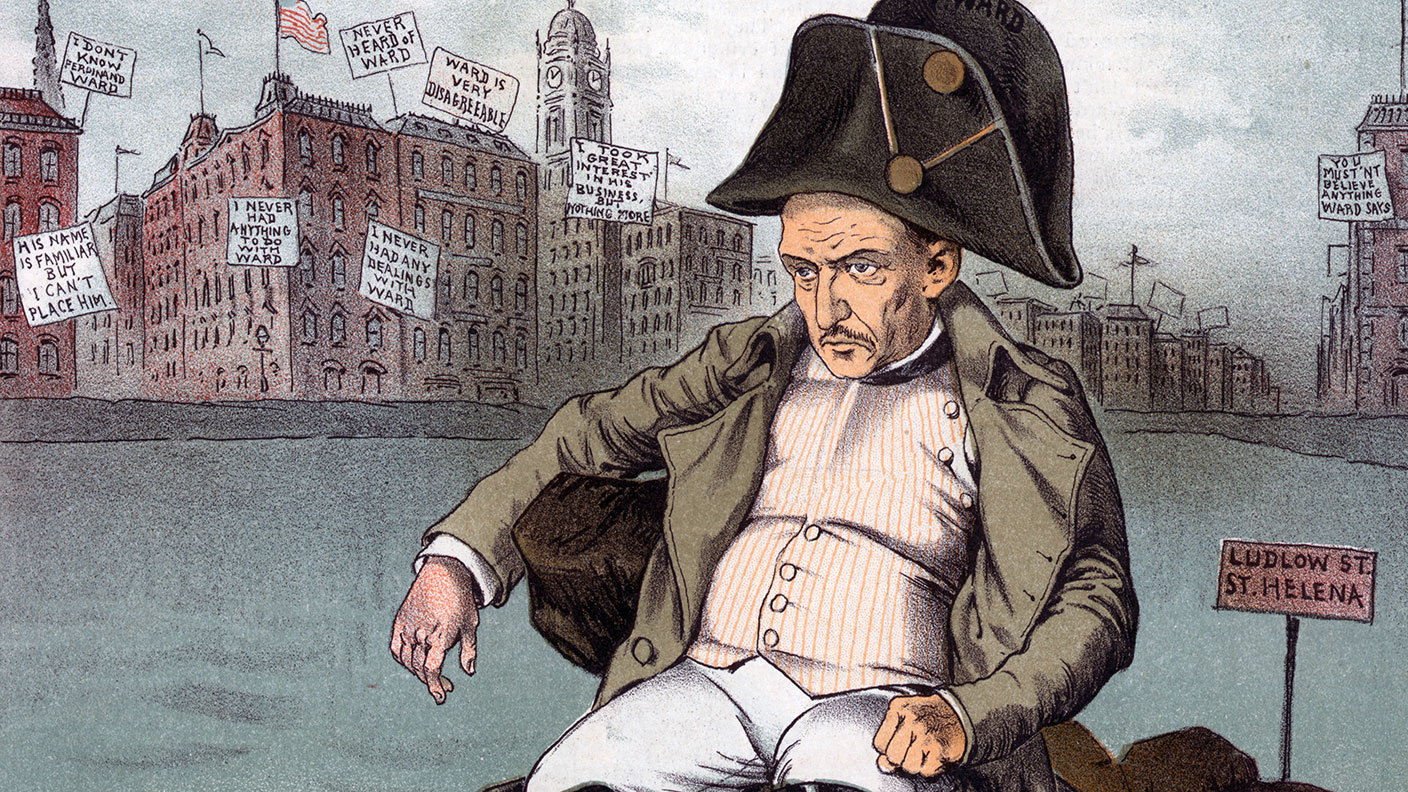

Great frauds in history: the downfall of Ferdinand Ward – the "Napoleon of finance"

Ferdinand Ward launched a Ponzi-style scheme based on fictitious government contracts, bringing down the Marine National Bank.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Ferdinand Ward was born in New York in 1851. He was dismissed from various clerical jobs in his early working life until finding a post as secretary to the superintendent of one of the New York commodity exchanges. A marriage to the daughter of a wealthy merchant allowed him to start speculating in commodities, and he had some initial success. By 1880 he had become established enough to set up his own brokerage, Grant & Ward, in partnership with Ulysses “Buck” Grant Jr, the son of former president Grant, and James Fish, who ran the Marine National Bank and was a friend of his late father-in-law.

What was the scam?

Ward quickly dominated the partnership, making all the decisions, and persuaded Grant Jr and his father to invest another $200,000 into the business. When this capital was squandered through bad investments, Ward simply altered the books to give the impression that the firm was making money. Greedy for cash to fuel an extravagant lifestyle, Ward then raised yet more money by launching a Ponzi-style scheme based on fictitious government contracts. Ward promised to pay investors interest rates of 10% a month, but no money was in fact invested, and investors were paid with funds raised from new depositors.

What happened next?

Fish’s Marine National Bank had heavily invested in Grant & Ward, financing this with a loan of $1.6m from New York City. By April 1884, the New York City comptroller decided to reduce the city’s deposits with the bank. Despite an emergency loan of $80,000 from the tycoon Cornelius Vanderbilt (underwritten by the former president), the bank collapsed, causing a minor financial panic and exposing Ward’s scam. Ward, who had briefly been known as the “Napoleon of finance”, quickly became the “best-hated man in the United States” and spent nearly seven years in jail.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lessons for investors

The creditors of the Marine National Bank were able to recover only half the $5.2m ($141m in today’s money) that the bank owed when it went bankrupt. Those who had invested with Grant & Ward recovered virtually nothing of the $14.5m ($393m) supposedly in their accounts when it collapsed (much of this sum represented fictitious profits that had been reinvested). The former president Grant was not involved with the scam, but his family connection was taken as a badge of respectability. Never invest just because a scheme has celebrity backing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

Kwasi Kwarteng: the leading light of the Tory right

Kwasi Kwarteng: the leading light of the Tory rightProfiles Kwasi Kwarteng, who studied 17th-century currency policy for his doctoral thesis, has always had a keen interest in economic crises. Now he is in one of his own making

-

Yvon Chouinard: The billionaire “dirtbag” who's giving it all away

Yvon Chouinard: The billionaire “dirtbag” who's giving it all awayProfiles Outdoor-equipment retailer Yvon Chouinard is the latest in a line of rich benefactors to shun personal aggrandisement in favour of worthy causes.

-

Johann Rupert: the Warren Buffett of luxury goods

Johann Rupert: the Warren Buffett of luxury goodsProfiles Johann Rupert, the presiding boss of Swiss luxury group Richemont, has seen off a challenge to his authority by a hedge fund. But his trials are not over yet.

-

Profile: the fall of Alvin Chau, Macau’s junket king

Profile: the fall of Alvin Chau, Macau’s junket kingProfiles Alvin Chau made a fortune catering for Chinese gamblers as the authorities turned a blind eye. Now he’s on trial for illegal cross-border gambling, fraud and money laundering.

-

Ryan Cohen: the “meme king” who sparked a frenzy

Ryan Cohen: the “meme king” who sparked a frenzyProfiles Ryan Cohen was credited with saving a clapped-out videogames retailer with little more than a knack for whipping up a social-media storm. But his latest intervention has backfired.

-

The rise of Gautam Adani, Asia’s richest man

The rise of Gautam Adani, Asia’s richest manProfiles India’s Gautam Adani started working life as an exporter and hit the big time when he moved into infrastructure. Political connections have been useful – but are a double-edged sword.