Why venture capitalists should stop hero-worshipping celebrities

Venture capitalists get all star struck when the celebrities turn up. But, while backing superstars may be attractive, it will not be good for profits, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

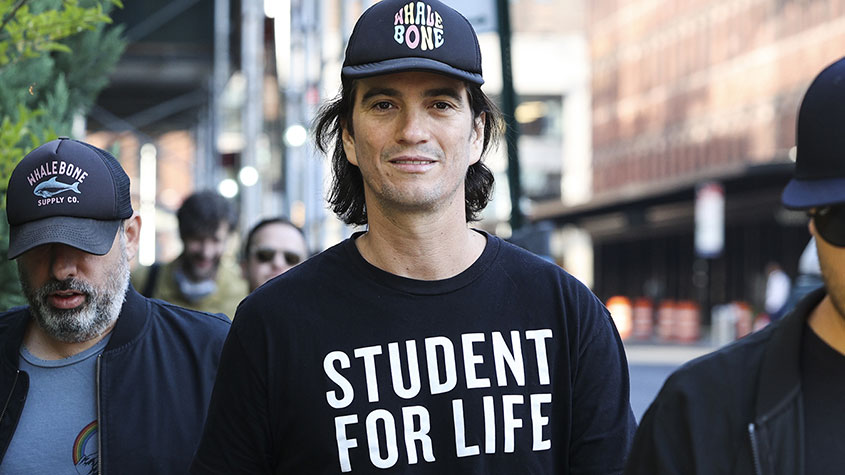

Some high-profile founders have found it remarkably easy to raise fresh capital in recent weeks. Adam Neumann, the founder of the temporary office company WeWork, has just raised $350m for Flow, a start-up aiming to transform the residential apartment market, with a total valuation for the new business of more than $1bn. Travis Kalanick, the key founder of the minicab empire Uber, received $850m in funding for his new venture, CloudKitchens, with Microsoft reportedly among its backers, putting a total valuation of more than $15bn on the new businesses.

Reality TV star Kim Kardashian is getting in on the act, teaming up with investment giant Carlyle to start a media private-equity firm. Tennis star Serena Williams has also raised an extra $111m to expand her firm Serena Ventures. It is seems clear that the venture-capital (VC) industry, once a quiet corner of the financial markets occupied mostly by serious bankers and accountants, has all of a sudden developed a cult of star-struck hero worship.

Opening doors

That is not to say that there aren’t some good ideas out there. Kalanick is definitely on to something and has been investing in dark kitchens – huge catering hubs that exist simply to make meals for the delivery market – for some years now. The business may look more risky now than it was at the height of the pandemic, when we all treated ourselves to a takeaway a couple of times a week to relieve the boredom of lockdown, but there’s no question that biking over hot meals to the home is a huge business and one that is not going to disappear any time soon. It is far more efficient to make the meals in a warehouse on an industrial scale than at individual restaurants, and while it may not be quite what the customers think they are ordering (most probably imagine they are getting something special from their local curry house), they probably won’t ever realise where the bike has come from.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Likewise, Neumann’s new property venture has the kernel of a great idea. In a world where many people are likely to rent rather than own for most of their lives, and will often be working from their homes for most of the week as well, it makes a lot of sense to create purpose-built rental communities that include social events, networking and plenty of business services, as well as being pleasant places to live.

Even Kardashian and Williams may well be able to bring something to an investment firm. After all, Kardashian is a smart businesswomen, as her success in TV illustrates, and she has already managed to spin that into clothing and skin care brands – there is no question that her fame will be able to open a lot of doors and potentially bring in some good deals.

Back to basics

The problem is that these celebrities have questionable records. Kalanick may have turned Uber into a huge global brand, but he also left the company in a total mess. He resigned from the company he helped found and, ever since, Uber has struggled to stabilise its management or its operations. Neumann was no better. WeWork ran up huge debts, its initial public offering (IPO) stumbled, and eventually Neumann was forced to leave the company and give up majority control. As for Kardashian and Williams, they may be smart, but they are not exactly investment professionals.

The reality is that most of the great entrepreneurs start out as complete outsiders. They don’t have many connections, they are not famous, they don’t have much money and no one has ever heard of them. They simply have a good idea, an appetite for hard work, lots of ambition, and a point to prove. The job of the VC houses should be to spot the great ones when they turn up, even if no one has ever heard of them before, and back them to the hilt. Sure, backing superstars may be attractive, and it will always get a few headlines. But if the investment industry can’t bring that to an end – and get back to basics – it will surely end up with a huge round of bad investments. And it will have no one to blame for that but itself.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

-

Tap into the key long-term growth trends with these resilient performers

Tap into the key long-term growth trends with these resilient performersA professional investor tells us where he’d put his money. This week: Zehrid Osmani, portfolio manager, Martin Currie Global Portfolio Trust, picks three favourites.

-

Look beyond familiar stockmarkets for reliable returns in rough times

Look beyond familiar stockmarkets for reliable returns in rough timesTips A professional investor tells us where he’d put his money. This week: Giles Parkinson, managing director of global funds at Close Brothers Asset Management.

-

7 winners and losers in the leisure sector

7 winners and losers in the leisure sectorTips It’s been a wild three years for hospitality, but crisis creates opportunities, says Michael Taylor of Shifting Shares.

-

Nationwide: house price growth sees its biggest drop since 2009

Nationwide: house price growth sees its biggest drop since 2009News Nationwide’s latest house price index shows house prices fell in May, and further challenges lie ahead.

-

3 renewable energy stocks to buy

3 renewable energy stocks to buyTips These stocks look poised to benefit as the world transitions to a net zero economy.

-

Look beyond the blue chips for the best bargains in British income stocks

Look beyond the blue chips for the best bargains in British income stocksTips A professional investor tells us where he’d put his money. This week: Chris McVeyof the FP Octopus UK Multi Cap Income Fund highlights three favourites.

-

Three British stocks offering all-weather income

Three British stocks offering all-weather incomeTips A professional investor tells us where he’d put his money. This week: Brendan Gulston, co-manager of the LF Gresham House UK Multi Cap Income Fund.