Currency Corner: is the krone’s long slow slide coming to an end?

Dominic Frisby looks at the Norwegian krone’s performance against the Japanese yen and asks, is it set for a major reversal?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As I write this sentence, I am reaching into my magic hat and the two currencies I pluck out are... the Norwegian krone and the Japanese yen.

There's a pair I bet you've never contrasted before.

Let's take a look at the two currencies, and see if there's a trade to be had.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, Japan. The fourth-largest economy in the world (behind the US, the EU and China). Its GDP stands at $5.75trn (PPP adjusted). With a population of around 127 million, that amounts to about $39,000 per head. It exported about $740bn of goods last year, mostly computers and machinery (34%) and vehicles (20%).

Norway is roughly the same size as Japan in terms of square kilometres. But its economy is rather smaller: PPP-adjusted GDP stands at just below $400bn, making it the 46th-largest economy in the world. Its population, however, is just five million, so its GDP per capita actually exceeds Japan by a considerable margin, at around $74,000.

Norway, too, sells machinery, but that amounts to just 4% of its exports. Its biggest export is, by far, mineral fuel (mostly oil) at 62.5%. Its second biggest export is fish, at 9.5%.

Currently one Norwegian krone will buy you just shy of 11.93 yen.

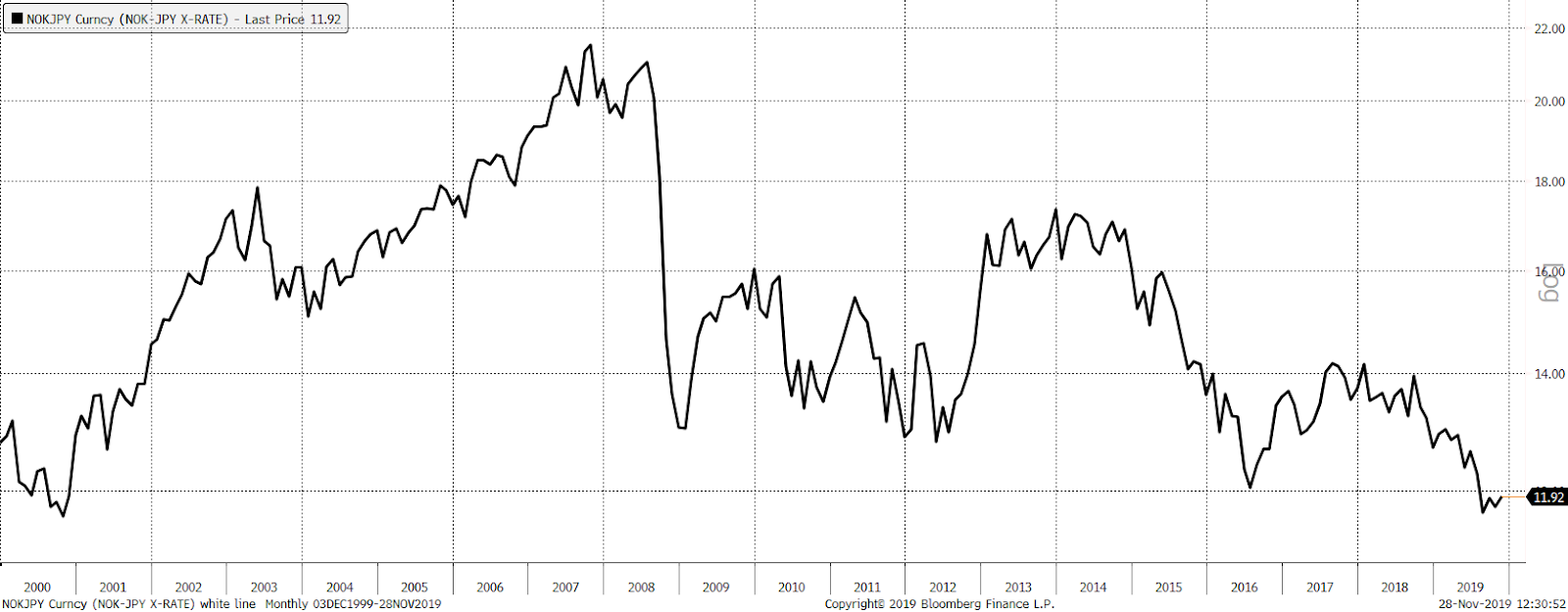

Starting with a long-term chart, to establish the parameters, below we see 20 years of the krone versus the yen. When the chart is rising the krone is strong and the yen is weak.

Between 2000 and 2008, the krone enjoyed a tremendous bull market, along with the rising price of oil, which ended with the global financial crisis. Almost eight years of gains were given back in a few short months.

Just shy of 22 was the high, and 11 was the low. And 2012 aside, the story of the last decade, has been one of grinding bear market in the krone.

But what really interests me about this chart, excites me even, is that fact that right now we are trading near 20-years lows, right at the bottom of the range.

Currencies have a habit of doing this lord knows why but we are right at the point where you would expect the krone to make a low.

Could the krone be about to bottom out?

