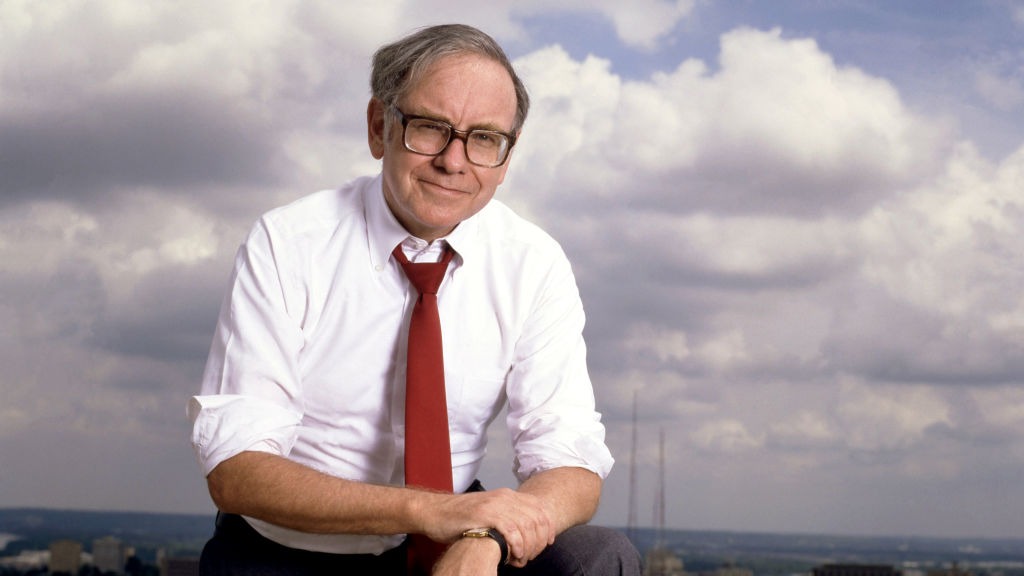

Who will be the next Warren Buffett?

There are several reasons why there won’t be another Warren Buffett. Times have changed, and the opportunities are no longer there, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On 3 May, Warren Buffett announced he was stepping down as the CEO of Berkshire Hathaway, handing over management of one of the largest and most successful investment firms of all time to Greg Abel. Investors will be asking whether Abel is up to the challenge, or, if not, where they can find someone as brilliant as the man he is replacing. The blunt answer is this: the markets won’t ever see his like again. There are three reasons for that.

First, as Buffett himself was always the first to point out, he happened to start his long career at precisely the right time. The post-World War II US economy in which he made the bulk of his fortune was characterised by a long period of rapid growth that had not been seen before, and which we may never see again. Sure, it took incredible skill to pick the right stocks and spot the right trends, but that is a lot easier when the economy is growing at the same time. A slower global economy, and one dominated as much by China as by the US, won’t offer the same opportunities.

Next, when Buffett began, there were lots of small companies to invest in that could generate stellar returns. Buffett’s big early successes were all in businesses that no one was paying much attention to. In the 1960s, he built large stakes in companies such as Dempster Mill Manufacturing and Sanborn Map, which generated outstanding returns. There are far fewer listed firms to choose from these days, especially among smaller companies.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We are all familiar with the way the number of quoted businesses has fallen in the City over the last 20 years. But it has been just as dramatic on Wall Street. In 1996, there were more than 8,000 quoted companies in the US, but that figure has dropped to only slightly more than 4,000, and it is still going down. When Buffett was starting out, there were lots of different companies he could take stakes in, and there were many more that had been neglected by investors or their managers for many years. The chances of finding a spectacular winner was therefore a lot higher. With so few left, it will inevitably be a lot harder for anyone else to pull off the same trick.

'The next Warren Buffett doesn’t exist'

Finally, the markets are far more researched than they ever were in the past. Buffett is famous for voraciously reading reports and accounts to find the next business to back. From the start of his career, he scoured financial statements to unearth assets that had yet to be exploited. That is possible if you are very good at scanning balance sheets and if no one else is taking the trouble. But there is far more information around now than there was when Buffett was starting his career. The hedge funds and private-equity houses are all looking at the same information and trying to spot the same opportunities. Artificial intelligence will streamline that process even more.

It is hard to imagine that a couple of guys in Omaha, no matter how smart they were, could spot something that the rest of the world had somehow missed. Buffett’s reputation is completely deserved. But it seems unlikely there will ever be another investor who does quite as well as he did. The investment world has changed too much for anyone to turn themselves into one of the five richest men in the world simply by investing well. The next Buffett doesn’t exist – and there is no point in looking for him.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King