India’s star is at risk of fading

The benchmark Nifty index is now down 9% and has just had its worst July for 17 years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

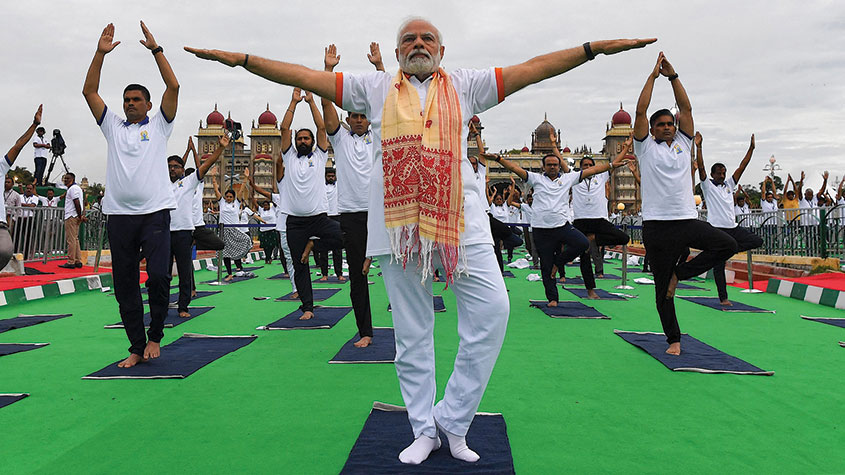

Has India lost its shine? Shares in the world's second-most populous nation rode to a record high in early June on the back of re-election for Prime Minister Narendra Modi, notes Benjamin Parkin in the Financial Times. Yet the benchmark Nifty index is now down 9% and has just had its worst July for 17 years.

The country's central bank cut interest rates to a nine-year low last week as it seeks to reignite growth, which currently sits at a five-year low, writes Corinne Abrams in The Wall Street Journal. Many had hoped that India's domestically-focused economy would be insulated from global trade tensions, but there are plenty of local problems instead. Private investment hit a 14-year low at the start of this year. "Government spending is capped by budget restrictions and consumers seem to be reining in spending."

Many of the problems can be traced back to a shaky financial system, writes Yigal Chazan in The Diplomat. India's state banks are "mired in a non-performing loan crisis, with some $150bn of bad loans". And a confidence crisis in the nation's overleveraged non-banking financial

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

sector or "shadow banks" has seen them rein in lending as well. The result is a credit squeeze that is making life difficult for business.

