Take a punt on Premier Oil

Oil explorer Premier Oil, back from the brink, is now a cheap turnaround play, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Small oil companies can shatter investors' nerves as well as their finances. The story typically begins as follows: a company acquires the rights to a prospect. It then announces that exploration results have been encouraging, which allows it to borrow money to develop the field. The share price soars on the hype. It then transpires that the initial estimates were overoptimistic, or the cost of drilling rises so quickly that the whole project becomes uneconomic. Investors get cold feet, sending shares crashing, while angry creditors refuse to lend the company any more money, which can sometimes trigger bankruptcy.

A few years ago Premier Oil looked set to become another cautionary tale. Between August 2014 and January 2016 the shares slumped by 90%. Financial problems, combined with the fall in the price of oil, threatened its viability. In early 2016 the shares cost a mere 19p. It managed to cling on. Buoyed by the recovery in the oil price, the shares have rallied sixfold over the past 30 months and are now trading at 127p.

North Sea field comes to the rescue

The main reason for this dramatic turnaround is that at the end of last year production finally started in the Catcher oil field in the North Sea, which Premier controls. This dramatically boosted its cash flow, allowing it to start paying down debt. The success of the Catcher field has also allowed Premier to persuade its lenders to extend the maturities of their loans. Now, instead of a large amount of debt coming due next year, virtually none of it will have to be repaid until 2021, which provides Premier with valuable breathing space.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's more good news. Last year the company, in conjunction with its American partner Talos, discovered Zama, a major offshore field in the Sureste Basin off the Mexican coast. Since Premier's block borders a holding by Pemex, the Mexican oil giant, Pemex is conducting additional drilling to test the extent of this find. The two companies are also talking about teaming up to develop the wider block, which should boost output. Premier has also begun to develop the Tolmount prospect, off the coast of Yorkshire, an area that could potentially yield both oil and gas.

It's important to stress that Premier is still far from a risk-free investment. Despite recent deleveraging, it still has a large debt pile. It is also vulnerable to any falls in the oil price (although this seems unlikely for now if anything, the supply/demand dynamics suggest that prices are far more likely to rise). However, the stock is priced at bargain-basement levels. It is on a 2019 price/earnings (p/e) ratio of 5.5; by contrast, the oil majors typically trade at 2019 p/es of around 15-20. This should provide a comfortable "margin of error" for investors and more than compensate for any downside risk. We'd suggest that you buy Premier Oil at 128.5p, at £25 per 1p. Because oil shares can be volatile, there's no point in having an overly tight stop, so we'd put the stop-loss at 88.5p. That gives you a potential downside of £1,000.

Trading techniques pairs trading

The problem with taking a single long (or short) position is that you're betting on two things: the performance of the individual asset, and the performance of the market as a whole. Even if a share outperforms other companies, you could still lose money if a falling equity market means it loses value. Pairs trading tries to get around this by focusing on relative, not absolute, performance. So in theory you should make money whatever the wider market does (assuming your bet is correct).

The technique involves taking both a long position and ashort position at the same time.The two stocks in questionwill usually have similar characteristics; they may be members of the same sector, for instance. That way, they are easier to compare and not susceptible to too many different variables. The idea is that one will do better than the other. You take a long position in the share that you expect to do better, and a short position in the other one. As a result, even if both shares fall, the money that you make from the short will more than compensate you for losses from the long position (assuming that the "long" falls by less than the "short").

When placing a pairs trade it is vital to ensure that your total exposure to both firms works out at the same amount. Say Company A is trading at 100p and Company B at 50p. If you go long on A at £1 per 1p, then you will need to go short on B at £2 per 1p. Bear in mind that the success of the pairs trade depends entirely on the relative performance, so if you're wrong and B outperforms A, then you will lose money, even if A's value rises in absolute terms.

How my tips have fared

All in all, it's not been the best two weeks for our tips. Our long positions haven't done that well with six out of seven of them losing ground. Semiconductor group Micron has fallen back to $53.01 (from $56.96), pubs operator Greene King is now 516p (535p), housebuilder Redrow is 532.5p (541.5p), airline Wizz Air is down to £34.26 (£38.13), fashion chain Next is £59.06 (£60.50) and drugs group Shire is £43.41 (£43.25). Indeed, the only share that managed to buck the trend is spread-better IG Group, now at 908p. In all, the net profit on our long positions is down to £569.25.

By contrast, the movements in our two short positions have essentially cancelled each other out. A few days ago the price of bitcoin moved above $8,000 for the first time since May. It is currently at $8,002, which means our profits on the trade have fallen to £806. However, Tesla's share price has fallen to $290.17, due to shareholders' ongoing irritation at Elon Musk's leadership of the electric-car group. While this is still above the $283 at which we recommended shorting it back in May, it does means losses on this position are now the lowest they have been.

One of our biggest dilemmas has been deciding when to close out trades. We always recommend you put a stop-loss on any trade to prevent losses spiralling out of control. However, we'll now also start automatically closing any trade that is unprofitable after six months. In cases of trades that are older than six months, but profitable, we'll keep adjusting the stop-loss upwards to lock in profits. We'll therefore stick with IG Group and our bitcoin short for now, since both are our best performers, but keep an eagle eye on them to ensure that they are worth keeping in the portfolio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

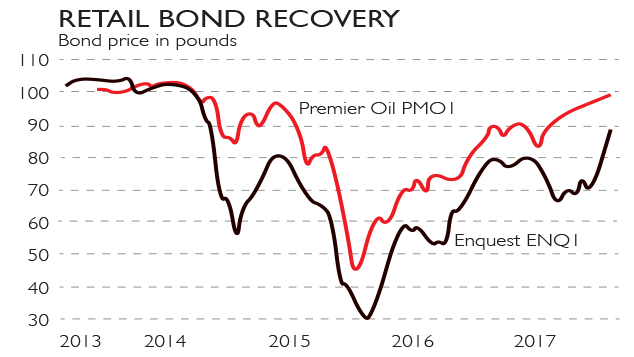

Two oil bonds for adventurous investors

Two oil bonds for adventurous investorsFeatures Two once-bedraggled oil exploration and production firms have issued bonds that promise investors a chunky yield. But they're definitely not for the nervous, says David C Stevenson.

-

Not every short-seller has had a wonderful week

Not every short-seller has had a wonderful weekFeatures Short-sellers made a fortune betting against Carillion earlier this week. But they don’t always win. John Stepek looks at the risks of short-selling, and a bet that turned bad.