Phil Oakley

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

After graduating with a MSc in International Banking, Economics & Finance from Liverpool Business School in 1996, Phil went to work for BWD Rensburg, a Liverpool based investment manager. In 2001, he joined ABN AMRO as a transport analyst. After a brief spell as a food retail analyst, he spent five years with ABN's very successful UK Smaller Companies team where he covered engineering, transport and support services stocks.

In 2007, Phil joined Halbis Capital Management as a European equities analyst. He began writing for MoneyWeek in 2010.

Latest articles by Phil Oakley

-

Annual reports reveal a company’s innermost secrets

Tutorials They may be boring, but annual reports offer you invaluable insights into companies, says Phil Oakley.

By Phil Oakley Published

Tutorials -

Gambles of the week: TalkTalk and John Menzies

Tips Having cast his analytical eye over TalkTalk and John Menzies in the past, Phil Oakley looks to see how they have fared, and what investors should do now.

By Phil Oakley Published

Tips -

Shares in focus: Can Serco recover from years of hubris?

Features New boss Rupert Soames has been tasked with turning outsourcer Serco around. Can he do it, and should you buy the shares? Phil Oakley investigates.

By Phil Oakley Published

Features -

Company in the news: IGas

Features Shares in fracking play IGas have been hit by controversy of director share dealing. Phil Oakley looks at what action investors should take.

By Phil Oakley Published

Features -

Valuing a share: Show me the cash flow

Features Working out a company's cash flow can tell you a lot about how it's performing. Phil Oakley explains.

By Phil Oakley Published

Features -

Gamble of the week: A risky bet on internet TV

Tips There's no denying the shares in this internet TV company are expensive, says Phil Oakley. But this could be one of those times when it's worth paying up.

By Phil Oakley Published

Tips -

Shares in focus: Next is a rare star in the retail sector

Features Fashion retailer Next has been an exception to the rule of the declining high street. Phil Oakley investigates to see if the shares are still worth buying.

By Phil Oakley Published

Features -

A smarter way to find value

Features One of the biggest mistakes investors make is to pay too much for a share, says Phil Oakley. Piotroski's F-Score is one way of avoiding that.

By Phil Oakley Published

Features -

Shares in focus: Will Ocado ever make money?

Features Ocado's shares are pricey, but the online supermarket has promise. Should you buy in? Phil Oakley investigates.

By Phil Oakley Published

Features -

Company in the news: BT

Features BT is a company in rude health, but support for the share is waning, says Phil Oakley.

By Phil Oakley Published

Features -

Shares in focus: Imperial Tobacco – a safe haven in a rocky market

Features Imperial Tobacco is defying the sceptics, so is it worth paying up for the shares? Phil Oakley investigates.

By Phil Oakley Published

Features -

Gamble of the week: A very cheap newspaper distributor

Tips Shares in this newspaper distributor have disappointed. Phil Oakley looks at what's gone wrong, and explains why the shares are a buy.

By Phil Oakley Published

Tips -

Company in the news: Foxtons Group

Features Foxtons has done very well out of the London property market, says Phil Oakley. So, what now for the estate agents?

By Phil Oakley Published

Features -

Don’t sleepwalk into disaster – manage your risks

Tutorials To become a successful investor, it's important to manage your risks. Phil Oakley explains how.

By Phil Oakley Published

Tutorials -

Shares in focus: Is National Express on the road to better profits?

Features National Express is a coach company going cheap. So, should you get onboard and buy the shares? Phil Oakley investigates.

By Phil Oakley Published

Features -

Company in the news: William Hill

Features These are tough times for bookmakers, but William Hill is doing all the right things. Phil Oakley explains what that means for the shares.

By Phil Oakley Published

Features -

Tips update: Rolls-Royce

Features Buying shares in Roll-Royce earlier this year hasn't worked out, says Phil Oakley. So, is it time for a rethink, or is now a better time to buy?

By Phil Oakley Published

Features -

Tesco shares could tank below a pound

Features Tesco is in big trouble. Its half-year results make grim reading, its chairman is leaving, and the share price is plummeting. Phil Oakley looks at where Britain's biggest supermarket chain goes from here.

By Phil Oakley Published

Features -

Buy high, sell higher: riding the momentum investing wave

Features Betting that price trends will continue is a very risky strategy, says Phil Oakley. But it can also be very profitable.

By Phil Oakley Published

Features -

Gamble of the week: A punt on property

Tips The housing market may well fall into a slump, says Phil Oakley. But if the fears are overdone, this property services company could be a good investment.

By Phil Oakley Published

Tips -

Shares in focus: Can Royal Mail deliver profits?

Features Pessimism surrounds the mail service’s prospects. Is it overblown, and should you buy the shares? Phil Oakley investigates.

By Phil Oakley Published

Features -

How safe is your dividend?

Tutorials By knowing what to look for, you can tell if a company's dividend is under threat. Phil Oakley explains.

By Phil Oakley Published

Tutorials -

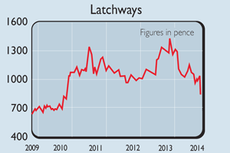

Gamble of the week: A bet on workplace safety

Tips This specialist maker of workplace safety kit is a good bet for contrarian investors, says Phil Oakley.

By Phil Oakley Published

Tips -

Company in the news: Sainsbury’s

Features Things are going from bad to worse in the supermarket sector. So, should you give Sainsbury's a wide berth? Phil Oakley reports.

By Phil Oakley Published

Features