Not every short-seller has had a wonderful week

Short-sellers made a fortune betting against Carillion earlier this week. But they don’t always win. John Stepek looks at the risks of short-selling, and a bet that turned bad.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week, short-sellers made a huge amount of money on one of the most-shorted stocks in the UK.

Support services group Carillion saw its share price topple by more than 70% this week and until there's more clarity on its future, it's hard to see where the bottom lies for this one.

But lest you think it's all strawberries, cream and champers for the shorts, this week also saw a lot of them get stung on another heavily shorted company.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Enter Premier Oil...

Short-selling is a risky business

As we discussed earlier this week

There is a widespread element of distaste for short-sellers. This, I feel, is unfair. Dislike of short-sellers stems from a number of reasons, almost all of them related to the fact that short-sellers often embarrass a lot of different powerful groups.

Anyone who blithely held Carillion, for example, in the face of all that short interest, will now be feeling somewhat chastened, and keen to find someone else to blame for their error. Short-sellers make a good target.

Regulators find them useful scapegoats too, when sectors that they claimed to be entirely sound turn out to be as rotten as termite-infested timber. Closely related to this is the dislike that governments have for them (witness short-selling bans during financial panics).

All in all, they are convenient to have around when something goes hideously wrong and you want to blame it on someone else mischief-making, parasitic speculators make a great target.

But I have a lot of sympathy for short-sellers. It's not easy to make money by short-selling. So you have to articulate your case far more clearly than many "long-only" investors. Put bluntly, long investors can be lazy. Short-sellers can't afford to be. They might be dreadful speculators, but they're dreadful speculators with a work ethic.

And when their bets go wrong, it's pretty painful as many of them found out later this week.

If you're a short-seller, you ultimately want to find a company whose share price is potentially heading towards a big fat zero. That's your holy grail.

So what makes the perfect short-selling target? One key characteristic is companies that are carrying a lot of debt or rather, companies that are carrying enough debt that they rely on being lucky, or on the indulgence of their creditors, to keep afloat. That sort of precarious situation is catnip to short-sellers.

You'd also want this company to be in a sector where there's a good chance that its future revenues are going to fall short of expectations. In fact, what you really want is a company that loaded up on debt based on revenues coming in at one level, and where revenues are now likely to horribly disappoint.

Hmm. Where would you find such a sector?

The tricky thing about betting on oil stocks either way

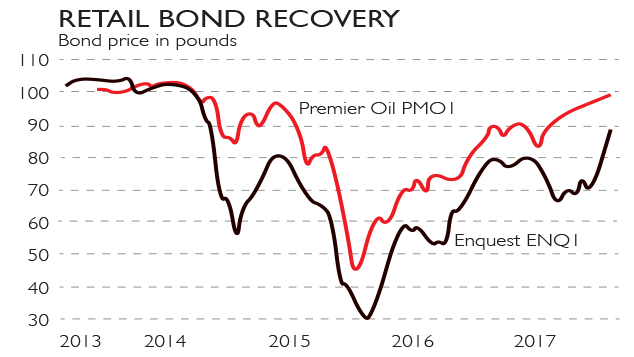

So there were bound to be some particularly vulnerable-looking stocks in the sector. And Premier Oil was one of the bigger ones to fit the bill.

The company has recently organised a financial restructuring after "a year of wrangling with lenders and bondholders", as the FT puts it. And it still carries more than £2bn in debt.

The ultra-forgiving world of zero-percent interest rates has undoubtedly helped it to stay afloat yield-hungry banks and lenders aren't as keen to pull the plug as they might be if better offers were on the table but it's not a position any company particularly wants to be in.

Of course, the tricky thing about oil stocks is that you can never be quite sure of when they might strike it rich. That's the problem for "long" investors in oil stocks they might be waiting in hope forever but it's also the problem for short-sellers. You never know when your rational case for being short could be upended by a lucky break.

And that's what happened to Premier this week. On Wednesday it announced a huge oil find in Mexican deep waters. It's one of the biggest such discoveries in the last five years, and a lot bigger than expected.

Premier owns 25% of the block. It was part of a consortium with Talos Energy and Mexico's Sierra Oil and Gas, which was awarded the exploration rights by Mexico's government in 2015.

As a result, the shares rocketed by around 35%. That would have been painful for anyone on the short side. And while there's still scope for future disappointment, it looks a lot more dangerous to be betting on the share price to tank from here.

To be clear, that's not a recommendation to buy into Premier it's not a stock I know a huge amount about, so do your own research but it's just worth noting: for every fantastic punt the short-sellers take flak for, there's a load of them nursing their burnt fingers on some other short that's gone wrong.

There are no sure things in markets. And that's the only reason the whole system works.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Take a punt on Premier Oil

Take a punt on Premier OilFeatures Oil explorer Premier Oil, back from the brink, is now a cheap turnaround play, says Matthew Partridge.

-

Two oil bonds for adventurous investors

Two oil bonds for adventurous investorsFeatures Two once-bedraggled oil exploration and production firms have issued bonds that promise investors a chunky yield. But they're definitely not for the nervous, says David C Stevenson.