How much gold does China have? A lot more than you think

Officially, China has the world's seventh-largest gold reserves. But it has been stocking up at an astonishing pace. Here, Dominic Frisby examines just how much gold China could have.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today as we like to do every couple of years we consider all the gold in China.

Next time the international money system comes under stress and that time may not be far away where the gold is, and who owns it, could be of great importance.

The world's central banks have been stocking up on gold

You may think gold is an antiquated asset, irrelevant to a modern digital world. China clearly doesn't. Since the global financial crisis, China has been accumulating gold at a staggering pace.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The implications are considerable.

There are going to be lots of numbers in this piece, so to anchor you with some kind of perspective, let me give you some of the major figures.

Total global central bank gold reserves stand at just below 34,000 tonnes, which is roughly 20% of the 175,000-or-so tonnes of total above ground supply.

The US is the world's largest owner with 8,133 tonnes. That number works out at around an ounce per citizen. Precious metals analyst Nick Laird reckons that if you add private and institutional holdings to this official 8,133 tonnes, there are 26,00027,000 tonnes in the US overall.

Below is table of central bank gold holdings, using World Gold Council Data data. In gold terms, these are the richest 20 nations. The UK sits proudly at 17th, two places below Kazakhstan and one above Lebanon.

| Row 0 - Cell 0 | Row 0 - Cell 1 | Tonnes | % of forex reserves |

| 1 | United States | 8,133.5 | 73.8% |

| 2 | Germany | 3,369.7 | 69.1% |

| 3 | International Monetary Fund | 2,814.0 | Row 3 - Cell 3 |

| 4 | Italy | 2,451.8 | 65.8% |

| 5 | France | 2,436.0 | 59.5% |

| 6 | Russia | 2,066.2 | 17.6% |

| 7 | Mainland China | 1,842.6 | 2.3% |

| 8 | Switzerland | 1,040.0 | 5.1% |

| 9 | Japan | 765.2 | 2.4% |

| 10 | Netherlands | 612.5 | 66.0% |

| 11 | India | 586.4 | 5.7% |

| 12 | European Central Bank | 504.8 | 14.9% |

| 13 | Taiwan | 423.6 | 3.5% |

| 14 | Portugal | 382.5 | 63.6% |

| 15 | Kazakhstan | 341.2 | 43.6% |

| 16 | Saudi Arabia | 323.1 | 2.4% |

| 17 | United Kingdom | 310.3 | 7.9% |

| 18 | Lebanon | 286.8 | 20.1% |

| 19 | Spain | 281.6 | 16.1% |

| 20 | Austria | 280.0 | 47.4% |

Central banks, by the way, have increased their buying this year at the fastest rate since 2012. They now account for around 10% of annual gold demand.

