The charts that matter: markets are getting nervous about global growth

John Stepek examines what effect investor concerns over global growth have had on the world's most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you missed any of this week's Money Mornings, here are the links you need.

Monday: What are leveraged loans and why should you worry about them?

Tuesday: What's behind the recent slide in the oil price?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday: Good news for markets fund managers are feeling jittery

Thursday: This is usually a good month to buy gold but it's a tough call this year

Friday: London's luxury new-build property is in big trouble

Other things you shouldn't miss this week: here' Merryn's take on Britain's productivity puzzle, and how it might be about to turn around. And the podcast is back!

This week Merryn and I talked about inflation, wages, oil, Brexit, the Japan/EU trade deal - and, of course, house prices. Have a listen here.

Now over to this week's charts.

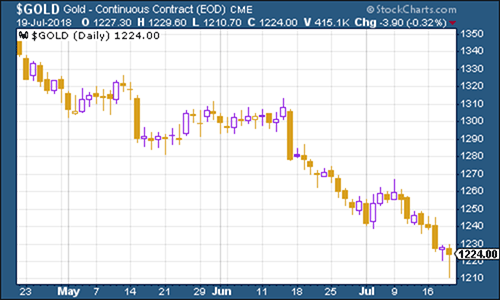

Gold has been struggling again this week. It's partly because Federal Reserve boss Jerome Powell remained pretty upbeat on the outlook for the US economy - which suggests that interest rates will keep going up, which in turn is a definite hurdle for gold (although if inflation picks up more rapidly than rates, it's a different story).

Also, technical analysis tends to be quite a big feature in the gold market and from a chartist's point of view, the outlook is pretty grim (although some measures suggest that now might be a decent contrarian buying opportunity).

My colleague Dominic Frisby covered this in detail in Money Morning this week. From my point of view, it's the same story as always in gold - you should own some as financial insurance for your portfolio, and hope that you don't need it.

(Gold: three months)

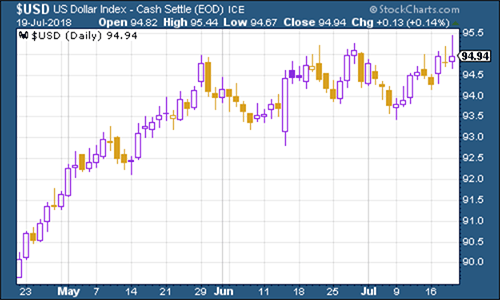

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners remains strong, helped by the Fed's upbeat take on the US economy. There are signs that Donald Trump is not so keen on rising interest rates, but so far the Fed seems happy to ignore him.

(DXY: three months)

However, markets aren't entirely convinced by the bullish argument. There are definite concerns growing over the health of the global economy. This is partly due to fears over a slowdown in China, concerns about trade wars, and just a general sense that the US is perhaps "overdue" a downturn. The yield on the ten-year US Treasury bond was again, virtually unchanged this week. I'll be taking a long look at the yield curve, and why people worry about its potential inversion, in the email on Monday.

(Ten-year US Treasury: three months)

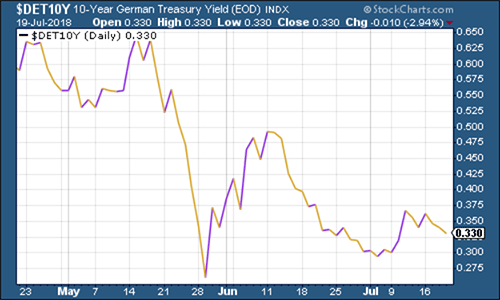

The yield on the ten-year German bund (the borrowing cost of Germany's government, which is Europe's "risk-free" rate) was also little changed.

(Ten-year bund yield: three months)

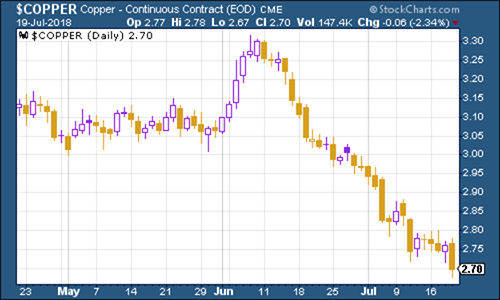

Copper remains in the doldrums. As with many commodities, the infrastructure metal has been having a very rough ride recently. That's down to concerns over China, primarily. But again, worth watching as John Authers notes in his FT newsletter, the falling copper price may also be a sign of a slowing US construction market which would indicate deeper problems.

(Copper: three months)

Bitcoin is doing what most assets do when people have written them off - it's having a rebound. The slowing Chinese economy is one of the most obvious factors I can see behind this - if there's any correlation between global events and the cryptocurrency price, it's all about capital flight as far as I can see.

(Bitcoin: three months)

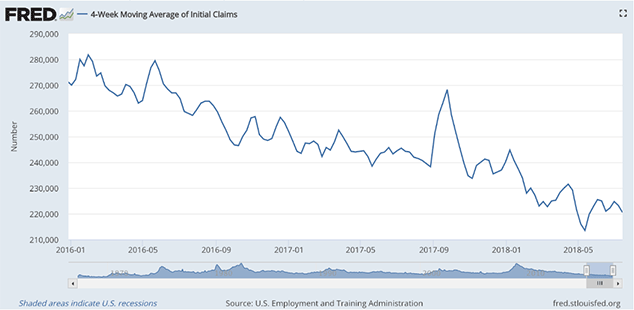

On US employment, the four-week moving average of weekly US jobless claims fell slightly to 220,500 this week, while weekly claims fell to their lowest level since 1969, coming in at just 207,000.

David Rosenberg of Gluskin Sheff notes that, in the past, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough of 213,500 about two months ago, so if there's anything to Rosenberg's observations (which are of course drawn from a limited pool of past cycles), then we should see the stock market hit new highs before this cycle is out.

However, at this rate, we could well see a fresh trough in the near future.

It also points to more inflationary pressure. The Fed's "beige book" survey, which came out this week, noted that "all districts reported that labour markets were tight and many said that the inability to find workers constrained growth".

(US jobless claims, four-week moving average: since January 2016)

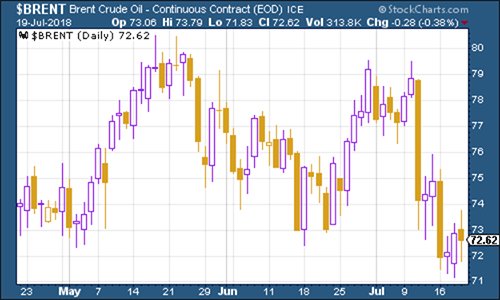

The oil price (as measured by Brent crude, the international/European benchmark) is struggling to work out whether it's coming or going. The supply picture is uncertain, with this week's news being that Libya may be able to export more than expected, and the US is pumping more oil than ever before. On the demand side, there's still the threat of trade war.

Yet in the longer run, for the moment, we suspect that a crash is unlikely from here, and that there is still money to be made from the sector. My colleague Matthew Partridge has more on the story in the latest issue of MoneyWeek magazine, out now.

(Brent crude oil: three months)

Yet another incredible week for Amazon. The internet giant's website crashed on "Prime Day" (its big annual sale for Prime subscribers) and a whole lot of its workers went on strike - yet one analyst reckons they still did 33% more business than they did last year.

The stock hit new highs again this week, cementing its reputation as the safest stock to own (for fund managers who fear getting fired in a crash - as I've said many times before, Amazon carries no career risk) in this particular bull market. It is now well on its way to pipping Apple to the post to become the first trillion-dollar company.

(Amazon: three months)

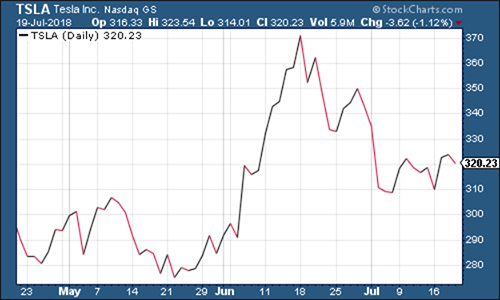

Electric car group Tesla had another relatively calm week, despite Elon Musk picking a fight with the British divers who rescued the trapped Thai football team. I suspect that Musk is now benefiting from the same sort of reputational forcefield that seems to surround Donald Trump - they've said so many outrageous things that no one takes anything they say entirely seriously anymore.

However, more worrying is a report from analysts Needham & Co who downgraded the company to "sell". They reckon that production problems are now spilling over badly into refunds - "based on our checks, refunds are outpacing deposits as cancellations accelerate", reports CNBC.

I still think it's just a matter of time before Tesla falls prey to a mix of over-borrowing, over-promising, under-delivering, and competition from more efficient rivals. For example, Porsche plans to start producing its first fully electric vehicle from next year.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?