Two oil bonds for adventurous investors

Two once-bedraggled oil exploration and production firms have issued bonds that promise investors a chunky yield. But they're definitely not for the nervous, says David C Stevenson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Energy stocks are in fighting form as Brent oil prices surge back to around $70 a barrel. This recovery is most obvious with the once-bedraggled exploration and production (E&P) players, such as London-listed Enquest and Premier Oil. These firms had a torrid few years as oil prices threatened to crash all the way down to $20 a barrel, making their main focus on expensive North Sea oil almost completely uneconomic.

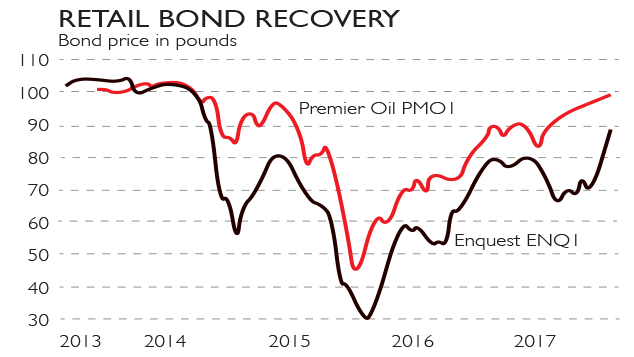

Share prices plummeted and the panic also hit their bonds (see chart below). Both had tapped the retail-bond market to help fund their capital expenditure, which seemed a great idea until the oil price collapsed at which point many retail investors overreacted by selling down their bonds at ludicrous prices. Most investors in distressed debt are comfortable with the idea that recovery rates on bonds in trouble are usually somewhere between 50p and 70p in the pound. Yet at varying points over the past few years, Enquest's retail bonds have traded below 50p in the pound.

Both Enquest and Premier realised their debt levels were too high and that bond investors were signalling a very real risk of default. This forced both to start renegotiating with their bondholders to stabilise their finances. That painful and protracted process finished with Premier Oil's deal with its bondholders last year (Enquest agreed a deal back in 2016). Meanwhile, both firms have benefited from some very helpful tailwinds at the operational level. The oil price has risen, while crucial new fields under development which required all that capital expenditure have also started to come online, kicking in extra cash flow.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In better shape

I've championed these bonds both here and in my column for the Financial Times before, and I am a very happy investor in both. The more obvious investment case is for Premier Oil's bonds. As part of the restructuring, Premier agreed to a higher interest rate of 6.5% per annum through to 2021 a yield to maturity of around 6.75% at the current price. Bond investors are also being paid additional equity, via warrants that are triggered above 42.75p a share (Premier's share price is now around 100p). So investors get a chunky yield for the next three years and some of the potential upside from the shares.

The Enquest bonds are for the more speculative investor. As long as the oil price stays below $65 a barrel, Enquest is now paying out an effective interest rate through to 2022 of 7% compounding per annum but in new bonds rather than cash. If oil is above $65, it pays in cash. This is known as a payment-in-kind (PIK) toggle note.

Both Premier and Enquest are still highly leveraged Premier has total debt of $2.7bn versus a market cap of £637m, while Enquest has $1.9bn of debt and a market cap of £448m. That makes both of these bonds risky. If the oil price crashes again, both could be in trouble once more. However, both are in much better operational shape and are churning out cash, which should increase as their production levels rise. I'm bearish about oil, but I don't think prices will slip much out of a $40 to $60 range. If that is the case, both Premier and Enquest might survive even at lower prices than today. There are risks, but Premier in particular looks a decent bet for a risk-tolerant income investor.

Markets signal better prospects

The more confident outlook and successful restructuring of Enquest and Premier Oil has been reflected in the price of their retail bonds. The Enquest 2022 notes have recovered from a low of just under £30 to £88 now. The Premier Oil 2021 notes are almost back to their issue price at £99.

| Name | Enquest | Premier Oil |

| Ticker | ENQ1 | PMO1 |

| Exchange | LSE ORB | LSE ORB |

| Currency | GBP | GBP |

| Original maturity | 15 February 2022 | 11 December 2020 |

| Original coupon | 5.5% | 5.0% |

| Original type | Fixed rate, unsecured | Fixed rate, unsecured |

| Revised maturity | 15 April 2022 | 31 May 2021 |

| Revised coupon | 7% | 6.5% |

| Revised type | PIK toggle, unsecured | Fixed rate, secured |

| Other revised terms | Extendable to October 2023 | Equity warrants |

| Frequency | Semi-annual | Semi-annual |

| Payments | 15 February, 15 August | 11 June, 11 December |

| Size | £155m | £150m |

| ISIN | XS0880578728 | XS0997703250 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Take a punt on Premier Oil

Take a punt on Premier OilFeatures Oil explorer Premier Oil, back from the brink, is now a cheap turnaround play, says Matthew Partridge.

-

Not every short-seller has had a wonderful week

Not every short-seller has had a wonderful weekFeatures Short-sellers made a fortune betting against Carillion earlier this week. But they don’t always win. John Stepek looks at the risks of short-selling, and a bet that turned bad.