The precious metals rollercoaster is heading into a big dip

It has been an exciting summer for precious metals enthusiasts, with gold, silver and platinum all making big gains. But now it’s all unwinding. Dominic Frisby looks at what might be coming next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It has been a summer never to forget for precious metals enthusiasts.

Gold rose by nearly $300 more than 20% from $1,267/oz to $1,565.

Silver rose by over $5/oz more than 40% going from $14.25 to $19.70.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And platinum rose by more than $200 nearly 30% going from $790/oz to $1,000. Finally, it looked like the game was back on for platinum.

Yet, now it's all unwinding rather.

Welcome to the helter skelter of precious metals.

Here's where you should be buying platinum and silver if they fall far enough

On Monday alone, platinum lost 6%, going from $940/oz to $880/oz. The other precious metals are also in intermediate-term downtrends, though none fell with the thud of platinum.

You often seem to get a seasonal correction in precious metals, either in late September or early October and here it is.

"Platinum, gold slide as dollar soars" ran the headline on CNBC. That's "why" precious metals are correcting. This is the explanation that is doing the rounds.

But what that narrative fails to acknowledge was that this incredible summer in precious metals has come while the US dollar has also been rising. That's one of the things that has been so extraordinary about it it hasn't been a US dollar weakness story.

But, yes, now precious metals are in a short- or even intermediate-term downtrend, now it is a US dollar strength story once again.

Where does it all end? There's the million-dollar question.

Silver, which slipped briefly below $17 earlier in the week, has already given back almost 50% of its summer gains.

But I think we see a $16 handle on it once again. I have $16.20 as a first target.

But, knowing silver as I do, it really wouldn't surprise me to see $15 again before we are done. Like a fiery volatile lover, silver will always show you a great time, but it turns nasty and wants to hurt you.

If we give everything back on these falls, then silver goes to $14. I'm not forecasting that, but I know what a monster it can be, so I see it as possible.

Silver at $14 would mean platinum back below $800. When platinum was last down there, all you could feel was pain, but then as soon as it was closing down on $1,000, below $800 looked like the buying opportunity of a lifetime (which for a platinum bug it probably was).

So if platinum goes back below $800, will we have the nerve to be buying? It is easy to say it now; harder when it gets down there.

Let's say it now, while it's easy to say. For those who think platinum has enormous long-term potential (and I am one), then you have to be a buyer below $800.

Just as I see $16.20 for silver, I think we see $835 for platinum. Below that, let's see.

So now let's turn our heads to the "safer" asset that is gold.

The trouble with gold it's too popular right now

We were warning a few weeks ago about the technical resistance gold was likely to encounter in the mid-$1,500s, but here is something that worries me and it's why I think this correction might be a bit more than just a correction.

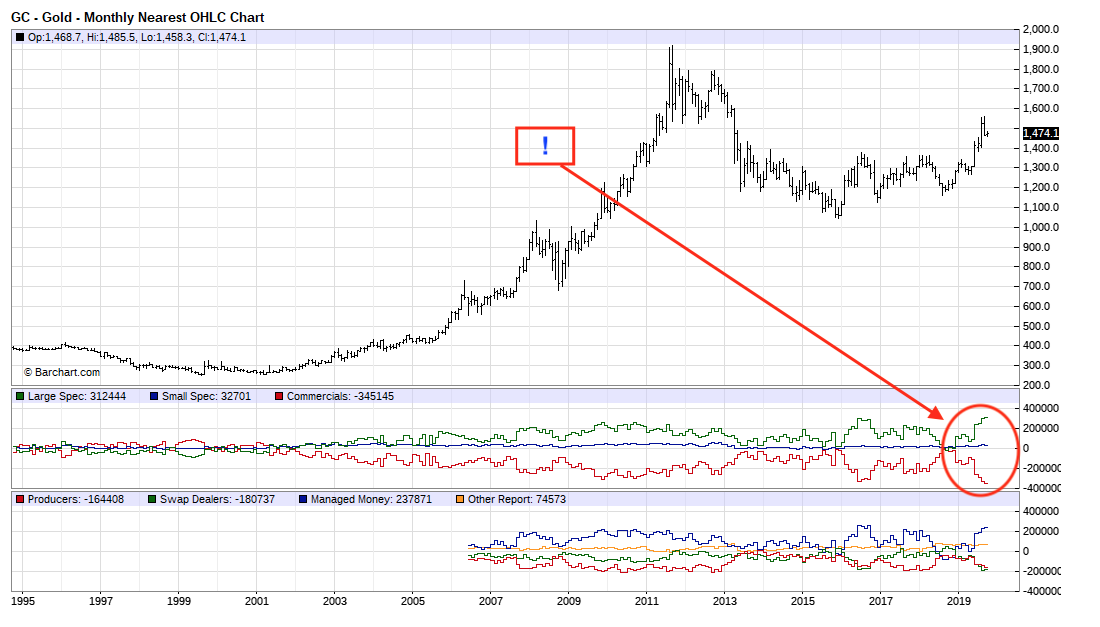

It's the data from the recent COT report. The COT report shows the positions of the traders on the Chicago futures exchanges it stands for Commitment of Traders.

There are three main categories of trader: the large speculators, the small speculators and the commercials.

It's a bit simplistic, but the commercials are seen as the smart guys and the specs are the dumbasses.

When there are lots of large specs who are long lots of positions in other words, they have a large open interest and there are lots of commercials who have taken the other side of the trade and are short, that is normally a big warning sign.

Very little open interest means "buy". Lots of open interest means "sell".

Here's my concern: the most recent Commitment of Traders data, released on Friday, showed net commercial short positions at the largest level in the 33-year history. Specs had the second-highest long positions.

Those kinds of extremities are a big warning signal, and normally portend significant corrections.

Here's the offending data. It's very reminiscent of 2016.

I don't mean to put the wind up any precious-metals longs. The COT report is just one indicator and there have been plenty of occasions when it has been wrong (most notably in 2010). It should not be the only indicator which informs your investment decision.

But it warns of excess and given gold's gains over the summer, there is some excess that needs unwinding.

Indeed, excess perhaps far more than a rising US dollar is a much more likely explanation for precious metals recent declines.

I think gold goes to the $1,440s, but those COT positions need to unwind. For that to happen may mean we go all the way back to the break-out point at the $1,360-$1,370 area.

I've written about that number many times before. It is a huge technical area. It was resistance for five years It would be quite normal to come back and retest it, and for it then to prove support.

The problem is if it gets down there, will we have the nerve to buy?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how