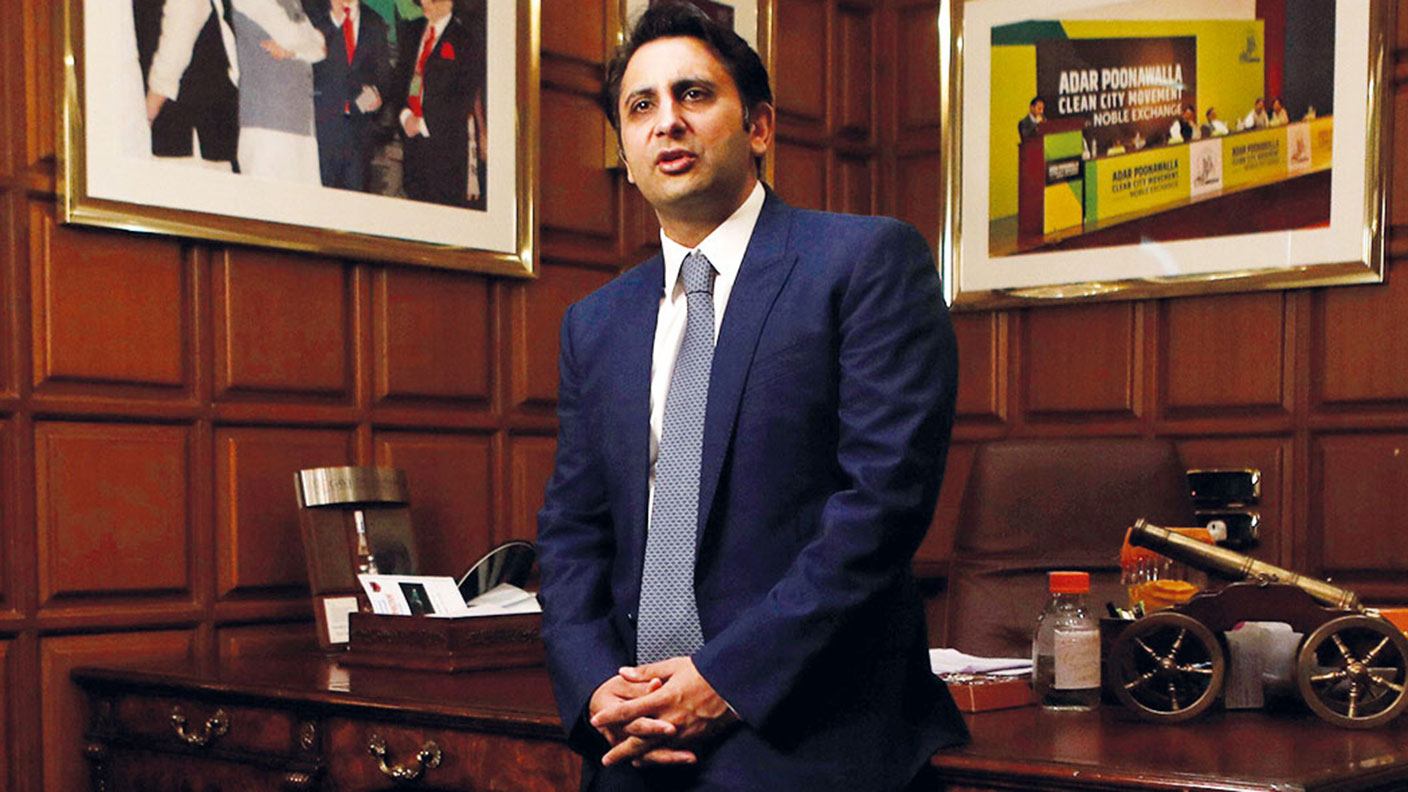

Adar Poonawalla: the vaccine prince who will save the world

Adar Poonawalla, the chief of the world’s biggest vaccine manufacturer by volume, has an ambitious plan to rescue us all from Covid-19. The future for his dynasty looks bright, says Jane Lewis.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If the world manages to escape the clutches of Covid-19 this year, it may be largely down to the efforts of Adar Poonawalla – the Indian tycoon known as “the vaccine prince”, says The Times. Poonawalla’s company, Serum Institute of India (SII), is “comfortably the biggest vaccine manufacturer by volume in the world”: some two-thirds of all the children on the planet have been vaccinated with one or more of its products. The company makes 1.5 billion doses of vaccines annually against diseases such as polio, diphtheria and hepatitis B.

