Company in the news: JD Sports

Phil Oakley tipped retailer JD Sports last April. Here, he sees how the company has got on, what investors should do now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

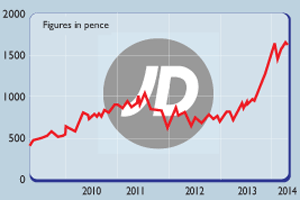

Last April,I suggested buying shares in sports retailer JD Sports (LSE: JD)at 1,735p. I thought the company had strong momentum and that a sensible strategy and strong profits growth could keep the share price heading higher. And that's what happened.

After splitting its shares into four last summer, the price last week was 508p a share (which equates to 2,032p pre-split). Trading has remained very strong. The five-week Christmas period to 3 January saw like-for-like sales rise by an impressive 12%.

Trading has been so buoyant that management expects pre-tax profits for the year to February to beat analysts' forecasts (£90m at the top end). Unsurprisingly, investors gave this news a big thumbs up.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So what of its prospects at the current price? I'm still quite optimistic that this company can keep on growing nicely. I like the fact that it owns a lot of the shoe brands that it sells and that it can do more with turning around the Blacks outdoor clothing business.

Then there's the potential to create a strong business in Europe to replicate its success in the UK. The firm has sold its struggling fashion business, which never really made a decent profit.

Last but not least, at 13.5 times 2016 forecast earnings per share, the shares are slightly cheaper than when I tipped them last year. I'd stick with it, or buy in if you haven't yet.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Will JD Sports rescue Debenhams?

Will JD Sports rescue Debenhams?News JD Sports has emerged as a “serious contender” to rescue Debenhams, a move that would escalate its rivalry with Mike Ashley, owner of Sports Direct and House of Fraser.

-

JD Sports is ready to run

Features Retailer JD Sports could buck the sector trend and looks attractively valued, says Matthew Partridge.

-

Athleisure: a tale of two retailers

Athleisure: a tale of two retailersFeatures The athleisure craze is helping JD Sports outrun long-term rival Sports Direct – but its shares are looking pricey, says Alex Williams.

-

Shares in focus: JD Sports leaves competitors standing

Shares in focus: JD Sports leaves competitors standingFeatures Retailer JD Sports is in great shape, says Phil Oakley. Can the company keep on delivering the goods?