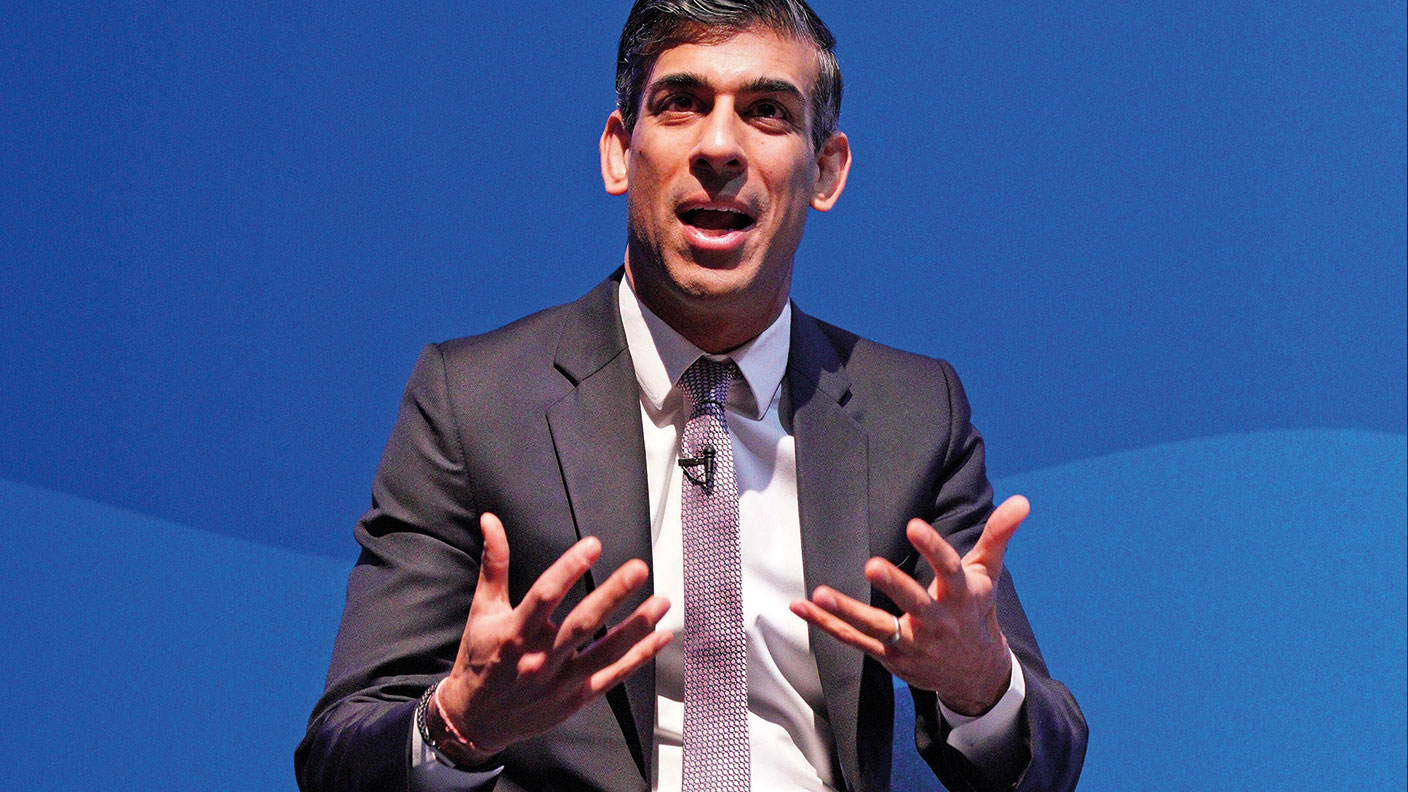

Most recently, Rishi Sunak’s lacklustre response to the current crisis over energy costs is proof that the chancellor has developed all the known symptoms of “Treasury brain”, says Eliot Wilson in CityAM. This unfortunate malady ends up affecting all chancellors and is “endemic” in the present Treasury – the symptoms being “instinctive parsimony, distrust of large-scale spending projects, a deeply possessive attitude towards taxpayers’ money and, most importantly in this case, appalling short-termism”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Isn’t fiscal stability important?

