Gamble of the week: A bet on workplace safety

This specialist maker of workplace safety kit is a good bet for contrarian investors, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Have you ever fancied working at the top of a tall building? Perhaps not. But people in that position want peace of mind that if they should slip or fall, then there will be something in place to make sure they don't come to any harm.

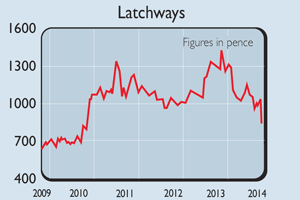

This is the bread and butter of this Wiltshire- based company, which makes specialist workplace safety kit.It has been going through a bit of a hard time over the last couple of years. Weak European economies have meant that construction companies haven't been busy and haven't bought a lot of itskit.

On Tuesday this week,Latchways (LSE: LTC)announced that things had got even worse. Wind-farm projects in Europe have been delayed, while a key American customer has apparently got too many of Latchways' products and doesn't need to order as many this year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Despite places such as the UK and Latin America doing better, pre-tax profits for the year to March 2015 are expected to be between £4.5m and £5.5m, compared to £6.8m last year. The shares were duly hammered and fell by 17%. Investors were probably wishing that there was a bit of safety kit to keep the shares from falling further.

Yet Latchways' management insiststhat this is a temporary blip and thatthe future will be much brighter.The directors have pledged to maintain last year's 39.5p dividend and hope that the 4.8% yield will persuade people to be patient. On top of this, there's more than £10m of cash in the bank and nodebt in other words, there's no riskof the company getting into financialdifficulties.

For example, onprofits of just £4.5m it would still bemaking a return on capital employed of18%, which is pretty decent. Two yearsago, that figure would have been over40% not many companies are capableof that.

Latchways' shares were over £14 back inNovember last year and don't look likereturning to those levels anytime soon.However, if you believe the managementwhen it says that profits can reboundstrongly over the next couple of years,then the shares could be a good buy forcontrarian investors.

Verdict: a buy for the brave at 830p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Could Chinese investments race ahead in the Year of the Horse?

Could Chinese investments race ahead in the Year of the Horse?As the Year of the Horse begins, we highlight the trends and sectors that could make great Chinese investments for the coming Lunar year

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure