Currency Corner: what will it take for sterling to turn around?

Sterling has had a woeful couple of years. But it's not going anywhere until Brexit is resolved one way or another, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hello and welcome to this week's Currency Corner.

I thought today I'd come back and take a look at the pound. It's had a woeful couple of months. In fact, it's had a woeful couple of years.

Let's not beat about the bush it's had a woeful dozen years back in 2007, it was $2.11, today it's $1.25.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

My narrative remains the same: it's cheap, it's undervalued, but it's not going anywhere until Brexit is resolved.

Whether that's by not leaving, or by leaving with no withdrawal agreement, it almost doesn't matter. The main thing is that Britain escapes this limbo in which it finds itself, and that there is a clearly visible path to a resolution, which at the moment there is not.

Boris Johnson is going to be Britain's next prime minister, as we have long since known. But both contenders in the Conservative Party leadership contest have pledged that come what may, Britain will leave the European Union on 31 October. Theresa May said the same thing about 29 March, but this time one suspects Johnson may stay true to his word.

The big question remains, "how"? This we do not know.

Will the EU agree to renegotiate? It has said it won't. Will Parliament allow no deal? It has said it won't. Will Parliament allow any deal?

Will there be a vote of no confidence and a general election? The Labour Party is in an even worse state than the Tories a general election could be even more damaging to them so unlikely. MPs on both sides of the House, as well as the so-called Independent Group in the middle, whatever it's called now I have no idea will not want an election as so many risk losing their seats.

The only parties who will want a general election are those who stand to gain by it being the Lib Dems and the Brexit Party and they have little influence in Parliament. And even the Brexit Party may not want to take on Johnson just yet.

There are so many ifs and buts and maybes. It's possible, even likely, that things will become clearer once Johnson is prime minister, and some kind of conversation with the EU resumes, but who knows. The one political constant over the last couple of years is the failure to make progress.

But we need some kind of political progress if sterling is to get out of this mire.

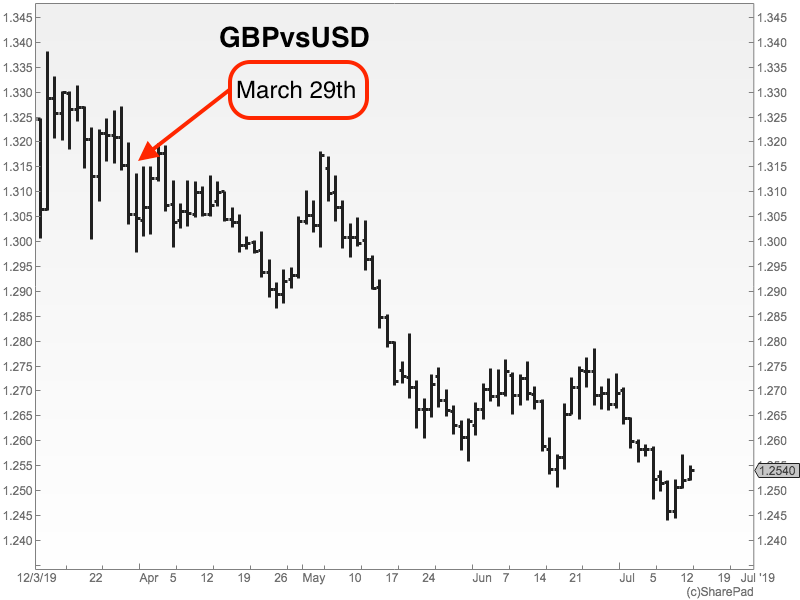

This is what a downtrend looks like

Here we see the pound since Britain failed to leave the EU on 29 March. That is what a downtrend looks like.

We have gone from $1.30 to $1.25.

Zooming out a little to a two-year chart, we can see we are re-testing the lows of late last year, and we are right at the bottom of a range which sits at $1.25 on the downside and somewhere around $1.34 on the upside.

This could be a nice tradable double-bottom here, but everything will depend on what tricks Johnson has up his sleeve. It's pretty plain to see from the last couple of months that the forex markets are not particularly keen on the no-deal rhetoric.

What's more, we are in a downtrend. So something needs to happen to reverse that.

The value arguments favour a higher pound (on a purchasing power parity basis, somewhere between $1.50 and $1.60 is "fair value"). The cyclical arguments do, too. Technically even with that dontrend we are at a number that would "make sense" as a reversal point.

The barriers are political and economic. First, markets will want to see something that persuades them that economically Brexit can work. Second, they will want to see some evidence that, politically, there is a path out of this quagmire.

A new prime minister in whom the public feels confidence may be just the ticket. There is no sign markets believe that even for a second at present.

But at least it is a start.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now