How to plan for the general election result

John Stepek looks at the potential outcomes of Thursday’s general election and explains what each would mean for markets – and what you can do to protect your wealth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You've probably noticed that we've got a general election on Thursday. You might even already have voted.

We're at the "fighting dirty" stage of the campaign. The papers are awash with more hypocrisy and self-righteousness than usual.

And social media is even worse. It feels like a constant stream of "30-second hates". (Two minutes is too long for our attention spans these days).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Ah well. I know which outcome I think is best for the economy, markets and the country overall a Conservative majority. It's not like I'm spilling any state secrets by confessing to that opinion.

But I'm not going to change anyone's mind at this late stage of the game.

Today I just want us to put our investor hats on, and run down the most likely outcomes from Thursday, and give you an idea of what might happen in each as a result.

What will the election result mean for Brexit?

There's always room for surprises in elections, as events of the past few years have shown.

This isn't necessarily because pollsters are bad at their jobs. It's because a "likely" outcome is not the same as a "certain" outcome.

An event with a one in a hundred chance of happening in a given time period is highly unlikely to occur over that time period. But it's not impossible.

So the fact that a Conservative majority is deemed as likely on Thursday, does not mean that it is certain.

So from an investor's perspective, it's probably worth looking at three outcomes: a Conservative majority (likely); a minority government led by Labour, supported by the SNP (less likely, but still very, very possible; and a majority Labour government (highly unlikely but not impossible).

So first off what would each of these mean for Brexit?

A Conservative majority would mean that Brexit moves onto the next phase. The pound would probably enjoy a relief rally in the short term.

The next phase, of course, is a long negotiating process. Attention would soon shift to the next potential "hard" deadline of the end of 2020. There would be a lot more headlines, and sterling will fluctuate again as a deal looks more or less likely, and more or less "hard".

But at least some of the uncertainty would be lifted. And Brexit would lose some of its potency as a domestic political issue in that, we'd know it wasn't going to be reversed.

A minority government could go in several ways. But given that no other party would willingly support the Conservatives, the most likely result is a Labour government propped up by the others, with the SNP particularly strong in the partnership.

But whatever the makeup of the coalition, on Brexit, the most likely result would be a second referendum. And it's also the most likely outcome of a Labour majority, as that's exactly what Labour have promised to deliver.

There would be a great deal of back and forth between Britain and the EU on this again, with lots of "will they, won't they" headlines about whether the EU would even tolerate another delay. But given the prize of a reversal of Brexit, I suspect they would.

Without being too conspiratorial about it, I think that leave would face an uphill struggle to win any second referendum. It was tough enough the first time and this time, the complacency of the status quo would be gone. I'm not saying a leave vote would be impossible, but it'd be hard.

All else being equal, the pound would weaken on further uncertainty, but perhaps recover somewhat once a second referendum appeared to be the only outcome.

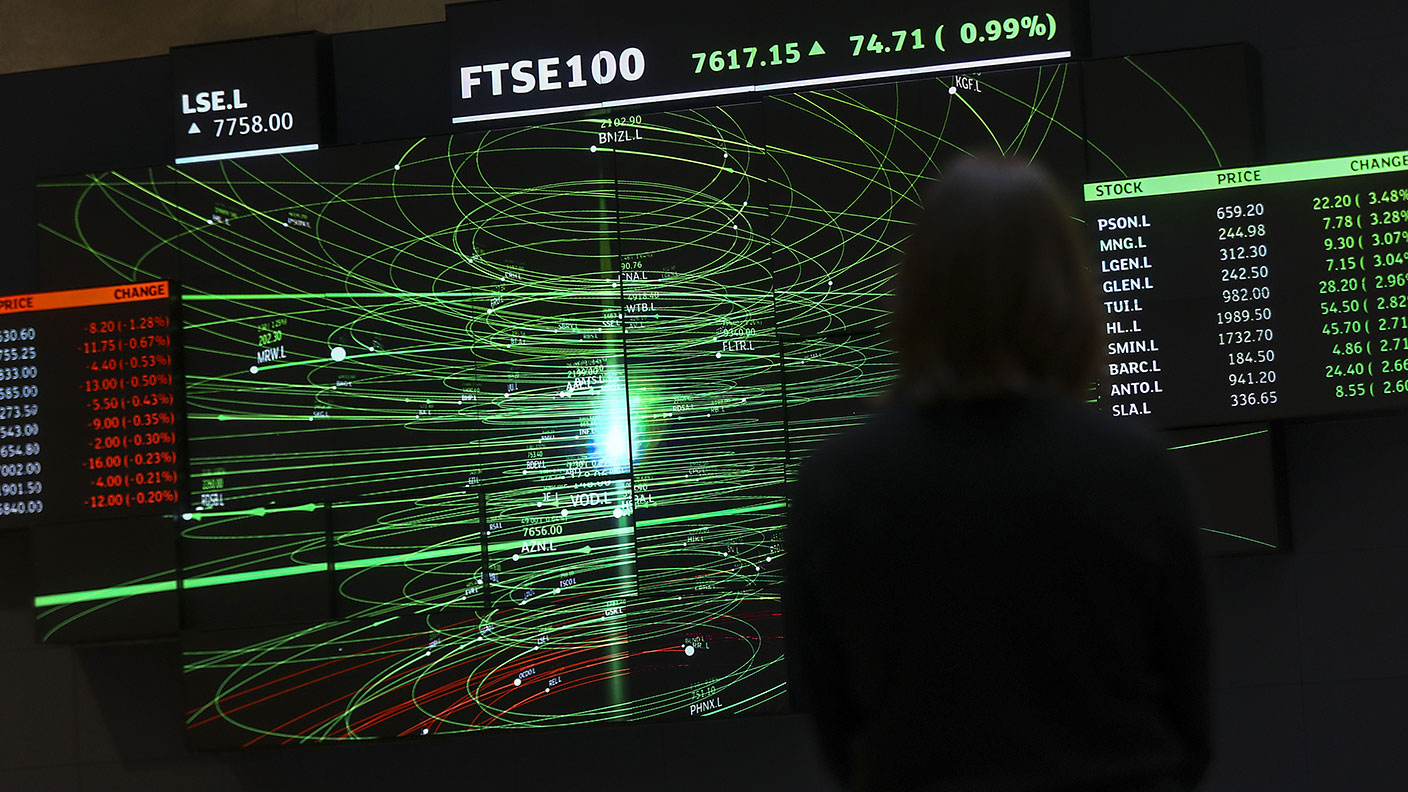

What will the election result mean for markets?

However, I suspect that any second referendum relief rally for the pound would be entirely offset by the economic plans laid out by a Labour-led government.

Don't get me wrong. Both the Tories and Labour plan to spend more. The Tories have been quite cagey about their plans but I would be surprised if there wasn't a "feel-good" budget after the election (rather than the usual "feel-bad" budget you get when a party feels safely in power for a while).

We've also got some more details on each individual party's tax policies from tax experts Blick Rothenberg on the website, here.

However, on a macro level, it's again clear that, for investors at least, the least disruptive result would be a Conservative majority.

The problem is that the tone from Labour is very much back to one of targeting those perceived to be well off, and also of property rights being a gift from the state something that is tolerated by those in power, rather than an inalienable legal right.

Property rights and respect for wealth creation are two things that underpin a successful capitalist model; if those are eroded you are looking at an environment which is hostile to investors.

What kind of effect are we talking? Capital Economics took a look at several historical comparisons from around the world, where a harder-left government than expected had been elected to power.

These cross-country comparisons are of course imperfect, as the researchers acknowledge. I'm not sure there's much you can learn about the UK's current scenario from Syriza winning power in Greece in 2015, for example.

However, looking at 1981's victory in France for Francois Mitterrand, which Capital Economics views as "the best analogy", a victory for the left-wing government there led to a 15% fall in French equities.

Capital Economics reckons the fallout for the UK of a Labour government, would be a near-term drop of about 10%. "Whether they fell further or rebounded would depend on how much of its agenda were implemented."

The question of course is: what can you do about any of this?

The answer is you could consider hedging your bets if you are that way inclined. You could take a punt with short-term money (that you can afford to lose) on a drop in markets or a slide in sterling. The idea would be to offset any drop in your existing "long" portfolio.

What I would say though is this: if you're not already clued up as to how to do that, now is not the time to panic and learn. It's not that important and it could cut both ways in any case.

The main reason to be aware of what could happen on Friday morning is to avoid panicking when and if it does.

If the Tories win, the pound will probably bounce and markets will do what they do. If there's a minority government or a Labour win, or uncertainty, the pound will probably fall and markets may well do likewise (I'm only uncertain because a weak pound tends to be good for stocks right now, but on this occasion I don't think it'd work like that).

After that, we can all take stock as to whether this means we should adjust our portfolios. But as I say, in the meantime, there's no sense in panicking and trying to second guess the outcome.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

What can markets tell us about the economy and geopolitics?

What can markets tell us about the economy and geopolitics?Sponsored Markets have remained resilient despite Russia's war with Ukraine. Max King rounds up how reliable the stockmarket is in predicting economic outlooks.

-

The tech bubble has burst – but I still want a Peloton

The tech bubble has burst – but I still want a PelotonAnalysis Peloton was one of the big winners from the Covid tech boom. But it's fallen over 90% as the tech stock bubble bursts and and everything else falls in tandem. Here, Dominic Frisby explains where to hide as markets crash.

-

The market is adjusting to a new “short dreams, long reality” world

The market is adjusting to a new “short dreams, long reality” worldAnalysis As interest rates rise, things are starting to change, says John Stepek. Reality is biting back. Gone are the fanciful ideas built on hope – a business now needs a solid foundation.

-

Stockmarkets bounced strongly yesterday – have we been saved from a bear market?

Stockmarkets bounced strongly yesterday – have we been saved from a bear market?Analysis Stockmarkets rose sharply yesterday after suffering big falls in recent weeks – but that doesn’t mean we've hit a bottom, says John Stepek. Here’s what’s going on.

-

Buy Russia – it’s cheap

Buy Russia – it’s cheapOpinion If you want to make money investing, you need to buy stocks when they’re cheap. And right now, says Dominic Frisby, there’s nowhere cheaper than Russia. Here’s how to play it.

-

UK stocks should cope with rising interest rates better than other markets

UK stocks should cope with rising interest rates better than other marketsAnalysis Central banks are turning hawkish and raising interest rates. John Stepek looks at what that means for both long duration and short duration assets.

-

We’re in a “superbubble”, says Jeremy Grantham – so are we heading for a “superbust”?

We’re in a “superbubble”, says Jeremy Grantham – so are we heading for a “superbust”?Analysis America's Nasdaq stock index is down by more than 10% after soaring to all-time highs in a "superbubble". Are we about to see a "superbust" stockmarket crash? John Stepek looks at what's going on.

-

Equity markets are growing again – but that might not be good news for investors

Equity markets are growing again – but that might not be good news for investorsAnalysis Last year was one of the busiest ever for new stockmarket listings. That may sound like good news for investors, but it spells tricky times ahead, says John Stepek. Here's why.