Why investors should venture into VCTs – and three to buy now

Each week, a professional investor tells us where he’d put his cash. This week: Alex Davies, founder of high net-worth investment service Wealth Club, picks his top VCTs

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This year marks the 25th anniversary of the introduction of venture capital trusts (VCTs). The idea was to encourage investors to support young and innovative businesses in exchange for generous tax concessions. Since 1996, VCTs have raised £8.4bn and helped thousands of private companies grow – from GO Outdoors, Secret Escapes, Everyman Cinemas and Five Guys to Zoopla, the first VCT-backed £1bn company. When you invest in a VCT you receive up to 30% tax relief. So on a £10,000 investment you could get back £3,000. All returns, typically paid through dividends, are tax-free. The annual allowance of £200,000 is both generous and straightforward.

There is a catch, though. VCTs are not open all year round. Demand for the popular ones far outstrips supply and they sell out quickly. So if any of the below whet your appetite, to avoid missing out invest now rather than waiting for the new tax year.

Northern VCT: the best of both worlds

The Northern VCT was one of the first to launch 25 years ago. If you had invested £10,000 at launch and reinvested dividends you could now be sitting on a tax-free pot of £47,837. If you factor in the initial tax relief and the relief on the dividend reinvestments, that figure would be £63,797.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This helps explain why last year’s offer was sold out in just 11 days. There are now three VCTs offering access to “the best of both worlds”: old-style investments (mainly management buyouts), which should provide some stability, as well as new younger and riskier plays with greater growth potential. Holdings range from AVID Technology Group – a manufacturer of electric vehicle components – to The Climbing Hangar, a chain of indoor rock-climbing venues.

Mobeus VCTs: a strong record

Another manager with a great record and loyal following is Mobeus. To date the Mobeus VCTs (there are now four altogether) have handsomely rewarded investors. If you had staked £10,000 on the combined 2010/2011 offer, by June 2019 you could have received around £9,800 in dividends alone before tax relief. If you invest now you get access to a diversified portfolio equally split between larger, established businesses such as Virgin Wines and Access IS (which makes boarding-pass scanners for airports) and younger rising stars such as MPB, a marketplace for second-hand photographic equipment. The former provide considerable income to support dividend payments; the latter offer growth. Nearly half of the portfolio companies are profitable.

Octopus: a tentacle in every pie

Octopus Titan VCT (LSE: OTV2) looks for pioneering companies with the potential to go global. It has had a string of high-profile exits, most notably Zoopla. Others include SwiftKey (sold to Microsoft), and Graze. At £825m of net assets, Octopus Titan is the largest VCT and with over 75 investee companies it is highly diversified.

There is a good mix of established businesses such as travel members’ club Secret Escapes and Calastone, the fund trading platform, and new businesses with the potential for high growth. New investments include Depop, an online marketplace for vintage clothing with 13 million users worldwide.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

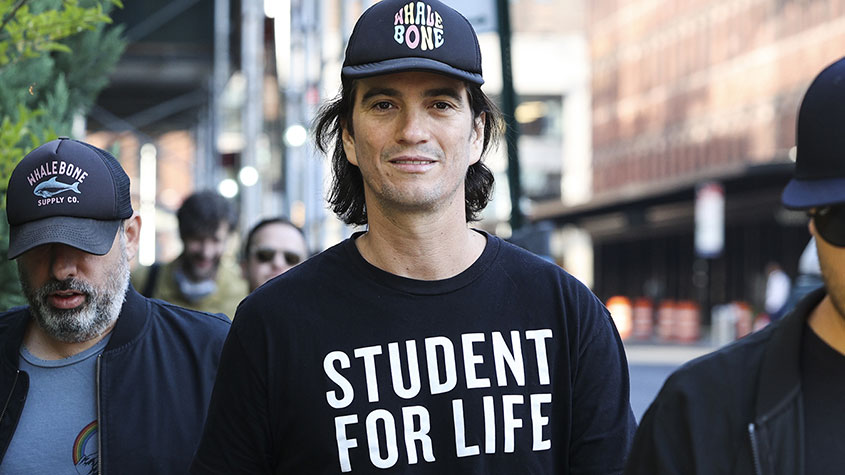

Alex is the founder and CEO of Wealth Club, the UK’s leading online investment platform for high-net-worth and sophisticated investors. Since its launch in 2016, 13,200 clients have invested £1.65 billion into early-stage companies via the platform. In 2024, Wealth Club broke new ground with the launch of a fund supermarket, giving investors access to top-tier private equity funds – the first offering of its kind in the UK. Prior to setting up Wealth Club, Alex was a director of Hargreaves Lansdown.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

Magic mushrooms — an investment boom or doom?

Magic mushrooms — an investment boom or doom?Investing in these promising medical developments might see you embark on the trip of a lifetime.

-

3 VCTs to consider as we near the end of the tax year

3 VCTs to consider as we near the end of the tax yearTips Venture Capital Trusts come with risks, but offer generous tax allowances that could entice investors ahead of the tax increases coming in April.

-

Why venture capitalists should stop hero-worshipping celebrities

Why venture capitalists should stop hero-worshipping celebritiesOpinion Venture capitalists get all star struck when the celebrities turn up. But, while backing superstars may be attractive, it will not be good for profits, says Matthew Lynn.

-

How venture capital trusts can provide income and growth for pension savers

How venture capital trusts can provide income and growth for pension saversAdvice Venture-capital trusts provide both capital gains and juicy dividends, which makes them the investment vehicle of choice for many pension savers. But they are risky, says David Prosser, so do your homework.

-

Is now a good time to invest in VCTs?

Is now a good time to invest in VCTs?Venture capital trusts have turned 30 years old. While VCTs are volatile, could now be the right time to invest?

-

Should you risk buying into venture capital trusts (VCTs)?

Should you risk buying into venture capital trusts (VCTs)?Tips Venture capital trusts (VCTs) are risky, but they are tax-efficient and focus on fast-growing private companies. David Stevenson picks a few to consider.

-

Venture capital trusts that offer growth, income and tax relief

Tips Professional investor Alex Davies, founder of high-net-worth investment service Wealth Club, is a fan of venture capital trusts (VCTs). Here, he picks some of his favourites.