A growth mirage

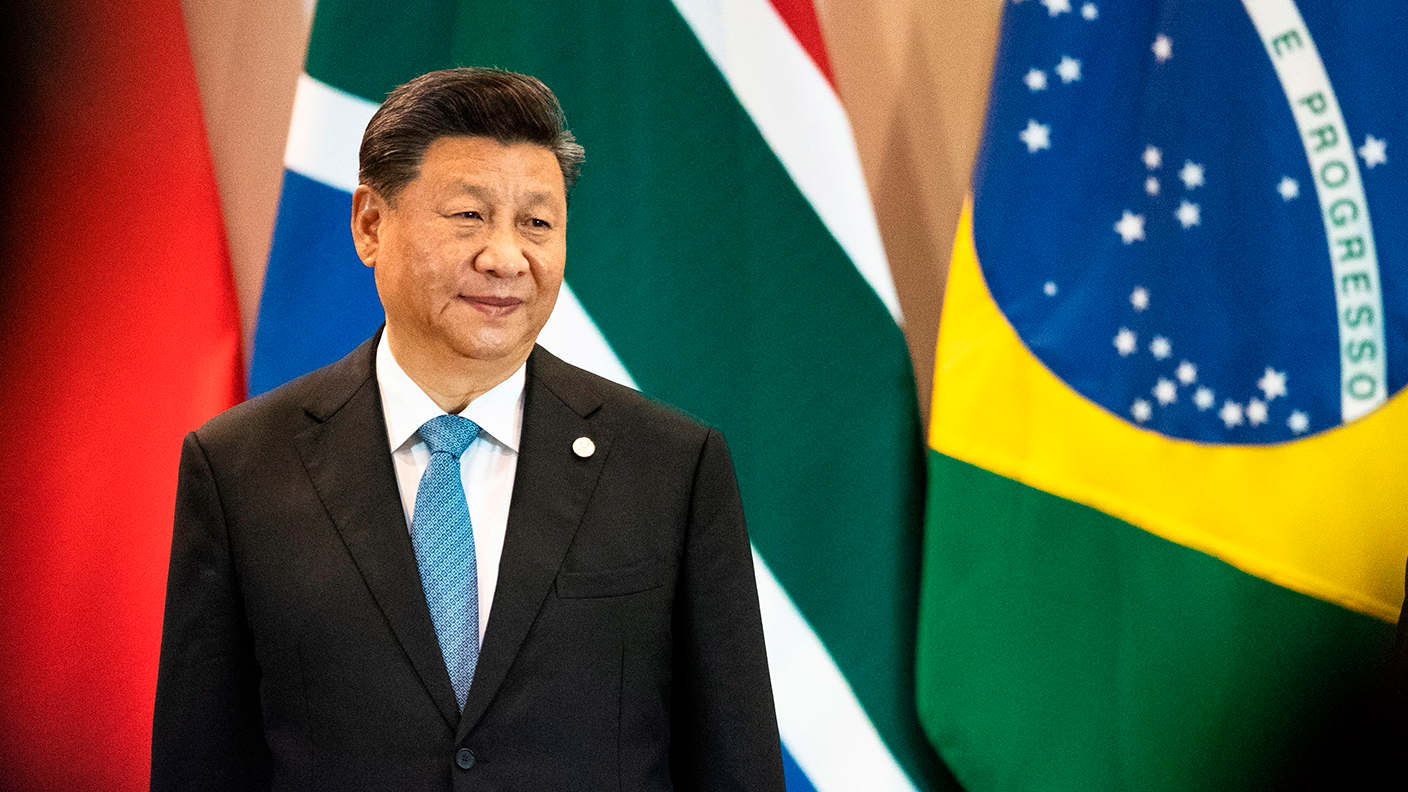

Official data show that India lost its title as the world's fastest-growing major economy to China in the first quarter of this year, with growth falling to an annual rate of 5.8%. Yet even that figure may be artificially inflated.

India's boast of "miracle" 7.5% growth has attracted more than $350bn in foreign investment over the past seven years, says The Economist. Yet Arvind Subramanian, India's former chief economic adviser, estimates that figures have been overstated by about 2.5% a year ever since 2011. If he is correct, then "rather than outperforming China, India has underperformed Indonesia".

Those betting that Modi would take bold measures to revive the economy have also been disappointed, reports Parkin. The latest annual budget was judged a missed opportunity to initiate the kind of bold reforms needed if he is to hit ambitious growth targets.

In the long run there is still much to like in India. Half of the population is under 25 and the middle class is rapidly expanding. The Mckinsey Global Institute forecasts that by 2025 "India will have 69 cities with a population of more than one million each". By 2030, Mumbai's economy alone will be bigger than the whole of Malaysia's economy is today.

Yet with a drumbeat of bad news hitting sentiment, and stockmarket valuations elevated shares trade on a price/earnings ratio of 27.5 the coming months are unlikely to bring investors much joy.

Crude oil is back in a bear market

Talk of a global economic slowdown is like a "bubonic plague for oil demand", Robert McNally of Rapidan Energy Group tells The Wall Street Journal. Last week Brent crude slid into a bear market after dropping more than 20% since its April high. The European oil benchmark was trading this week at less than $61 per barrel.

The falls came as the International Energy Agency (IEA) cut its forecasts for worldwide oil demand for this year and next, reports Matt Egan for CNN. The IEA says that "oil demand grew at the weakest pace since 2008" during the first five months of 2019. In developed nations oil demand has fallen for three quarters in a row. "That hasn't happened since 2014."

The slump is a surprise given the rocky supply picture, writes Andy Critchlow in The Daily Telegraph. Tensions in the straits of Hormuz have raised fears of global shipments being "choked off" by Iran, whilst sanctions on Tehran and Venezuela have also squeezed supply.

Yet the rise of shale technology means that the US is now the world's largest producer of crude. Oil major Shell says its US wells can "turn a profit at $35 per barrel". That puts oil cartel Opec in a bind. "Arab kingpins" need prices closer to $80 a barrel to sustain "their high-spending autocratic economies". Yet further production cuts would be difficult to enforce and could ignite the ire of Trump. "Opec has no easy answer."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

Modi’s reforms set Indian stocks on fire

Modi’s reforms set Indian stocks on fireIndian stocks pass a new milestone, but global fund managers are holding back. Are there signs of overheating?

-

Shining a light on India

Shining a light on IndiaAdvertisement Feature Despite some short-term challenges, India remains very attractive for investors. Here’s why.

-

India’s economy has come a long way in 75 years, but where next?

India’s economy has come a long way in 75 years, but where next?Briefings India has come a long way since independence to become the world's fifth-largest economy. But early mistakes and now a divisive leader are holding back the economy’s potential.

-

Investor optimism ebbs in Indian stockmarkets

Investor optimism ebbs in Indian stockmarketsNews India’s BSE Sensex stockmarket index has fallen by almost 8% so far this year. Interest rates are on the rise, and foreign investors have been selling up.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

The Brics never lived up to their promise – but is now the time to buy?

The Brics never lived up to their promise – but is now the time to buy?Analysis Twenty years ago hopes were high for Brazil, Russia, India and China – the “Brics” emerging-market economies. But only China has beaten expectations. Max King explains why and asks if now is the time to buy.

-

India: the next global growth engine

India: the next global growth engineNews India's stockmarket is booming, up by 37% so far this year, and the BSE Sensex index has delivered an annualised return over the last five years of more than twice that of the FTSE 100.

-

Forget China, here’s why you should invest in India

Forget China, here’s why you should invest in IndiaTips As China becomes increasingly hostile to investors, India, with a young, educated, tech-savvy population and a reform-minded government, is becoming an emerging-market favourite. Merryn Somerset Webb picks the best ways to invest.