Yes, but it’s a means to an end, not an end in itself – and the Treasury is prone to confusing the two, say critics. The Treasury is not just in charge of fiscal policy, it’s the UK’s economic ministry, charged with steering long-term growth and prosperity.

Part of the problem is that in most developed economies the Treasury’s functions are spread across different departments of state. Here, the Treasury is both the economics ministry responsible for fostering policies that encourage long-term growth and the finance ministry responsible for fiscal policy and public-sector debt. It is also, third, in effect a budgetary ministry responsible for managing departmental spending.

Why does that matter?

Because the mega-ministry is an overmighty behemoth, dominating the whole domestic policy agenda and yet tasked with potentially conflicting aims that lead it to prioritise cost-saving at the expense of long-term benefits. It unbalances Whitehall by sucking in many of the most talented civil servants. It’s also the only department to send two ministers to cabinet (or three if you count the Treasury’s “First Lord”, the PM). In short, it’s too powerful.

In the post-war decades, the Treasury was the hub for “Keynesian demand-management”, says The Economist – while under Margaret Thatcher it drove the monetarist revolution. Under New Labour, the Treasury commandeered social policy; under the coalition of 2010-2015 it oversaw austerity. Now its instinctive caution and lack of long-term vision is hindering the kind of action needed to address the UK’s structural problems and cost of living crisis, critics say.

Critics such as who?

Left-wing voices have been arguing for years that the Treasury is a fundamentally conservative institution whose fiscal caution is against the national interest. But these days it’s not just the usual suspects making that case. The core problem with the Treasury, according to the FT’s chief economics commentator Martin Wolf, is that it is “institutionally sceptical about anything that comes from spending departments and is particularly sceptical about schemes for economic improvement”.

The Treasury is competent, but also “defensive and defeatist” – and its excessive caution is almost certain to doom the “levelling up” agenda to failure. It’s a “dead hand” on policy-making that needs to be “lopped off”. Wolf’s FT colleague Robert Shrimsley castigates the Treasury as a “complacent toad” that squats over government instilling it with short-termism and lack of ambition. Its “groupthink, innate fiscal orthodoxy” and resistance to the devolution of powers to the regions have long made it a “block to progress”, says Shrimsley. And given the weakness of this prime minister, that’s not going to change.

So should the Treasury be broken up?

It has been tried before, in the 1960s, when the Labour prime minister Harold Wilson – determined to push through a levelling-up-style “National Plan” for growth and investment – decided that a finance ministry focused on spending restraint could not also be charged with setting long-term economic strategy. Wilson’s solution was to split up the Treasury, handing some of its responsibilities to a new Department of Economic Affairs.

The idea, says George Dibb in the New Statesman, was that a “creative tension” between the Treasury and its upstart sibling would benefit the government overall. Alas, the arrangement led merely to turf wars and discord, while a balance-of-payments crisis engulfed Wilson’s government.

So what to do?

Other governments have toyed with reform. Gordon Brown, pre-1997, considered a plan to slim down the Treasury, but dismissed it on the grounds of the DEA precedent leading to “turf wars”. Later, “Operation Teddy Bear”, a plan mooted in 2003 by Tony Blair and Peter Mandelson, was aimed at clipping Brown’s wings by making the Treasury into a much-reduced finance ministry overseeing macroeconomics, and splitting off oversight of departmental spending. Brown, by now a powerful chancellor, saw them off.

In 2016, Theresa May created an expanded business department (BEIS) that trod on the Treasury’s toes, and was scaled back again after May left office. Even today, says Dibb, there are “echoes of the DEA experiment” in the joint No. 10 and No. 11 policy team set up by Dominic Cummings.

What Johnson’s ousted chief adviser realised was that there’s not much point in joined-up policy-making if that merely means joining it up to the dead hand of the Treasury, says Dibb. How should the UK prepare to meet the economic and fiscal challenges of the 21st century? “The answer is simple: we need to break up the Treasury.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?