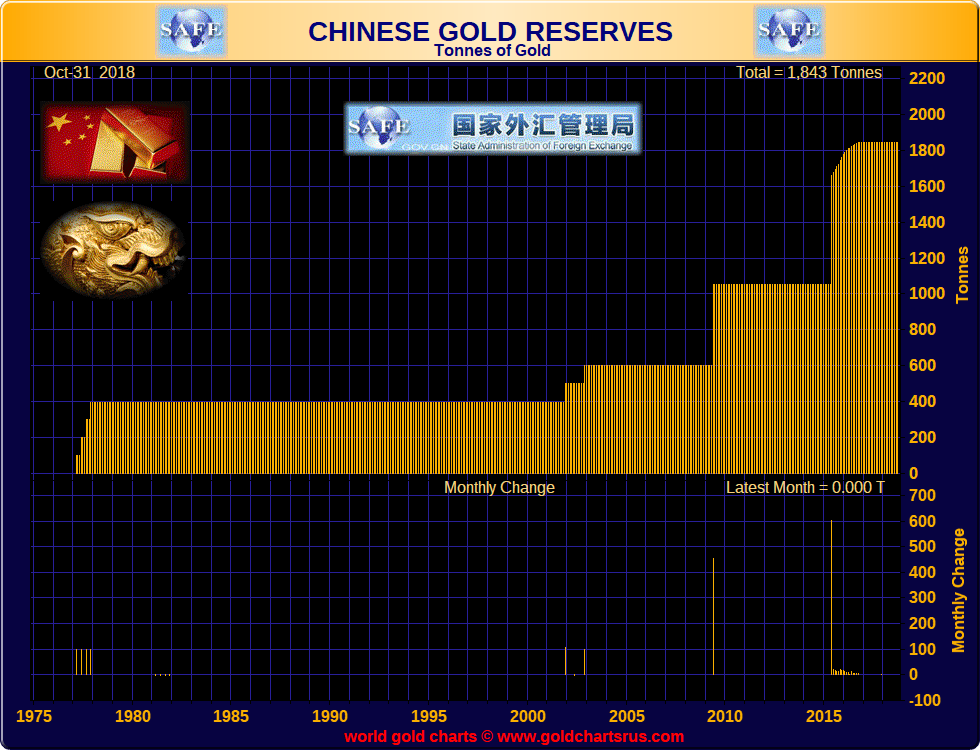

The People's Bank of China (PBOC China's central bank) announces its gold holdings every five years or so. The current stated figure is 1,842 tonnes. Below, we see China's holdings since the 1970s.

So that's what they say they have. Now let's look at what they have accumulated. We'll start with what they've mined.

In 2007, China overtook South Africa to become the world's largest gold producer, mining 276 tonnes. Last year it mined 430 tonnes, about 50% more than Australia, the world's second-largest producer.

China now accounts for around 15% of total annual global gold production. But China keeps all of the gold it mines; it does not sell a single ounce abroad.

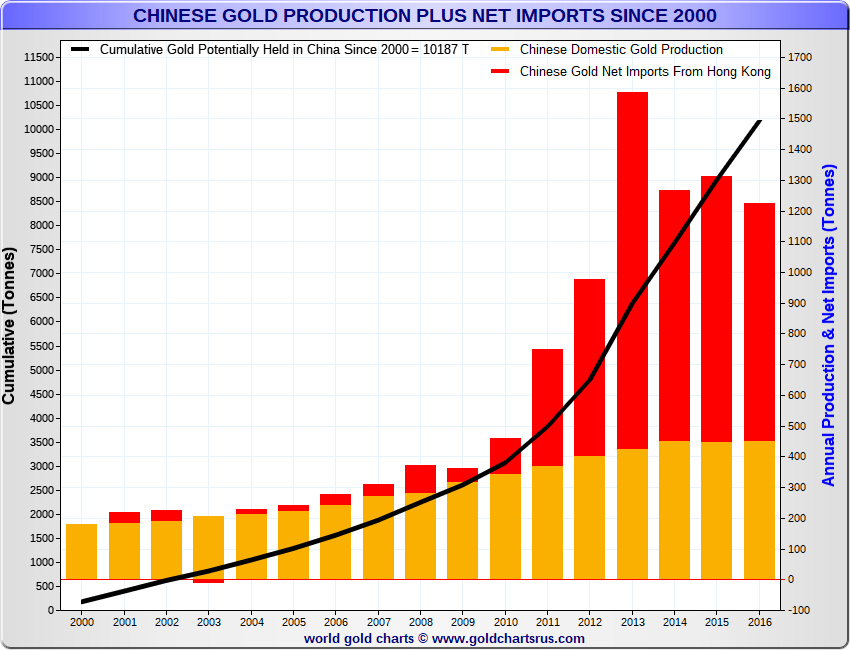

As well as keeping all of the gold it mines, since 2010, China has ramped up its gold imports. In 2014, it overtook India to become the world's largest importer, buying gold from Hong Kong, Switzerland, London, Australia and Singapore.

It is hard to get precise figures as many of these trades are over the counter, but Hong Kong does provide them and they are astonishing. Between Hong Kong imports and Chinese gold production, China has accumulated more than 10,000 tonnes of gold since 2000.

(Charts courtesy of Nick Laird at goldchartsrus).

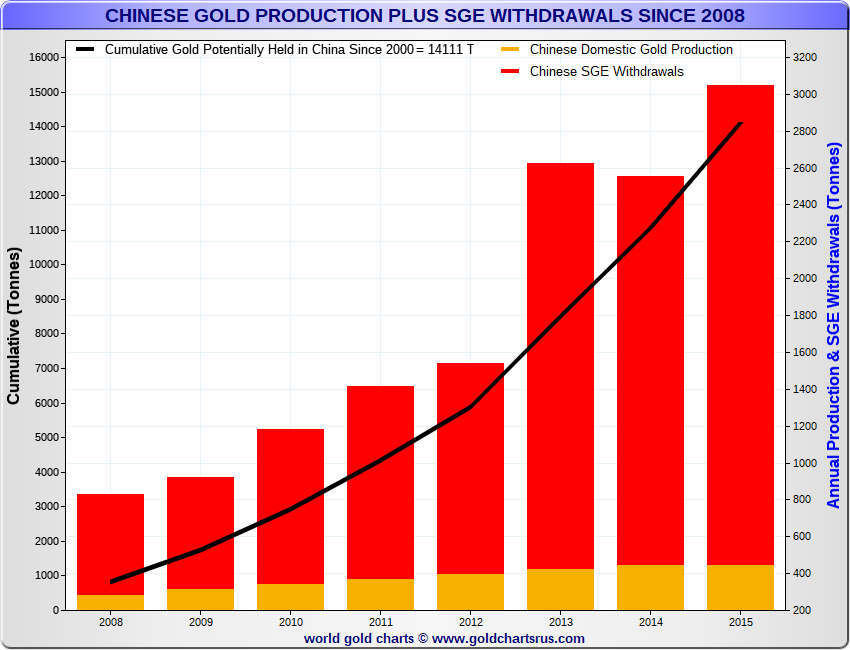

Meanwhile, all the gold that enters China must be sold via the Shanghai Gold Exchange (SGE), and it is possible to get numbers for SGE withdrawals since 2008. These take the grand total of imports and production to 14,111 tonnes.

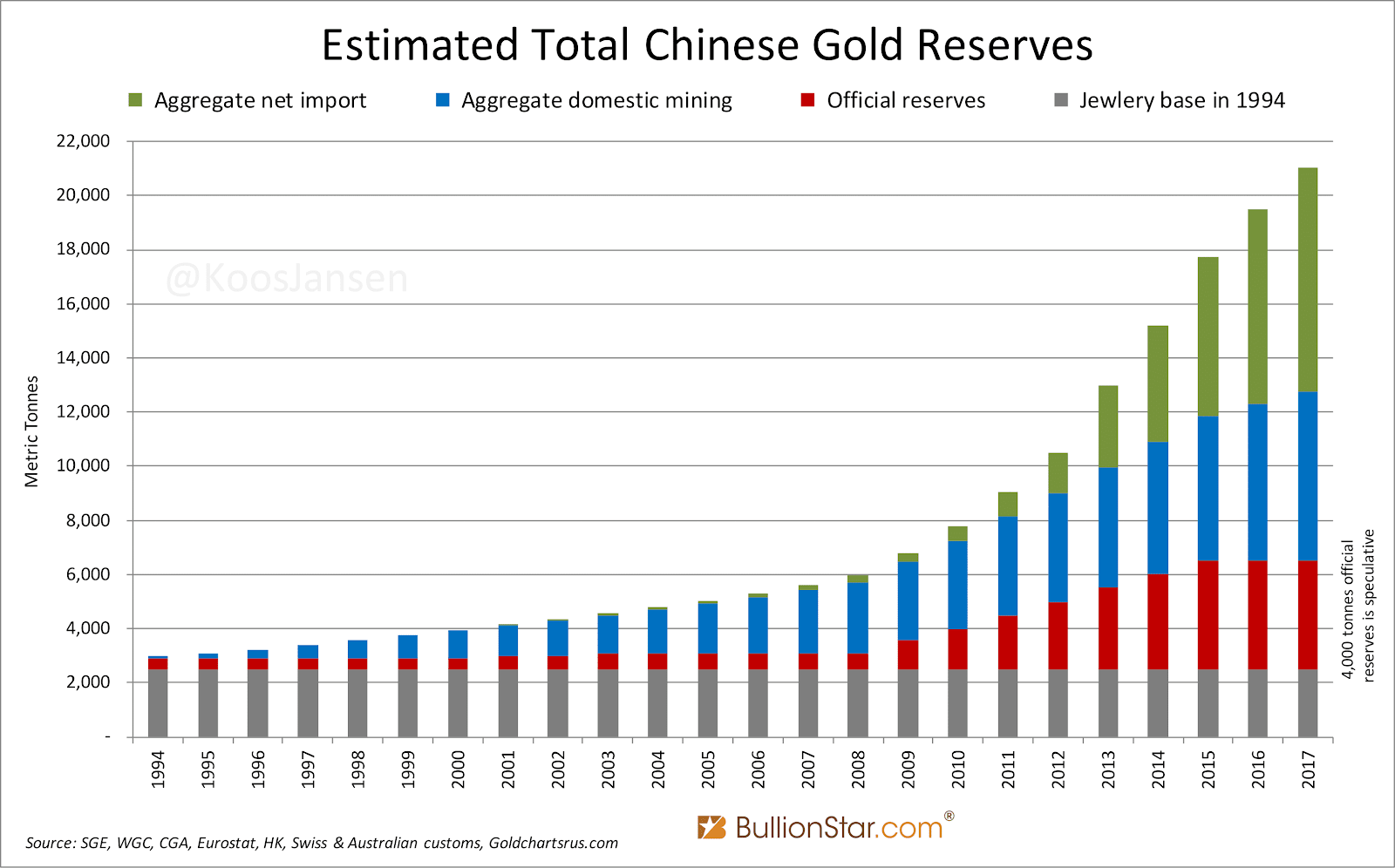

There is also, to add to this number, all the gold that was in China, whether as bullion or jewellery, prior to 2000.

So how much gold does China really have?

Not all of the gold that makes its way to China goes to the central bank, it should be stressed. Indeed, China has encouraged private accumulation of gold.

Quite how much is falling into domestic hands is hard to quantify, but Bron Suchecki of the Perth Mint, studying gold flows, argues that China aims for private citizens to accumulate 55% of flow with the remaining 45% going to commercial banks and the Chinese central bank. Even if half of that 45% goes to the PBOC, then their holdings are likely to be higher than the stated 1,842 tonnes.

However, as precious metals analyst Koos Jansen argues, the PBOC does not buy all its gold from the SGE. It goes elsewhere. There are several reasons for this.

The SGE sells its gold in yuan and the PBOC prefers to use dollars. The PBOC likes to buy 12.5kg bars, which do not trade on the SGE. The SGE has stated that only consumers buy gold over its exchange although in practice that doesn't seem to be the case.

The PBOC does not like to disclose all its gold purchases, which on the SGE it would have to do. It prefers "monetary gold" which does not require disclosure on customs reports. The PBOC prefers an OTC (over-the-counter) market such as London, to an exchange such as Shanghai (less disclosure required).

What's more, as Ross Norman, CEO of Sharps Pixley, tells me: "There are other state agencies apart from the PBOC, which buy gold there's the State Agency for Foreign Exchange, China Investment Corporation (the sovereign wealth fund) and the military, for example.

"And they all often use other means to the SGE to buy their gold. There's the London Bullion Market, other market makers and banks in London, there are the Swiss refiners, a lot goes through Dubai. This is all official gold one way or another, but the real numbers are obfuscated and unknown."

Norman continues: "The PBOC's figures can be whatever they want them to be. In all probability, it's much higher than officially stated. My guess is that they gave that figure of 1,842 tonnes to be high enough to get credibility with the IMF to satisfy its criteria to be included in SDRs (the IMF's international currency basket), but not so high as to issue any kind of challenge to the US."

Jansen concurs, estimating official Chinese holdings to be around the 4,000 tonne mark. That would make it the second-biggest owner of gold after the US.

Jansen's grand total of all the gold in China now stands at around 21,021 tonnes.

Norman, who works at the coalface of bullion dealing, thinks it's even higher than that. "So much gold has been making its way to China without being declared. It really wouldn't surprise me to see official Chinese gold holdings above the 10,000 tonne mark."

That's an extraordinary number. It would mean that China has more gold than the US.

China's official gold holdings currently amount to just 2% of its foreign reserves. 10,000 tonnes would equate to 11% of foreign exchange holdings. That's about the international average. In those terms, 10,000 tonnes is not such an extraordinary number.

But there is no way China could declare that it was holding 10,000 tonnes today. It would cause enormous disruption. First, it would send the gold price a long way higher which it won't want to do while it is still accumulating.

Second it would cause untold disruption in the forex markets a yuan backed by gold could strengthen significantly. China doesn't want this just yet, either it wants the yuan low for trade purposes. Meanwhile, it has an extraordinarily large US dollar holding in its foreign exchange reserves. I rather expect it wants to protect the value of its holding at least for the time being.

But third, and perhaps most of all, to declare that it had more gold than the US would be a direct challenge to American supremacy, almost a declaration of war. China's not ready for that. Not yet, anyway.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how