Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The rapid recovery of equity and credit markets has surprised most investors and commentators. It is due to the extreme measures implemented by central banks and governments to support their financial markets and stimulate their economies. This has allowed prices for risk assets to become detached from underlying trends in the global economy. This is not a new phenomenon. For about 30 years central banks have become increasingly active in financial markets. Central bank activism has been instrumental in suppressing financial market volatility. This has made financial assets seem less risky than they otherwise would be, driving prices higher and encouraging excessive accumulation of debt.

Why consumer prices haven’t taken off...

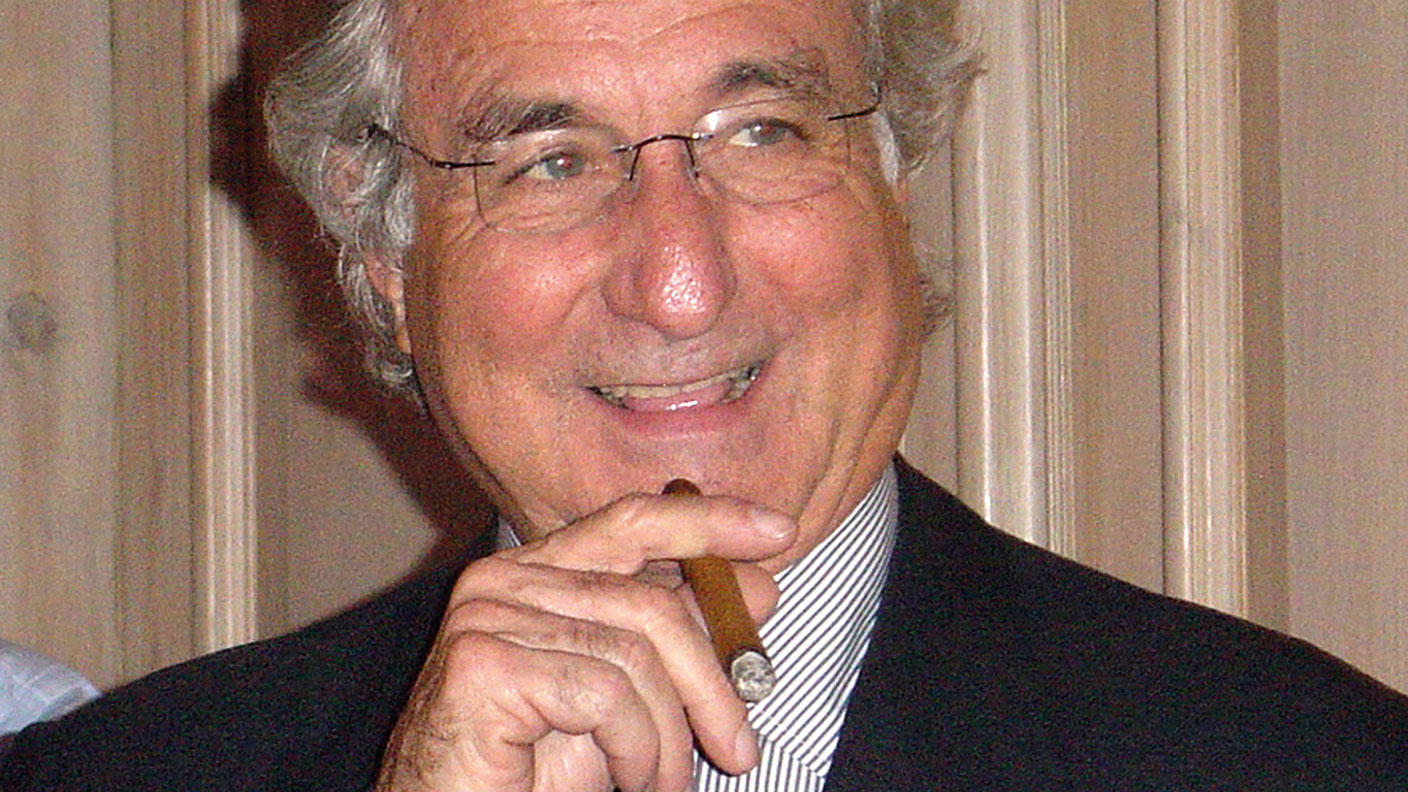

Central banks have successfully inflated asset prices, but all their interest-rate cuts and money printing have not – yet– given consumer prices a significant boost. Why not? One thought experiment that can shed some light on this conundrum is to think about the dynamics and consequences of a hypothetical enormous Ponzi scheme – perhaps similar to Bernie Madoff’s infamous one, but much larger. In a simple Ponzi scheme, the organisers mark up clients’ accounts to reflect apparently consistent good returns. But the returns are not genuine. Clients’ withdrawals are simply met from new client inflows. The result is “phoney wealth”.

Ponzi schemes collapse when they become so large that new customer inflows are insufficient to finance outflows. But for this thought experiment, imagine an enormous and long-lasting Ponzi scheme is supported by the central bank. As the scheme starts to collapse, withdrawals cannot be honoured at face value. But the central bank then steps in, guaranteeing to finance withdrawals by “lending” unlimited funds to the scheme, all financed by central bank money printing.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“Central banks have become increasingly active in markets over the past 30 years”

In this case those who withdraw their funds will end up with newly created money in return for their notional holdings in the Ponzi scheme. The money supply (the amount of money in the economy) will jump. But is that necessarily inflationary? The Ponzi scheme customers now have money in the bank where they previously had what they believed were funds in a safe and secure investment scheme. It is not clear that they will rush out to spend this money. In fact, their “financial near-death experience” – when it looked as though the scheme was about to collapse – may make them particularly cautious.

This Ponzi scheme analogy helps to explain why post-crisis central bank purchases of assets at inflated prices relative to fundamentals does not, in itself, necessarily create generalised inflation, even when money is created in the process. But in the real world of today there are other things going on too. Central banks and governments are also subsidising lending to, and creating money to support, businesses that may ultimately fail.

