The charts that matter: yields soften after US inflation data rises less than expected

The US dollar strengthened this week. Here’s how it affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

On the cover of this week’s issue of MoneyWeek, we’ve looked at how China is cracking down on many sectors of the economy, particularly on tech, which is rattling investors. The regulatory clampdown on online education platforms and tech giants such as Tencent and Alibaba has had an inevitable knock-on impact on the price of the leading UK-listed China funds, says David Stevenson. Is this a buying opportunity or is there more to come?

Meanwhile, our big investment feature this week is on how Reits can help your portfolio fight inflation. Cris Sholto Heaton takes an in-depth look at which sectors and which countries offer the best opportunities.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you’re not already a subscriber, sign up for MoneyWeek magazine now.

This week’s “Too Embarrassed To Ask” video explains what "tapering" is. That matters right now because it tends to make markets jittery when it happens and central banks are debating when to do it. Here's what it means.

We don’t have a new podcast for you this week, but I just wanted to alert you once again to last week’s podcast with GMO’s Jeremy Grantham. If you haven’t listened to it yet, please make sure you do – Grantham is one of the smartest minds in markets and in this extended podcast he and Merryn cover everything from bubbles to the state of American capitalism to house prices in the UK. It’s not one to miss. And we’ll be back with a new podcast next week. Listen to everything he has to say here.

- Monday Money Morning: The US jobs market is booming – but what does that mean for markets?

- Web Article: What does China’s Covid Delta outbreak mean for the economy?

- Tuesday Money Morning: What the "climate emergency" means for investors

- Wednesday Money Morning: How much further will the gold price fall?

- Thursday Money Morning: Record-low mortgage rates mean house prices are likely to keep rising

- Friday Money Morning: Three key lessons on the 50th anniversary of the gold standard's demise

Now for the charts of the week.

The charts that matter

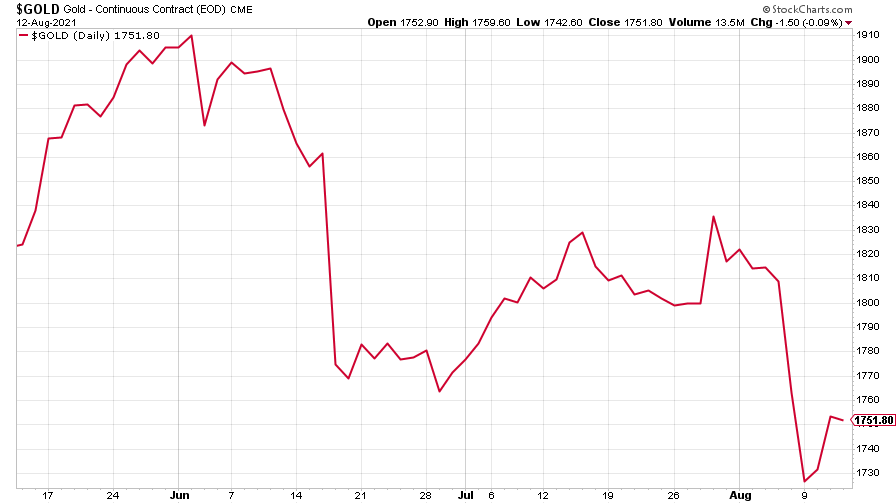

Gold fell hard at the start of the week, partly due to concerns that strong US employment date would convince the Federal Reserve to end loose monetary policy at a faster pace. However it made up a lot of ground by the end of the week as US inflation and consumer confidence data were both weaker than expected.

(Gold: three months)

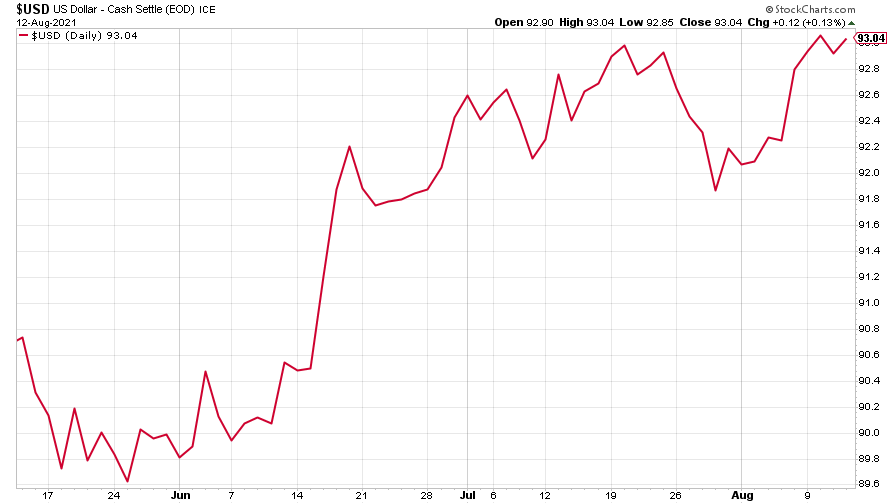

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was on the rise but ebbed towards the end of the week as the economic data mentioned already came in a bit weaker than expected.

(US dollar index)

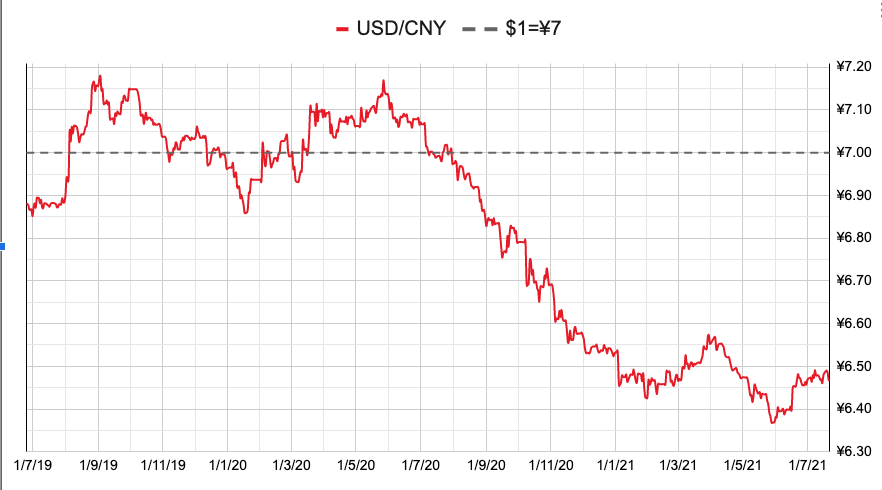

The Chinese yuan or (renminbi) rose accordingly (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

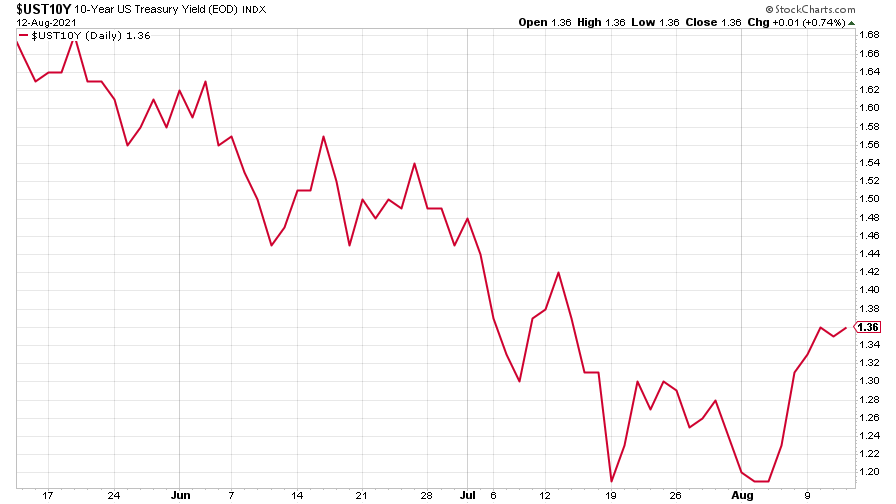

The yield on the ten-year US government bond rose early in the week amid the debate on whether the Fed will start easing stimulus or not, but dipped towards the end of the week.

(Ten-year US Treasury yield: three months)

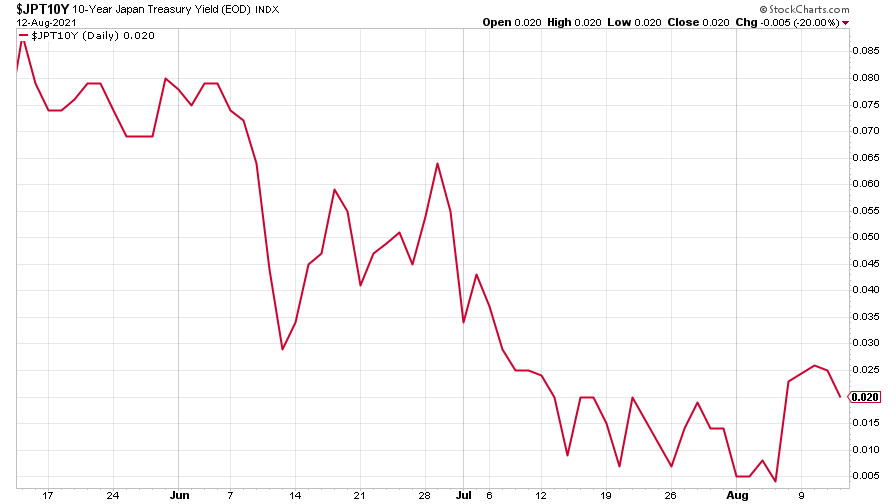

The yield on the Japanese ten-year bond fell a little.

(Ten-year Japanese government bond yield: three months)

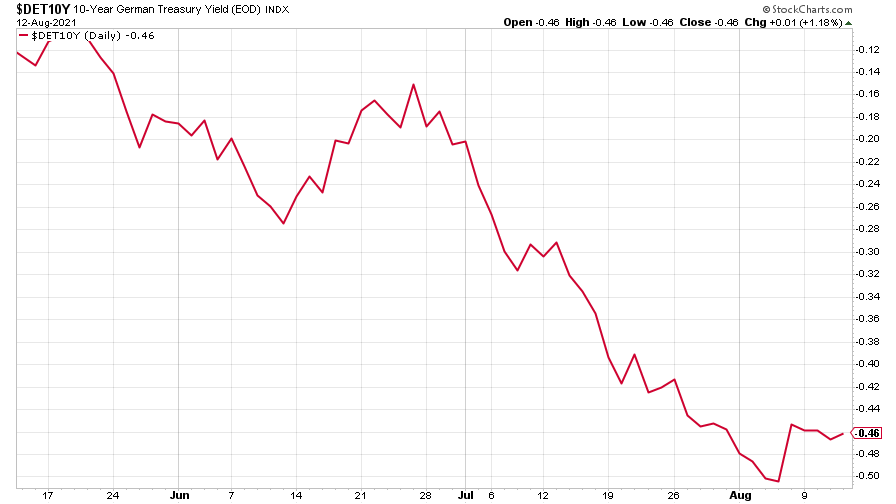

And the yield on the ten-year German Bund was little changed.

(Ten-year Bund yield: three months)

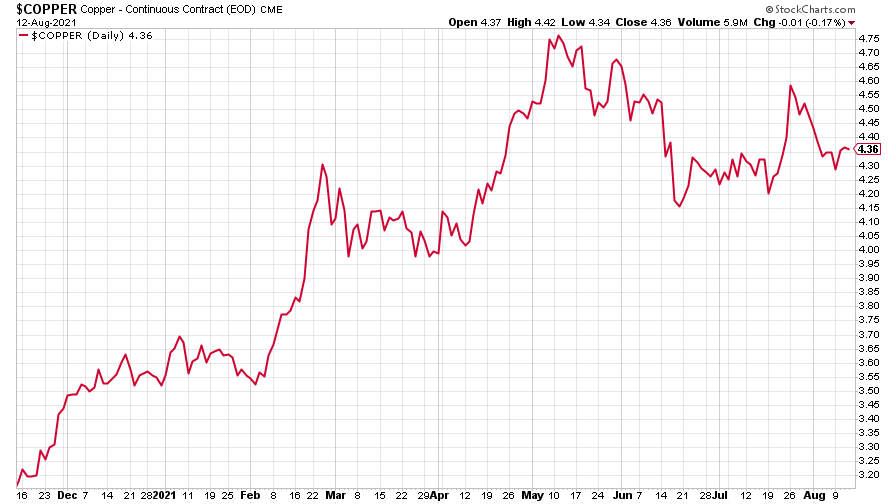

Copper prices eased after supply disruptions at the world's biggest copper mine in Chile showed some signs of abating.

