The charts that matter: if the dollar stays strong, everything else will stay weak

The US dollar doesn’t look like weakening anytime soon. John Stepek looks at how that affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

There's a fresh MoneyWeek podcast on its way in which Merryn and I discuss Brexit and the value in UK stocks. Meanwhile, you really shouldn't miss this one Merryn interviews Jonathan Tepper about his book, The Myth of Capitalism, where he explains what's gone wrong with capitalism and how to fix it. Tepper does not want to tear down capitalism, I hasten to add instead he reckons we don't have enough of it.

If you missed any of this week's Money Mornings, here are the links you need.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: What's next for global markets? Keep a close eye on the oil price

Tuesday: What really scares markets about the latest Brexit mess

Wednesday: How much gold does China have? A lot more than you think

Thursday: What does May's victory mean for markets?

Friday: More good news on house prices there's no sign of them picking up soon

And seriously don't miss this week's issue of MoneyWeek magazine in which I look at what a no-deal Brexit would mean for your money. If you're not already a subscriber, sign up here now.

And now... over to the charts.

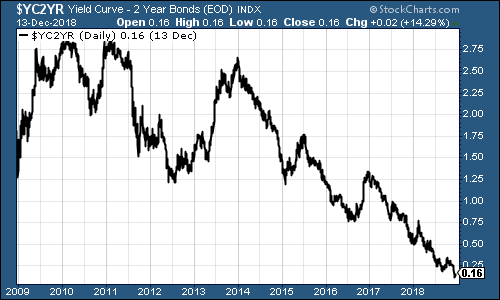

First, the yield curve. If you've forgotten what it is, here's your reminder. The short version is that the chart shows the difference (the "spread") between what it costs the US government to borrow money over ten years rather than two. Once this number turns negative , the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

The key thing to remember here is this until it goes below zero, there's no signal. And this week, it has bounced ever so slightly. So we've still not triggered a recession warning.

(The gap between the yield on the ten-year US Treasury and that on the two-year: going back ten years)

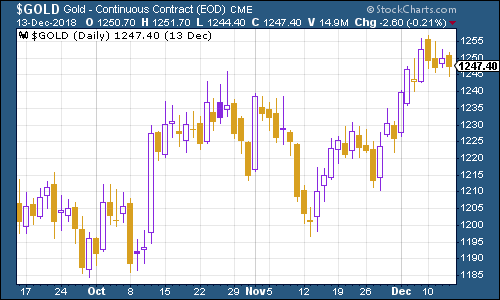

So how about gold (measured in dollar terms)? The yellow metal is still trading at around $1,240 an ounce, but the reality is that until the US dollar shows genuine signs of weakness, gold will have to battle for every step.

(Gold: three months)

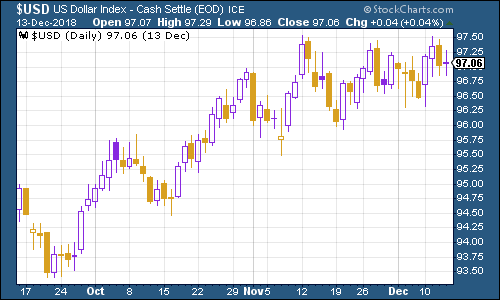

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners is still trading in a narrow range. Will we get a dollar bear market, which is basically what we need to reignite bullishness in pretty much every other market?

It's a tricky one. The problem is that the euro is a key component of the comparison basket, and it is struggling just now as growth weakens in both France and Germany. Unless the US Federal Reserve decides to ditch the December interest rate rise, I'm not sure we'll see a weaker dollar this side of Christmas.

(DXY: three months)

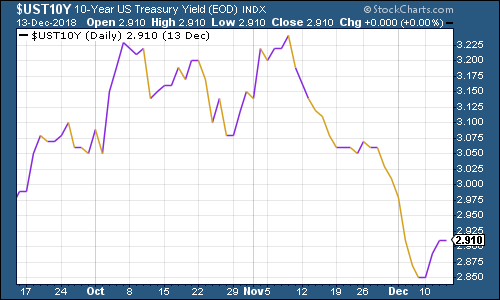

Bond yields continued to fall, although they approached the end of the week off their lowest points the ten-year US Treasury bond remained below 3%, the "line in the sand" that it burst through near the start of this year.

(Ten-year US Treasury yield: three months)

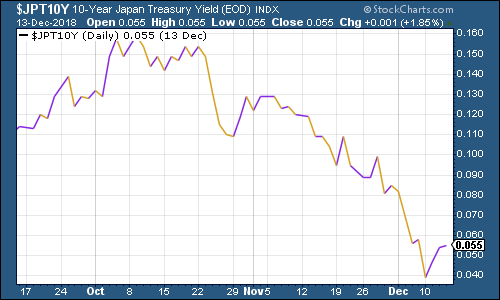

The Japanese government bond (JGB) yield hasn't turned negative again yet but it's far off from doing so.

(Ten-year Japanese government bond yield: three months)

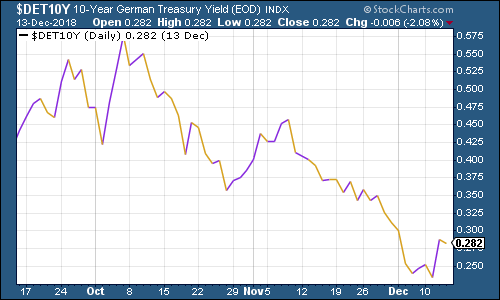

Ten-year German bund yields (the borrowing cost of Germany's government, Europe's "risk-free" rate) climbed a little, partly because the European Central Bank is planning to ditch quantitative easing, which means no permanent buyer of last resort for eurozone bonds anymore.

