The charts that matter: the Fed chucks investors a bone

With America's central bank sounding more likely to cut short-term interest rates, John Stepek looks at how it affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. If you haven't signed up to stay informed on the MoneyWeek Wealth Summit yet, then don't forget to do it now. This week alone, we've confirmed a few big speakers you'll recognise their names for the big day on 22 November. So make sure you get to hear about the tickets first when they go on sale sign up for our free updates, right here.

We have a new podcast this week Merryn and I talk about the big story of the week, Neil Woodford's plunge from grace. Have a listen here and do leave a comment beneath if you so desire.

If you missed any of this week's Money Mornings, here are the links you need:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: Is Donald Trump a genius? Or should we simply take him at face value

Tuesday: What Neil Woodford's woes mean for your money

Wednesday: The global collapse in trust has driven a secret bull market in gold

Thursday: Central banks might not be able to save us from what's coming next

Friday: What happens to Neil Woodford's shareholdings now?

Also, be sure to read this week's Currency Corner (in association with currency broker OFX) this week it's all about the yen and don't miss our webinar this coming Tuesday at 1pm. Register now FREE to watch it live here or to watch the recording later.

And if you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up.

Now, to the charts.

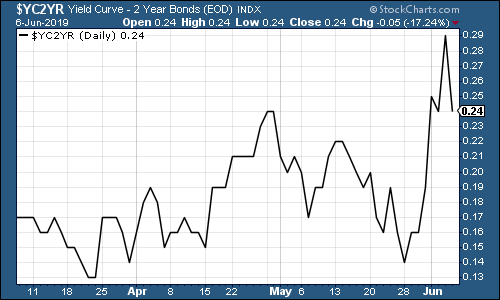

The yield curve (remind yourself of what it is here) spiked higher this week. The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two.

Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year is now inverted. But with the Federal Reserve (America's central bank) this week sounding much more likely to cut short-term interest rates, the rate on the two year slid faster than the rate on the ten-year. Thus the yield curve between them steepened.

Let's see how long it lasts though.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

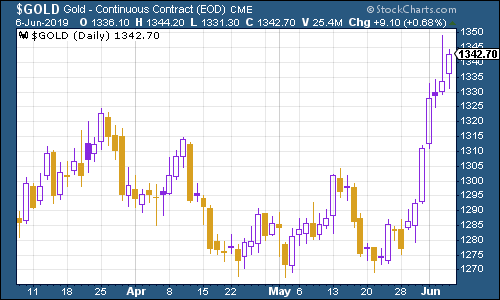

Gold (measured in dollar terms) had a good week. Investors are getting nervous, and they also like the idea that the Fed might cut rates. A dovish Fed combined with positive inflation is good news for gold it means monetary policy is loosening.

(Gold: three months)

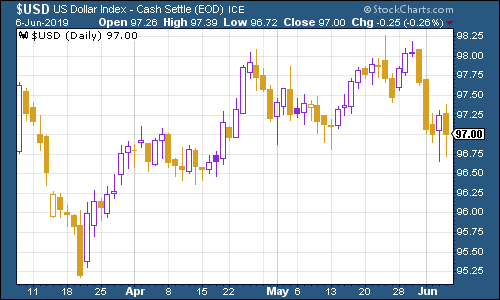

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners meanwhile fell back this week as markets start to expect the Fed to cut any day now (they may be disappointed).

(DXY: three months)

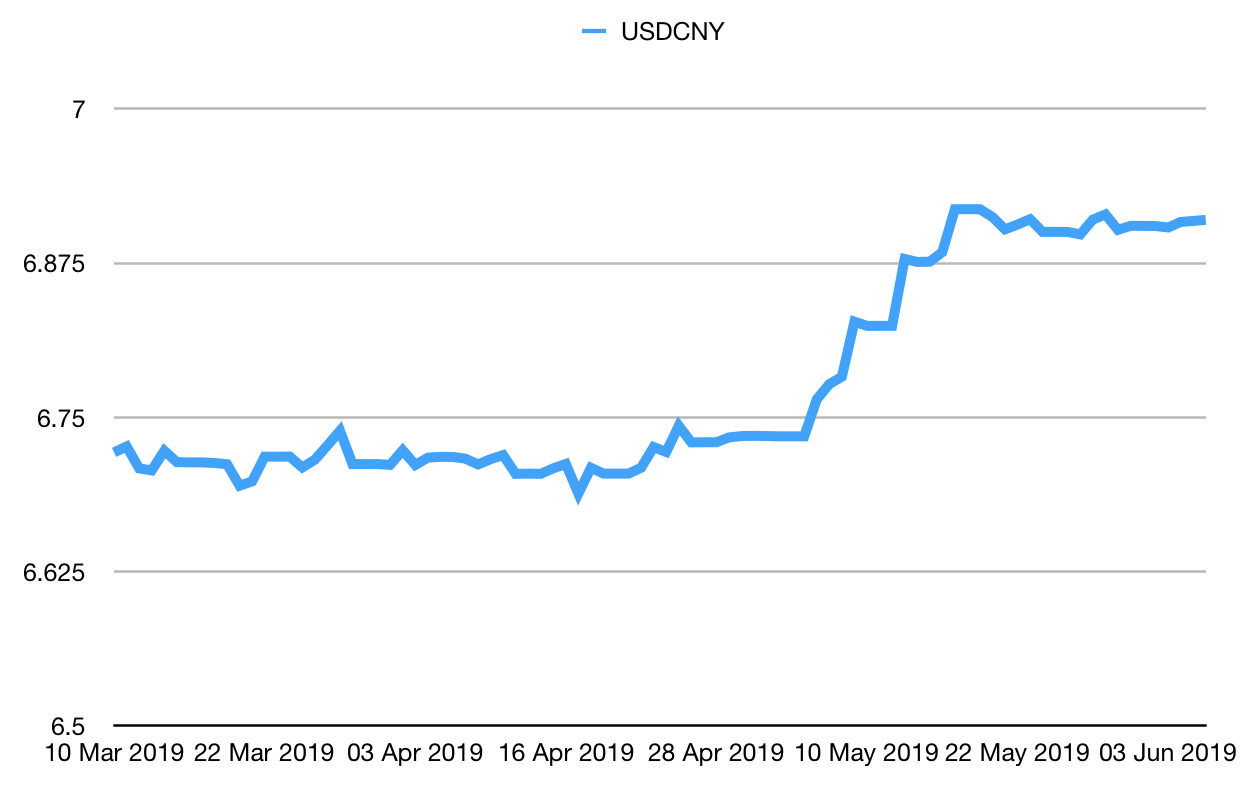

The number of yuan (or renminbi) to the US dollar (USDCNY) has stayed relatively stable this week and below the critical 7.0 level that would suggest China might be on the verge of a severe devaluation.

(Chinese yuan to the US dollar: three months)

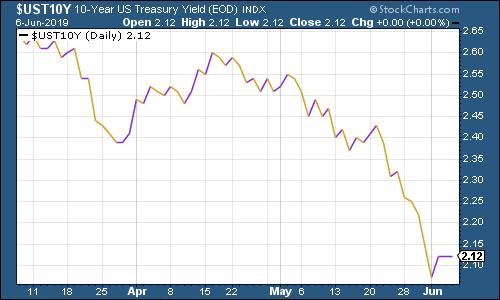

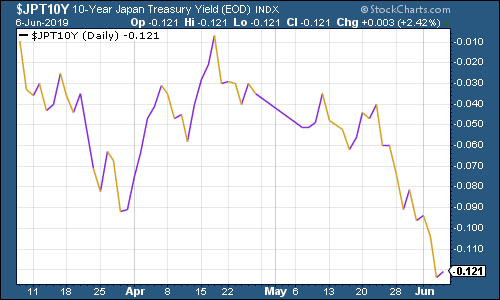

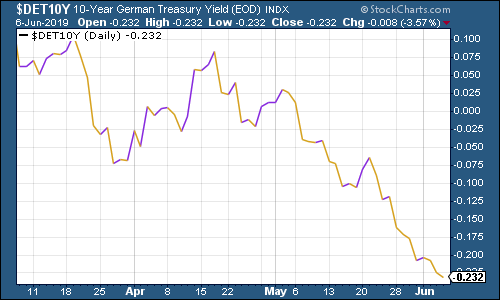

Ten-year yields on major developed-market bonds continued to slip this week, although there was a tiny bit of relief for the US and Japan as the Fed hinted that "the Powell put" might be around the corner. But the yield on the German bund kept sliding to fresh record lows as German industrial output slid the German economy is now looking very weak indeed.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

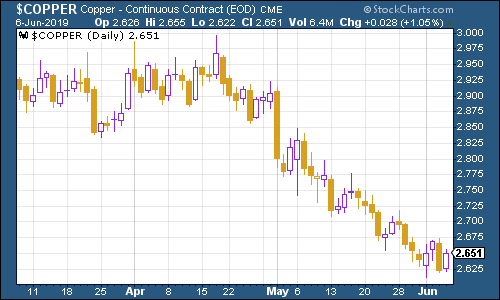

Copper is still wobbly but perked up a little along with markets, helped by the Fed relief bounce.

(Copper: three months)

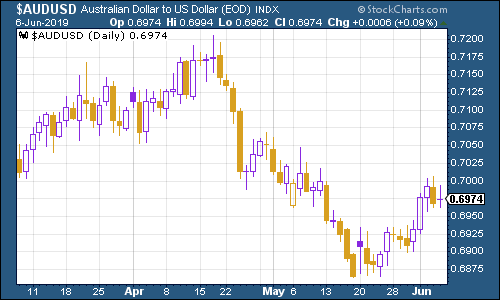

The Aussie dollar our favourite indicator of the state of the Chinese economy continued to rally as the US dollar weakened.

(Aussie dollar vs US dollar exchange rate: three months)

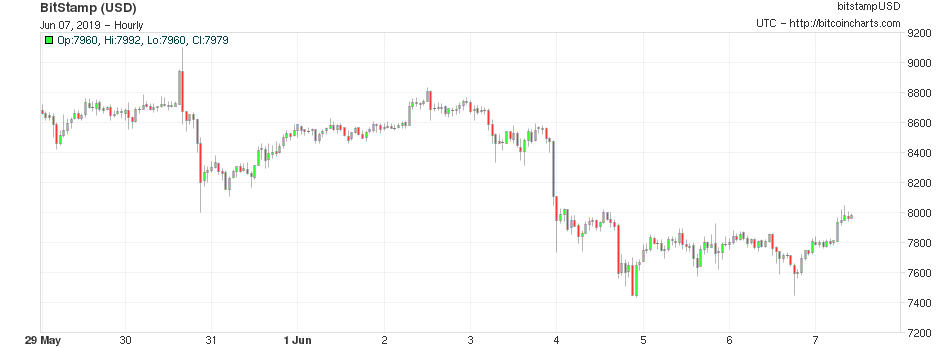

Cryptocurrency bitcoin seems to be consolidating (and again, it's not especially correlated to the actions of the dollar). However, it's come a long way in a short period and now we're seeing aggressive price targets again which suggests that sentiment might be running ahead of it again.

(Bitcoin: ten days)

