Andrew Van Sickle

Andrew is the editor of MoneyWeek magazine. He grew up in Vienna and studied at the University of St Andrews, where he gained a first-class MA in geography & international relations.

After graduating, he began to contribute to the foreign page of The Week and soon afterwards joined MoneyWeek at its inception in October 2000. He helped Merryn Somerset Webb establish it as Britain’s best-selling financial magazine, contributing to every section of the publication and specialising in macroeconomics and stock markets, before going part-time.

His freelance projects have included a 2009 relaunch of The Pharma Letter, where he covered corporate news and political developments in the German pharmaceuticals market for two years, and a multiyear stint as deputy editor of the Barclays account at Redwood, a marketing agency.

Andrew has been editing MoneyWeek since 2018, and continues to specialise in investment and news in German-speaking countries owing to his fluent command of the language.

Latest articles by Andrew Van Sickle

-

Brazilian stocks take off – but politics could lay them low again

Features Brazil’s Bovespa stockmarket index has just reached a new record peak, but investors should keep a close eye on the political backdrop.

By Andrew Van Sickle Published

Features -

US stocks shrug off the government shutdown

Features Last week Congress failed to approve a bill to continue funding government operations. But US equities have largely ignored the fuss, hitting yet more record highs.

By Andrew Van Sickle Published

Features -

Turkey’s boom will turn to bust

Features Turkish stocks have just reached a new record.But with high debt, a weak lira and an authoritarian government, Turkey’s boom could quickly turn to bust.

By Andrew Van Sickle Published

Features -

Africa is back on track for prosperity

Features Investors’ enthusiasm for Africa dwindled as commodity prices fell. But there has always been more to the Africa story than raw materials.

By Andrew Van Sickle Published

Features -

The bond bull market is finally over

Features Investors have been talking about the end of the bond bull market for years. But it hasn't materialised - until now.

By Andrew Van Sickle Published

Features -

Fed interest-rate rises won’t hold the gold price back

Features Some analysts worry that higher US interest rates are bearish for gold. But the evidence doesn’t bear this out.

By Andrew Van Sickle Published

Features -

Germany is weaker than it looks

News The German economy appears to be firing on all cylinders. But under the surface lurk fundamental vulnerabilities that could hamper its long-term performance.

By Andrew Van Sickle Published

News -

Oil soars, but hits a ceiling

Features The price of oil has now reached $70 a barrel for the first time since early 2015, and is still rising. But unless there is a serious supply disruption, it's unlikely to go much higher.

By Andrew Van Sickle Published

Features -

Get set for a stockmarket melt-up

Features Stocks are massively overpriced, but the benign economic backdrop suggests that the markets will march on. Indeed, the most likely scenario now, say some observers, is a dramatic 'melt-up'.

By Andrew Van Sickle Published

Features -

Commodities make a comeback

Features Raw-materials prices rose sharply in 2017 – and they have made a strong start to 2018, too.

By Andrew Van Sickle Published

Features -

China edges into the company big league

Features China’s internet giants, Tencent and Alibaba, have jumped into the top ten of the world's biggest companies my market cap.

By Andrew Van Sickle Published

Features -

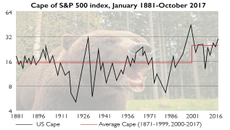

Ignore the Cape sceptics

Tutorials The cyclically adjusted price-earnings (Cape) ratio is an excellent predictor of long-term equity returns. And now, in the US at least, it is flashing red.

By Andrew Van Sickle Published

Tutorials -

Gold’s lustre may fade

Features Gold was overshadowed by equities and base metals in 2017, but still rose by around a tenth. This year, however, it may not fare so well.

By Andrew Van Sickle Published

Features -

Europe’s surprise boom will keep going

Features The eurozone's economy expanded by 2.4% in 2017, compared with analysts’ average forecast of 1.5%. So what went right?

By Andrew Van Sickle Published

Features -

China braces for a slowdown

Features China looks on track for annual growth of about 6% this year, rather than the 6.7% widely expected.

By Andrew Van Sickle Published

Features -

Italy: the eurozone’s weakest link

Features Italy's economy is almost totally paralysed. It has barely expanded since 199; debt has reached an unsustainable 130% of GDP; and political instability has thwarted serious reform efforts to revive the economy.

By Andrew Van Sickle Published

Features -

A stellar run for stocks everywhere

News Stock markets continue their steady climb as the year draws to a close.

By Andrew Van Sickle Published

News -

Greece: out of intensive care

Features Europe’s perpetual basket-case, Greece, is on the mend, says Andrew Van Sickle.

By Andrew Van Sickle Published

Features -

Don’t tuck into the emerging-market leftovers

News While emerging markets have performed well over all, two have been left behind, says Andrew Van Sickle.

By Andrew Van Sickle Published

News -

A new dawn for emerging equities

News Emerging-market equities spent much of this decade treading water, but since early 2016 they have been making up for lost time.

By Andrew Van Sickle Published

News -

The zombies stalking the economy

News Failing companies, or corporate “zombies” are holding back growth in the developed world.

By Andrew Van Sickle Published

News -

Trump will burst the bond bubble

News After months of bluster, the administration finally appears on the verge of passing a significant piece of legislation that could affect the bond market.

By Andrew Van Sickle Published

News -

Japan: slowly but surely, it’s getting there

News The key to overcoming deflation and stagnation in Japan lies in the labour market.

By Andrew Van Sickle Published

News -

Opec mops up the oil glut

News The members of Opec, the oil exporters’ cartel, agreed to “extend-and-maybe-amend” their output deal.

By Andrew Van Sickle Published

News