Time to venture into venture capital trusts

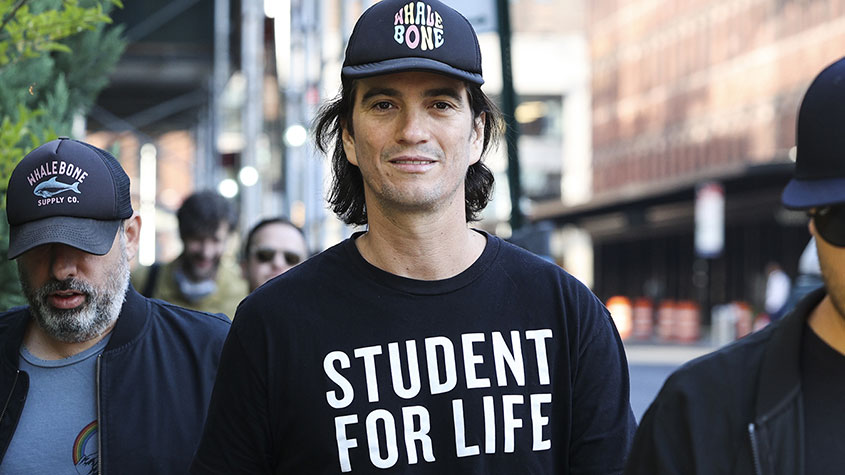

Professional investor Alex Davies, founder of high net worth investment service Wealth Club, picks his top venture capital trusts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, a professional investor tells us where he'd put his money. This week: Alex Davies, founder of high net worth investment service Wealth Club, picks his top VCTs.

The tax burden in Britain has reached a 49-year high. Higher earners have been hit the hardest: their share of the nation's tax bill has almost trebled since the 1970s. At the same time, investing tax-efficiently has become considerably harder over the past few years.

For instance, not only has there been a crackdown on the buy-to-let sector, with the relief on mortgage-interest payments reduced and stamp duty for second homes raised, but the pensions annual allowance has been cut too. Many fear tax relief for higher earners could be on the way out. So where can wealthier investors turn?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

One of the last relatively straightforward and tax-efficient investments left is a venture capital trust (VCT). In exchange for the greater risks of investing in young innovative companies, VCT investors get 30% income-tax relief when they invest, along with tax-free returns in the form of dividends.

Owing to recent changes in the law, the types of companies VCTs can make new investments in are now typically younger and less established than previously. That said, if you invest today you get exposure to the whole portfolio of a typical VCT, which will often include more established companies that qualified under the old rules. They should help support dividend payments while the new riskier investments come to fruition. But future dividends could be lumpier than before.

A dependable VCT maven

One of the managers I would be most happy to put my money with is Bill Nixon, manager of the Maven VCTs. Consider VCTs 1 and 5 (LSE: MIG1 and LSE: MIG5). Maven historically specialised in management buyouts, which still represent as much as 66% of the current portfolios. It has also been one of the most active managers since the rule changes, with nine new investments in 2018 alone. As a result, investors get a good mix of new and old-style investments. These include companies servicing the oil and gas industry, a leading manufacturer of shower trays and a car seller. Since 2015 Maven has completed 11 profitable ventures, delivering returns of up to 7.1 times the cost of the stake.

A tentacle in every pie

The new VCT rules play to Octopus's strengths. The Octopus Titan VCT (LSE: OTV2) has concentrated solely on early-stage, high-growth businesses ever since its inception in 2000. It has a great record of spotting and nurturing rising stars and achieving high-profile exits. Zoopla, the first VCT-backed £1bn company; travel group Secret Escapes; Graze.com, which makes healthy snacks; and dog-food maker Tails.com all received funding from Octopus Titan. One of its most recent partial exits was realised at 80 times the lowest price at which they invested.

Two proven performers

Like Octopus, Proven has specialised in fast growers for many years so it should be well positioned to prosper under new rules. Over the last 20 years both the Proven and the Proven Growth and Income VCTs (LSE: PVN and LSE: PGOO) have generated great returns. Successful exits last year included luxury watch retailer Watchfinder, sold to Swiss luxury goods groupRichemontSA, providing a ninefold return, and Chargemaster, the UK's largest electrical car charging firm, reportedly sold to BP for £130m.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is the founder and CEO of Wealth Club, the UK’s leading online investment platform for high-net-worth and sophisticated investors. Since its launch in 2016, 13,200 clients have invested £1.65 billion into early-stage companies via the platform. In 2024, Wealth Club broke new ground with the launch of a fund supermarket, giving investors access to top-tier private equity funds – the first offering of its kind in the UK. Prior to setting up Wealth Club, Alex was a director of Hargreaves Lansdown.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

Magic mushrooms — an investment boom or doom?

Magic mushrooms — an investment boom or doom?Investing in these promising medical developments might see you embark on the trip of a lifetime.

-

3 VCTs to consider as we near the end of the tax year

3 VCTs to consider as we near the end of the tax yearTips Venture Capital Trusts come with risks, but offer generous tax allowances that could entice investors ahead of the tax increases coming in April.

-

Why venture capitalists should stop hero-worshipping celebrities

Why venture capitalists should stop hero-worshipping celebritiesOpinion Venture capitalists get all star struck when the celebrities turn up. But, while backing superstars may be attractive, it will not be good for profits, says Matthew Lynn.

-

How venture capital trusts can provide income and growth for pension savers

How venture capital trusts can provide income and growth for pension saversAdvice Venture-capital trusts provide both capital gains and juicy dividends, which makes them the investment vehicle of choice for many pension savers. But they are risky, says David Prosser, so do your homework.

-

Is now a good time to invest in VCTs?

Is now a good time to invest in VCTs?Venture capital trusts have turned 30 years old. While VCTs are volatile, could now be the right time to invest?

-

Should you risk buying into venture capital trusts (VCTs)?

Should you risk buying into venture capital trusts (VCTs)?Tips Venture capital trusts (VCTs) are risky, but they are tax-efficient and focus on fast-growing private companies. David Stevenson picks a few to consider.

-

Venture capital trusts that offer growth, income and tax relief

Tips Professional investor Alex Davies, founder of high-net-worth investment service Wealth Club, is a fan of venture capital trusts (VCTs). Here, he picks some of his favourites.