The charts that matter: will the US dollar crack?

The US dollar is a lot stronger than it was a fortnight ago. Can that continue? John Stepek looks to the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back. We had a cracking time at the MoneyWeek Wealth Summit last Friday. I'll be writing it up for the special year-end double issue of MoneyWeek magazine (subscribe now to make sure you get your copy!). We'll also be releasing bits and pieces from the day via podcast and video over the course of the month.

And look out for news on more events coming in 2020 this one was a big hit, so it's very likely that we'll be upping the ante further over the next 12 months stay tuned

Money Morning and Currency Corner

No new podcast this week I'm afraid, but we'll hopefully have one from the conference out next weel. Meanwhile, if you missed any of this week's Money Morning articles, here are the links you need:

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: How Christine Lagarde's drive for ever-closer union will affect your wallet

Tuesday: Currency Corner: clash of the commodity currencies

Wednesday: What are the biggest mistakes investors make when it comes to tax?

Thursday: What last night's big opinion poll tells us about the pound

Friday: House prices are still far too high but things are improving slowly

Currency Corner: Is the krone's long slow slide coming to an end?

Subscribe: Get your first 12 issues of MoneyWeek for £12

And if you're looking for a longer read about investing, The Sceptical Investor is a great guide to the psychology of markets, including a whole chapter on how the fear of death affects your attitude towards investing (very Christmassy, I'm sure you'll agree). Oh, and I wrote it. So I might be biased.

The charts that matter

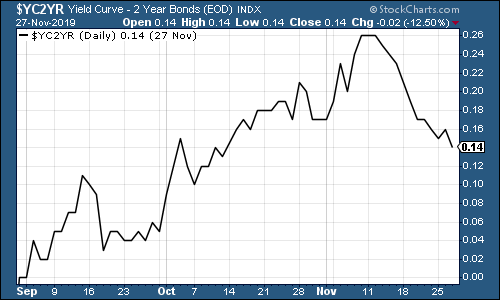

The yield curve has headed lower over the last fortnight. The yield on the ten-year US government bond is still higher than the yield on the two-year, which is the normal course of things.

Again though, remember that the curve inverted towards the end of August (in other words, the yield on the two-year was higher than that of the ten-year), which indicates that a recession is on the way within 18-24 months (so some time in 2020 or 2021), if history is any guide. The fact that the curve has since un'-inverted is of no relevance. Of course, this time could be different we don't have that many historic occurences to judge on. But inversion has proved a pretty reliable indicator in the past.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

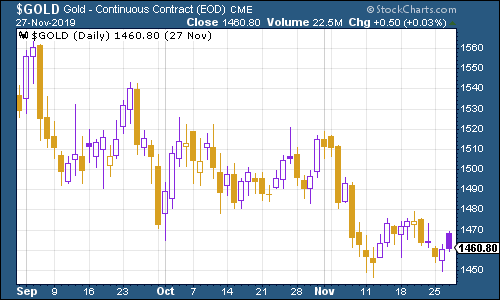

Gold (measured in dollar terms) has been ambling around over the last couple of weeks. On the one hand, stocks are doing really well (which is risk-on'). But the dollar is stubbornly refusing to enter a convincing bear market, which is very much risk-off'. So gold is not quite sure where to go.

(Gold: three months)

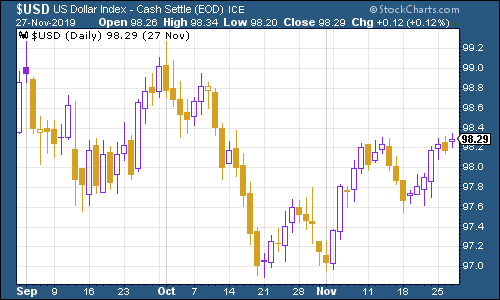

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners is a lot stronger than it was a fortnight ago. That is not good news for anyone who is betting on the bull market continuing.

Now my base case scenario is still weighted ever so slightly towards the dollar getting weaker it just feels like the right' outcome. But I don't have high conviction on this.

(DXY: three months)

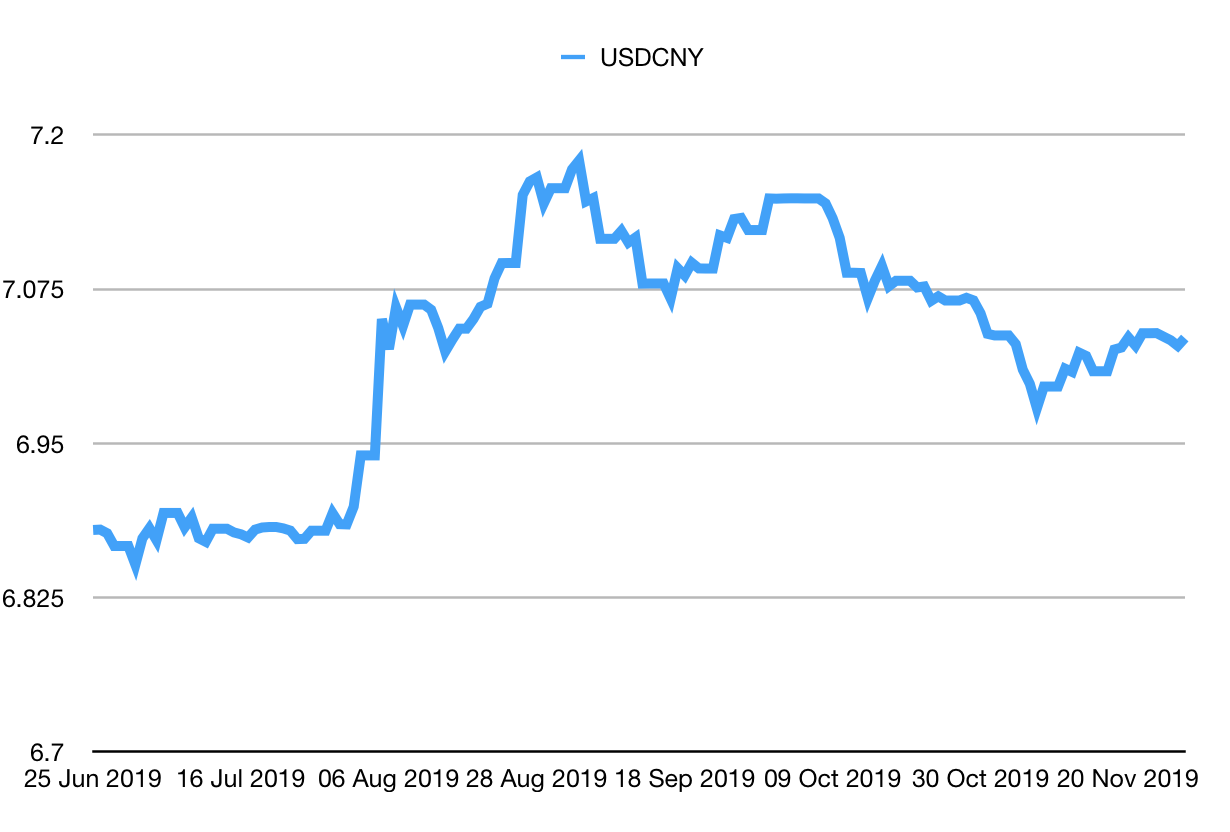

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) continued to amble around the key seven to the US dollar mark (much higher than seven means markets are worried about deflation, lower indicates a more risk-on' mood).

(Chinese yuan to the US dollar: since 25 Jun 2019)

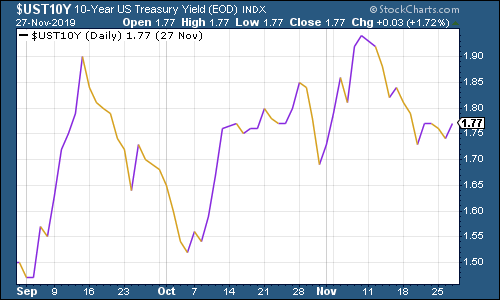

Yields on ten-year yields on major developed-market bonds have slipped back in the last two weeks. Here's the US...

(Ten-year US Treasury yield: three months)

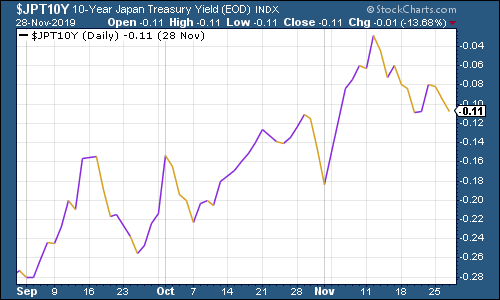

The Japanese ten-year has stayed firmly negative after almost making a break for freedom earlier in the month.