(Copper: nine months)

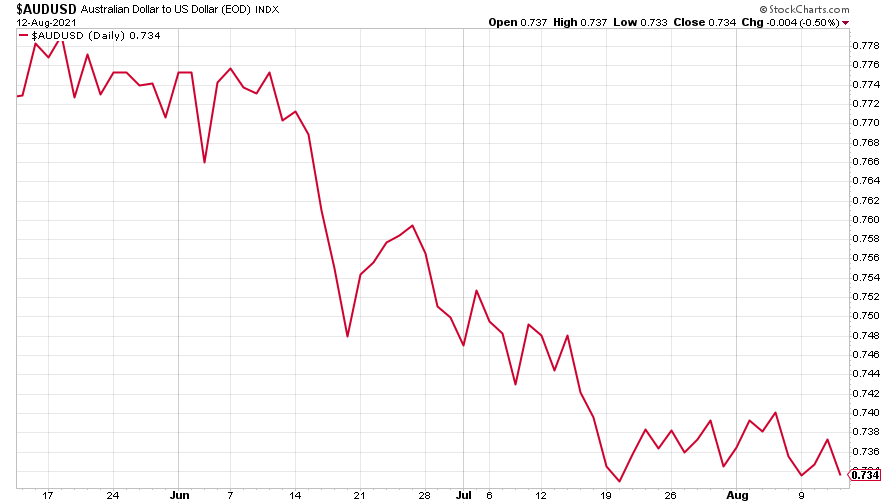

The Australian dollar fell.

(Aussie dollar vs US dollar exchange rate: three months)

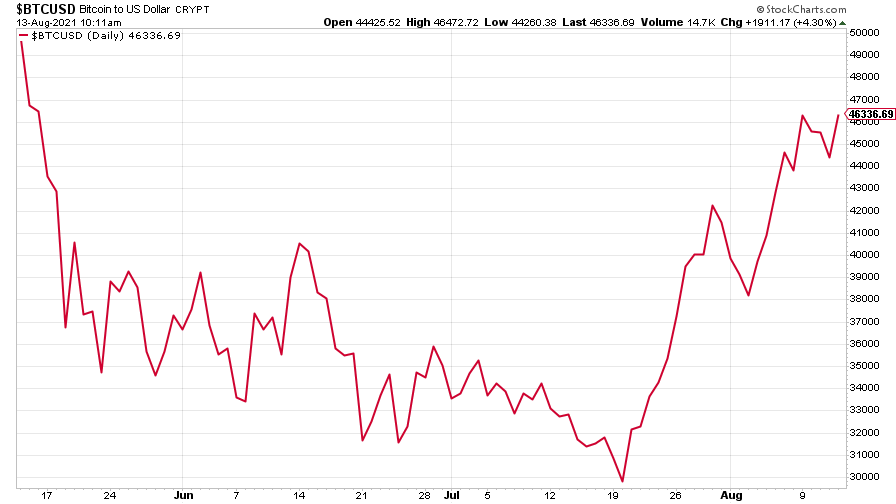

Bitcoin rose, recovering from a recent slide as pressure mounted on House Speaker Nancy Pelosi to alter the crypto tax provision in the Senate's infrastructure bill.

(Bitcoin: three months)

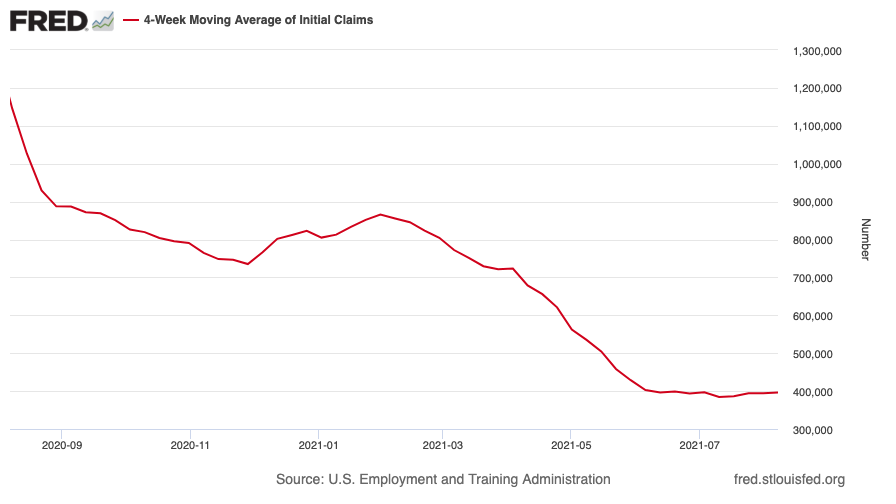

US weekly initial jobless claims stood at 375,000, a decrease of 12,000 from the previous week's revised level.

