The charts that matter: the dollar strengthens and Delta worries mount

The dollar strengthened this week as Delta fears resurfaced. Here's how it affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On the cover of this week’s magazine, we’ve got why inflation is here to stay and why it is time to protect your portfolio. Unlike in 2008, widespread money printing and government spending are pushing up prices. But central banks can’t raise interest rates because the world can’t afford it, says John Stepek.

Meanwhile, our big investment feature this week is how to put a price on big oil majors and how their stock prices are lagging despite a stunning recovery in oil prices to levels seen well before the pandemic.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you’re not already a subscriber, sign up for MoneyWeek magazine now.

This week’s “Too Embarrassed To Ask” video explains what a “share buyback” is. Share buy backs differ from dividends, and simply involve a company buying back its own shares. Here's what it means and why it matters.

And joining Merryn on the podcast this week is Jeremy Grantham, GMO’s chief investment strategist. They talk about the current state of the markets and where investors can "hide" from all the craziness, plus inequality, inflation, and why you should rush out and get the longest fixed-rate mortgage you can. Listen to everything he has to say here.

- Monday Money Morning: Inheritance tax planning: using Aim shares to cut your inheritance tax bill

- Tuesday Money Morning: Inheritance tax planning: how pension can shield your estate from inheritance tax

- Web Article: Tencent shares dive as China targets video games industry

- Wednesday Money Morning: The case for nickel – a crucial metal in the Green Energy Revolution

- Web Article: What Joe Biden's bipartisan infrastructure deal means for cryptocurrency investors

- Thursday Money Morning: Bitcoin miners are cleaning up their act, using green energy to drive higher profit

- Friday Money Morning: Lab-grown meat: how “moo’s law” will drive innovation

Now for the charts of the week.

The charts that matter

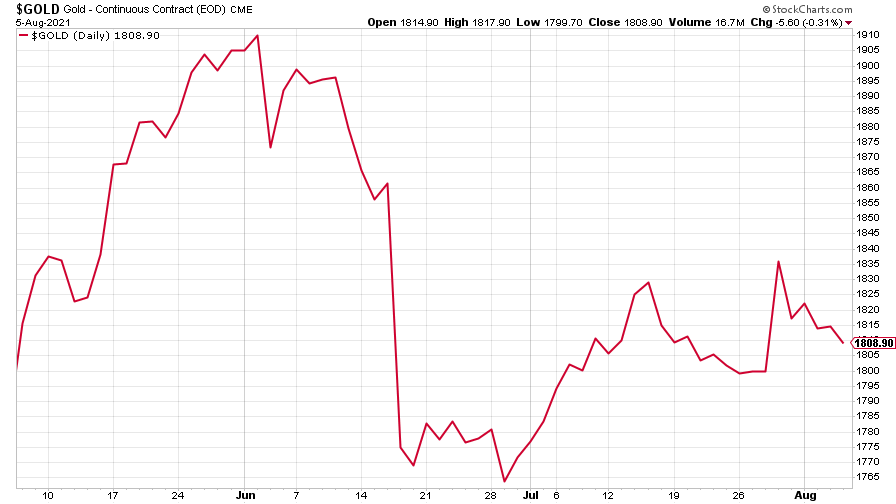

Gold fell ahead of the US jobs report and as Fed officials signalled the possibility of an earlier tapering.

(Gold: three months)

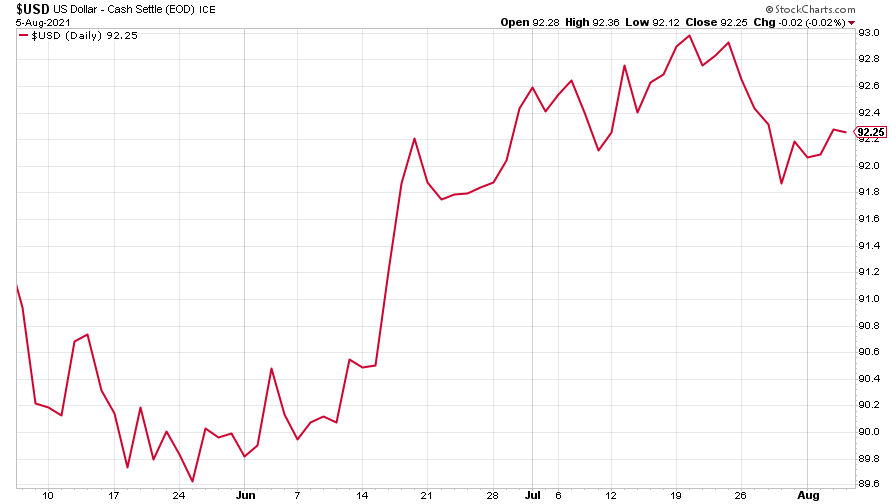

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) climbed a little higher.

(US dollar index)

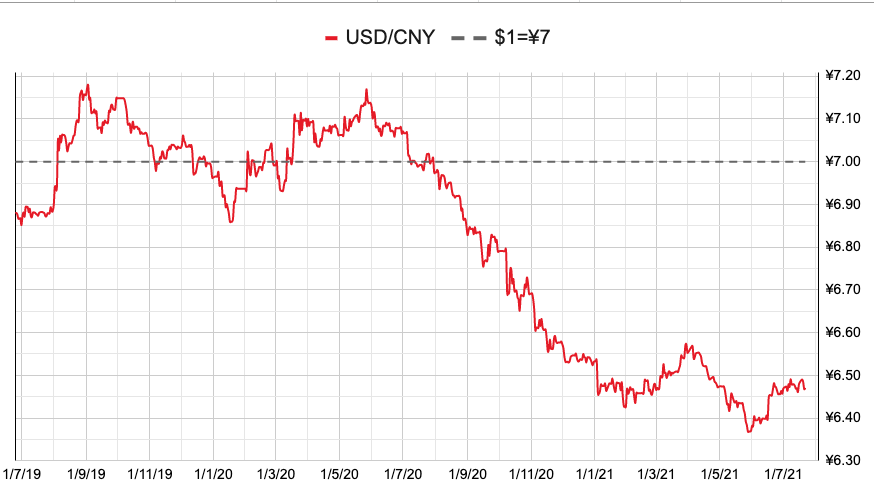

The Chinese yuan or (renminbi) reflected the dollar's strength, weakening a little (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

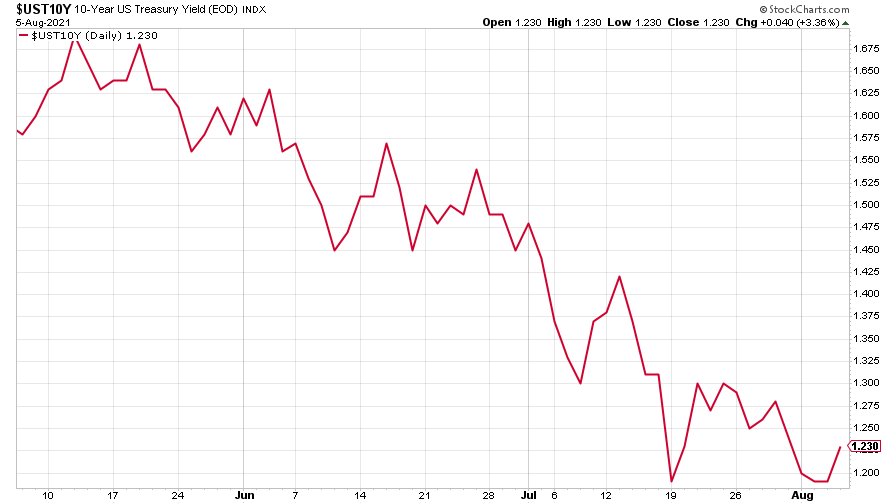

The yield on the ten-year US government bond rose which may partly explain why gold prices fell.

(Ten-year US Treasury yield: three months)

