The pound looks cheap – but will it get even cheaper?

While the dollar surges, UK politics are making things decidedly tricky for the pound, which looks remarkably cheap right now. Dominic Frisby looks at what the future holds for sterling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We are talking currencies in today's Money Morning.

Recent moves in the US dollar have taken my breath away. They've taken a lot of people's breath away: a 7% move in as many weeks.

That might not impress fans of bitcoin or Tesla, but in the world of major currencies, that's a big move.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is there further to go?

The US dollar is in a rampant bull market right now

Here's a Trivial Pursuit question for you. (Actually, it's a question from my gameshow, but you get the point).

In terms of trading volume, which is the biggest market in the world?

1. The stock market

2. The bond market

3. The forex market

The answer (as I'm sure you've deduced, given the subject of today's missive), is C, the forex markets.

That makes the biggest currency in the biggest market, kind of important. And, since April, the US dollar has been in a rampant bull market that is upsetting the global applecart.

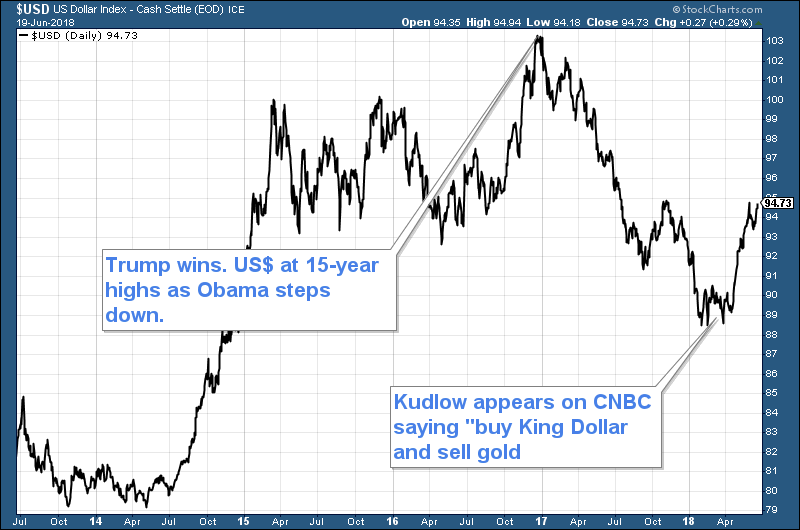

The US dollar rose strongly in the latter years of President Obama's office, especially 2014. By the time he stood down, it had hit a 15 year-high. The arrival of his successor, President Trump, saw quite a turnaround.

The dollar, basically, went straight down through 2017. Correspondingly, commodities had a good time of it. Emerging markets had a good time of it. The euro dumbfounded many with its strength. The word "inflation" was being bandied about once again.

But then, in the February to April quarter, those US dollar declines stopped.

Shortly after accepting Trump's offer to become director of the president's National Economic Council,Larry Kudlowappeared on CNBC in March, saying: "I have no reason to believe the president doesn't support a strong, stable dollar I'm not saying the dollar has to go up 30%,I'm just saying let the rest of the world know that we are going to keep the world's international reserve currency steady. That creates confidence at home I would buy King Dollar and I would sell gold."

Many will have dismissed Kudlow's comments as hot air, but those who heeded them have made out like bandits. From late April, the dollar has been on a tear. Oil and precious metals have taken a hit. The euro, the pound and the yen have taken a hit. Emerging markets have, in many cases, been clobbered.

Here's the US dollar index the US dollar measured against the currencies of its major trading partners over the last five years. You can see the gains under Obama in 2014, followed by the fall under Trump in 2017.

This last month or two has been extraordinary. There appears to be some resistance around 95 on the chart, which might slow things down, but I don't see why it can't go further.

The pound was closing in on $1.44 two months ago. Now it's sitting at $1.31 and staring down the barrel of descent into the $1.20s. It looks awful.

Yet the pound, much though it may not feel like it, is actually up on the year against the Canadian dollar, it's up against the Aussie dollar, it's up against the South African rand, it's even up by a tiny amount against the euro. It's down against the Japanese yen, Swiss franc and Singapore dollar, however. As currencies go, it is mid-ranking.

When you look at the relative valuations between the pound and the dollar, the pound seems "too cheap". Most measures of purchasing power parity have fair value at $1.50 or $1.60. I had one email explaining that the right price should be phi $1.618 the "golden ratio", which I rather liked.

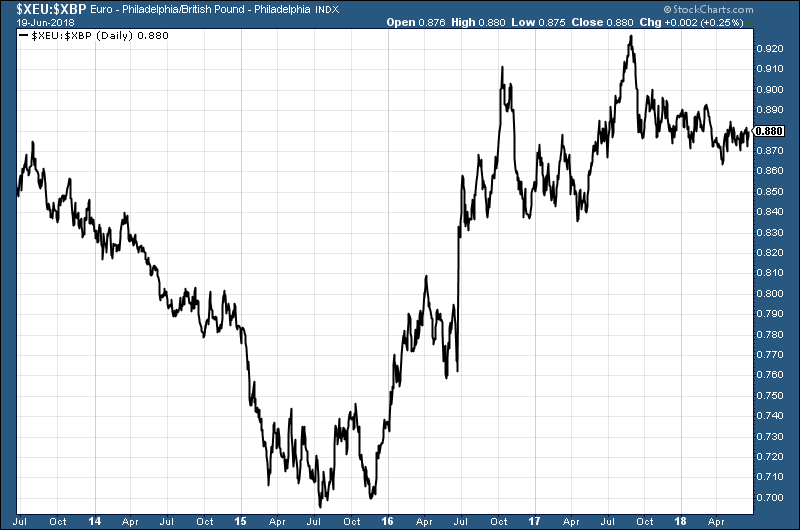

On a valuation basis alone, to head back into the $1.20s might seem too much. But forex trends are powerful things. They go on a lot longer than many expect often for many years and though the pound may be "too cheap" against the dollar, the euro is not.

Currently at $1.15, the euro was at $1.04 little more than a year ago. Shortly after the turn of the century it was 82c. There is plenty of "room" for further US dollar appreciation against it.

The political picture is tricky for both the euro and the pound

Politics also affects currencies. From my humble seat in southeast London which is not on the pulse I'd say that Britain and Europe both have greater political problems than the US.

The campaign to bring down Trump goes on, but Trump-haters are so loud and relentless that their effect, counter-intuitively, has been to make his position stronger. I don't quite know how that works, that's just what seems to be happening. His approval ratings are high. That is dollar bullish.

The EU has Italy and Brexit to deal with, although it seems to be dealing with the latter much better than we are. It has greater economic problems than the US. Unemployment is high, growth weak, the central bank is still printing money and rates have not yet started rising (maybe when they do that will bring euro strength).

In the UK, on the other hand, the inability of our leadership to actually show leadership and administer Brexit is such that Britain could easily slip into some kind of constitutional crisis, unless it gets its act together and that would be extremely pound bearish, of course.

I remain of the view that the pound is going higher in the years ahead, but my bullishness has been rather tempered by this recent move in the dollar and by the failure to administer Brexit.

Forex markets like security. The certainty of any kind of Brexit deal would deliver that, but instead we are getting constant, unresolved can-kicking (it's one reason the pound and the euro are locked in such a tight range).

If we are to see the pound outperform both the euro and the dollar and it should do, as it is undervalued against both first, we need some clarity over Brexit. That means strong leadership, which we don't have. At the moment we are limping our way towards a fudge.

Then we need the right deal. Longer term, the most bullish scenario, in my view, is for Britain to become an independent, free-trading centre (the last thing the EU wants on its doorstep) with a well-managed currency and fiscal rectitude (pigs might fly). What will tie us most to the fate of the euro is the more-likely-looking fudged Brexit.

Here, for your reference, is the pound versus the euro over the last five years (when the line is high, the euro is strong).

On a longer-term basis you can see just how much "room" there is for euro to come back to something like 80p or lower. That would be normalisation. But its destiny and ours is in the hands of our leaders. Over to you, Theresa.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both