(US initial jobless claims, four-week moving average: since Jan 2020)

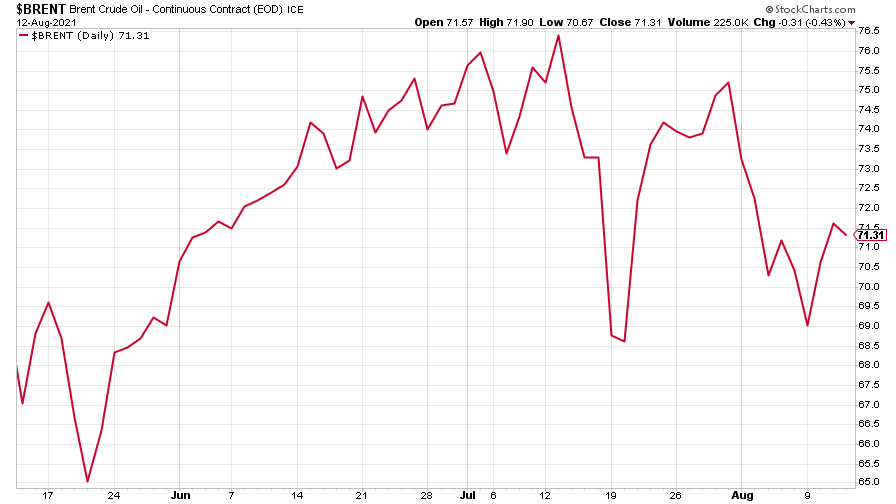

Brent fell a little after fears resurfaced that the Delta variant of Covid-19 may hit demand.

(Brent crude oil: three months)

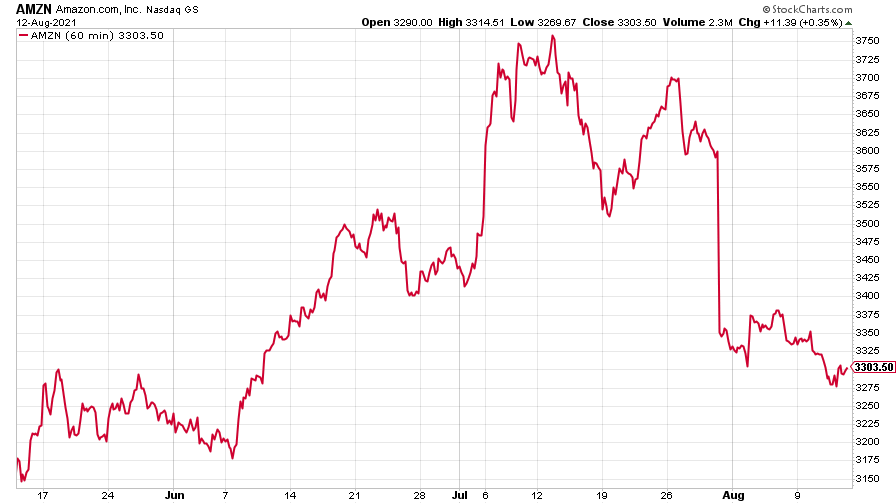

Amazon fell a little, continuing some bearish sentiment from disappointing earnings at the end of last month.

(Amazon: three months)

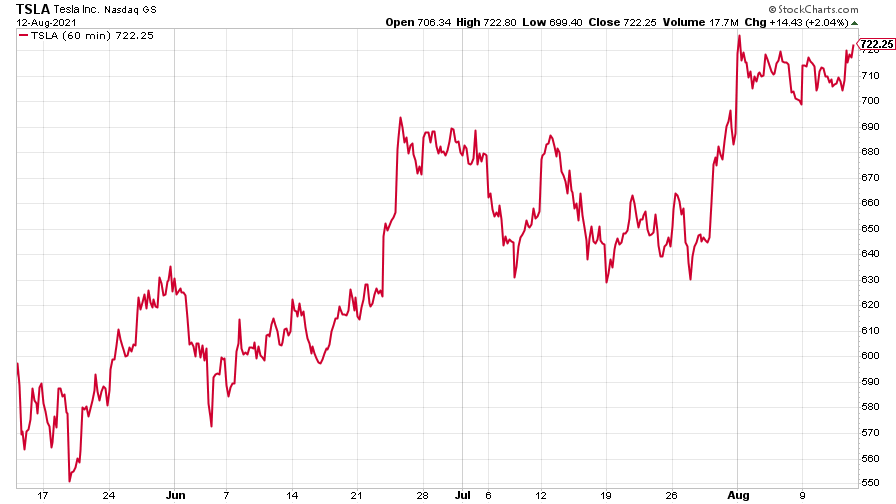

Tesla's stock rose after Jefferies analysts raised their price targets on expectations that Tesla will become a mass-production electric vehicle leader.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.