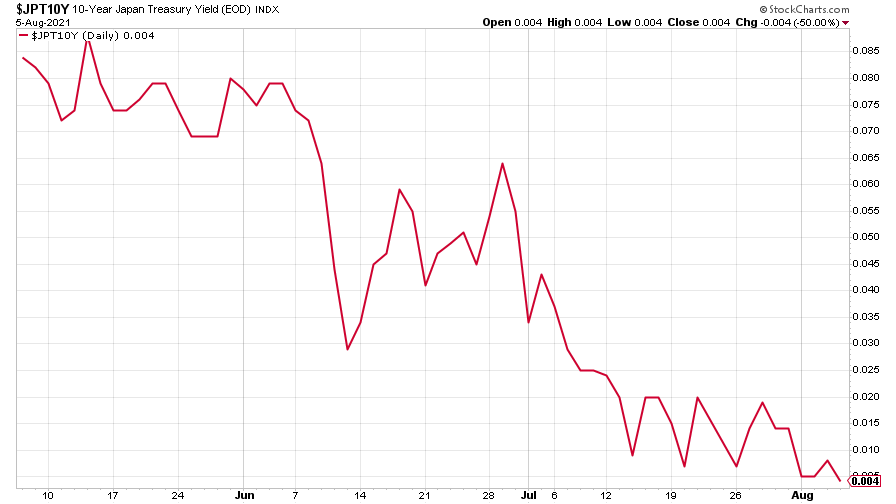

The yield on the Japanese ten-year bond slipped as worries mounted over the spread of the deadly Delta variant.

(Ten-year Japanese government bond yield: three months)

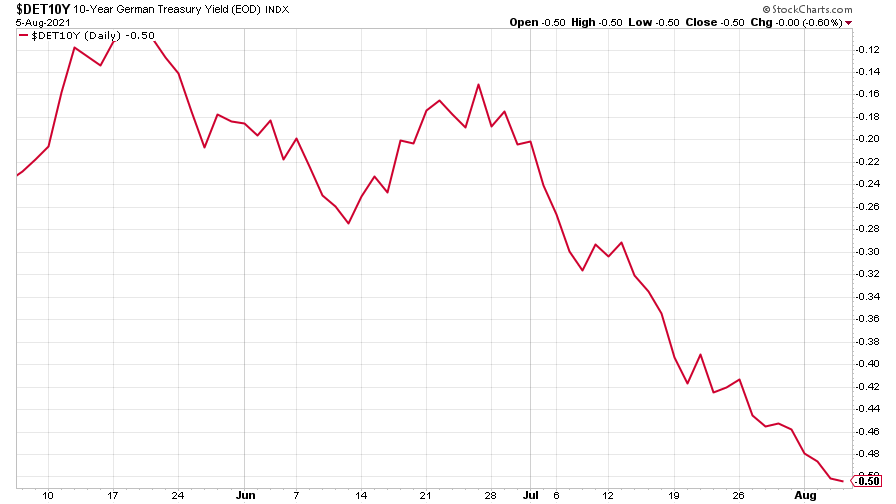

And the yield on the ten-year German Bund also fell.

(Ten-year Bund yield: three months)

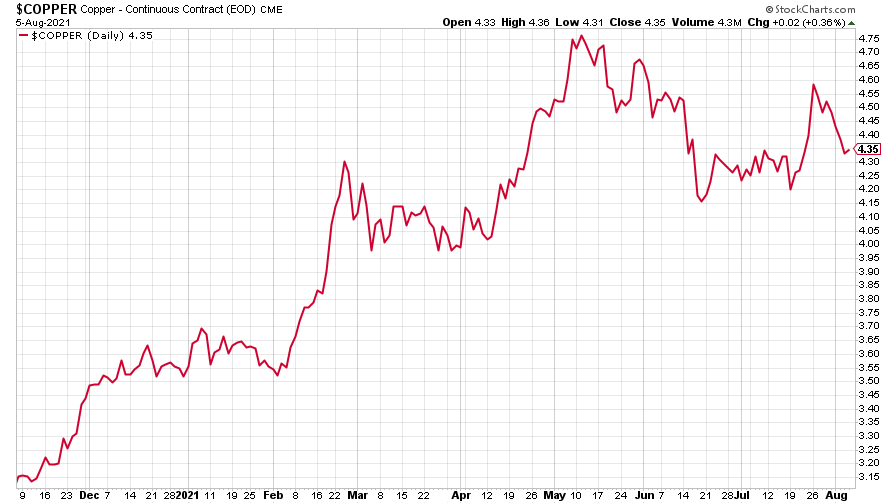

Copper fell on the firm dollar and on fears that the virus may suppress demand.

(Copper: nine months)

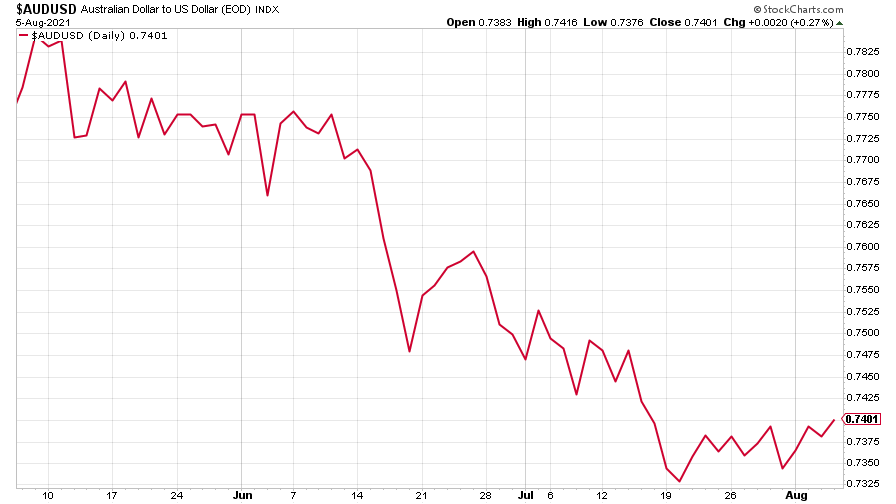

The Australian dollar drifted upwards a little.

(Aussie dollar vs US dollar exchange rate: three months)

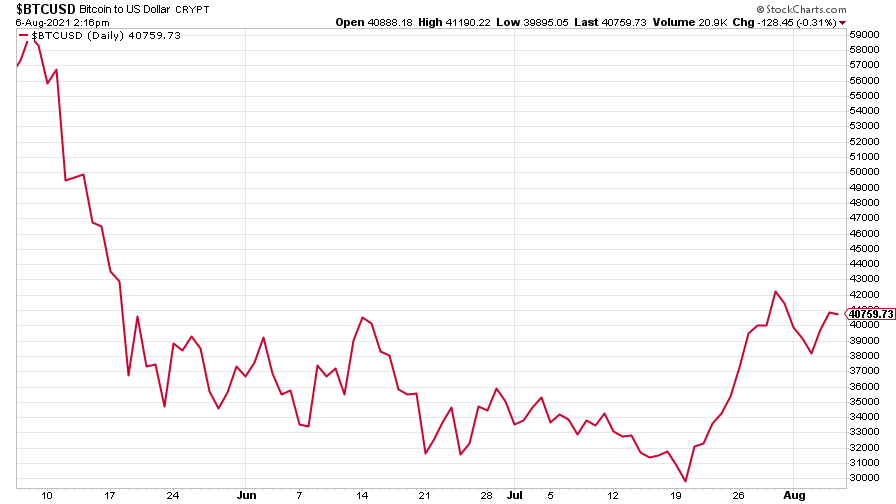

Bitcoin remained volatile as crypto received some concessions under the US infrastructure plan.

(Bitcoin: three months)

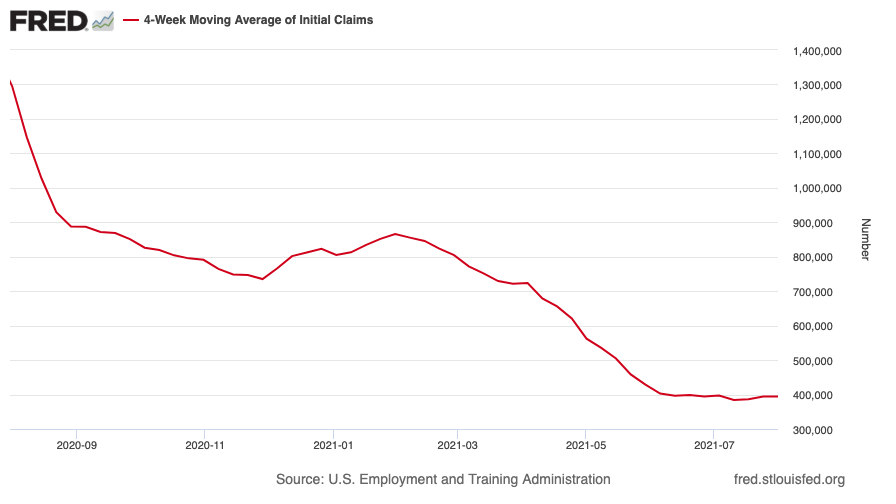

US weekly initial jobless claims jumped by 51,000 to 419,000. The four-week moving average rose by 250 to 384,500.

(US initial jobless claims, four-week moving average: since Jan 2020)

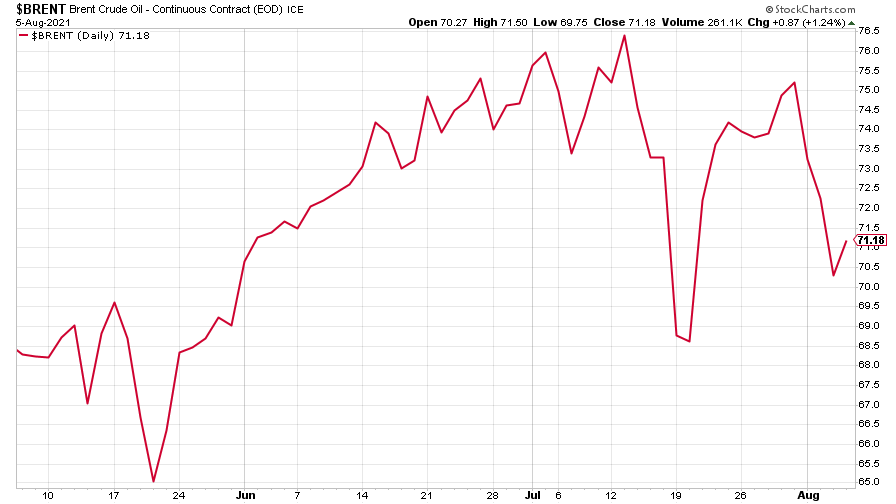

Brent remained volatile on virus concerns and a buildup in US stockpiles.

(Brent crude oil: three months)

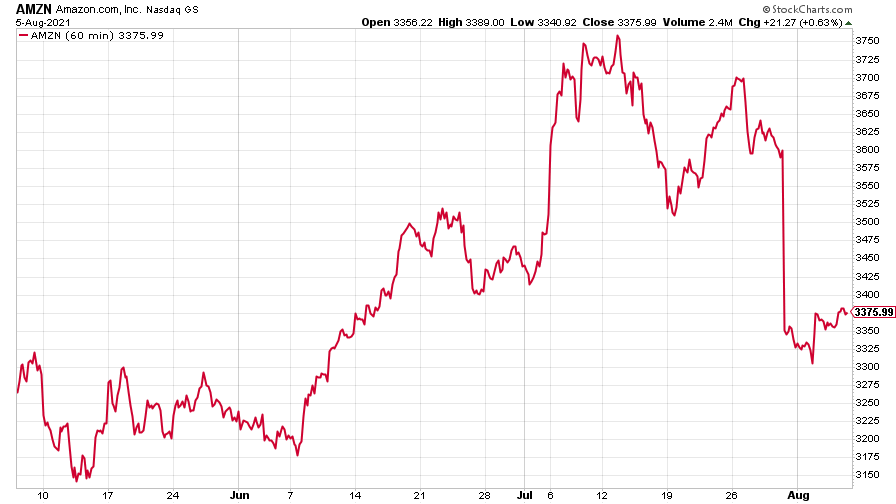

Amazon rose a little after a volatile week.

(Amazon: three months)

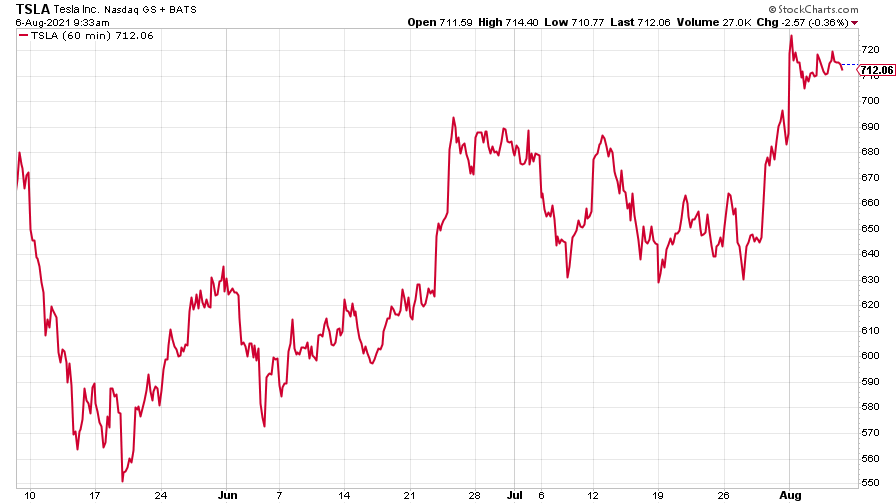

Tesla continued to rise a week after it posted solid earnings.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.