We're near the tipping point for electric cars

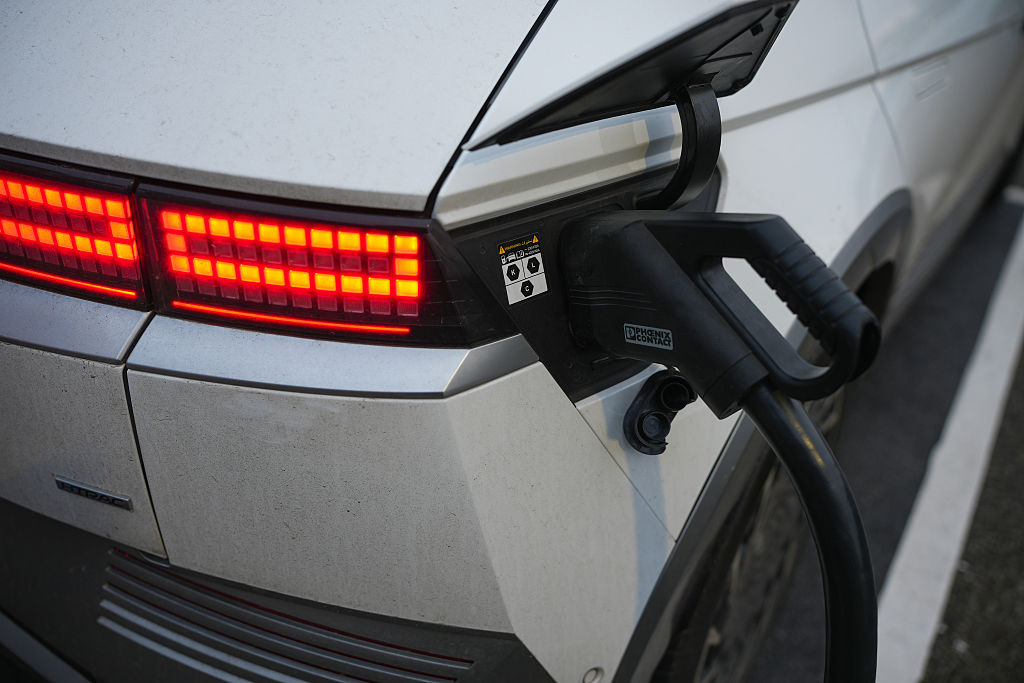

Demand for electric cars is soaring soared. And while the switchover will be expensive, we could be near a tipping point.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

January’s statistics on new car sales for the UK were pretty dire. New registrations fell by more than 7% on last year. There are lots of reasons for that – shifting rules on emissions, plus fewer people falling out of financing deals (and thus upgrading to new models), saw diesel sales fall by more than a third, while petrol car sales fell by near-10%. But there was one bright spot. Demand for partly or entirely electric vehicles soared. The number of new battery-powered electric vehicles hitting the roads trebled (from a low base), while sales of various hybrid types were up sharply too.

Over in the US, shares in Tesla – king of the electric-car makers (for now) – went on an extraordinary run. The share price has doubled since the turn of the year. I can’t pretend to understand it and it’s clear the stock is in some sort of mania phase. But I won’t complain – it’s a big holding in one of our favourite investment trusts, Scottish Mortgage.

Oh, and there was a headline-grabbing story earlier in the week when the Financial Times reported that Japanese carmaker Nissan may “double down” on production at its Sunderland plant should we end up with a “no-deal” Brexit and tariffs by the end of the year. One contingency Nissan is apparently examining (though the car group denied the story) is to close its continental European plants and focus on grabbing UK market share. Nissan also makes Britain’s most popular electric car, the Leaf. A modified Leaf, we learn, has just completed the largest autonomous driving experiment seen on UK roads – the car drove itself 230 miles around British roads without a single accident.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why am I telling you all this? Well, all of these stories land in a week that has seen Britain’s politicians bring forward a ban on all new cars with any form of internal combustion engine – including hybrids (those which have a battery and a petrol or diesel engine) – by 2035. Call me cynical, but that might be the sort of thing to make a big, politically crucial employer – one with a lead in electric-car development in the UK market, say – think twice about upping sticks, even if Brexit doesn’t go exactly the way it hopes.

True, it’s easy to put two and two together and come up with five. But whatever the specifics of the Nissan story, it’s clear that a mix of factors – from political expediency to technology to genuine demand from consumers – is creating a tipping point for electric vehicles (hopefully ones that will eventually drive themselves).

It’ll be expensive, of course. Philip Johnston in The Daily Telegraph points out that a full switchover would mean a £28bn-sized hole in the budget every year simply through the loss of fuel duty. And that’s before you get to the investment in infrastructure required. But then again, we live in an era where government spending doesn’t matter. Perhaps this is how the UK embraces Modern Monetary Theory (MMT) – the notion that a government can spend what it likes until inflation takes off.

What does this mean for investors? When it comes to bubbles, I prefer to invest in “anti-bubbles” – the assets that get neglected along the way, perhaps like oil major BP. But as a hedge against my own bearishness and a bet on the tech, I’ll also suggest our readers stick with their Scottish Mortgage holding.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?

-

Electric vehicle drivers to be charged new per mile tax from 2028

Electric vehicle drivers to be charged new per mile tax from 2028Electric vehicle drivers will be forced to pay a 3p per mile tax, as taxation will be brought closer in line with petrol and diesel cars

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon