How Asia's RCEP deal has brought the return of free trade

While Britain and the EU struggle to come to terms, 15 Asia-Pacific countries quietly signed the biggest free-trade deal in history. That’s a welcome development, says Simon Wilson

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

What’s happened?

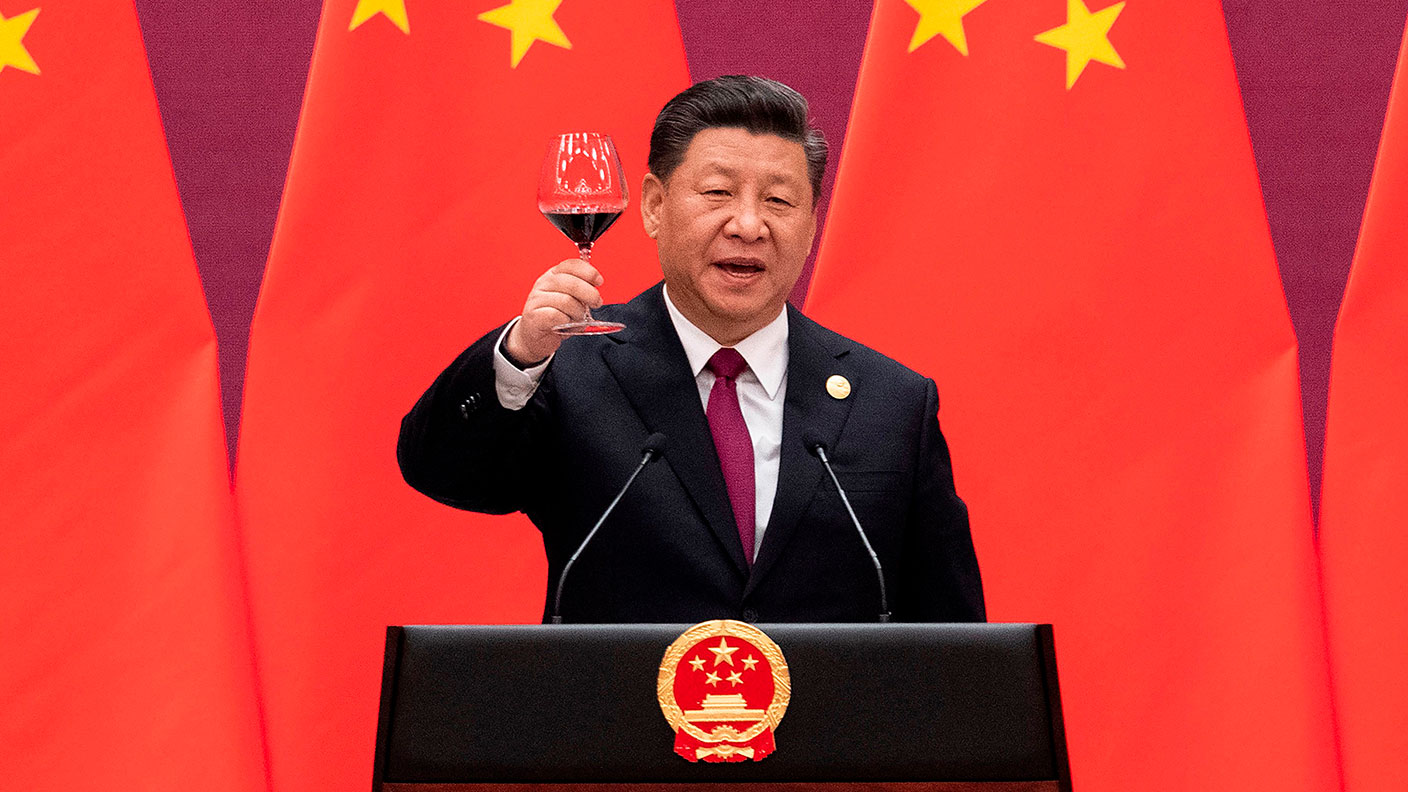

In the middle of last month, as the UK and EU were struggling to nail down the world’s first free-trade agreement explicitly aimed at putting up fresh barriers to trade rather than tearing them down, 15 Asia-Pacific economies quietly signed the world’s biggest free-trade agreement. The Regional Comprehensive Economic Partnership (RCEP) has been signed by China, Japan, South Korea, Australia and New Zealand – along with ten southeast Asian countries, all members of the existing Asean trade bloc. The agreement covers almost a third of the world’s population and about 30% of global GDP – and is the first ever free-trade deal between China, Japan and South Korea, the biggest, second-biggest and fourth-biggest Asian economies. Of the major Asian economies, only India has opted out, over concerns over cheap Chinese imports. But as one of the original negotiating partners, it has an option to join at a later date.

When does the deal take effect?

It’s likely to be years rather than months, and some of its provisions may not take effect for up to 20 years. After eight years of tortuous on-off negotiations, the deal was concluded following a four-day international summit in the Vietnamese capital, Hanoi, in mid-November. But it must now be ratified by each country, and will not take effect until at least six of the ten Asean nations, and three of the five non-Asean nations, have done so. The key aim of the agreement is the progressive lowering of tariffs to allow more free movement of goods and encourage investment.

How is this different from the TPP?

RCEP represents a bigger bloc, but a less comprehensive deal. Since President Trump withdrew the US from the Trans-Pacific Partnership (TPP) trade deal in 2017, it has been renamed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and was ratified by its 11 remaining members in 2018-2019. The RCEP nations’ overall market size is nearly five times greater than that of the CPTPP, and the trade between them twice as big. Seven countries (notably Japan and Australia) are in both blocs. But crucially, the new bloc includes China and South Korea (and six southeast Asian economies that are not CPTPP signatories). It does not include the Americas members of the CPTPP (Canada, Mexico, Peru and Chile). However, compared with CPTPP, the RCEP is less comprehensive – and with much less emphasis on labour rights, environmental and intellectual property protections and dispute resolution mechanisms.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How important is the agreement?

RCEP was conceived as a grand “tidying-up exercise”, says The Economist, bringing together various smaller trade agreements in place between the Asean nations and Australia, China, Japan, New Zealand and South Korea. As such, only a limited amount of Asian trade is affected. Indeed, “of the $2.3trn in goods flowing between signatories in 2019, 83% passed between those that already had a trade deal”. The biggest benefits, in terms of trade liberalisation, will probably come of RCEP’s rules of origin – that is, the principles setting out how much regional content a product must have for it to enjoy lower tariffs. Currently, exports from an Asean state could face three different sets of rules when exported to China, South Korea or Japan. Now such companies will only need to comply with one and the rules are relatively liberal: many products will need just 40% of their value to be added within the region in order to take advantage of lower tariffs”.

Who gains the most?

The RCEP is not “China-led”, in the sense that it was the Asean nations that conceived the pact and have driven it forward. But it definitely serves China’s interests. The old TPP included provisions that reined in state-owned firms and included rules on labour and environmental standards. RCEP includes none of those constraints and is likely to strengthen China-centric supply chains. But a study by Peter Petri of the Peterson Institute and Michael Plummer of Johns Hopkins University estimates that Japan and South Korea will gain the most, with real incomes 1% higher by 2030 than they would have otherwise been.

So a bit of damp squib?

It has certainly been over hyped, says Salvatore Babones in Foreign Policy. The RCEP is a “straight tariff-reduction agreement at a time when base tariffs are already low, and countries don’t hesitate to impose punitive tariffs whenever it suits their foreign-policy objectives”. Moreover, it avoids hard issues such as state subsidies, intellectual property theft and investor-state disputes. Yet it remains the biggest free-trade deal in history, says Petri and Plummer for the Brookings think-tank. Together, CPTPP and RCEP are the only major multilateral free-trade agreements signed in the Trump era. And as now configured (ie, without the US) both of them “forcefully stimulate intra-East Asian integration around China and Japan”. RCEP will “help China strengthen its relations with neighbours”, and accelerate northeast Asian economic integration.

What should America do?

In terms of pushing back against China, and reasserting US leadership on trade, the “obvious move”, says the FT, would be for the Biden administration to take the US into the CPTPP. Alas, while “such a move would make sense in diplomatic and economic terms”, it is probably “politically impossible in the current US climate”. There is an interesting geostrategic dilemma for India, too, with its goal of emerging as this century’s second Asian superpower. The Modi government has stood aside from RCEP, but India “must take care it does not relapse into the defensive, inward-looking attitude that has served the country so badly in the past”. And for the Western world as a whole, RCEP presents a salutary reminder. Whatever the prevailing mood of scepticism towards economic liberalisation, “free trade is the best route to greater prosperity”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.