What’s more, money is being created to pay people’s wages when they are not working and, potentially, to finance government investment. In a “Ponzi economy” real investment in the economy will tend to be weak because returns cannot compete with the pretend returns promised by the Ponzi scheme. So long-term economic growth will be low, maybe zero. Yields on government bonds will be low too, reflecting high prices: they are a safe asset in a very low-growth world. The existence of “zombie companies”, firms kept alive by government and central bank support, will tend to make the economy worse over time. This all militates against inflation for now.

... but will eventually

Nevertheless, inflation is inevitable eventually when money is growing rapidly in excess of the productive potential of the economy. So today there are these opposing forces – the deflationary forces created by a very weak global economy that is to a degree being frozen in place by central bank distortion of asset prices, directed credit and zombie companies, and the more permanent inflationary forces of money creation unmatched by production. In the short term it is very difficult to quantify which is winning out.

Government bond yields are a key indicator. As long as deflationary forces are more powerful yields will remain very low. However, once inflation begins to take hold yields will rise, even if central banks attempt to hold market interest rates down. In that case the more central banks print money to buy bonds and keep yields down, the more people will want to sell them.

Unfortunately, neither of these two outcomes represents a good environment for holding equities longer term. If government yields fall again, markets will be vulnerable to a crash because the divergence between equity valuations and deteriorating fundamentals becomes too great. But the inflation scenario is bad news too. Where we are now, stuck in the middle of the two outcomes – with yields comparatively stable – is the only macro background that works for equities. But given excessive valuations and excessive debt, we cannot stay stuck in the middle between deflation and inflation for very long.

• Tim Lee is an economist and a co-author of The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis (McGraw-Hill 2020).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim Lee is an economist and a co-author, together with Jamie Lee and Kevin Coldiron, of The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis (McGraw-Hill, 2019)

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

The scourge of youth unemployment in Britain

The scourge of youth unemployment in BritainYouth unemployment in Britain is the worst it’s been for more than a decade. Something dramatic seems to have changed in the labour markets. What is it?

-

In defence of GDP, the much-maligned measure of growth

In defence of GDP, the much-maligned measure of growthGDP doesn’t measure what we should care about, say critics. Is that true?

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again