Now Poonawalla, 39, “has an ambitious plan” to supply the Oxford/AstraZeneca coronavirus vaccine to half the planet by this time next year. And he plans to do so at $3 a dose, “which barely covers costs”. When the pandemic set in, he says, “I decided to go all out” – immediately embarking on a dramatic expansion of manufacturing facilities funded by £270m of his company’s money and another £3m from the Bill and Melinda Gates Foundation. The family has cash to spare. According to Forbes, his father, Cyrus Poonawalla, who founded the company in 1966, is worth $11.5bn, making him India’s sixth richest man last year.

Indeed, Poonawalla senior (“the vaccine king”) has almost doubled his wealth during the pandemic, says Business Today (India), thanks to partnerships with global pharmaceutical majors. Poonawalla junior is clear that his primary motivation is not to make money, but to save lives. Whatever the case, he has been lauded across Asia as one of the world’s chief “virus busters”, says The Economic Times of India.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A life of glamour

The Poonawallas – so called because of their base in the city of Pune (known as Poona during the British Raj) – are “a fixture of India’s business aristocracy”, noted the FT in 2014. The family is famous for its stable of racehorses, its stud farm, and one of the country’s most expensive sports-car collections. In 2015 the clan bought a sprawling seaside mansion in Mumbai for $113m in “the most expensive residential property deal in India’s history”. Adar Poonawalla was educated in Britain and enjoys an old-fashioned life of glamour – owning paintings by Picasso, Dali, Rembrandt and Rubens, spending holidays on the French Riviera, attending grand prix and calling the Prince of Wales “a close and very dear friend”. His private office, notes The Times, is “a disused Airbus A320”, which he has lavishly refurbished, complete with boardroom and bedroom.

The family’s journey into vaccines happened almost by chance, says Business Insider. Although hailing from a family of wealthy landowners, Cyrus Poonawalla inherited just 40 acres and knew he had to go into business. It was “a chance meeting with a veterinarian” who worked at his stud farm that triggered an idea to produce vaccines. The timing was propitious, says The Times. When he set up the Serum Institute in 1966, “lots of new vaccines were coming on stream”, but most were imported and far too pricey for most of the country’s population – so the business took off rapidly. It got another boost when Adar Poonawalla joined in 2001 and started developing an international market – cutting the price of vaccines by producing them in huge quantities and focusing on developing countries that the pharma giants ignored.

The future for the dynasty looks bright. Once “a niche industry”, vaccine manufacturing has found a new status due to Covid-19 and the growing threat of future global pandemics. The modern world, says Poonawalla, is “a melting pot…just waiting to churn out more of these kinds of terrible viruses”. He thinks we were “lucky” with Covid-19. “Can you imagine if ebola were as infectious as coronavirus?”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example

-

Michael Moritz: the richest Welshman to walk the Earth

Michael Moritz: the richest Welshman to walk the EarthMichael Moritz started out as a journalist before catching the eye of a Silicon Valley titan. He finds Donald Trump to be “an absurd buffoon”

-

David Zaslav, Hollywood’s anti-hero dealmaker

David Zaslav, Hollywood’s anti-hero dealmakerWarner Bros’ boss David Zaslav is embroiled in a fight over the future of the studio that he took control of in 2022. There are many plot twists yet to come

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The political economy of Clarkson’s Farm

The political economy of Clarkson’s FarmOpinion Clarkson’s Farm is an amusing TV show that proves to be an insightful portrayal of political and economic life, says Stuart Watkins

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

Luana Lopes Lara: The ballerina who made a billion from prediction markets

Luana Lopes Lara: The ballerina who made a billion from prediction marketsLuana Lopes Lara trained at the Bolshoi, but hung up her ballet shoes when she had the idea of setting up a business in the prediction markets. That paid off