(Ten-year Japanese government bond yield: three months)

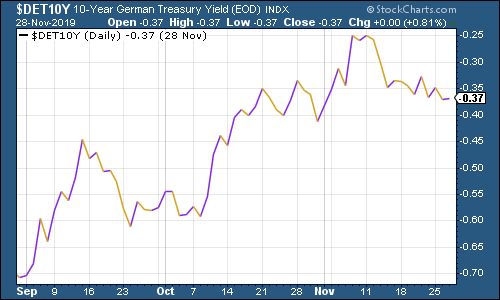

The yield on the German bund meanwhile, is only slightly more negative, partly because sentiment towards the eurozone's biggest economy isn't quite as grim as it was.

(Ten-year Bund yield: six months)

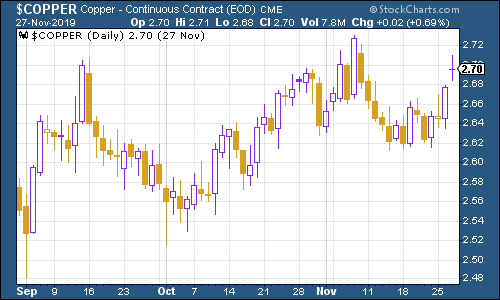

On the upside, copper has been making a bit of a comeback. A rising copper price tends to bode well for global demand, and as such, is a risk-on' indicator.

(Copper: six months)

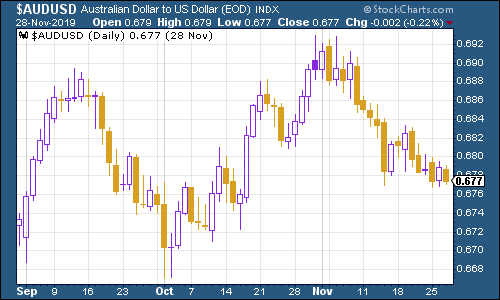

The Aussie dollar continues to slip back against the US dollar, although this is mainly an Australia-specific issue for now (Aussie economic data this week was quite weak, increasing the odds of a rate cut by the Australian central bank at some point), rather than a wider China story.

(Aussie dollar vs US dollar exchange rate: three months)

Investors have clearly grown bored with cryptocurrency bitcoin in the past fortnight or so, with its price sinking back down below $7,000 at one point. That said, it's rebounded solidly since then.

(Bitcoin: ten days)

