The charts that matter: Amazon – the stock that carries no career risk

Fund managers buy the things that won’t get them fired when the crash comes. With that in mind, John Stepek looks at Amazon and the other charts that matter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:The cracks are starting to show in the eurozone's most stable member

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:We're heading ever closer to all-out trade war

Wednesday:The good times are over for UK housebuilders

Thursday:The pound looks cheap but will it get even cheaper?

Friday:Believe it or not, UK interest rates "should" be around 3% right now

We haven't recorded a new podcast this week but if you haven't listened to the most recent one yet, then you'll find it here.

Now over to this week's charts.

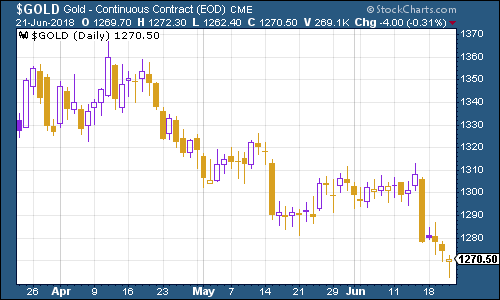

Gold finally gave up defending the $1,300 an ounce level this week. It slid as the US dollar continued to strengthen. Protectionism and an apparently hawkish US central bank it's all stacking up in favour of the dollar and against the yellow metal.

As always, I think you should have some. It's there as insurance. The same things that are working against it just now could easily give rise to another crisis. A stronger US dollar markets hate that. Protectionism that could turn nasty. Rising US interest rates the view that reversing quantitative easing without causing a mishap is almost as optimistic as believing that Tesla can hit its Model 3 production targets to schedule.

(Gold: three months)

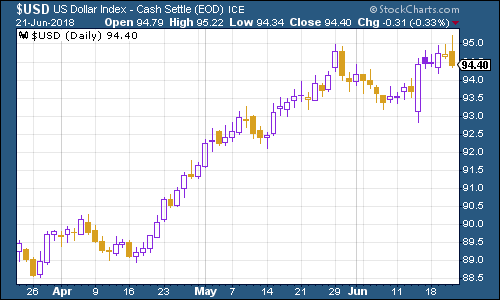

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners is looking interesting. My colleague Dominic talked about this in Money Morning this week. Given that the Federal Reserve is still by far the most aggressive central bank out there, it's hard to make a case for a weaker US dollar from here. Then again, when the dollar is strengthening, things tend to break elsewhere in markets.

(DXY: three months)

The yield on the ten-year US Treasury bond was again, little changed this week. The long bull market in bonds might have ended in summer 2016, but goodness knows, it's dying hard.

(Ten-year US Treasury: three months)

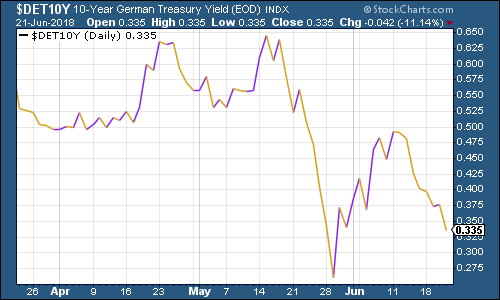

The yield on the ten-year German bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate slipped along with the US yield. There's also the fact that the European Central Bank is far more dovish than the US central bank, meaning that eurozone bonds still have the endless backing of a central bank behind them.

(Ten-year bund yield: three months)

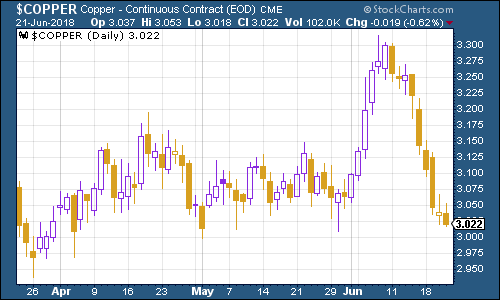

Copper collapsed all the way back to where it was a couple of weeks ago. Concerns about strike action at the huge Escondida mine in Chile have eased off.

(Copper: three months)

Bitcoin was becalmed again this week. It appears to be carving out a new range below the $7,000 a coin mark (apologies for getting all "technical analysis"-speak on you, but I have no other real frame of reference for bitcoin).

We've been using a ten-day chart for bitcoin over the last few months (mainly because it was moving up so rapidly that a longer-term chart was frustratingly hard to read). But I think now that it's settled down we can move to a three-month timeframe like most of the rest of the charts here.

You can see that bitcoin's time in the sun has certainly moved on for now. What it ends up being worth is the big question, which will ultimately depend on what people end up using it for.

(Bitcoin: three months)

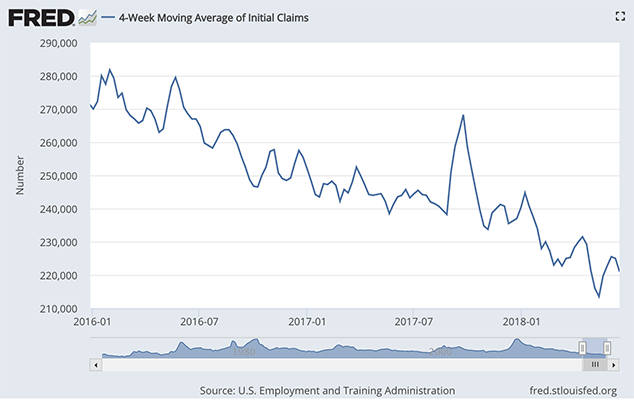

On US employment, the four-week moving average of weekly US jobless claims fell a little to 221,000 this week, while weekly claims came in at 218,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough last month and could easily hit another one in the near future, if claims keep falling like this so if there's anything to Rosenberg's observations (and do note that they are drawn from a limited pool of past cycles), then we should see the stock market hit new highs before this cycle is out.

(US jobless claims, four-week moving average: since January 2016)

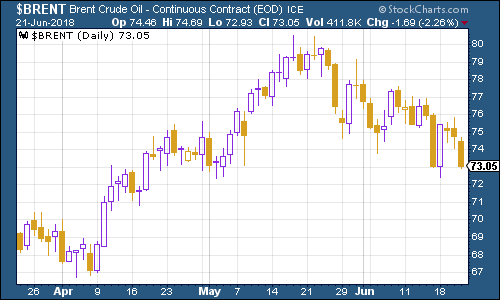

The oil price (as measured by Brent crude, the international/European benchmark) slid further this week. The Saudis and the Russians want to increase production. However, at the time of writing, Iran is not so keen. We'll see what happens once the big meeting between oil cartel Opec and Russia ends on Saturday.

(Brent crude oil: three months)

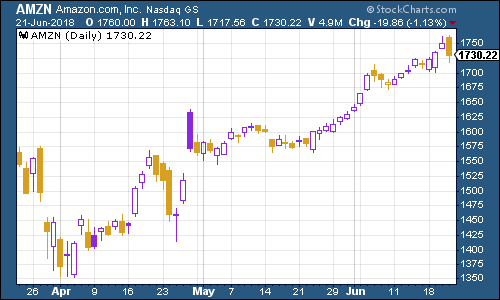

I've said this before, but I think it's worth revisiting. Back in the olden days (way back in, oooh, the 1980s at least), there was a catchphrase: "no one ever got fired for buying IBM". You can interpret that in a few ways, but the basic idea is that IBM was so widely liked and respected that it was the safe choice for the person choosing suppliers for their burgeoning IT department. So if things went pear-shaped, no one would blame you, whereas if you'd chosen an edgy, niche supplier, your neck was on the line.

Today, the phrase could be reinvented for the US stockmarket: "no one ever got fired for owning Amazon".

John Authers notes in his daily FT column that, in effect, the US stockmarket has been entirely propped up by the big tech stocks this year. He looked at the gains made by Facebook, Amazon, Apple, Microsoft, Netflix, Nvidia and Google. If you exclude them from the S&P, then the market would actually have fallen this year rather than risen by 2%.

Even more notably, the S&P 500 Consumer Discretionary index has gained $318bn in market cap this year. However, two of its components Amazon and Netflix have gained $375bn between them. So strip them out, and the best-performing US market sector this year has in fact fallen.

Authers looks at this in his usual admirably even-handed manner. You can look at this in a positive way, he notes most stocks were overpriced at the start of this year. We're now seeing a correction of that, which is only being hidden by the gains being made by the big tech stocks.

This is a fair point, and I wouldn't entirely discount it. However, I probably have more time for the negative take. That is "world stockmarkets have run out of steam and confidence, while investors pile into some genuinely strong companies and bid them up towards levels that cannot be sustained."

In short, fund managers have no idea what to buy because nothing is cheap, and so they buy the things that won't get them fired when the crash comes.

And Amazon is the best example of that. The "Nifty One", if you will. Some rent-a-gob on CNBC the other day was calling for Amazon to hit $2,000 a share next. Someone else said: "There's a lot of risk of overthinking this stock."

Buy now, ask questions later. I mean, that's the kind of in-depth expert analysis we all want to see being applied to our own portfolios, eh?*

(*This is sarcasm just in case).

(Amazon: three months)

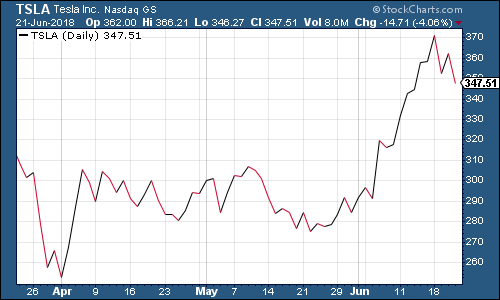

Electric car group Tesla slipped this week. With a tech CEO's typically cavalier approach to things like HR and procedures and the rest of it, Elon Musk went off on one about rogue employees trying to sabotage the company. The employee in question claims that he is in fact, a whistleblower.

Frankly, the ability of Tesla shareholders to sit through these sorts of melodramatics without questioning the ability of the company to deliver on its end goals is increasingly astonishing to me. But as usual, I will note that it's perfectly possible that I'm missing something.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how