Currency Corner: the Japanese yen is looking good against the euro

The Japanese yen has been gaining strength against the euro for some time now. In today's Currency Corner, Dominic Frisby looks at where the pair may go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today in currency corner we are going to take another currency pair at random and see where it takes us.

It's a pair I've never looked at before: the Japanese yen and the euro.

I must say, I've no idea what to expect.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

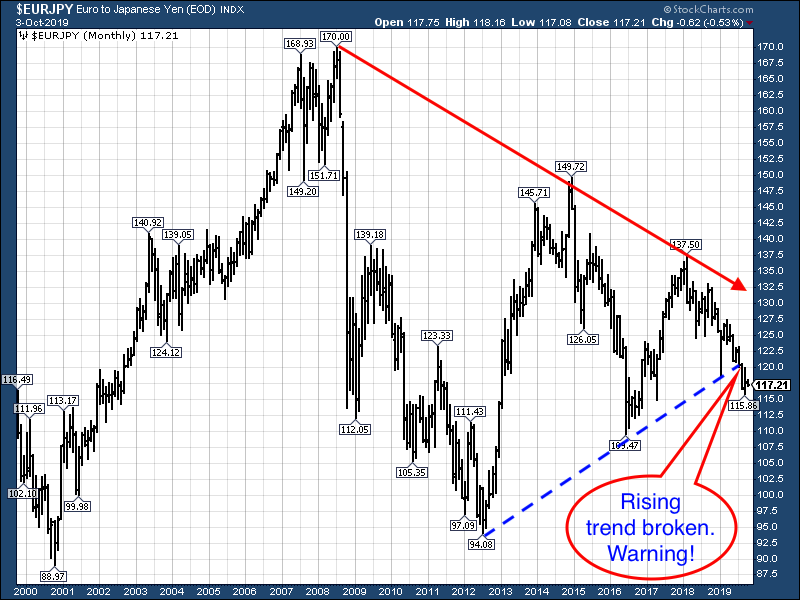

So let's start with a long-term, 20-year chart. Here we see the euro against the yen (EURJPY) since 1999. This shows you how many yen it takes to buy a euro. The fewer yen it takes, the stronger the yen is so when that chart is falling the yen is getting stronger. When it is rising the euro is getting stronger.

One euro is currently 117. (I love the yen symbol the isn't it a cool symbol?)

As with so many forex charts that we have looked at since I began writing this column, once again the sea change that was 2008 and the Global Financial Crisis is clearly visible.

From shortly after the turn of the century through until 2008, the euro got stronger and stronger, almost doubling in relative value.

In 2000, it took 89 to buy a euro. In 2008, 170 were needed.

Since then however, the euro has been in decline. The 2008-2012 period saw the most weakness. 2012-2014 saw two years of euro bull market, followed by the resumption of the bear.

On a long-term basis we clearly see lower highs in the euro. It is in a downtrend. And it is in a downtrend on a short- and intermediate-term basis as well. 2017 may have been a good year for the euro, but since 2018 it's been in decline.

Gosh, I think this is a good pair for traders. The trends go on for such a long time. Even the counter-trend rallies do as, for example, we see between 2012-2014 and 2016-2018. If you can latch on to these trends, you can make a lot of money.

Where might the yen be headed next against the euro?

So where does today's downtrend end? 109 is an obvious target the 2016 lows. But after that, sub-100 comes into play the 2012 and 2000 lows.

It's worth also observing how that rising trend line (the blue dashed line) from the 2012 lows was broken earlier this year. It's only a line on a chart, I know, but such trend lines being broken is, nevertheless, a bearish sign.

I also observe how, in common with so many forex charts right now, EURJPY at 117 is somewhere in the middle of its long-term range between 89 and 170 (although in this case lower middle). So many forex pairs seem to be in the middle areas, broadly speaking, of long-term trends. Euro-US dollar is as well, as we saw last week.

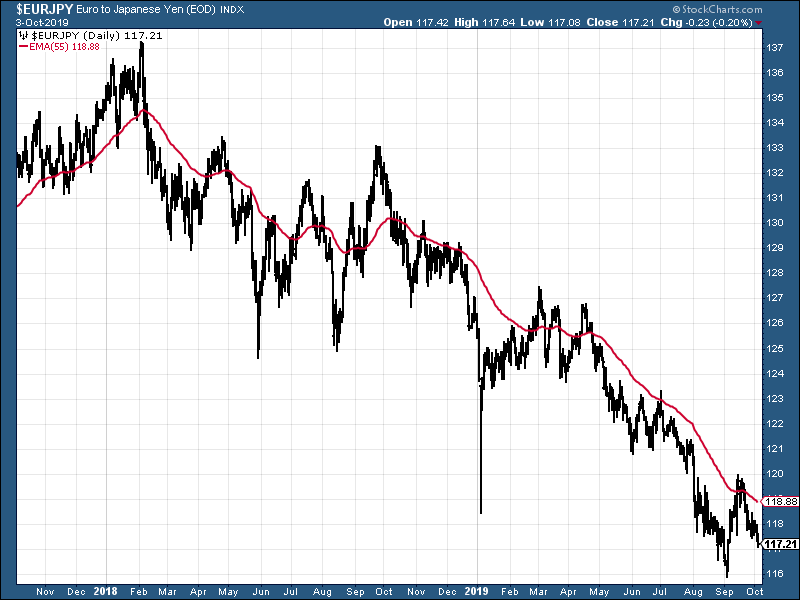

Here was see EURJPY over the last two years. I've also drawn a 55-day moving average in red to help clarify the trend as if it needs clarifying. It's very much down.

The euro is getting weaker. The yen is getting stronger. The direction of travel is clear.

This trend is quite mature, but that doesn't mean it can't go on. You can see from the long-term chart above, just how long EURJPY trends tend to go on for.

Japan led the world in monetary manipulation. Artificially low interest rates meant that funds borrowed yen cheaply, deployed the capital elsewhere, where returns were higher, and pocketed the difference. That was the "yen carry trade".

Any sign of panic meant that funds would immediately buy back the yen and pay the loans back, with the result that the yen tends to rise during periods of global panic. This was especially the case in 2008.

But now all central banks are in the suppressed interest rates game, not least the European Central Bank, so the yen carry trade is not quite the sure thing it once was deemed to be.

I wonder what new ways to weaken its currency the Japanese central bank is currently concocting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge