The global collapse in trust has driven a secret bull market in gold

In times like these, when trust in everything – governments, the media, science, democracy itself – has evaporated, gold is doing just what it's supposed to, says Dominic Frisby. It's getting more valuable.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Just before we get started this morning, a reminder to sign up for our webinar, on Tuesday 11 June.

At 1pm, you'll be able to go online and watch me discuss everything from the state of global trade to the outlook for the pound, and what it all means for British businesses, with MoneyWeek executive editor John Stepek and currency specialist Alex Edwards from OFX.

If you are at all interested in currency markets, and particularly if you run your own business or are involved in managing currency exposure for businesses, you'll find it extremely useful. Sign up now. (Even if you can't watch it live, sign up so you have the option to watch it later).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And now, back to today's topic gold.

Every year, Incrementum AG a Liechtenstein-based investment company puts out its research note, In Gold We Trust.

At over 300 pages, it's probably the most comprehensive gold analysis there is.

The 2019 edition came out just last week, and I thought this week I'd share some of the charts with you those that really jumped out at me.

How much more distrusting have we become? Check out these charts

The main authors of In Gold We Trust Ronald-Peter Stoeferle and Mark J Valek are (as you might expect) hardcore goldbugs. Theirs is a world view with which many MoneyWeek readers will have a lot of sympathy. I know do.

There is too much debt in the world, especially government debt. Easy money, low rates, monetary manipulation, the balance sheets of central banks and all the rest of it have stored up a host of problems, and when the dam breaks it will be nasty. Gold is thus an essential diversifier in everybody's portfolio.

One word, however, appeared more frequently than I have ever known it to. It's a word with which bitcoin bugs will be only to familiar "trust". Bitcoin, of course, was designed to obviate the need for it "in proof we trust", runs the saying.

Incrementum observes that in the West, trust is disappearing. People no longer trust their governments. They do not trust their politicians. They do not trust their scientists, or their economists. Experts are biased. The media is biased. Even systems and processes are no longer trusted whether it's education, healthcare, even democracy itself.

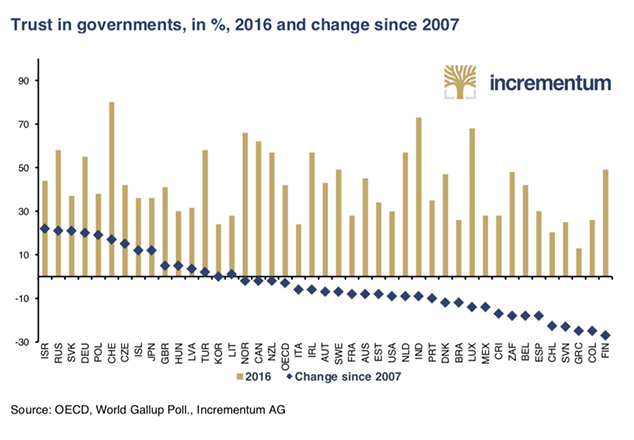

The blue squares in the chart below chart declining levels of political trust in various countries around the world. Interestingly, Finland has seen the biggest falls.

It's easy to explain why such trust should have evaporated, from lies about the Iraq war, to the authorities' reaction to the financial crisis of 2008. Society, as a result, has become polarised in a way that we simply weren't used in the nineties and early noughties.

It's interesting that the UK actually saw a marginal rise in trust between 2007 and 2016, albeit from much lower levels. This probably reflects the difference in perception between the Brown and Cameron administrations. When the 2018-2019 data gets released, I think you'll see UK trust in governments at an all-time low.

As far as Incrementum (and any like-minded gold or bitcoin bug) is concerned, this loss of trust in our institutions and in each other is leading up to the humdinger a loss of trust in money itself. Indeed, that's why bitcoin was designed in the first place.

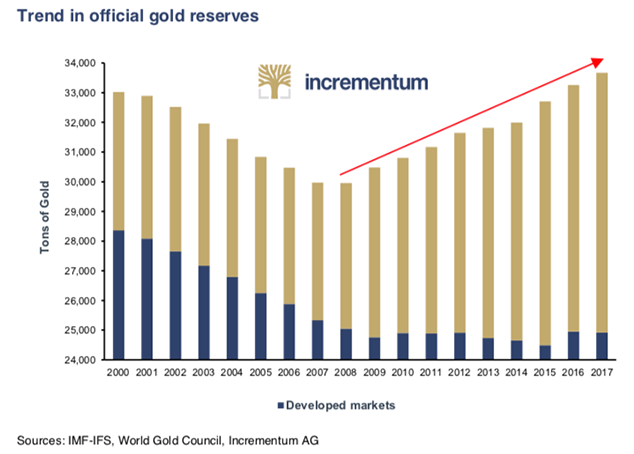

At a global level, this is manifesting itself in mutual distrust among central banks. Some have repatriated gold held overseas, while others have been increasing their gold holdings in what is known as the de-dollarisation of the economy. Hungary has increased its gold holdings tenfold, for example. That's extreme but most nations are at it.

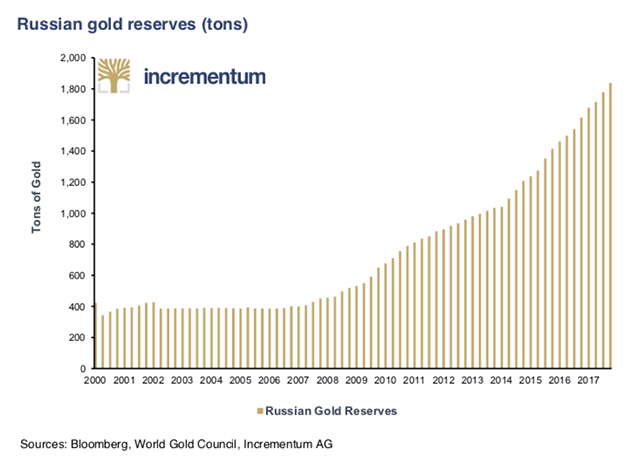

It's no coincidence that the change in trend began in 2008. That's when they bailed out the banks. What struck me, in particular, was, cumulatively, how much gold Russia has bought.

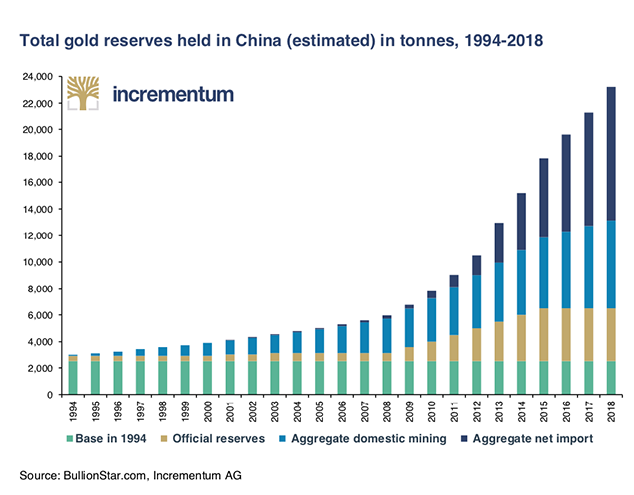

While the growth in China's holdings, as I have written about before, is extraordinary.

So loss of trust was one big theme of this year's report. And these central bank reserve charts go some way to demonstrating the scale aof that loss of trust.

Gold's secret bull market

I just want to cover a couple more charts which caught my eye.

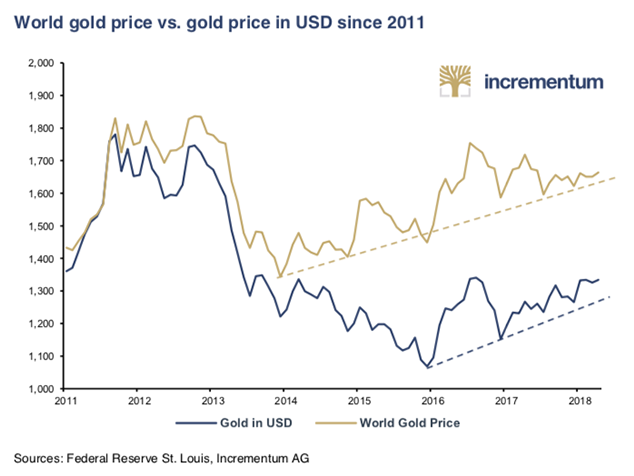

We tend to think of gold in US dollar terms, because that is the official price in which gold is measured. As a result, our perception is that gold peaked in 2011 at $1,920 per ounce and has been in a bear market ever since. Today it sits around $1,330.

But over the same period the US dollar has largely been in a bull market. It has been strengthening against most currencies.

On the other hand, I've often described gold as a hedge against your own government. And in the UK, for example, it has served that purpose well. Gold was £700/oz in early 2016, before the Brexit vote. Today it's 50% higher, at roughly £1,050.

In this next chart we see the world price of gold ie gold plotted against all major national currencies. You wouldn't know it, but by this measure, gold has been in a bull market since 2013.

Gold has, in other words, been doing what it is supposed to do.

There are many great charts in the report, and I recommend you take a look. But I wanted to finish off with one final chart that caught my eye.

Commodity prices are incredibly low, believe it or not

A common theme of mine in recent years has been the extraordinary valuation ascribed to the digital economy, while the real economy has lagged. Whether it's the valuations ascribed to FANG stocks or bitcoin, or the earnings of tech entrepreneurs, the digital economy has eclipsed the physical economy. The reason is scalability, as I outlined last week.

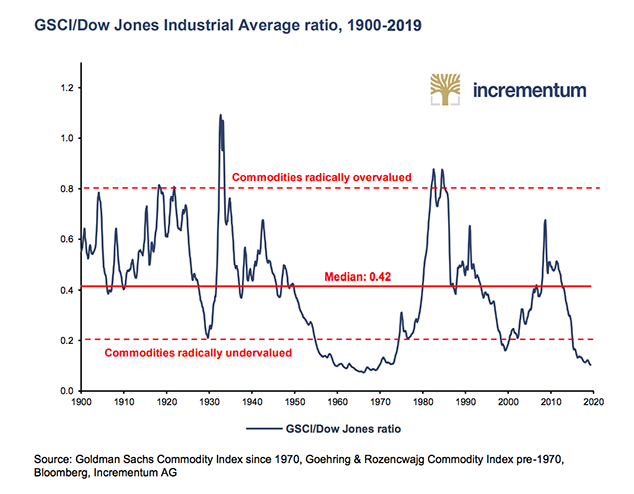

Real stuff is a burden. The physical economy is hard. Nowhere is this dichotomy more apparent than in the commodities markets. We think of the great commodities bull market of the 2000s, and then the subsequent bear market we are in today.

But oil is still above $50 a barrel, copper costs nearly $6,000 a tonne, and wheat is around $200 a bushel. Prices don't feel that low.

However, if we look at commodity prices relative to stock prices, they are actually more depressed than they were at the turn of the century, before that great secular bull market. In fact they're almost as low as they were in the late 1960s.

Here we see the ratio of the Goldman Sachs Commodities Index against the Dow Jones.

I don't think it starts tomorrow. Probably not even this decade. But the stage is being set for a turnaround in commodities and as such the real economy. And if all the inflation that has built up over the last decade manifests itself in commodity prices, then you really will need to own some gold.

For now, amid the recent stockmarket correction, gold has had a nice little rally over this past couple of weeks to around $1,330. It's looking strong. But the big barrier remains that $1,360 area that has been resistance for some five years now. Will 2019 be the year it gets through? Let's hope so.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how