The cycles in the metals market: when will zinc and copper shine?

The prices of two of the world’s most important industrial commodities have slipped over the past few years. Dominic Frisby assesses the outlook and explains how to cash in on the next upswing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The oldest man-made object in the world is made of copper. A tiny awl found in a grave in what is now Israel, it dates back some 7,000 years. Copper would become a key component of the bronze age. Price records don't go that far back, but in modern times it has tended to move in very long cycles: 30 years of feast followed by 30 years of famine.

Between 1885 and 1945 the price was pretty consistent around the 15 cents per pound (lb) mark. There'd be the odd period when it slipped below that level notably in 1929 (when it went below five cents/lb) and the odd period when it surged to 20 cents and above notably during World War I, when it got to 30 cents. Otherwise 14-15 cents was the norm. After World War II a bull market began that lasted some 30 years or more.

In 1974 copper hit a high around $1.50. It had risen 1,000%. But it would be another 30 years before that high was surpassed. Only in 2005 did copper get through the $1.50/lb mark. Once it got through $1.50 in 2005, copper took off like a rocket. This was the great commodities bull market of the 2000s.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The commodities bull market of the 2000s

The demands of the new Asian middle class, especially China's, were inexhaustible. Economies were booming: wherever there is construction, especially of infrastructure, there is copper demand. After decades of underinvestment in exploration and development, new copper supply could not match that demand. New discoveries were few and far between. Better still, the dollar was mired in a multi-year bear market. The conditions for copper could not have been better.

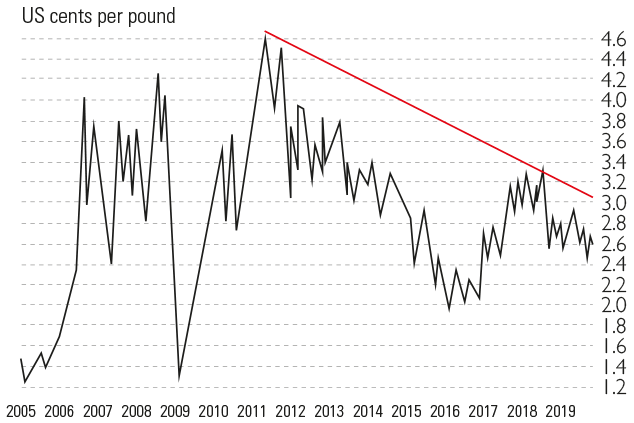

The first high came in at just over $4/lb in 2006. Five years of incredible volatility followed. In 2008 copper lost 75% of its value, before it eventually rocketed to its final, all-time high in early 2011, of $4.65/lb. From 61 cents to $4.65/lb: not quite a 1,000% gain, as in the previous bull market, but not far off. Ever since, aside from a two-year relief rally (prompted by Donald Trump promising a huge increase in spending on infrastructure), the price has slid slowly.

In the 21st century the cycle has been rather less biblical. Ten years of bull market and here we are now in the eighth year of the bear. Are we nearer the bottom than the top? The current price is $2.60/lb. So we are somewhere in the middle of a range that stretches from, say, $1.50/lb on the downside and $4.60 at the top.

Below you will find a chart of copper over the last 15 years. I've drawn a trend line over the upper range. It's pretty clear what the current direction of travel is.

What goes up...

These long price cycles are not just common to copper. They are also typical of metals generally, whether precious or base. There is a reason for them: the nature of mining. It takes a long time and a lot of money to build a producing mine. It starts with exploration. First some prospectors have got to find a deposit. That in itself can take years. Once a discovery has been made, the deposit needs to be assessed carefully to gauge how much of it can be recovered: how big the "proved reserves" are. That again requires many millions of dollars of drilling. Once proved resources have been established, capital can then be raised to meet the cost of permits and building the mine. Another few years are spent on this.

It is normal for the journey from discovery to production to take a decade and often, depending on the size of the project, hundreds of millions of dollars. But it can take longer. In the broader economic context, this leads to boom and bust in mining. There is a shortage of a metal. Its price therefore goes up. Investors see its price going up and so they think they can make money in this metal. Millions are thrown at exploring for it, or developing old projects that, at lower prices, were uneconomic. But it takes many years before this metal gets to market. So the price of the metal keeps on rising.

