Athleisure: a tale of two retailers

The athleisure craze is helping JD Sports outrun long-term rival Sports Direct – but its shares are looking pricey, says Alex Williams.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The "athleisure" craze is helping JD Sports outrun long-term rivalSports Direct but its shares are looking pricey.

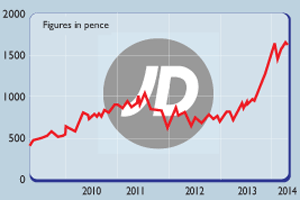

Shares in JD Sports, the sportswear chain, are racing as the company cashes in on a craze for jogging bottoms. The "athleisure" trend the term for clothes that can be worn on the high street and in the gym has pushed JD to a record half-year profit.

Retailers are suffering as sales move online, but the company has positioned itself as "the home" of athleisure, dominated by designer lycra and pricey trainers. The chain's growth has been so fast, pushing up sales 20% to £971m, that it would be "unreasonable" to expect it to continue at its current pace, said the group's chairman, Peter Cowgill.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"Never underestimate" the ability of the fashion industry "to reinvent a trend, give it a fancy name, and try to tell you it's new", says Ben Marlow in The Daily Telegraph. Athleisure is nothing more than an excuse to look fashionable while slouching around in tracksuits for the entire weekend.

Because models are "strutting around" in tracksuit bottoms, many Londoners are slavishly copying the trend, turning up to work in their yoga pants. But it may be more than a passing trend. Staying fit and showing it off has become a cultural norm: going to the gym is no longer a chore, but an "aspirational" form of living, so it's "no longer shameful" to parade around in gym gear.

Contrast JD Sports with its embattled rival Sports Direct, says Paul McClean in the FT. While JD says it has athleisure "sewn up", Sports Direct has focused on being the cheapest retailer, meaning it has missed the trend, as its founder, Mike Ashley, has been embroiled in questions over conditions for workers. As a result, JD's shares are up 50% in the last year, while Sports Direct is down by two-thirds.

JD is showing Ashley "how the game should be played", says Jim Armitage in the Evening Standard. It has no zero-hours contracts and directly employs most of its staff. While Ashley has argued with suppliers about how their products are piled up, JD works with them "hand in glove", setting aside dedicated space for key brands, such as Adidas and Nike. That has fostered a sense of "theatre" around the gym-buying obsession. It is "marketing claptrap, but it works".

The divergence in the two firms' fortunes has been growing for a while. Over two years, JD has shot up 250%, as Sports Direct has issued successive profits warnings. But the stockmarket, Armitage says, is up to speed. Like its lycra gym pants, JD looks overpriced, on a lofty price-earnings multiple of 27 times. Sports Direct is on 6.9 times. "For all the quality on offer at JD Sports, if I were looking for a shares bargain, I know where I'd go."

IPO watch: doughnut king Krispy Kreme

The UK initial public offering (IPO) market has been lacklustre for most of this year, but Krispy Kreme is likely to tempt investors. The IPO is expected to raise around £200m but is it likely to be a good long-term investment?

Trading IPOs can be a winning strategy: between 1965 and 2005, new listings in the US jumped by an average of 22% in their first month of trading, according to one study. However, studies have also found that hot performance early on is usually followed by poor returns. Add in the trend towards healthier eating and it's likely that Krispy Kreme shares will be a bit too sickly for prudent investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Frasers is showing the rest of the retail world how it’s done

Frasers is showing the rest of the retail world how it’s doneTips Frasers Group – formerly known as Sports Direct – is a company many people love to hate. But its policy of judicious acquisitions and its move upmarket have proved to be a huge success and profits are booming, says Rupert Hargreaves.

-

Will JD Sports rescue Debenhams?

Will JD Sports rescue Debenhams?News JD Sports has emerged as a “serious contender” to rescue Debenhams, a move that would escalate its rivalry with Mike Ashley, owner of Sports Direct and House of Fraser.

-

Shambles at Sports Direct

Shambles at Sports DirectFeatures A chaotic set of results at Sports Direct last week wiped a fifth off the shares and fuelled speculation that the company will be taken private. Alex Rankine reports

-

JD Sports is ready to run

Features Retailer JD Sports could buck the sector trend and looks attractively valued, says Matthew Partridge.

-

Gamble of the week: Sports Direct

Tips From an investment perspective, there is a lot to dislike about Sports Direct, says Alex Williams. But could it be worth a punt?

-

Company in the news: JD Sports

Features Phil Oakley tipped retailer JD Sports last April. Here, he sees how the company has got on, what investors should do now.

-

Shares in focus: JD Sports leaves competitors standing

Shares in focus: JD Sports leaves competitors standingFeatures Retailer JD Sports is in great shape, says Phil Oakley. Can the company keep on delivering the goods?