How to arm your portfolio for the new global arms race

Russia and China are becoming more bellicose, while our defences look threadbare. Jonathan Compton explains how investors can profit from the West’s belated scramble to square up to potential enemies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Russia and China are becoming more bellicose, while our defences look threadbare. Investors can profit from the West's belated scramble to square up to potential enemies, says Jonathan Compton.

"Cry Havoc!' and let slip the dogs of war" Julius Caesar, Act 3 Scene 1

Alexander the Great's military policy was as extreme as it was effective. Each state he invaded was offered a simple choice: immediate surrender or be flattened. In the latter scenario, every male over 12 was put to the sword and women were forcibly married to his soldiers or sold into slavery. The area was repopulated with loyal immigrants from Greater Macedonia. Usually outnumbered in battle and with little technological edge, Alexander won through a combination of mobility, aggression, good intelligence and organisation. Not only were his wars self-funding and the Macedonian treasury bursting at the seams with conquered loot, but he was also the only person in history who managed to subdue Afghanistan.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As an investor in World Conquest plc, you would have been ecstatic with the returns produced by CEO Alexander the Great. Today, with the global geopolitical outlook ever more threatening and the forces of liberal democracy scrambling to catch up with hostile powers in a global arms race, World Conquest plc is again looking a good investment especially since the defence sector is contracyclical, and offers investors growth at a time when the global economic and stockmarket upswings could soon run out of steam.

We have a dictator problem

I remain convinced that liberal democracy, with its individual rights and relatively free markets, is the best form of political and economic governance yet devised. At the turn of the century I was happy this model had seemingly triumphed, yet in truth it is in rapid retreat. We now have a dictator problem. Most people three-quarters of the world's population are either ruled by de facto dictators (Russia, China, The Philippines, Turkey and most of the Middle East), or by rampant nationalists (India and many less powerful nations). Dictators and nationalists often turn to foreign adventures when they want to find a distraction from economic downturns. The drift towards authoritarianism comes on top of perennial flashpoints such as the Israel-Palestine conflict or Kashmir.

Three key developments stand out. The first is the reign of Vladimir Putin, who notoriously stated in 2005 that the "collapse of the Soviet Union was the major geopolitical disaster of the century". Ever since, he has proven aggressively opportunistic in trying to rebuild Russia's territory, reach and military. He started with overwhelming cyberattacks in Estonia in 2007, invaded Georgia in 2008 and seized Crimea in 2014.

Every neighbour save China has come under pressure, and whenever an opportunity arises, he moves. Sometimes he offers money, propaganda, or cyber support to pro-Russian political parties, as in Hungary or Serbia; sometimes threats, as in the Caucasus. When political stalemate arises, his troops soon follow as in Syria. The recent assassination attempt of Sergei Skripal is but one paragraph in a long book of state-sponsored murder under Putin.

The second development is in China. President Xi Jinping has more real power than any previous ruler, including even Kublai Khan. Policy is increasingly expansionary. In the 1980s its armed forces were vast but had puny firepower. A programme of modernisation followed, shrinking the armed forces to two million and, with ever-improving manufacturing and advanced technology, upgrading its equipment. China's two new aircraft carriers, more for training than warfare, demonstrate the extent of the upgrade. The next generation will be as good as anything America can offer.

China is gradually taking control of much of the Western Pacific by occupying disputed islands and militarising them. It is also developing state-of-the-art cyber warfare, intelligence and data gathering. This year alone China has been caught stealing vast amounts of data or interfering in elections across Asia and according to Microsoft (and many other leading US tech groups) throughout America. China is also using its financial muscle. It has created the Asian Infrastructure Bank based in Beijing as a counterweight to the US-dominated IMF and World Bank. In poor countries it is building computer infrastructure for free, preparing the ground for future cyber espionage.

The third trend, which has facilitated the first two developments, has been America's foreign policy vacuum. Bruised by repeated failures from Vietnam to Iraq and Afghanistan its appetite to be the world's policeman has waned. President Obama spoke frequently on foreign affairs (remember his "pivot to Asia" policy?) but then did nothing.

President Trump, meanwhile, has sent out very mixed messages. He has rattled America's allies within and outside of Nato with threats to remove the vital US military umbrella if they do not up their defence budgets and reduce their dependency on "enemies". Hence Trump's criticism of Germany cuddling up to Russia for energy, which by 2025 will provide more than half its gas supply. In the meantime, though, he cosies up to Putin. He has also repeatedly threatened China, now in the form of tariffs on a wide range of imports, but it is not clear what he is trying to achieve. His short attention span and erratic behaviour suggest the vacuum will endure.

A Sino-Russian alliance

The old USSR and Nazi Germany formed the 1939 Molotov-Ribbentrop Pact, which combined mutual non-aggression, trade and investment deals and secret plans for the partitioning of Poland. The current mutual-admiration club between Russia and China has alarming echoes of that period. In 2010 Russia carried out a major military exercise to simulate conflict with China. Yet this month saw Vostok 18, the largest military exercise by Russia in more than three decades. This involved 300,000 troops, 1,000 aircraft and nearly the same number of tanks, and was joined by China's People's Liberation Army. This exercise was against "other enemies" (you, me, Japan and Nato) and mirrors other deepening ties in trade, naval co-operation and investment.

President Xi Jinping recently described President Putin as his "best, most intimate friend". Western defence experts tend to play down this love affair as an axis of convenience. But as each country secures its own back door by cosying up to its neighbour, Russia gains the space to pursue its agendas in Europe and the Middle East while China can do the same in the Pacific. America's reaction has been a puny joint exercise with India. It is ill-prepared to face gradual incursions by either, let alone both.

The West: inefficient, underpowered and outplayed

On paper the liberal democracies have overwhelming financial strength and firepower. In 2017 the world's military expenditure was $1.7trn, roughly 2.2% of global gross domestic product, only a tiny increase since the 2008 financial crash. Of this, America accounted for a third (twice Russia and China combined), the rest of Nato about 14%. Adding in natural allies such as Japan and Australia, the "good guys" make up just under two-thirds of world military expenditure, even more in terms of firepower. Yet within this picture of stagnant budgets, China's military spending has more than doubled in the past decade, and Russia's already much higher as a percentage of GDP has risen by 50%. What's more, the data is seriously misleading.

Consider the number of battlefield tanks, a vital weapon in any conflict. In theory Venezuela has more tanks, at 690, than Britain and France combined, but given the mess the country is in I'm not alarmed. By contrast, Germany's main battle tank, the Leopard 2, is reckoned the best in the world. On paper the Bundeswehr has 250, but according to the German Ministry of Defence only 95 are battle-ready. The rest are disarmed or lacking spares. In February, the head of the German Armed Forces Union reported that the country's military lacks"everything"from combat-ready helicopters and aircraft to soldiers.

Prime Minister Abe in Japan has been more bellicose; the country's Self-Defence Forces have improved considerably. But Japan still spends less than 1% of GDP on defence. Japan and Germany are huge economies but military pygmies. On paper between them they have 1,250 quality tanks. Even on the unproven assumption that Russia's 20,000 and China's 10,000 tanks are less effective or that only half actually work, each country could flatten its neighbours with ease should America choose not to help. Meanwhile, the RAF is short of flight-ready modern combat aircraft and we will have no maritime patrol planes at all until 2020, while trophy projects such as two new aircraft carriers will not have their full complement of aeroplanes until 2023 at the earliest. This is highly unwise for an island nation.

The liberal democracies often don't get much bang for their buck, either. Last month off Falmouth I saw the latest tanker in the Royal Fleet Auxiliary: 45,000 tonnes at a cost of $200m. A spanking new civilian tanker of the same size costs around $50m. Even allowing for extra military kit and technology, it is very expensive. This pattern is repeated in most democratic defence ministries, which have an appalling record of overspending or buying the wrong equipment.

While such incompetence is partly due to asking people trained in warfare to oversee highly complex design, engineering and manufacturing, the underlying problem is that Britain, or say Germany, lack scale. Making a limited number of highly advanced tanks or ships is always going to be expensive. The obvious solution is to pool resources, but this runs the risk of being dependent on a foreign power which might fail to deliver or change its mind.Add this all up, and the West has a problem. History shows that being under-armed and underprepared is a bad choice.

The virtual battleground

Cyber warfare is another area we need to keep a close eye on. We cannot know the effectiveness of our systems until they are seriously tested. But we do know that China's tech companies will soon be as good as, or better than, their American and European counterparts, implying that their military applications will also be top-notch. We also know that within national budgets, cyber expenditure by Russia and China has been ramped up dramatically over the past decade, at a far faster rate than in the West.

Commercial cyberattacks sourced from both countries are proving ever more effective. In 2017 the NHS fell over in an hour following a brief cyber-attack, allegedly by North Korea. If Pyongyang really was behind it, we should be really afraid given that the country has no tech sector. It is more likely to have been a minor Russian or Chinese test. They must have been very encouraged by the results.

We are finally fighting back

Yet the tide is turning. Every liberal democracy has woken up to the threat of major foreign powers seriously interfering in its domestic affairs, its under-equipped armed forces, and the fact that American support is no longer guaranteed. Defence budgets have therefore started to rise worldwide as even the squishiest peaceniks are recognising the threats. America is budgeting an 8% increase in 2019. Japan is buying new F-35 stealth fighters, giving it the ability for the first time to reach targets in North Korea and China.

Australia has embarked on a ten-year splurge on defence equipment, spending an extra A$200bn. North Vietnam has opened its ports to visiting American warships for the first time since conquering the South in 1975. Meanwhile the US vacuum is creating new alliances such as deeper co-operation between Japan, India and Australia, or within Asean. In Europe defence budgets are also set to rise and globally, according to Jane's Defence Spending, military expenditure will increase 3.3% this year, exceeding the post-Cold War high set in 2010. The belated recognition of all the threats we face and the consequent global arms race spell opportunity for investors. We look at some of the most interesting defence plays below.

The best stocks to buy now

In defence, size matters, so I concentrate on companies with the ability and financial strength to take on complex long-term contracts. One easy route is an exchange-traded fund (ETF) to track defence stocks.

The SPDR S&P Aerospace & Defense ETF (NYSE: XAR) invests in leading US aerospace and defence businesses; the iShares US Aerospace & Defense ETF (NYSE: ITA) does largely the same but has a tighter focus on pure defence plays.

As I cannot find a global armaments fund I propose four leading companies and one smaller, specialist group. I own two UK companies. BAE Systems (LSE: BA) is one of the five largest defence companies in the world and the predominant supplier to the Ministry of Defence. Over time it has gobbled up many competitors and now spans the industry. Aircraft is the largest sector by sales at more than 50%, followed by warships, armoured vehicles, armaments and defence electronics.

BAE has global reach, its largest market being America. Interests include theLockheed Martin F-35 Lightning II, theEurofighter Typhoon, submarines, aircraft carriers and the Australian frigate programme.

Cyber and specialist electronic warfare systems are two fast-growing areas. In the UK the relatively small (£1.5bn) Qinetiq Group (LSE: QQ) is the nearest we have to a defence technology company. It designs and combines different software systems and has a euphemistically named "disruptive" division.Spun out of the Ministry of Defence, it has broadened its reach so that now 30% of revenue is from overseas.

Germany is set to spend more on defence and a major beneficiary will be Rheinmetall (FRA: RHM). Apart from making the guns for the Leopard 2 tank, it manufactures other cannons, armoured vehicles, infantry weapons and ammunition.

A €4bn company, it has seriously lagged Germany's DAX index and looks too cheap. Under-borrowed with a good order book and a forward multiple of 15 times, it is one to lock away.

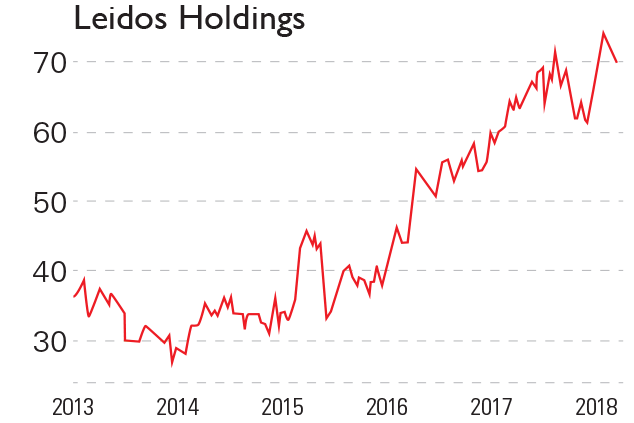

Nearly 70% of the earnings from Leidos Holdings (NYSE: LDOS) arise from defence. Mid-sized with a $10bn market cap, it is nevertheless the largest global player in "technical defence solutions": cyber warfare. US broker Jefferies has it on a 2018 price-earnings ratio of 15, with a growing order bookand strong free cash flow.

The larger L3 Technologies (NYSE: LLL) has almost equal revenue from electronic, sensor, aerospace and communications systems. New orders and acquisitions should see an acceleration in growth next year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

No peace dividend in Trump's Ukraine plan

No peace dividend in Trump's Ukraine planOpinion An end to fighting in Ukraine will hurt defence shares in the short term, but the boom is likely to continue given US isolationism, says Matthew Lynn

-

Investors need to get ready for an age of uncertainty and upheaval

Investors need to get ready for an age of uncertainty and upheavalTectonic geopolitical and economic shifts are underway. Investors need to consider a range of tools when positioning portfolios to accommodate these changes

-

6 natural gas stocks to buy to profit from the gas gold rush

6 natural gas stocks to buy to profit from the gas gold rushTips Natural gas will be a crucial source of power for years to come, says Matthew Partridge. Here are six natural gas stocks to buy to benefit.

-

The challenge of turbulent markets

The challenge of turbulent marketsAdvertisement Feature Today, ISA investors face one of the most challenging economic environments seen in recent years. However, good companies can still thrive, even in the toughest economic conditions. That’s why BlackRock’s fund managers focus on these businesses when they’re looking for investment opportunities.

-

High energy prices are here to stay

High energy prices are here to stayAnalysis The rising cost of producing energy means high oil and gas prices are here to stay argues Max King

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.