Shares in focus: Britain’s business landlord looks trim

British Land weathered the property bust well. But how long can the good times last? And are its shares still a good home for your money? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

British Land weathered the property bust well. Hang on to your shares, says Phil Oakley

British Land is one of the UK's biggest commercial property companies and is a real-estate investment trust (Reit). Its £12.8bn property portfolio is currently made up of retail properties (56%), such as shopping centres and supermarkets, and offices (44%) in the City of London and the West End.

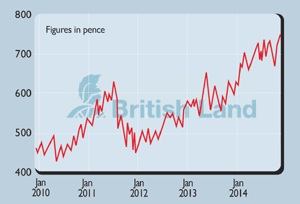

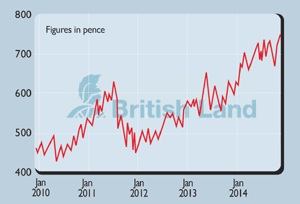

While much has been done to prop up Britain's housing market since the financial crisis, the country's commercial property sector experienced a proper boom and bust. The cheap money which fuelled a credit boom in the early-to-mid 2000s saw property companies such as British Land ride a rising tide of prosperity. The company's net asset value (NAV) per share (a proxy for its value to shareholders) peaked at nearly £14 back in 2007. Two years later it had crashed to below £4 as investors panicked, sales dried up and valuations plunged.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, British Land weathered the storm well. It sold some of its properties and asked shareholders for more money to reduce its debts. It has since pursued a strategy of investing in top-quality property in prime locations. During the last couple of years this has started to pay off handsomely as Britain's economy has recovered and the appetite for property in London has increased. But how long can the good times last? Are property values too frothy? Or are shares in British Land still a good home for your money?

The outlook

There's no doubt that British Land is sitting on some very high quality property assets. The potential problem for investors in the company's shares is that its shopping centres and offices are starting to look quite expensive.

It's not hard to see why. The aftermath of the financial crisis saw interest rates driven down to rock-bottom levels. In turn, once everyone was over the initial shock, these low interest rates sent the value of most quality assets soaring. Just as the valuations of shares and bonds tend to rise as interest rates fall, so do those of commercial properties. In a world where decent returns on your money are increasingly hard to come by, hedge funds and foreign investors are chomping at the bit to get their hands on London offices and even some of Tesco's and Sainsbury's supermarkets.

To put things into perspective, back in 2009, the IPD UK commercial property index (the main measuring stick for the sector) offered a rental yield (annual rent as a percentage of the average property's value) of 8.8%. At the end of September this year, the market value of British Land's portfolio offered a yield of 4.7% based on the rents it receives. Its West End offices are valued at a yield of just 3.6%.

These yields have been trending lower as investors' appetite for property has grown. In other words, investors have been willing to accept ever-lower yields on their investment, as they come to believe that rates will stay low for much longer than they once thought. This is known as yield compression', and it accounted for two-thirds of the 11.8% rise in British Land's NAV per share between March and September this year. Yields might keep falling but further big gains in value from this effect are unlikely. So given that British Land shares are currently trading at around their NAV, where are the future gains in value going to come from?

Should you buy the shares?

First and foremost, to be a buyer of the shares, you have to assume that interest rates will stay low for a long time to come. This is quite likely in my view. This means that gains in value are likely to come from two main sources: growth in rental income and gains from developing properties. Here, the outlook looks quite promising. The London office market is red hot just now. Demand for high quality office space is very high and fresh supply for now is low, as are vacancies. As mentioned, high investor demand is pushing yields lower (British Land has sold some properties for a yield as low as 2.5%), but more importantly rents are rising. British Land is confident it can get rent increases of 3%-5% a year for the next few years. Its offices are 95% occupied and the vacant space offers a potential to get higher rents from refurbishing and re-letting.

The company's shopping centres are also on the up and nearly fully let. Visitor numbers have been growing and its tenants' sales have been increasing. While the internet is clearly a threat to British Land's assets, it is benefitting from extra investment and trends such as click and collect' (buying online and picking up from a shop). British Land is confident that rents in this sector can grow by 1%-3% per year on a three-to-five-year view.

It's also encouraging that British Land is not splashing its cash on buying properties at high prices. Instead it has been selling. It has made nearly £1bn of profit from developing properties in recent years with another £300m expected from existing projects. Throw in developments in the likes of Shoreditch and near Paddington station, and you can see the potential for the NAV to grow. Don't bet on big dividend increases though, as the company is looking to build up its dividend cover.

All in all, British Land is in rude health with strong finances (the debt-to-value ratio on its portfolio is a prudent 36%). As long as the UK economy stays robust and interest rates low it's difficult to see the shares falling a long way. That said, it looks as if the easy money has been made.

Verdict: a solid hold

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how