... must come down

This can lead to something of a frenzy. More and more money gets thrown at mining this metal, but still supply is not increasing to meet demand. In many cases people are stockpiling the metal in expectation of higher prices. Investment decisions get less and less informed, and cash gets raised for suspect projects that will probably never get off the drawing board. Finally, those early mines start to come into production and other ways are found to increase production (such as recycling and increased mining in existing properties, processing lower-grade ore and so on). The increased supply hits the market and the price starts to fall.

All those mines in development are no longer economic at these lower prices. Investors no longer see a potential return and capital dries up. Projects shut down. People lose their jobs. And so bust comes to mining. So many lose their shirts that it is many years before investors will touch mining again. The increased production resulting from the previous boom keeps the market in balance for a while, but then sometimes many years later production starts to fall off, just as demand starts to rise again.

"Where's the money going to come from to meet this rising demand?" many start to ask. "Hang on, there's a structural shortage of metal here." The question you must ask yourself is: how far into this bear cycle are we?

Supply and demand in the copper market

The most consumed metals in the world, according to the US Geological Survey, are aluminium and iron. Then comes copper. It is cheap, versatile and conductive; electrical wiring, telecom cables and electronics account for 75% of its consumption.

Copper also finds use in purposes as diverse as birth control and killing bacteria and yeast (thanks to its microbial properties). We even need to eat small doses of copper, though this does not affect demand. We get what we need from our vegetables. An uptick in copper demand usually suggests people are investing, especially in construction, so it is indicative of economic activity. Thus we have the nickname Dr Copper, the metal with a PhD in economics. It is a barometer of the economy. Without wishing to be too much of a grinch, this nickname dates back to a time when we didn't have the readily available information that we do now; today there are probably better measures. But the notion still makes sense.

The world's largest copper consumer is, by some margin, China. It accounts for almost 50% of global demand. The rest of Asia takes up 21%; Europe 18%; and the Americas 12%. Africa and Oceania between them account for barely 1% of global demand. Was ever there a more telling statistic about the relative state of economic expansion around the world? The world's largest producer, also by some margin, is Chile. Globally, some 21 million tonnes were produced last year, 28% of which was mined in Chile. The next-largest producer is Peru on 11%; then China (7%); then the US and the Democratic Republic of the Congo, both on about 5.7% each.

Preliminary 2019 data from the International Copper Study Group (ICSG) shows a market that is pretty much in balance. There's been a tiny fall in world mine production (1%) and a slightly smaller decline in world usage. Total world production (from both mining and secondary production such as recycling) stands around 11,740,000 tonnes, while usage stands at 11,960,000. There's a slight deficit, but not enough to spark a multi-year bull market.

The zinc cycle

Let's turn our attention next to the fourth most-consumed metal in the world, after iron, aluminium and copper. Zinc's main uses are also in the construction industry: the frames of buildings, bridges, roofs, staircases, beams and piping all contain zinc. A coating of zinc over iron or steel protects the metal beneath from rusting.

It is also used in alloys (brass and bronze), in compounds with a range of applications, particularly in batteries from everyday AAs and AAAs to silver-zinc batteries in aerospace and, increasingly, in fertiliser. The market for zinc is worth around $35bn a year. To put that in perspective, that's about a fifth of the size of the copper market, but around double the size of the lead and silver markets. The price is currently at $2,377 a tonne, or $1.07/lb, less than half the price of copper in other words. Just over $2/lb ($4,500/tn) was the all-time high in 2007.

The baffling thing about zinc is the extraordinarily low stockpiles on the London Metals Exchange. In late 2015 these stood at over 1.2 million tonnes. They've been in decline ever since and now sit at 2008 crash lows of just 60,000 tonnes. That should mean a supply shortage and a corresponding price rise, but it never seems to materialise.

Like copper, the zinc market is in a slight, but not significant deficit. Total production for the first half of 2019, according to the International Lead and Zinc Study Group (IZLSG) was 6,513,000 tonnes. Total usage was 6,647,000 tonnes. So there is a 134,000-tonne deficit. China is the world's largest producer. It accounts for just over 35% of global supply, with Peru in second. There has been a reduction in supply this year not only from China, but also from Peru, Finland, India, Ireland, Mexico, Turkey and the US, but this has been offset by increases in production from Australia, Namibia, South Africa and Sweden, so that global zinc production is set to rise by about 2% this year.

China is also the world's largest zinc consumer, surprise, surprise. It is a net importer, despite being the world's largest producer. According to the ILZSG, zinc usage in China remains constant. Demand has, however, fallen in Europe, Turkey and Japan, while increasing in South Korea, South Africa and the US with the net result being a modest increase in usage.

All in all then we see a market that does not seem poised for either a huge bull or bear run, just the typical annual gyrations you tend to see that is, aside from the unusual situation with the LME inventories. The price reflects this too. Following a bonanza in the 2000s, it slumped in 2008. Then there was an anaemic recovery which began a six-year period of going pretty much nowhere. Like copper, it had something of a rally in 2016-2017, before slipping back into a downtrend.

The catalysts for the next bull market

Being a financial writer you find that having strong opinions, whether bullish or bearish, make for much better copy. But sometimes you have to accept that there isn't always a strong bearish or bullish case. My strong opinion today is largely neutral!

Copper and zinc are both in downtrends, but I don't think either are necessarily set for total disaster. The bearish scenario is that we get either a rip-roaring bull market in the US dollar or that trade war between China and the US, which I doubt either really wants, escalates into something more significant.

There are some bullish scenarios to consider as well. Widespread adoption of electric vehicles, for example, will require a huge electrical infrastructure spend. The political will, for the most, part is there. That means a lot of copper consumption. An electric vehicle uses around three times as much copper as a conventional one.

Meanwhile, keep an eye on monetary policy. modern monetary theory and people's quantitative easing (QE) are gaining a lot of traction. The latter would entail the central-bank creation of money not to buy financial assets, but to spend on improving infrastructure. We know the establishment's first instinct in the face of economic contraction is monetary expansion. QE to bail out banks would not be politically acceptable. But to spend on infrastructure would not be such a hard sell. In fact, I can see politicians desperate to buy popularity positively embracing it. That's got to be bullish for zinc and copper. Especially as a couple of years down the road it'll be coming at a time when so little has been spent on exploration and development that there won't be the metal supply to satisfy the demand. And so the mining cycle will turn once more.

The best plays on copper and zinc

A well-balanced portfolio should always contain some exposure to industrial metals. My favourite play on both metals and energy in general is BHP Billiton (LSE: BHP). It's like an all-in-one energy and metal exchange-traded fund (ETF). This £95bn market-cap company pays a yield, currently in the 5%-6% range.

You can play the metals directly via ETFs that track the price: ETFS Copper (LSE: COPA) or ETFS Zinc (LSE: ZINC). The world's largest copper-producing companies are Codelco, owned by the Chilean government, followed by Freeport McMoran (NYSE: FCX), and Glencore (LSE: GLEN). Other notable producers are Antofagasta (LSE: ANTO) and Rio Tinto (LSE: RIO). Both make the top ten. The world's largest zinc producers include Glencore, BHP Billiton, Anglo-American (LSE: AAL) and KAZ Minerals (LSE: KAZ).

If you want some spicy, smaller-cap situations that I am optimistic about even in the event of flat or even lower metal prices, consider the following. All are listed in Canada. Let's start with the copper plays.

First, there's a company I have mentioned before, Regulus Resources (Toronto Venture Exchange: REG). Regulus has a market cap around C$130m and is developing a project in northern Peru known as Antakori. Its price, like that of copper, has gone nowhere for more than two years now. It is currently running an enormous drilling programme, which is delivering terrific results. It's going to have to raise more money, probably later this year or early next, and that may provide the buying opportunity. But I can't help thinking this company should be a C$5 stock based on what it's finding. I am waiting patiently for the market to see what I do .

Second, I own Amerigo Resources (Toronto: ARG). This is a producer in Chile that operates by processing fresh and historic tailings (material left over after metal has been extracted from ore) from Codelco's El Teniente mine. Its production is increasing while its costs are falling, and my hope is that the markets will give this C$122m market-cap company a rerating when it gets some more good quarters under its belt.

Then there are two zinc exploration and development plays. One is Solitario Zinc (NYSE: XPL; Toronto: SLR). It has good high-grade projects in Peru and Alaska, both in partnership with majors, and a 10% interest in zinc explorer, Vendetta, operating in Australia. The cash position is about $9.5m, and has been well preserved. It has a small amount of revenue from some royalty deals. At $0.29, it has a market cap of $16m, so to my mind, it is an extraordinary value proposition at the moment. You're getting its assets for around $6m.

But beware: Solitario has been a proven value trap. A chronic lack of news flow and rotten zinc markets have done for Solitario, but it has the potential to be much higher.

My other zinc junior is Tinka Resources (Toronto: TK), which appears to have made a major discovery in Peru. It costs C$0.16. This was an C$0.80 stock last year and could easily be so again if zinc gets up off the floor and the good drill results keep coming. I own shares in all the above juniors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.