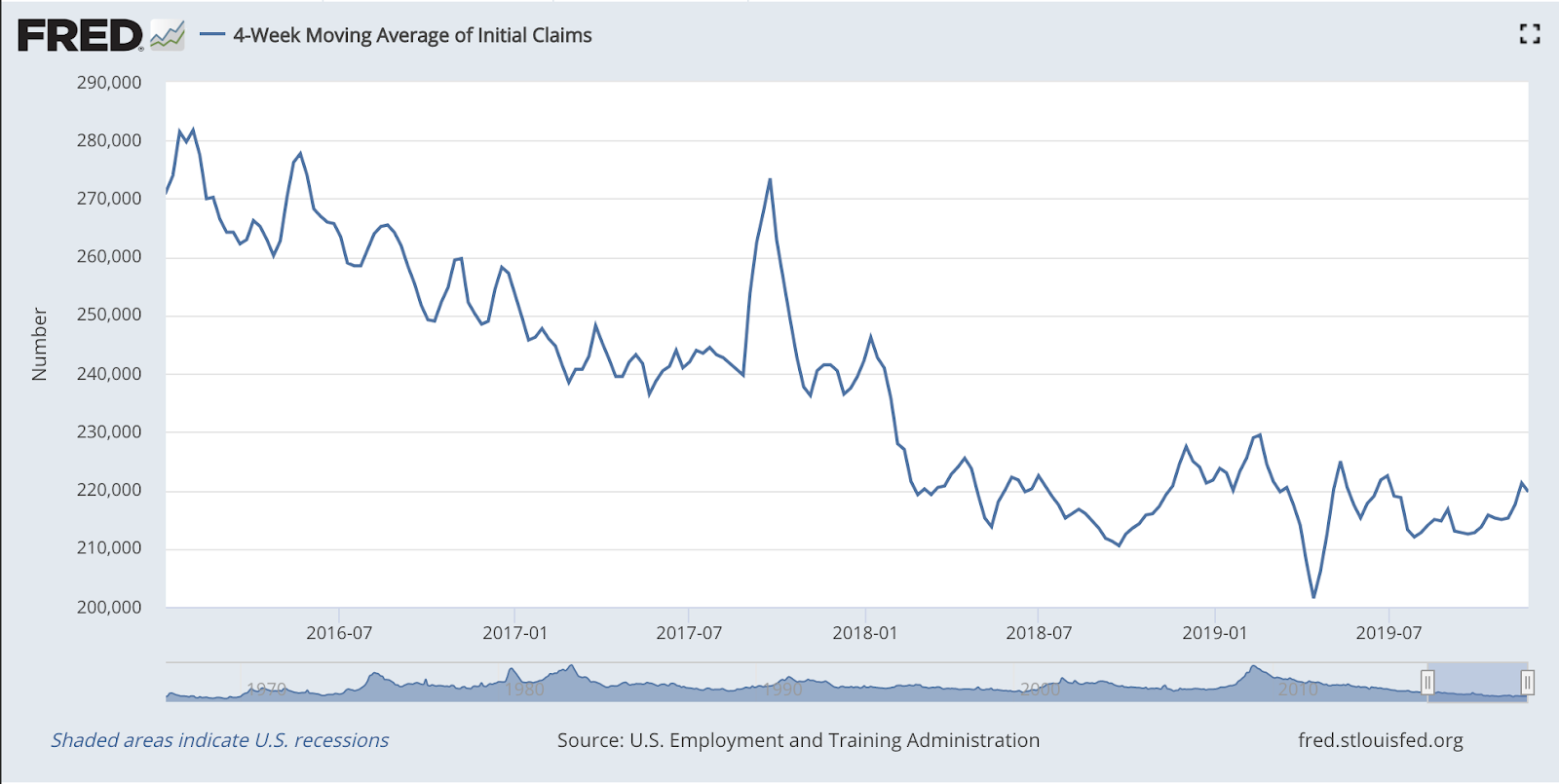

US weekly jobless claims slid to 213,000 this week, better than expected, from a five-month high of 227,000 last week. The four-week moving average came in at 219,750. I'm wondering if we're now seeing tentative signs of this unemployment measure edging higher, which in turn would suggest that a downturn might indeed be on the way.

(US jobless claims, four-week moving average: since January 2016)

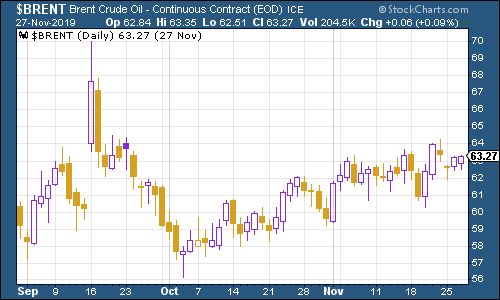

The oil price (as measured by Brent crude, the international/European benchmark) has barely shifted in the past two weeks. I suspect that oil is building up steam to give us all a nasty surprise on the upside, but let's just keep an eye on it.

(Brent crude oil: three months)

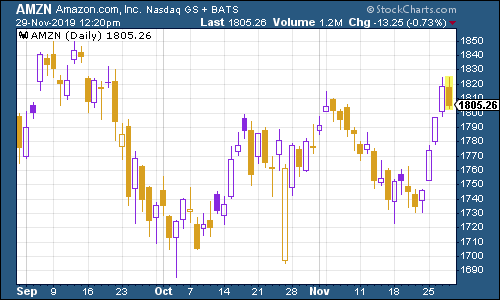

Internet giant Amazon, the company that no fund manager will ever get fired for owning, has rallied over the past two weeks, along with the rest of the market.

(Amazon: three months)

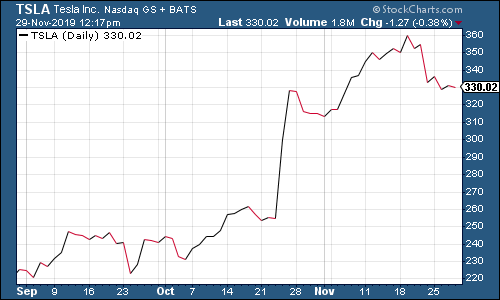

Meanwhile, shares in electric car group Tesla ebbed a little from their recent highs, despite the somewhat chaotic introduction of the Cybertruck proving once again, that most PR is good PR.

(Tesla: three months)

Have a great weekend. Oh, and if you're interested in currencies, do make sure you tune in for the webinar I'm hosting for currency specialists OFX it'll be a chance to ask questions, particularly if some of your income is generated overseas. I'm hosting it on Tuesday 3 December. Sign up for the webinar here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?