Currency Corner: the outlook for the Japanese yen

The Japanese yen – the third-most traded currency in the world, after the US dollar and the euro – has been flat for some time now. Dominic Frisby looks at where it might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week in Currency Corner we are going to look at the third most-traded currency in the world.

Just before that however, this is your last reminder to sign up for our webinar, on Tuesday 11 June (ie, this coming Tuesday). At 1pm, I'll be discussing currencies and global trade with MoneyWeek executive editor John Stepek and currency specialist Alex Edwards from OFX.

You can go online and watch it live and ask us questions! or watch it later. If you are at all interested in currency markets, and particularly if you run your own business or are involved in managing currency exposure for businesses, you'll find it extremely useful. Sign up now either to watch it live or to catch up later.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

OK, so back to the third-most traded currency in the world. The US dollar occupies first place and the euro second. In third? The Japanese yen.

Let's start with a little bit of trivia the meaning of the word. Yen means "round shape" or "round object". The etymology is the same as that of the Chinese yuan and Korean won. And it could be argued that the yen has its roots in, of all places, Spain.

In the 1500s, Spanish dollars, or, as your parrot might have called them, pieces of eight (silver coins minted in Mexico), began to make their way across the Pacific via Acapulco and Manila, on so-called "Manila galleons" as trade routes opened up between Asia and the Americas.

These silver coins effectively became the currency of East Asia. The first yen, minted in 1871, was essentially a copy of the Spanish money.

Today the yen accounts for about 22% of global forex trading, and about 5% of global foreign exchange reserves. The International Monetary Fund's SDRs (special drawing rights, its basket of major currencies) are about 8% Japanese yen.

I think it's fair to describe the yen as a heavily-managed currency. The Bank of Japan has been suppressing interest rates for what seems like an eternity, attempting to manage the deflation that has been so particular to Japan for so long. Short term interest rates have actually been negative at -0.1% since 2016.

And it has been printing money, then using that money to buy assets, in a process officially known as quantitative easing (QE), since the late 1990s.

One consequence of these policies has been Japan's extraordinary national debt, which now stands at more than 250% of GDP, making it the most indebted nation on earth.

The other consequence has been the emergence of what is known as "the yen carry trade". You borrow cheap money in Japanese yen (with its ultra-low interest rates), and then use it to buy something else where the return is better. That might be bonds, a foreign currency with a higher rate of interest, or stocks.

However, when there are wobbles in other markets say stocks sell off the leverage (borrowing) involved means that people quickly sell whatever they have bought and buy the yen back.

Thus, despite Japan's vast debt, the yen behaves like a safe haven. When there are market wobbles, people reverse their carry trades to buy yen and it goes up. During the financial crisis of 2008 and its aftermath, the yen rose by more than 20%.

European debt wobbles in 2010 saw it appreciate by 10% against the euro. In 2013, with uncertainty around the Italian elections, the yen rose 5% against the euro and 4% against the dollar in just one day.

And we have seen just such a pattern even more recently. The stockmarket sell-offs of late last year saw the yen rally against the dollar by about 7%. The recent sell-off which began in late April saw it rise by 5%.

What now for the yen?

It's ironic, of course, that a currency with such an obvious time bomb in the form of the national debt of the issuing government should be a safe haven. But, hey, when did a market ever care about something like irony?

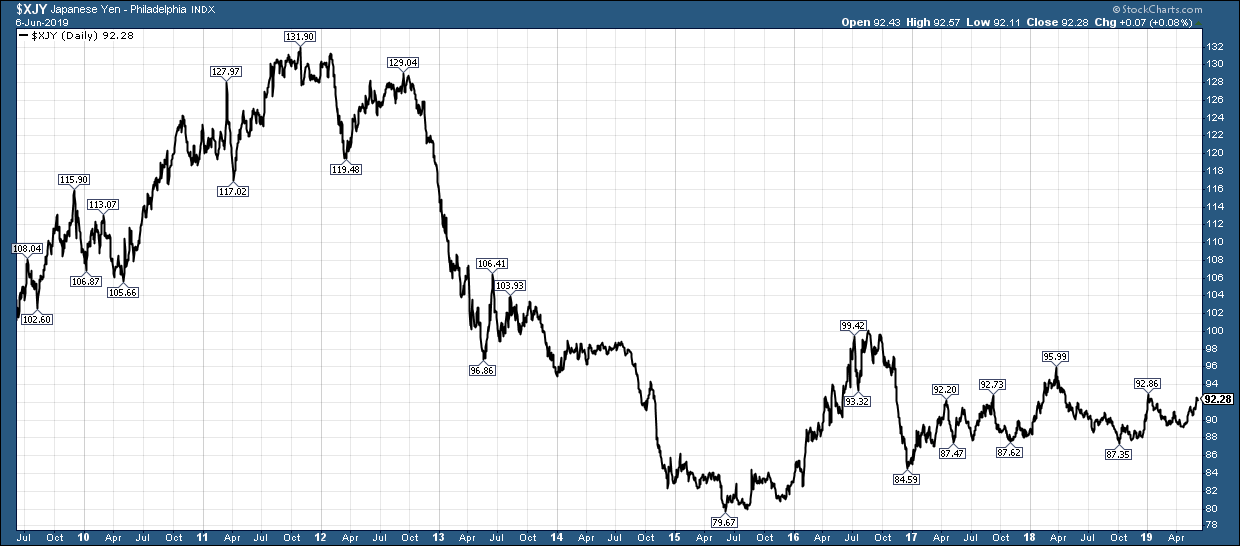

Here for your information is a chart of the yen against the dollar over the last ten years.

You can see the huge declines during the bull market run of 2011-2016.

2016 Donald Trump's first year saw US dollar weakness against pretty much all currencies in the first half of the year.

Since 2017, the trend has been flat and range-bound. And that's where we are today.

Looking forward to the webinar next week. Hopefully, see you there.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.