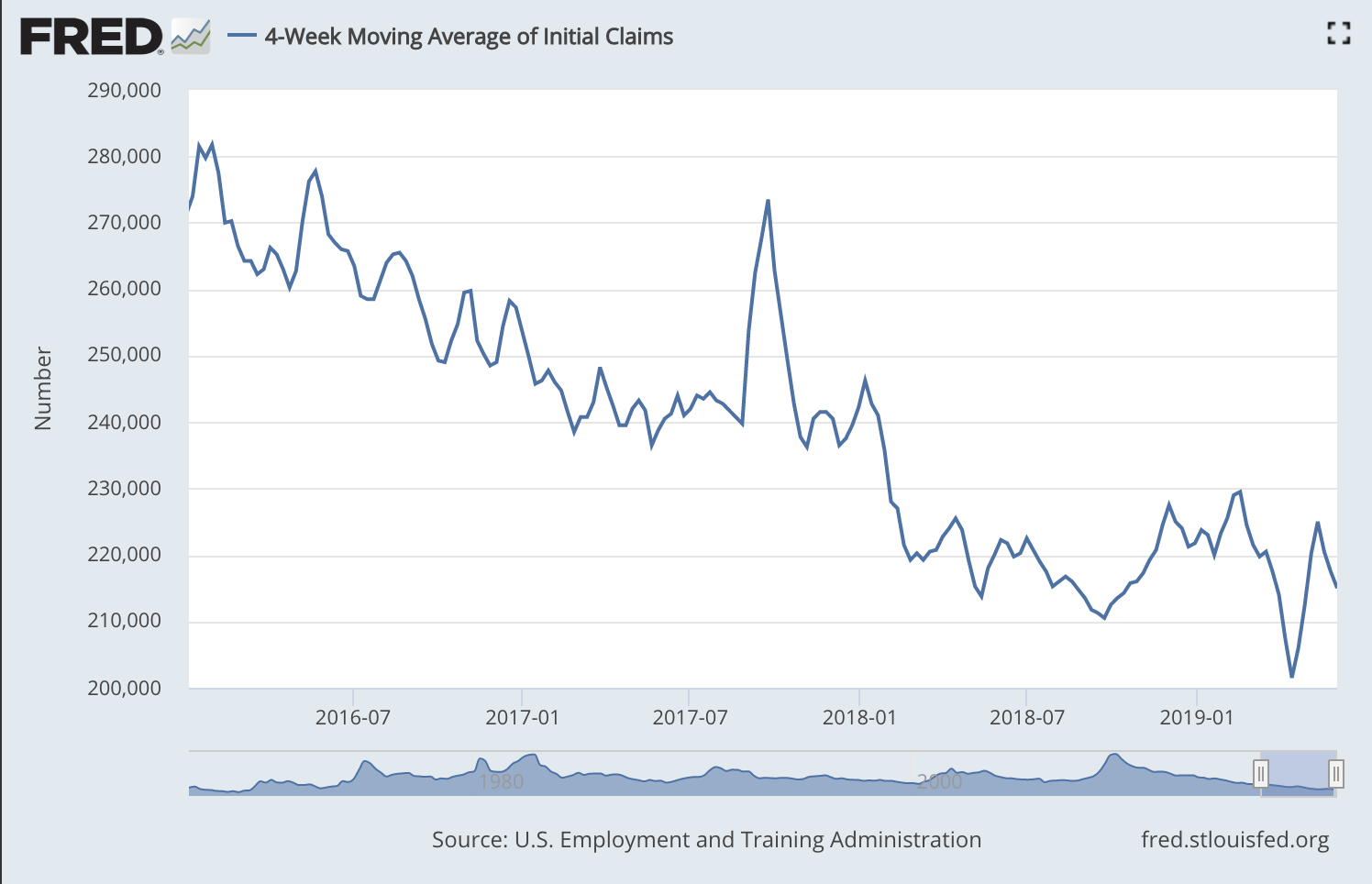

Unemployment is admittedly a lagging indicator (it doesn't start rising until the economy is already getting worse). And yet, while we're all looking for signs of bad news, it's still hard to find any on this front.

Seven weeks ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to 201,500. They jumped over Easter, but have eased since. This week, the moving average fell to 215,000, while weekly claims came in at 218,000 (flat on last week, which was revised higher from 215,000).

US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (although of course this is from a tiny sample size). So maybe we've already peaked. But maybe we'll see another trough still too early to call.

(US jobless claims, four-week moving average: since January 2016)

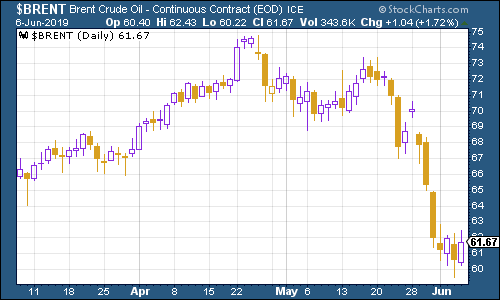

The oil price (as measured by Brent crude, the international/European benchmark) continued to slide although it benefited towards the end of the week from the more "risk-on" mood.

(Brent crude oil: three months)

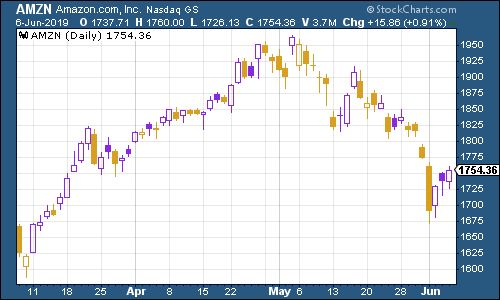

Internet giant Amazon again moved in line with the wider market, bouncing as the Fed spoke soothingly to investors.

(Amazon: three months)

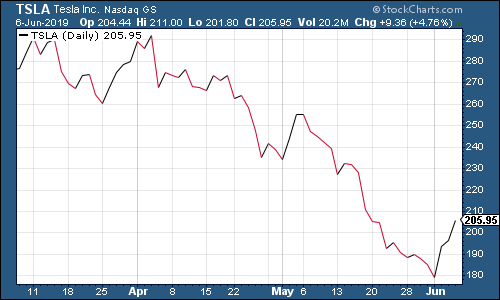

Electric car group Tesla also put in a bounce from its recent travails.

(Tesla: three months)

That's all for this week have a great weekend, and if you haven't read my book, The Sceptical Investor yet, I'm sure it would make the perfect gift for Father's Day. I mean, not necessarily for your dad (although it definitely beats socks), but why not treat yourself? It's been a tough week you deserve it. You can pick up a copy here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how