Why you should give the US stockmarket the benefit of the doubt – for now

There are plenty of reasons to think that US stockmarkets are due a big fall. But they carry on rising. It will happen eventually, says Dominic Frisby, but not yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

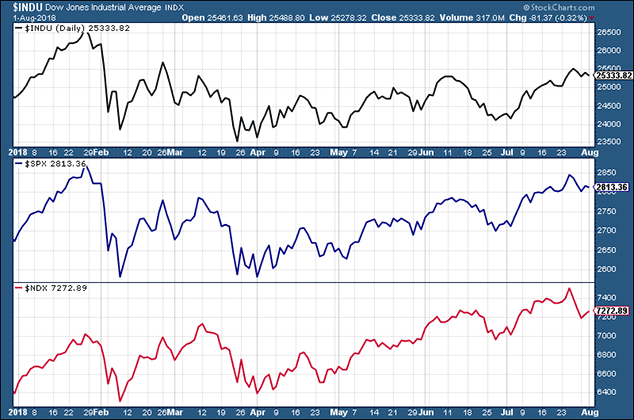

Today we consider the main US stockmarkets: the Dow, the S&P 500 and the Nasdaq.

Where others have slid, they have held up. Just.

Does this mean there's a shorting opportunity here? Where others have gone, the US markets are bound to follow?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Or is the relative strength they have shown here a sign of markets that want to go higher?

Reasons to be fearful, part 392

There have been several "anti-bull-market" narratives coursing through the world of finance these past few months.

First and foremost, is President Donald Trump's continued talk of tariffs and protectionism, of putting "America first". Fear of trade war has pushed the US dollar higher and many international stockmarkets, most notably China, lower. It has also kicked commodities, especially metals, right where it hurts.

Second, is tightening monetary policy. The US is now most definitely in a rate-tightening cycle and the reality of this sinking in. Yesterday the Federal Reserve Open Market Committee (FOMC) voted unanimously to keep rates on hold, which was widely expected, but its view of the US economy was upgraded to "strong" the Fed chairman, Jerome Powell, used the word "strong" four times in the first paragraph.

The inference is that there will be a rate rise in September and another later in the year, probably in December. Markets have now given a September rise a 90% probability. The central bank has targeted three more rate rises in 2019, though the market is pricing in only one move. Early days.

But the idea that there will be two more rate rises in 2018 is not new. It's been expected for some time. Rob Hanna of Quantifiable Edges has studied the performance of the S&P 500 on FOMC days under Powell, and found that markets tend to rise, perhaps due to Powell's tendency to avoid surprises.

So the fact that the main indices sold off a little yesterday might be deemed a little concerning but given that the sell-off was tiny (the Dow sold off 0.3% and the S&P 500 by 0.1%), I do not see too much to worry about.

Third, there has been the disappointment of the markets star performers in recent years, the FAANG stocks Facebook, Amazon, Apple, Netflix and Google, which John wrote about yesterday.

Netflix announced disappointing earnings a fortnight or so ago, then Facebook did the same on 25 July and duly lost 24% of its market cap. Facebook missed its revenue targets by a small amount (earnings were $13.23bn as opposed to the $13.36bn Thomson Reuters consensus estimate).

The number of users also disappointed, but the main concern seems to be the "fake news" scandals, the way user data gets exploited and the potential for significant government clampdown, which will disrupt its potential.

The result was the disappearance of an eye-watering $123bn in market cap.

Twitter also saw a major sell-off of 20% last week when it announced a decline in monthly users, even if its revenue matched expectations. Twitter is less significant than the FAANGs, but the disappointment is still a major dent in the pro-tech bullish narrative.

However, this same narrative was given a boost this week after Apple reported strong third-quarter earnings, which beat expectations turns out people are happy to buy thousand-dollar phones.

Tesla also reported a second-quarter loss yesterday, which was greater than expected, but bullish chat from the CEO, Elon Musk, in which he backed prior forecasts for profitable third and fourth quarters, sent the stock 11% higher in after-hours trading.

I'd say that those are three very dangerous themes trade wars, tightening monetary policy and a wobbly tech sector. And in a plummeting stockmarket environment, they would easily be enough to explain any falls.

It doesn't pay to be too bearish all the time

But we do not have plummeting US stocks. All the indices are up on the year.

Sure, they're not at their year highs. For the Dow and the S&P 500 these came in January. For the Nasdaq, these came last week.

But after a rocky February and March, all three indices have remained in uptrends. Below we see the year-to-date performance of the Dow in black, the S&P 500 in blue and the Nasdaq in red.

They're in clear uptrends. And this has been the case since April.

2018 has not been the runaway bull market that we saw in 2017. Rather, I would describe it as a year of consolidation a consolidation that was both necessary and inevitable. Consolidations happen both through time and price. If a consolidation takes place with a gentle uptrend, that is a good sign.

I look at charts and I get jittery. I look at the news and I get jittery. But I always get jittery. That's normal.

Sure we could could get a classic autumn crash, and it would look obvious in the rearview mirror. But for now, in my mind, you have to give the US stockmarket the benefit of the doubt. It has remained strong in the face of some very anti-bullish narratives.

If it continues to creep up to the extent that the Dow and the S&P 500 retest their old highs, or even exceed them, the strength of the markets will become very clear and suddenly a FOMO trade (fear of missing out panic buying) comes into play, and that will push stocks sharply higher.

We'll get a bear market eventually, but I don't think we are quite there yet.

Finally, a little bit of self-promotion: if you're in Edinburgh for the festival this August, please come to my show Dominic Frisby's Financial Gameshow at the Gilded Balloon. You will laugh, you will learn, and there are all sorts of fab prizes to be won including MoneyWeek subscriptions (thank you MoneyWeek), silver bars (courtesy of Sharps Pixley), bitcoin cash and a whopping £500 jackpot, courtesy of a bitcoin cash.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King