The spread between German and Italian bonds changed little though, as the Italians made soothing noises about their budget deficit (not to mention the fact that the French decided to blow through the deficit rules without so much as a nod to the EU, makes it a lot harder for Brussels to get too narky with the Italians).

(Ten-year bund yield: three months)

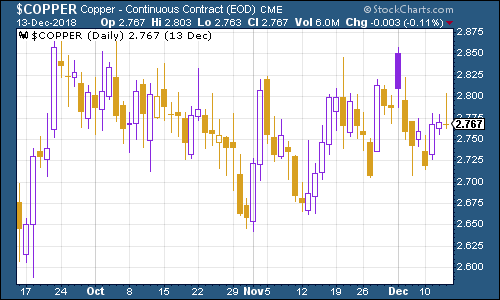

Again, for all the fears of a growth slowdown, copper is still in a period of suspended animation.

(Copper: three months)

There's been no Santa Claus rally for cryptocurrency bitcoin. At the end of November there came a bit of a false dawn, whereby it rallied back above $4,000. But now it's heading back down towards $3,000 and its lowest point since it peaked in December last year.

One thing I am starting to wonder how much are bitcoin's woes this year down to attempts to crack down on capital flight from China? That's one angle I will look into I'll let you know if I find anything helpful.

(Bitcoin: tendays)

Here's an early warning recession indicator that does have me slightly concerned the four-week moving average of weekly US jobless claims. This week it dipped to 224,750, as weekly claims came in at just 206,000. That was the lowest level since the 202,000 we saw in mid-September which was the best showing since 1969. However, the four-week moving average is still well above the most recent trough.

As David Rosenberg of Gluskin Sheff has noted in the past (and fair warning, this is taken from a small sample size), the stockmarket usually does not peak until after we've seen jobless claims (as measured by the four-week moving average) hit rock bottom for a cycle. On average, the peak follows about 14 weeks from the trough for jobless claims. A recession follows about a year later.

So if mid-to-late September was the bottom, that would imply a market peak around late December, or the start of next year. As I've already noted, the data is particularly dodgy around this time of year, so I wouldn't write off a fresh trough yet. That said, US payroll figures were pretty disappointing in November so this is one indicator to keep a very close eye on.

(US jobless claims, four-week moving average: since January 2016)

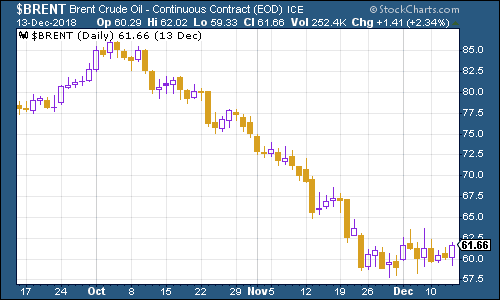

The oil price (as measured by Brent crude, the international/European benchmark) continues to struggle (and had fallen hard at the time of writing on Friday night). That said, it isn't heading for new lows as yet. Again, I think the oil price is well worth monitoring a recovery would likely signify a turn for markets, whereas a fresh slide would probably mean the same for stocks.

(Brent crude oil: three months)

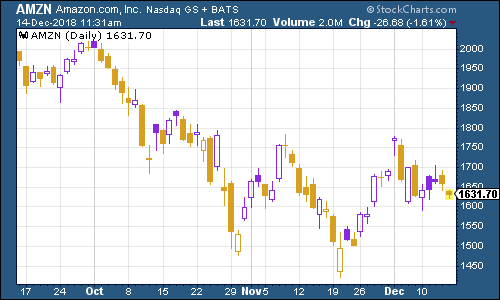

Internet giant Amazon didn't make it back above $1,800 (I reckon that if it does we get to the point then we can probably argue that this correction is over). Indeed it has slipped back over the past week, which has been another rough one for markets.

(Amazon: three months)

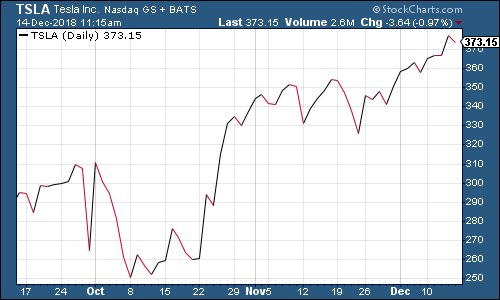

What can I say about electric car group Tesla? The stock is near an all-time high, and analysts keep raising their price targets on it. Frankly, it's staggering, particularly at a time when the rest of the market has taken on a rather more "tentative" tone, to say the least.

Things like this make me think two things: firstly, if a trade looks obvious (like "short Tesla"), it's often wrong, or way too early, which in the case of short-selling (which cannot be comfortably held for any great length of time) is the same as being wrong.

Secondly, if Tesla can keep rising then you have to ponder whether or not this market is really as vulnerable as it might feel.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

UK interest rates live: experts expect MPC to hold rates

UK interest rates live: experts expect MPC to hold ratesThe Bank of England’s Monetary Policy Committee (MPC) meets today to decide UK interest rates. The last meeting resulted in a cut, but experts think there is little chance of interest rates falling today.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension