Summary

- The Office for National Statistics (ONS) released UK inflation data for the year to May 2025 today (18 June);

- CPI hit 3.4% for May, in line with expectations and down slightly from the previous month;

- Slowing transport inflation offset a rise in furniture and household goods prices;

- Chancellor Rachel Reeves says there is "more to do" to bring inflation under control;

- The Bank of England (BoE) expects inflation to rise to 3.7% by September;

- The Consumer Prices Index (CPI) measures changes in the cost of everyday goods and services;

- CPI jumped to 3.5% in April.

| What is inflation? | CPI versus RPI inflation | Upcoming CPI release dates |

Good afternoon and welcome to MoneyWeek’s rolling coverage of the latest UK inflation figures.

With the release of May inflation data scheduled for tomorrow morning (18 June), we’ll bring you live previews of the announcement, as well as rolling coverage and reaction after the release.

What do analysts expect for UK inflation in May?

Analysts at the Bank of England (BoE) expect the headline CPI figure to come in at 3.4% for May, down slightly from its April reading. The consensus expectation among analysts polled by FactSet is slightly higher at 3.5%.

That suggests inflation will remain well above the 2% figure that the Monetary Policy Committee (MPC) targets.

BoE forecasts currently project inflation to increase to 3.7% in September. However, inflation is then expected to fall to around 2.4% by Q2 2026.

When is May UK inflation data announced?

The Office for National Statistics (ONS) will release May inflation data tomorrow morning (18 June) at 7am.

Join us live then for breaking news on the headline figures as well as deeper analysis of the report.

What is the Consumer Prices Index?

The Consumer Prices Index (CPI) is the official measure of inflation that policymakers and analysts tend to focus on. Most central banks, including the BoE, target a CPI rate of 2%.

It isn’t the only measure of inflation, though. There is also the Retail Prices Index (RPI), which includes costs of home ownership as well as the prices measured by CPI.

There is also the Consumer Prices Index including owner occupiers’ housing costs (CPIH). This measures inflation with the costs of owning, maintaining and living in a home included – as such, it has similar characteristics to RPI. While the methodologies used to calculate each are currently different, the two will be fully aligned from February 2031.

Read more about the different inflation metrics here: CPI versus RPI inflation.

Why May inflation might be lower than expected

While the BoE expects inflation to come in at 3.4%, economists at Oxford Economics are expecting CPI to come in slightly lower at 3.3%.

“April's surprisingly strong reading in the services category should partially unwind in May's data,” said Edward Allenby, economist at Oxford Economics. “This is because the outturn was artificially boosted by an unusually large increase in vehicle excise duty sub-category, which the Office for National Statistics has since revealed was due to an error in the data supplied by the Department for Transport and will be corrected in May's release.

“Furthermore, April's rise in services prices was also exaggerated by a very high reading in the air fares sub-category, as the month's collection dates coincided with the Easter holiday unlike in 2024. The upward pressure from this effect should also unwind in May's data. We expect minimal movements in the other major inflation categories.”

Charles Stanley: households are feeling the strain of inflation

Monthly inflation data reports give all sorts of information to policymakers, particularly those involved in setting interest rates. That in turn has a knock-on effect on various other important areas of your finances, like mortgage rates or the performance of the stock market.

But inflation is felt by everyone far more keenly and directly than this, in real-time, because it is a direct measure of how much we pay for the goods and services we use everyday.

The jump in inflation during April, to 3.5% from 2.6% in March, reflected a ramping up of these costs.

“Household finances are under renewed strain,” says Rob Morgan, chief investment analyst at Charles Stanley. “Although average wages have been trending higher, mounting expenditure on bills and groceries, plus higher mortgage costs for many thanks to higher interest rates, means extra income is typically spent on essentials rather than saved.”

April’s figure was elevated by the impact of increased employer costs, such as higher minimum wages and National Insurance payments. The hope is that the impact of these will fade over time.

“While services inflation stands to remain elevated in the short term thanks to increased employer costs, it is a factor that should fade as the months roll by as companies scale back hiring and restrain pay where possible,” says Morgan.

Read more about what inflation is and how it affects you here: What is inflation?

Good morning, and welcome back to our UK inflation live blog. Just under 15 minutes to go until the ONS releases the latest inflation data.

As a reminder, most observers expect inflation to have been around 3.4% in the 12 months to May. Stay here for live updates as it happens.

BREAKING: Inflation hit 3.4% during May

The ONS has released May’s inflation data, and the headline CPI figure comes in at 3.4% for the 12 months to then.

CPIH, which includes the costs of owning, maintaining and living in a house, hit 4.0%..

More detail and analysis on the way.

Transport pricing mitigates food and furniture inflation

That slight easing in headline inflation rates between April and May appears to have been driven largely by a slowdown in transportation price rises.

Transport costs increased 3.3% in the year to April, but just 0.7% in the year to May.

That offset an increase in prices of furniture and household goods, which fell 0.5% in the year to April, but rose 0.8% in the year to May.

ONS chief economist: inflation "little changed in May"

“A variety of counteracting price movements meant inflation was little changed in May,” said Richard Heys, acting chief economist at the ONS.

“Air fares fell this month, compared with a large rise at the same time last year, as the timing of Easter and school holidays affected pricing. Meanwhile, motor fuel costs also saw a drop.

“These were partially offset by rising food prices, particularly items such as chocolates and meat products. The cost of furniture and household goods, including fridge freezers and vacuum cleaners, also increased.”

Other May inflation metrics

As a recap, headline CPI inflation came in at 3.4% over the 12 months to May; in other words, consumer prices according to this methodology were 3.4% higher in May 2025 than a year before. Likewise. CPIH (which includes home ownership and maintenance costs) was 4.0%.

Core CPI – a variant of the headline metric which excludes energy, food, alcohol and tobacco (as these are typically more volatile) increased 3.5% in the 12 months to May, down from 3.8% the month before.

Encouragingly, CPI services inflation slowed considerably from 5.4% in April to 4.7% in May.

Compared to the month before, CPI rose by 0.2% in May 2025.

Easing CPI inflation is “good news” for Reeves but rising food costs a concern

“Easing inflation may be relatively good news for chancellor Rachel Reeves who bangs the drum of stability, but prices remain elevated and well above the Bank of England’s target of 2%,” said Alice Haine, personal finance analyst at Bestinvest, an online investment platform from Evelyn Partners.

“The main driver behind the lower headline rate was falling transport inflation, a reflection of falling air fares after the Easter break and an error in the tax figures provided by the Department of Transport for the ONS’s April inflation data,” Haine adds.

“Worryingly, food inflation bucked the trend and rose to 4.4% from 3.4% in April as supermarkets came under pressure from rising costs.”

Reeves responds to May inflation figures

The chancellor of the exchequer, Rachel Reeves, has responded to today’s inflation reading.

“Our number one mission is to put more money in the pockets of working people,” Reeves said. “We took the necessary choices to stabilise the public finances and get inflation under control after the double digit increases we saw under the previous government, but we know there’s more to do.”

Reeves' statement highlights last week’s £3 bus fare cap extension and increase to free school meals. “This government is investing in Britain’s renewal to make working people better off,” Reeves said.

Chancellor Rachel Reeves has said "there's more to do" to bring inflation under control following the release of May figures.

Middle East turmoil could push inflation higher

While higher food and drinks costs have impacted May’s headline CPI figure, the real danger ahead could be the impact of the brewing conflict in the Middle East on energy prices, according to Nicholas Hyett, investment manager at Wealth Club.

“The net result is that UK inflation remains high, and far higher than elsewhere in Europe,” said Hyett. “That is unwelcome but not unexpected.

“The hope was that price increase would slowly roll off over the course of the next 12 months as we annualise things like council tax hikes and the effect of April's higher labour costs. The turmoil in the Middle East has upset that.”

Oil prices are on the rise as a result of the turmoil, and Hyett highlights that global energy flows could become disrupted if the conflict expands.

“As a key input into pretty much everything, a spike in oil would drive up prices across the board.”

Correction means inflation effectively held steady in May

As expected, today’s release has included a revision to last month’s headline figure as a result of an error in the Vehicle Excise Duty (VED) component, which added 0.1 percentage points onto the headline rate last month.

Once that is accounted for, “inflation in May effectively held steady”, said Myron Jobson, senior personal finance analyst at Interactive Investor.

“Looking beyond the headline figure, core inflation… eased as expected,” Jobson added. “It is important to remember that inflation affects everyone differently.

“We all have a personal inflation rate because our spending habits vary. Depending on the goods and services you buy, your personal inflation rate may be lower - or higher - than the headline figure.”

How does inflation affect your savings?

Inflation has a knock-on effect on all sorts of aspects of your personal finances. It will impact the rate at which certain fixed bills, like your broadband or phone contract, increase each year. Because it informs interest rate decisions, higher inflation can also lead to higher mortgages, as well as higher interest rates on your savings.

While that may sound like higher inflation is good news for savers, the opposite is true. Higher inflation eats into the spending power of the interest that your cash generates.

Many people are unaware of this. Research from Tesco Bank showed that 39% of people are unaware of the impact of inflation on their savings. Within that group, 21% said they didn’t know what impact inflation has on their savings, while 11% believe that higher inflation increases the value of their savings.

“When the rate of inflation is on the up, it means the costs of things in our everyday lives are going up. In turn, our money, and our savings, don’t stretch as far as they once did,” said Chris Henderson, savings and payments director at Tesco Bank.

“While there is no fail-safe way to protect your money from inflation, making sure you are getting the best interest rate on your savings can help,” Henderson added.

The fact that the Bank of England is engaged in an interest rate cutting process further dampens the prospects for savings in the foreseeable future.

“Savers are facing a squeeze,” said Sally Conway, savings expert at Shawbrook. “Inflation is sticking, everyday costs are still rising – and interest rates on many savings accounts have been coming down. With further rate cuts expected, the opportunity to lock in higher returns may not last much longer.”

May inflation recap

Just to recap, here are the headline inflation figures following this morning’s release:

Metric | Year-over-year change (%) | Month-over-month change (%) |

|---|---|---|

CPI | 3.4 | 0.2 |

CPIH | 4.0 | 0.2 |

Core CPI | 3.5 | 0.2 |

Source: Office for National Statistics

Why inflation is likely to stay high over the summer

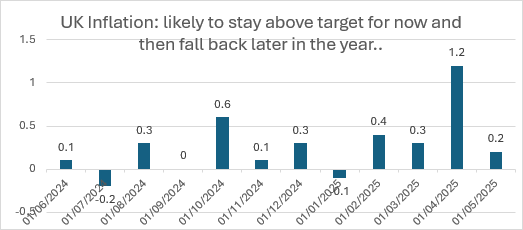

The 3.4% headline CPI figure announced today tracks changes in prices over the last 12 months.

So, all 12 data points in that time period will inform the next reading. High-inflation months, where prices rose relatively fast month-over-month, skew the CPI average upwards, while lower-inflation months do the opposite.

There’s some bad news on that front. The monthly inflation increases in June and July 2024 were both very low – July’s, in fact, was negative. These are currently holding the headline annual inflation rate down.

“As these two numbers fall out, the 12-month average will likely increase, hence inflation staying elevated over the summer months,” says Rory McPherson, chief investment officer at Wren Sterling.

As the BoE expects, though, this impact will be transient. “Once that’s passed, we assume a more normal trajectory and then in November (when that big 0.6% reading for October 2024 drops out), we should start to trend down,” McPherson explains. The upshot, he believes, is that “this will likely mean that UK inflation stays above 3% for some time to come before falling back towards 2%”.

How could the Middle East conflict impact inflation?

A slowdown in transport inflation helped keep May’s CPI figure little changed despite rising food prices.

However, George Lagarias, chief economist at Forvis Mazars, fears that this reprieve could be short-lived given the conflict threatening to escalate between Israel and Iran.

“With the war in the Middle East pushing energy prices higher, that transportation offset might very well disappear by the next month,” he says. “Consumers are beginning to feel the heat of inflation again.”

Inflation: the outlook

Today’s inflation reading has changed little in the minds of most experts. September is still expected to see the peak of UK inflation this year.

“Looking ahead, we expect headline inflation to rise gradually in the coming months, and peak in September,” said Edward Allenby, UK economist at Oxford Economics. The BoE’s estimates put inflation peaking at around this time at approximately the 3.7% level.

“From the autumn, inflation is likely to cool as the positive contribution from the energy category disappears," says Allenby. The energy price cap is falling by around 7% for a typical household from 1 July. This reduction in energy prices “should outweigh the impact of sticky services inflation” according to Allenby.

Oxford Economics expects UK inflation to average 3.3% this year, falling to 2.6% in 2026.

What’s happening with housing inflation?

Consumer price inflation wasn’t the ONS’s only inflation announcement today. We’ve also had a separate update on private rent and house price inflation.

In the 12 months to May 2025, average UK monthly private rents increased by 7.0% to £1,339. This rate of inflation is down from 7.4% in the 12 months to April.

“Rental inflation is slowing as demand cools on lower migration and improved affordability for first time buyers rather than any increase in rent supply,” said Richard Donell, executive director of research at property website Zoopla. “We expect the rate of rental inflation to slow in the coming months which will be welcome news for renters.

Average UK house prices increased by 3.5% to £265,000 in the 12 months to April (house price figures typically lag rent and consumer price data by one month). That’s down significantly from 7.0% in the 12 months to March.

“The big decline in the rate of house price inflation reflects the ending of the stamp duty holiday which is now filtering through into slower price growth,” says Donnell. “We expect the rate of price growth to slow further over 2025 as home buyers face a large choice of homes for sale which will support a buyers market.”

Thanks for following

Thanks for following our inflation live blog. We’re going to leave inflation coverage here and instead turn our attention towards tomorrow’s key MPC meeting that will determine interest rates.

How will the MPC digest today's inflation news? Katie Williams will bring you all the answers here.