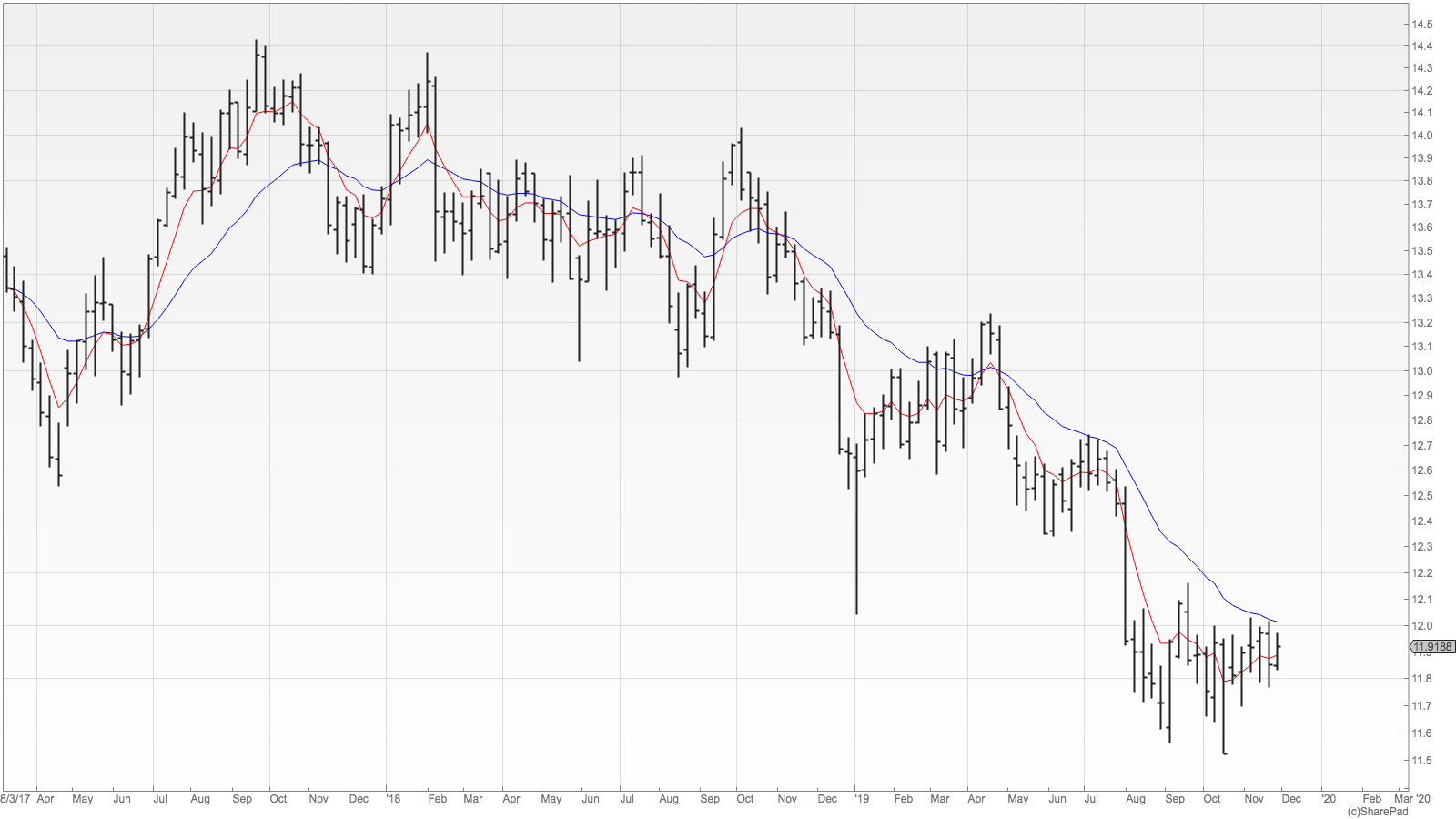

Let's zoom in and look at the more recent price action. Below, we see a weekly chart of the last three years, along with the 21 (blue line) and six-week (red line) exponential moving averages.

You'll note that both moving averages the six-week in particular are flattening out, when until the autumn they were very much sloping down. In other words, the downtrend is also flattening out.

In addition, the krone has got above its six-week moving average, though it hasn't yet got above its 21.

There are signs this market is reversing in the intermediate term. We don't yet have a buy signal but we are shaping up for one the daily chart is showing a gentle uptrend since the 19 October low at 11.5.

It depends, of course, whether you trade on a daily or weekly timeframe. But there is a chance we are setting up a major reversal here. A bull market in the krone would also mean a bull market in oil, which, let's face it, is long overdue. But a bull market in oil would have some interesting implications for the global economy.

I shall be watching this unlikely pair over the coming weeks. We could be setting up for something here. Who'd've thought it?

That's the fun thing about picking these pairs at random. You never know quite what you're going to stumble across.

Dominic's new book Daylight Robbery: How Tax Shaped Our Past And Will Change Our Future, published by Penguin Business, is available at Amazon and all good bookshops. Audiobook at Audible.co.uk. Signed copies are available at dominicfrisby.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how