Currency Corner: This cycle suggests that the next big move for sterling is up

Dominic Frisby explains why this uncannily reliable eight-year cycle in the pound means he's bullish about sterling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back to Currency Corner. Today I want to explain why I am bullish about the pound, and why I think its prospects are good.

I should stress, before the pound can stage a proper bull market, Brexit needs to be resolved. It almost does not matter whether that resolution comes in the form of not leaving, Theresa May's deal, or leaving on WTO terms. What is important as far as the pound is concerned is that there is some form of resolution.

But once we have that, the prospects for sterling look good to me.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I'm not going prognosticate about how our economy might or might not look post-Brexit. The reason for my bullishness stems from an odd cycle I have observed.

I don't mean to go all voodoo on you. While I'm aware that there are many cycles in life, from the seasons of the year to the stages of life (what Shakespeare called the "seven ages of man"), I'm also aware that is very easy to look at events, find an arbitrary pattern, and declare it a cycle.

Nevertheless, this eight-ish year cycle in the pound does seems to be uncannily reliable, for whatever reason (even if that reason is coincidence). Every eight years the pound seems to make a marked low.

Introducing Frisby's Flux

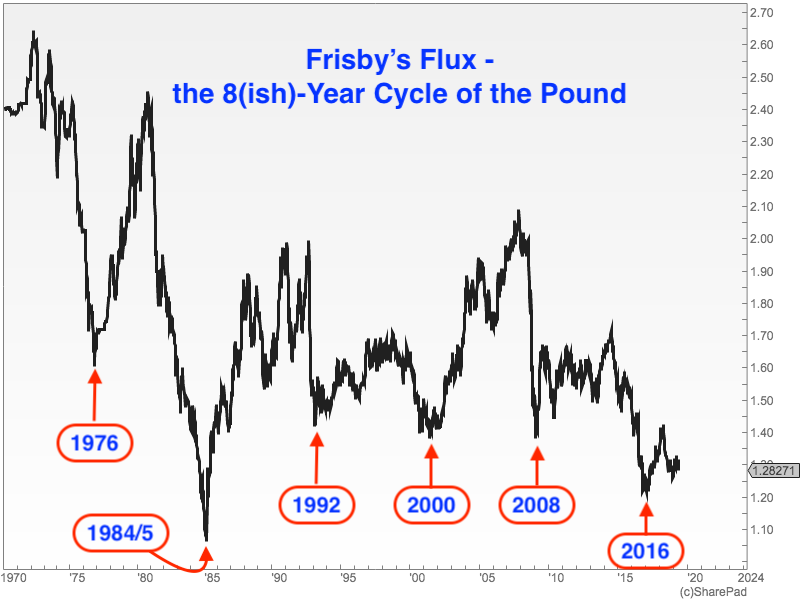

Let me start by showing you a chart I have drawn of the pound against the US dollar (AKA "cable") since 1970. This is good as a starting point, as it is shortly after the US abandoned the gold standard, which was a landmark event in the evolution of national currencies (a topic for a future column, perhaps).

You can see that every eight years or so, starting in 1976, the pound has put in a major and very very tradable low.

I've called this cycle "Frisby's Flux" because, as far as I know, I was the first to observe it, and I want to get my name out there.

1976 the IMF: The first low came at around $1.60 during the inflationary turmoil of the 1970s. This was the year of the IMF (International Monetary Fund) crisis. At one point inflation reached 24%. Can you imagine that!?

The Labour government went to the IMF and borrowed $3.9bn, at the time the largest loan ever requested. From high to low, sterling lost around 40%. But it recovered. By the early 1980s sterling was back above $2.40.

1984-85 the miners' strike and the Plaza Accord: Then came the next bear phase, in which the pound would drop by more than 55% and reach an all-time low against the dollar. By forex standards this is an extraordinary fall. This was the era of the Falklands War and then the miners' strike. Meanwhile, the US dollar was showing extraordinary strength. Indeed, it was so strong that France, Germany, Japan, the US and the UK eventually colluded to depreciate it. This was the Plaza Accord of 1985. Again sterling would recover this time to $2.

1992 Black Wednesday: But, almost as night follows day, eight years later, in 1992, sterling hit another marked low. This was Black Wednesday, when the Bank of England took the UK out of the European Exchange Rate Mechanism (ERM). It had fallen from $2 to $1.40 a 30% loss. The killing that George Soros made selling the pound would seal his reputation in finance.

2000-01 the dotcom collapse: Eight years later, around 2000, as the dotcom bubble collapsed, so the pound lost 20% of its value. Again it recovered. By 2007 it was above $2.10.

2008 the financial crisis: Then we got the financial crisis of 2008 and the pound lost 35%, hitting a low of $1.36.

2016 the post-Brexit flash crash: Eight years on from that collapse takes us to the infamous Flash Crash of 2016, shortly after Theresa May's speech at the Conservative Party Conference, when she lost her voice. Having been above $1.70 at one point earlier in this cycle, it hit a low of $1.14, according to some measures. The overall drop from high to low, was almost 35%.

And that brings us to today. My view is that we have seen the lows. We saw them two years ago in the Flash Crash.

As I say, I don't see us going anywhere significant until a Brexit resolution is in sight. We may see that sooner than you think, if the 1922 Committee gets its way. Equally, we may not.

In any case, until we get that resolution, I see us meandering around $1.30. But once we do get it, the pound will rally against most foreign currencies, just as it has done after each of its previous eight-year lows. And come say 2021 or 2022 we should be looking to go again with the eventual low targeted some time in 2024.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how