The charts that matter: recession fears take hold

John Stepek looks at how the charts that matter most to the global economy have reacted to fears of a recession.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back. Have you booked your ticket for our conference on 22 November yet? No?

Here's why you need to go. The theme of the Wealth Summit is summed up in the phrase "protect and grow". On the protect side of the ledger, there's plenty to fret about, there's no denying that. So make sure you're prepared for the big threats by getting the expert views on what might be coming and how to prepare for it.

At a time of negative bond yields and the rise of cryptocurrencies, we'll be talking about the future of money, the threat to cash, the death of privacy, and how you can prepare your portfolio for it.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

At a time of constitutional turmoil and the rise of the hard left, we'll be talking about how to protect your wealth from political risk and the threat of expropriation.

And on the "grow" side of things the more optimistic, opportunity-driven side we'll be looking at what hugely increased lifespans could mean both for your investment portfolio and your retirement planning.

And we'll be talking to some of the best investment trust managers in the world for their views on where the best opportunities are.

I'm just scratching the surface here it's going to be a packed day with some incredible guests lined up (not to mention lunch and networking drinks later). A ticket to the conference might just be one of the best investments you make this year get yours here.

(Oh and if you happen to work in the finance industry, you might also be interested to know that attending the conference will count for six hours of CPD, as endorsed by CISI).

Podcasts, Money Morning and Currency Corner

No new podcast this week (although I'm recording one live with The Week team and LBC's Iain Dale this afternoon in the middle of London you can probably pop along if you got this early and you live nearby-ish). But if you missed the recordings of Merryn's Edinburgh shows, catch up with them here now.

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Why investors should pay attention to director dealings

Tuesday: House price affordability is slowly improving (ie, prices are falling)

Wednesday: The precious metals rollercoaster is heading into a big dip

Thursday: Is a recession coming? Here's what to watch out for

Friday: The economic data is looking steadily worse

Currency Corner: Currency Corner: the Japanese yen is looking good against the euro

Subscribe: Get your first 12 issues of MoneyWeek for £12

Deal: get 25% off a copy of my book, The Sceptical Investor

The charts that matter

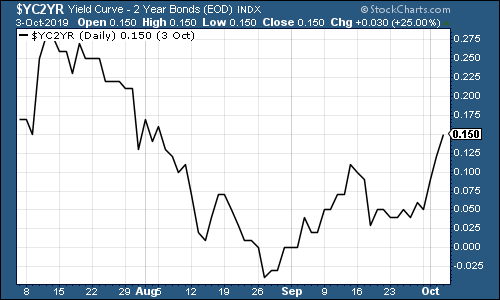

The yield curve inverted a few weeks ago, which is an indicator that recession will likely arrive 18-24 months.

It's back in positive territory now in other words, the yield on the ten-year US government bond is higher than the yield on the two-year, which is the normal way of things. In fact, it spiked significantly this week.

Why the spike? This was driven mostly by expectations for short-term interest rates falling (in other words, the two-year yield dropped by more than the ten-year yield) because the market now thinks the US Federal Reserve, America's central bank, is likely to cut rates later this month, after a stream of weak data.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

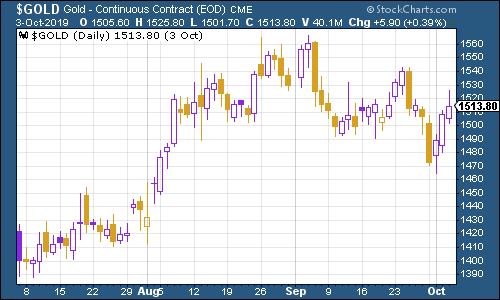

Gold (measured in dollar terms) had a tough start to the week but rallied towards the end. Maybe the dip that Dominic Frisby feared won't be as deep as expected? Who knows, but it's worth owning some as insurance in any case.

(Gold: three months)

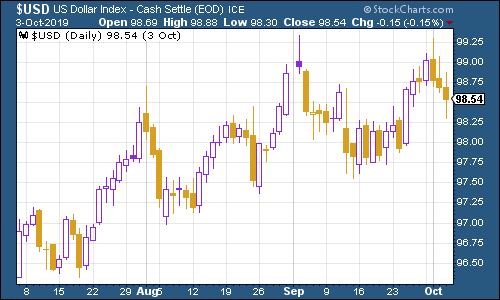

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners again couldn't quite make up its mind this week. Will it go for another breakout? Or will its rise be halted by a blast of monetary policy as the economic data deteriorates?

(DXY: three months)

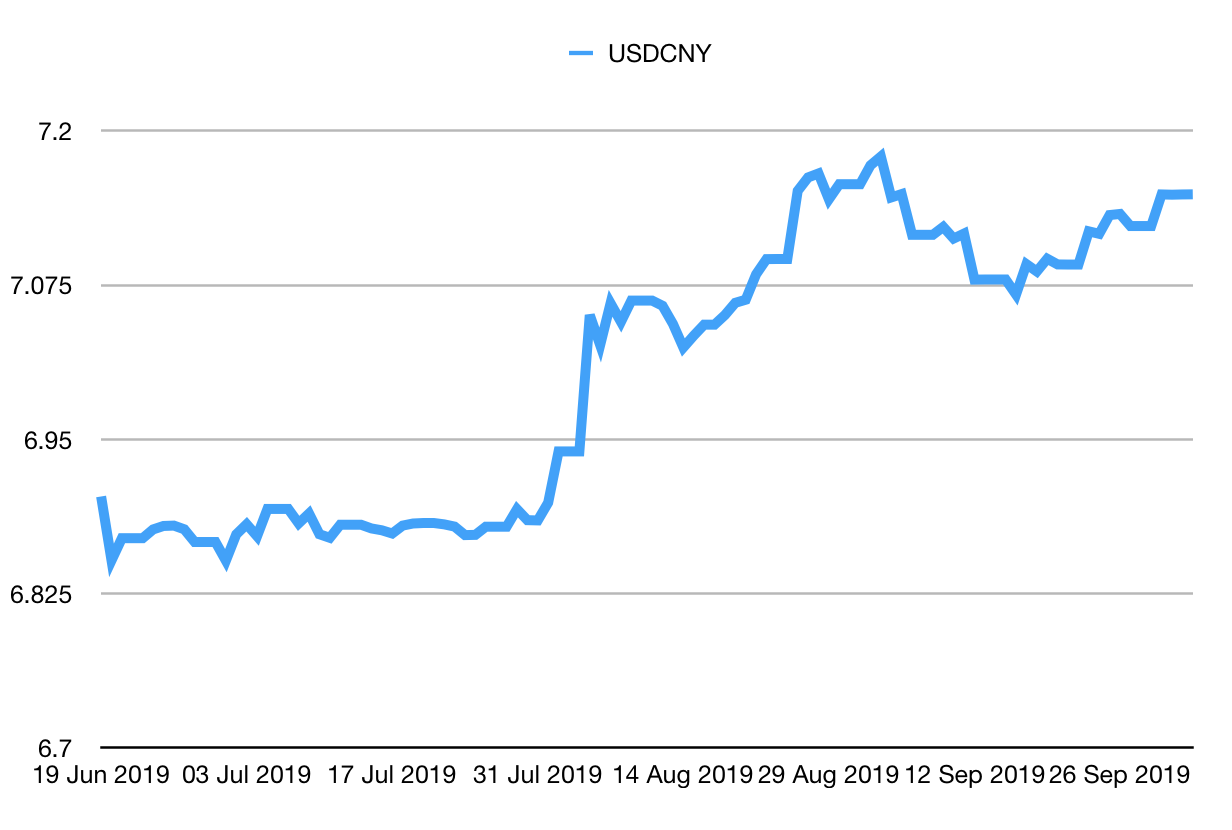

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) is climbing higher above the 7.0 level. Again, that's a warning that markets are concerned about Chinese growth and deflation.

(Chinese yuan to the US dollar: three months)

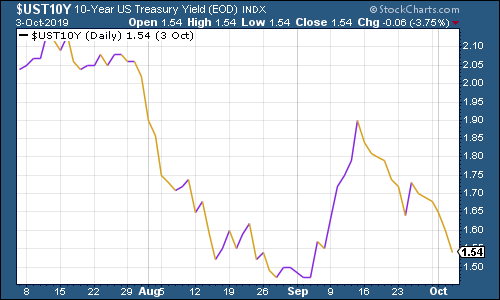

This week, the behaviour of ten-year yields on major developed-market bonds diverged somewhat. The US ten-year yield slipped back as fears grew that the US economy is slowing or even heading for recession.

(Ten-year US Treasury yield: three months)

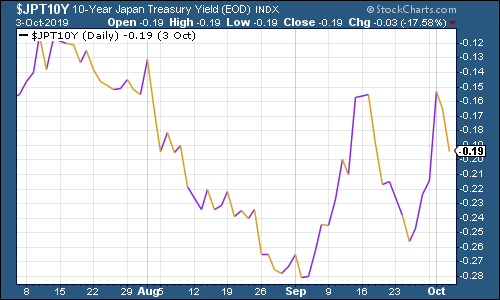

However, something interesting happened in Japan. The Japanese central bank warned that it might stop buying as many long-dated Japanese bonds, in favour of buying shorter-dated ones. That had quite a big impact on the ten-year yield, as you can see in the chart below.

