JD Sports is ready to run

Retailer JD Sports could buck the sector trend and looks attractively valued, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Shareholders in JD Sports Fashion (LSE: JD) had a turbulent 2018. In the first nine months the stock soared by 40% to a peak of 508p. But the company fell victim to investors' shift away from growth stocks during the autumn. By Christmas the shares were down to 339p. A recent rally has boosted them to 380p. So what next?

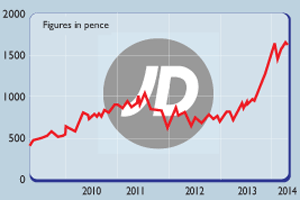

JD Sports has done well over the past few years, with revenue tripling between 2014 and 2018. Some of this was due to acquisitions, including the decision to buy Go Outdoors in 2016. However, most of it has come from correctly anticipating that people increasingly want to wear sports clothes that are fashionable, not just functional.

Another thing to note is that growth has been remarkably consistent, with sales expanding by double digits each year since 2011, with the sole exception of 2014. This growth isn't at the expense of profitability either: the company boasts an impressive return on invested capital of 33%.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Of course, past growth doesn't necessarily mean that it will be successful in the future, especially with an economic slowdown on the cards. However, we're confident JD Sports will continue expanding, especially since it has worked hard to grow its business outside the UK (which until the summer accounted for around two-thirds of revenue).

Until recently, most of its efforts were focused on bolstering its presence in Europe. However, the acquisition of US sports retailer Finish Line, which was completed in June, will give it a foothold in America, which it can hopefully then build on, allowing it to maintain its growth rate in the medium term. It has also started opening some stores in Asia.

We are intrigued by JD Sports not as a bargain-basement value play, but because of its great track record and strong future growth potential. However, while you might expect its strong performance and prospects to be reflected in the company's valuation, the price/earnings ratio (p/e) is hardly exorbitant.

Its p/e is a very reasonable 14.7 times trailing earnings, possibly because some investors are becoming excessively cautious about the retail sector. Indeed, if the predictions about its future growth in the next few years turn out to be accurate this could fall to 12.3 times 2020 earnings, which is substantially lower than the figure for the FTSE index as a whole. Since this is a trading column, we generally like to buy stocks with positive price momentum. So I'd suggest you hold off buying until JD Sports reaches 400p we want to ensure the current rally in its shares isn't just a temporary bounce.

A trade triggered once a share reaches a certain minimum price is known as a stop order, and is offered by most major spread-betting firms.If it does reach 400p, I'd go long at £10 per 1p (IG Index's minimum is £1 per 1p), with a stop loss of 300p. The total possible downside is £1,000.

How my tips have fared

Over the last few weeks, four of our five long positions have gone up in value, with Greene King rising to 553p (from 523p), Cineworld increasing to 273p (from 269p) and John Laing Group reaching 333p (from 313p). In addition, Takeda's takeover of Shire finally went through with Shire shareholders getting the equivalent of £46.90, which means that we made £365 in profit from the trade.

However, Saga fell below our stop-loss of 102p, which meantwe closed our long position for a loss of £525. Overall, we are making a collective profit of £180 on our three remaining open positions (Greene King, Cineworld and John Laing Group).

Nonetheless, the value of our shorts has increased, too. Bitcoin went up to $4,018 (from $3,250); Netflix increased from $274 to $297; Just Eat is now 601p (from 578p);Weis Markets costs $48.32 (from $46.52) while Rightmove is 455p (from 436p).

Of course, some of our shorts did actually fall, with Twitter going down from $36.25 to $29.95 and Snap going from $9.85 to $5.95.The upshot is that we're making a profit of £2,561 on our seven shorts.

Five new-year trading resolutions

We devoted the final trading page of last year to assessing our performance. We had a mixed 2018, with a small number of very profitable positions outweighed by a large number of smaller losses. So over the holiday I had a think about which elements of my strategy might need changing, especially in light of market turbulence. I've come up with five new-year trading resolutions.

1. Continue to ditch losers

While taking a long-term view is a good idea for investors, traders don't have that luxury, especially if they are using leverage (as you do inspread-betting). Last yearwe employed a new strategyof closing all positions that hadn't made a profit withinsix months. It kept losseson each position to a manageable level, sowe're keeping this rule.

2. Adjust stop losses

Alongside our policy of cutting losers, we gradually adjusted the stop-loss on our winning positions upwards to help us lock in profits. This strategy can help protect you from sudden negative reversals, as it did in the case of IG Group and Petrobras. The tactic can also ensure you don't hold onto trades that are only marginally profitable fortoo long.

3. Become more patient

Our decision to short bitcoin was aided by our tip to wait until the price was falling.By contrast, we were arguably too eager to jump back into short trades on the S&P 500 index and Tesla. The lesson: don't trade unless both the momentum and fundamentals are in your favour.

4. Find stronger catalysts

Since we started this column more than two years ago, the trades that have done better have been those with either a definite catalyst or idea behind them. For example, our successful Petrobras trade was based on the idea that the political risk baked into the price was overdone. Yet when we've bought a share for more general reasons, just because it seemed "cheap", say, we haven't done so well. So we're going to work harder to find shares with interestingangles or triggers forshare-price movements.

5. Balance shorts and longs

Last year most of our shorts did much better than our long positions. However, they would have done even better had we put as much money behind them as our less successful longs. With the markets set for a turbulent year, we'll ensure all our positions have the same potential downside of £1,000.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Will JD Sports rescue Debenhams?

Will JD Sports rescue Debenhams?News JD Sports has emerged as a “serious contender” to rescue Debenhams, a move that would escalate its rivalry with Mike Ashley, owner of Sports Direct and House of Fraser.

-

Athleisure: a tale of two retailers

Athleisure: a tale of two retailersFeatures The athleisure craze is helping JD Sports outrun long-term rival Sports Direct – but its shares are looking pricey, says Alex Williams.

-

Company in the news: JD Sports

Features Phil Oakley tipped retailer JD Sports last April. Here, he sees how the company has got on, what investors should do now.

-

Shares in focus: JD Sports leaves competitors standing

Shares in focus: JD Sports leaves competitors standingFeatures Retailer JD Sports is in great shape, says Phil Oakley. Can the company keep on delivering the goods?