Shares in focus: JD Sports leaves competitors standing

Retailer JD Sports is in great shape, says Phil Oakley. Can the company keep on delivering the goods?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The sportswear chain is in good shape. But is the price right? Phil Oakley investigates.

Competition in the sportswear and outdoor fashion business has been savage in recent years. Firms such as JJB Sports and Blacks Leisure have been high-profile victims of the decline of the British high street.

Saddled with high rent and wage bills, these companies could not sell enough goods to pay their way. The current market leader, Sports Direct, has fared much better, with low-price business models and clever internet sales techniques that have been tough to compete with.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Even so, smaller rival JD Sports has managed to hold its own and keep on growing. Having started out from one shop in the Lancashire town of Bury in 1981, it has come a long way and now has 885 stores, including a growing number of shops in Europe.

It has also tried to capitalise on the misfortunes of its competitors. In 2012, it bought out Blacks and Millets from the receivers, and in 2013 it bought struggling UK fashion business Ark. It hopes to make these companies profitable again and get agood return on its investment.

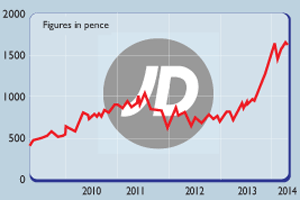

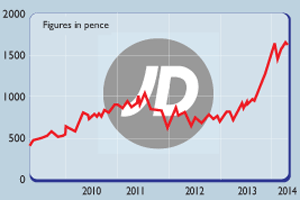

The company's share price has been on a very strong run of late and it's trading at close to its all-time high. This is usually not the time to jump in, but good businesses can keep share prices on an upwards trend. So the big question for potential investors is: can JD Sports keep delivering the goods?

The outlook

It is able to make more money from these brands than it does from selling popular third-party brands, such as Nike or Adidas. Shoes are a very important part of the product range and strong demand for women's trainers has helped sales during the last year.

Another part of JD Sports' strategy is to stick to the quality end of the market so that it doesn't have to cut prices too much to shift stock. This has allowed its sports shops to earn high profit margins. Now it wants to take this model across Europe and create a big, profitable business there.

It has been doing reasonably well in France and Spain, despite these nations' weak economies. It has also bought some shops from struggling retailers in Holland and Germany, which it will convert to the JD Sports brand.

Elsewhere the company is faring less well. Its fashion business saw bigger losses last year, especially at its main Bank brand, which focuses on the youth market. Predicting fashion trends is notoriously difficult to get right, but new management has been brought in to turn the business around.

Self-help measures, such as improved IT, cheaper rents and more third-party brands, could also help to cut losses, but won't be a game changer as far as the share price is concerned.

The Blacks and Millets businesses have required a lot of work to fix. They were badly managed in the past and have been a big drag on JD Sport's profits during the last two years. However, there are signs that the tide is beginning to turn.

Unprofitable shops have been closed and the business actually broke even in the second half of last year. If it can sell more own-brand Berghaus kit and Hunter boots, then Blacks and Millets could start making a modest contribution to profits from this year on.

It's also bought Tiso, a premium outdoor clothes retailer based in Scotland. This business is currently loss making, but with JD Sports having better buying terms with suppliers, it should start making money in the next year or so.

A healthy balance sheet

Its future minimum rent payments are over £600m. However, it has enough profits and cash flows comfortably to pay this rent bill and is in no imminent danger of getting into financial difficulties.

But surely a lot of this good news is already priced in? Maybe not. It's true that JD Sports is not trading on the single digit price/earnings ratio it was a couple of years ago, but on just over 14 times February 2015 earnings, with percentage profit growth expected to be in the low-to-mid-teens, the shares look reasonable value.

They are also still a lot cheaper than Sports Direct, which trades on over 25 times forecast earnings although its profits are expected to grow faster.

Normally, I'd suggest waiting for shares in JD Sports to fall back a little before you buy in, but I usually only suggest doing that when the shares are actually a bit expensive and that's not the case here.

Do be aware that British brand management group Pentland Group owns 57.5% of the company's shares, which means that it might be a little bit tricky to buy large numbers of shares. However, this should not be a problem for most private investors.

Verdict: buy

JD Sports (LSE: JD)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Will JD Sports rescue Debenhams?

Will JD Sports rescue Debenhams?News JD Sports has emerged as a “serious contender” to rescue Debenhams, a move that would escalate its rivalry with Mike Ashley, owner of Sports Direct and House of Fraser.

-

JD Sports is ready to run

Features Retailer JD Sports could buck the sector trend and looks attractively valued, says Matthew Partridge.

-

Athleisure: a tale of two retailers

Athleisure: a tale of two retailersFeatures The athleisure craze is helping JD Sports outrun long-term rival Sports Direct – but its shares are looking pricey, says Alex Williams.

-

Company in the news: JD Sports

Features Phil Oakley tipped retailer JD Sports last April. Here, he sees how the company has got on, what investors should do now.