(Ten-year Japanese government bond yield: three months)

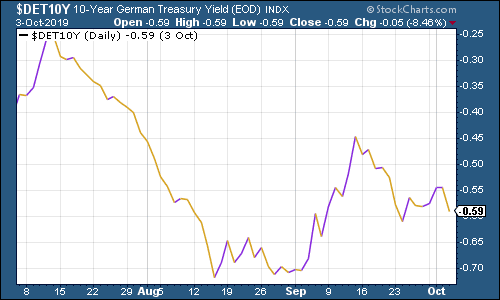

German yields meanwhile were little changed amid continuing gloom on the German outlook.

(Ten-year Bund yield: three months)

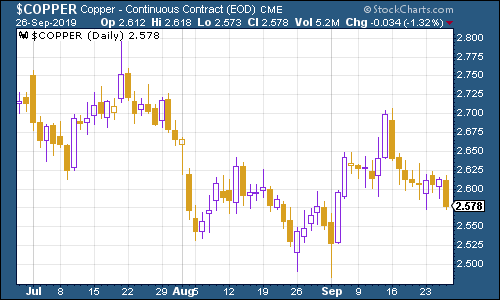

The price of key infrastructure metal copper was battered as globally economic data came in weaker than expected.

(Copper: three months)

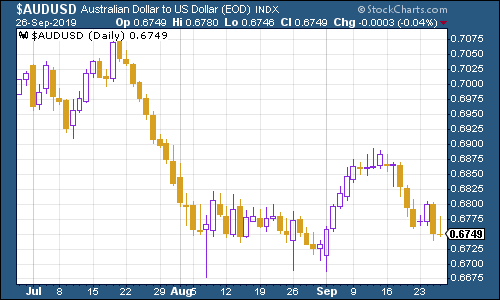

The Aussie dollar slipped against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

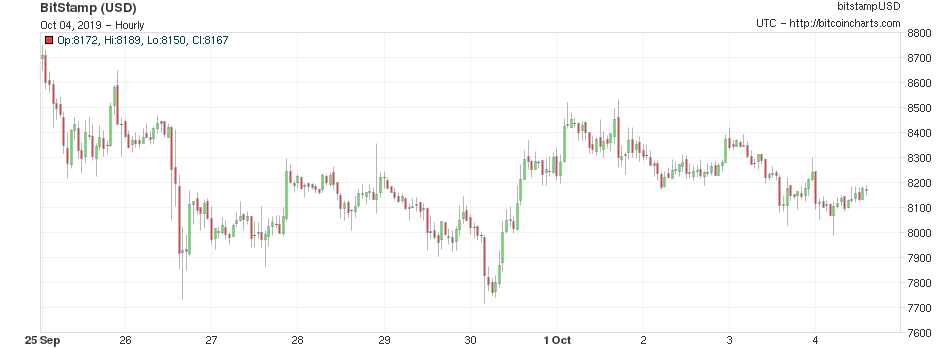

Cryptocurrency bitcoin had a better week after falling below $8,000 a coin at one point early in the week.

(Bitcoin: ten days)

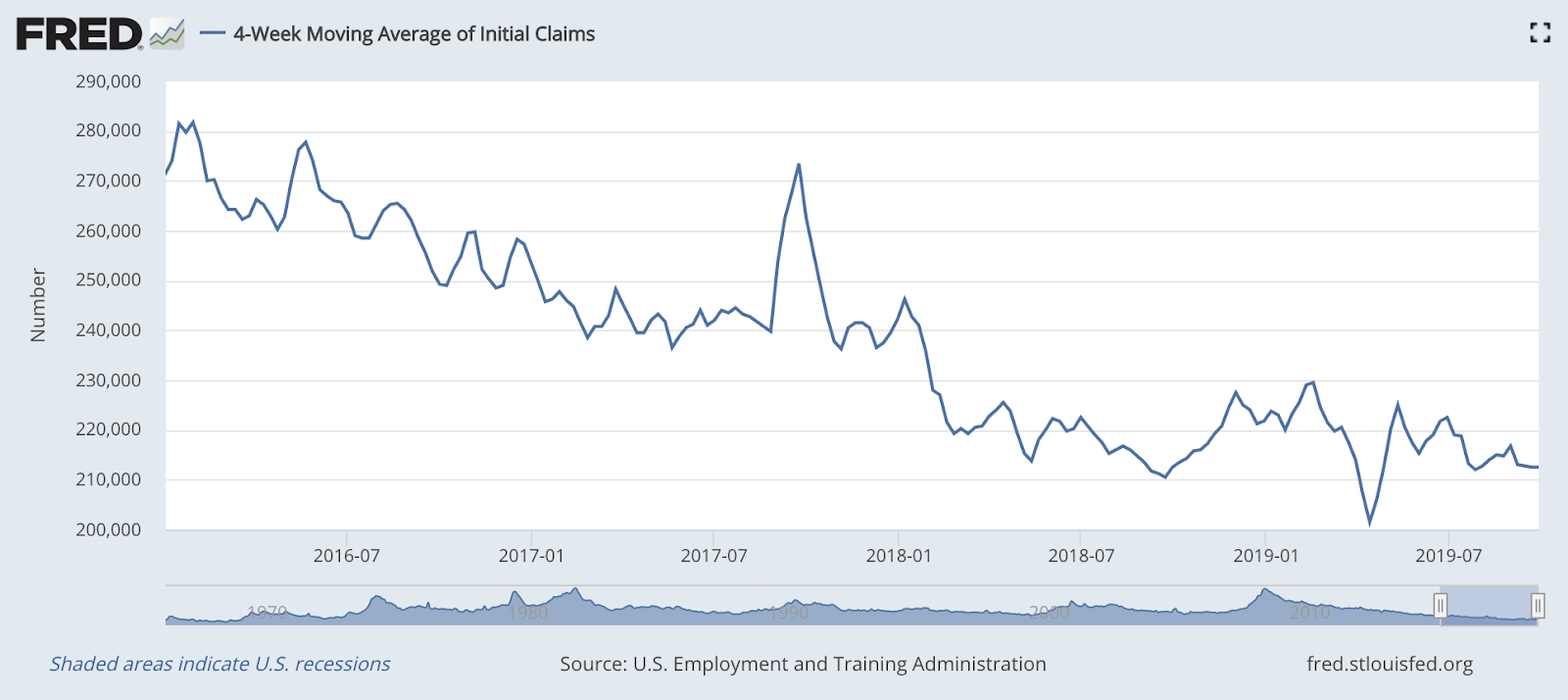

US weekly jobless claims increased this week to 219,000, a little higher than expected, up from 215,000 last week (which was revised higher by 2,000). The four-week moving average rose a little to 212,500.

A sustained uptrend would indicate that a recession is on the way. We haven't seen this yet, but as a lagging indicator we might not get a clear view of a spike higher until a recession is almost upon us.

Meanwhile, yesterday's US nonfarm payrolls data was inconclusive. US companies and the government added fewer employees in September than expected (although the figure for August was revised up), and annual wage growth was a lot weaker than expected (it came in at 2.9%, down from 3.2%). But the actual unemployment rate hit a fresh near-50-year low of 3.5%.

(US jobless claims, four-week moving average: since January 2016)

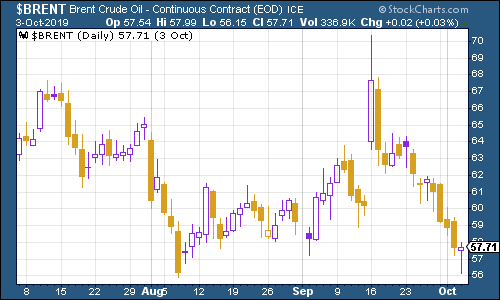

The oil price (as measured by Brent crude, the international/European benchmark), just kept falling, and is now lower than it was before the recent attack on Saudi Arabia. This is partly because Saudi production was restored more rapidly than expected. But it's quite extraordinary when you think about it. I'm increasingly wondering if oil might surprise us in the next six months or so.

(Brent crude oil: three months)

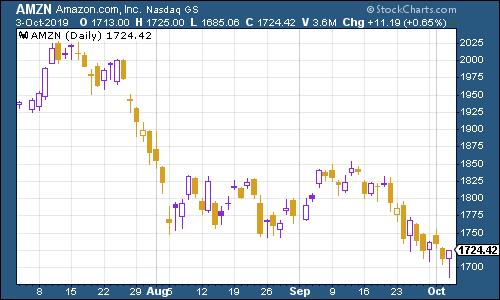

Internet giant Amazon had a calm but mediocre week, slipping back with the wider market.

(Amazon: three months)

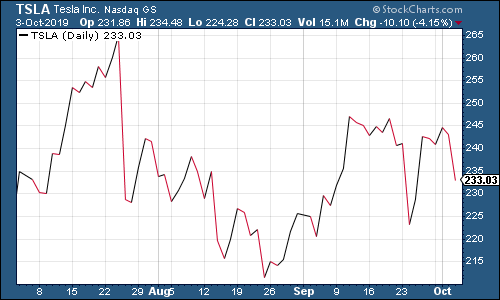

Electric car group Tesla saw its shares decline as the company missed the market's hopes for vehicle deliveries in the third quarter. Tesla managed 97,000 cars, but investors had been hoping for more like 100,000.

(Tesla: three months)

Have a great weekend. And don't forget to book your ticket!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?